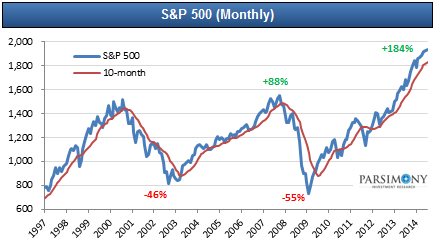

You don’t need to be a professional investor to appreciate that the S&P 500 chart below has extreme danger written all over it, and yet the VIX fear index trades at close to a record low. That means it is still very cheap to buy downside insurance against a crash in the stock market from these elevated levels.

You don’t need to be a professional investor to appreciate that the S&P 500 chart below has extreme danger written all over it, and yet the VIX fear index trades at close to a record low. That means it is still very cheap to buy downside insurance against a crash in the stock market from these elevated levels.

Many professional investors are starting to do that now by shorting the SPY exchange traded fund for the S&P 500 using options (click here). This is more efficient than using one of the widely criticised inverse ETFs that reset daily and amplify losses faster than gains.

…continue reading & view large charts HERE