One of the hallmarks of the rally in the stock market over the past year and a half has been driven by multiple expansion and not by earnings growth. The market has rallied some 40%, including dividends, over the past 18 months while earnings have only improved approximately 10% over that same time frame.

In addition, a good portion of this growth is from stock buyback activity rather than from organic increases in revenues or earnings. S&P companies bought back more stock in the first quarter of this year than they did in all of 2009 when valuations were much lower. This level of activity is now nearing the peak in 2007 just before markets started their epic decline.

One of the core reasons earnings are hard pressed to advance is due to tepid demand and revenue growth. Revenues for the S&P 500 are projected to only increase 3% to 4% year-over-year in 2014. Wage growth is running at just two percent domestically, just keeping up with inflation and overseas demand is hardly robust right now. Given that the operating margins of the companies in the S&P 500 are at record highs, there are very few operational costs left to cut.

This is why I concentrate on stocks and sectors that are seeing solid organic revenue growth to plumb for possible investment plays. One of these promising areas is energy services. Credit Suisse just raised their growth estimate for global drilling activity in 2014 to 6% to 8% from 5% to 6% previously. In addition, domestic energy service demand remains robust as oil and gas production continues to increase at an impressive rate. Some of these firms should also benefit as this fracking technology migrates to be utilized overseas; China just started the fracking process at a large commercial field. Finally, valuations in the sector are also very reasonable given the overall market multiple.

There are myriad ways to play the solid demand currently happening in energy services. Here are a few I find attractive at current levels.

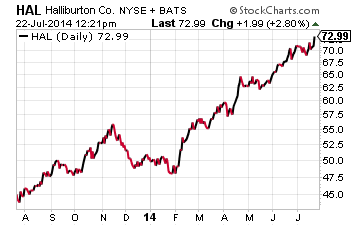

Halliburton (NYSE: HAL) andBaker Hughes (NYSE: BHI)have the most exposure to North America among the major energy services firms. Both just recently reported quarterly results that beat expectations and showed strong demand coming from the domestic drilling market. Both firms are also seeing even faster international growth.

Both companies are priced right in line with the overall market multiple even as their earning trajectories are much steeper than the S&P 500 driven by revenue increasing at a 10% clip annually. I like Halliburton a bit better here due to the market share leadership in domestic pressure pumping. Over 50% of these contracts should be renegotiated at higher prices by the end of the year. The company is also doing a solid job of providing “value add” services that are improving margins.

For a backdoor play on the growth of energy services some of the railcar manufacturers are benefiting from the huge explosion of oil production over the past half-decade. Not only do they provide the oil tankcars that are transporting a significant and growing amount of the oil being produced domestically, they also build the railcars that haul the “frac” sand needed to get oil and gas from shale formations.

Many of my readers from late 2012 followed me into American Railcar (NASDAQ: ARII) until I sold the shares due to valuation earlier in the year made a tidy fortune. However, my favorite play in this space right now is Trinity Industries (NYSE: TRN).

The company continues to benefit from increasing demand for its railcars and consistently beats quarterly earnings estimates. Trinity Industries has a market capitalization of around $7 billion and the backlog just in its railcar division is over $5 billion. Trinity should also benefit as demand in its construction and industrial segments picks up as the economy accelerates in the second half of the year.

The company continues to benefit from increasing demand for its railcars and consistently beats quarterly earnings estimates. Trinity Industries has a market capitalization of around $7 billion and the backlog just in its railcar division is over $5 billion. Trinity should also benefit as demand in its construction and industrial segments picks up as the economy accelerates in the second half of the year.

Trinity is tracking to better than 50% earnings gain on back of an over 25% increase in revenues year-over-year in 2014. Despite its growth drivers, the shares go for right at 12 times forward earnings; a significant discount to the overall market multiple.

For those investors willing to move out on the risk curve and looking for higher risk/reward play, small cap Key Energy Services (NYSE: KEG) might be worth a look here. The company has been dogged by poor guidance and an investigation into corruption at its smaller Mexican operation. The company also has a high degree of debt.

For those investors willing to move out on the risk curve and looking for higher risk/reward play, small cap Key Energy Services (NYSE: KEG) might be worth a look here. The company has been dogged by poor guidance and an investigation into corruption at its smaller Mexican operation. The company also has a high degree of debt.

Key operates as an onshore, rig-based well servicing contractor. It is in the process of moving approximately 60% of its 40 rigs in Mexico to the United States where it is seeing solid growth especially in the Permian shale region. The company posted a small loss in 2013 and is on track to do so again in 2014.

However, the consensus calls for Key to post 35 to 40 cents a share in earnings in 2015 as revenue growth returns. Insiders bought a good slug of stock at these price levels last year and stock sells for just nine times the earnings it made in 2011 and 2012. Given its small size and slowly improving business fundamentals, I would not be surprised to find the company as a takeout target if M&A activity continues to be robust in the energy sector.

One of the few consistent job and economic drivers over the past half-decade domestically has been the oil and gas sector. In addition to providing high paying jobs and the benefits of increasing energy independence, the recent energy boom has rewarded investors and should continue to do so.

With the market looking as it does there are fewer and fewer places for the individual investor to find real profit potential from fast growing stocks. One of the few remaining is the small cap space, one that’s brought double and triple digit winners to my own portfolio and those of my readers. I’ve just launched a new small cap service called Small Cap Gems, and we’re offering a Charter Member discount. If you’d like to get in on this ground breaking new service or just want more information CLICK HERE.

Positons: Long HAL & TRN

About Bret Jensen

Bret Jensen is the small cap stock lead analyst with Investors Alley. Bret’s small cap newsletter will focus on firms whose growth and value prospects are misunderstood by the overall markets, leading to double and triple digit gains potential. Previously Bret was Co-Founder and Chief Investment Strategist for Simplified Assessment Management, a fund in the top 5% for total returns its inaugural year, and a technology manager in the financial services industry.