What a difference a week can make. Recall it was just two weeks ago tomorrow, Friday, Sept. 19, when the Dow Jones Industrial Average closed at a fresh, record high of 17,350 … but it has been a stomach-churning rollercoaster ride ever since with volatile whipsaws along the way.

Last week the Dow posted triple-digit gains or losses every single trading day, and the turbulence continues into this week, leaving investors with a bad case of whiplash and pondering what comes next.

It’s hard to pin down the exact reason for the market turbulence. Worries about Russia, Ukraine, Syria, ISIS, China, interest rates … take your pick. But the truth is none of this is really new; these events have been background noise for months now as global stocks kept moving higher.

Perhaps the return of higher market volatility is simply to be expected at this point. After all, September and October have historically been some of the most volatile months of the year for markets.

September and October can be scary for investors, but often produce buying opportunities

So here’s the key question: Is this just another temporary selling-squall that will soon blow over, or is there a bigger storm brewing for stocks?

To help answer that question, let’s review the seasonal trends and where we are now in the stock market cycle. A closer look at the evidence suggests a buying opportunity may be just around the corner.

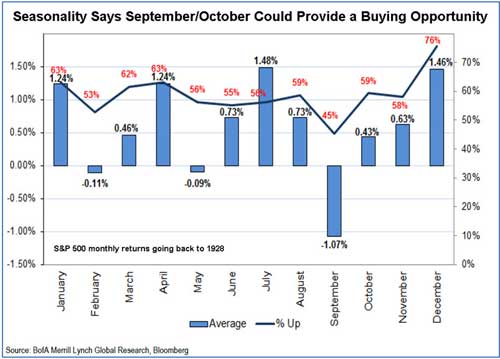

As shown in the chart below, September has historically been by far the worst month to be invested in stocks. And October has the fourth-worst monthly performance.

September is the only month of the year that is down more often than it’s up, falling 45 percent of the time since 1928, and posting an average loss of 1.1 percent. This year was a bit below average, with the S&P 500 falling 1.5 percent last month.

A correction could be just what you’ve been waiting for

The good news: While September and October have a well-deserved bad reputation for some nasty market selloffs in the past, more recently stocks rallied during the month of September in three of the past five years.

But in spite of the September swoon, there’s a very good reason for optimism: We have just entered the seasonal sweet-spot for stocks!

The stock market and broader economy tend to follow cycles. And it’s uncanny how often these patterns repeat, not every year mind you, but often enough to profit. And perhaps the most powerful pattern of all is tied to the four-year election cycle in the U.S.

Right now we’re in the mid-term year (or year #2) of the four-year Presidential Cycle. Based on almost a century of data going back to 1928, this cycle hits a bullish peak from September of the mid-term election year (right now) through August of year #3.

This stock market cycle offers triple the average profit potential

The average return for the S&P 500 during this period is 19.6 percent, over just three-quarters of a year. This compares quite favorably to the average full year gain of just 7.5 percent for the S&P in all years — nearly three-times the upside potential!

In fact, the next three quarters are the three best consecutive quarters of the Presidential Cycle based not only on historical returns, but also the persistency of stocks rising.

* The fourth quarter of year #2, which began Wednesday, is up 86 percent of the time and posts average gains of 6.5 percent …

* First quarter of year #3 (Jan. — March, 2015) is up 81 percent of the time with stocks rising 5.7 percent on average …

* And the second quarter (April — June) is up 71 percent of the time with an average gain of 4.7 percent!

These results are well above the norm, almost three times better, than the 1.9 percent average quarterly gain for the S&P 500 going back to 1928!

Bottom line: Corrections are perfectly normal from time to time; they come with the territory. What is unusual is that we haven’t had more than a 10 percent pull back in stocks since 2012, so you could say we’re overdue.

But the most bullish phase of the four-year Presidential Cycle began yesterday, and there is plenty of upside potential ahead for stocks over the next few quarters.

If history is a guide, this correction should result in a wonderful buying opportunity for a year-end rally … that may continue well into 2015!

Good investing,

Mike Burnick