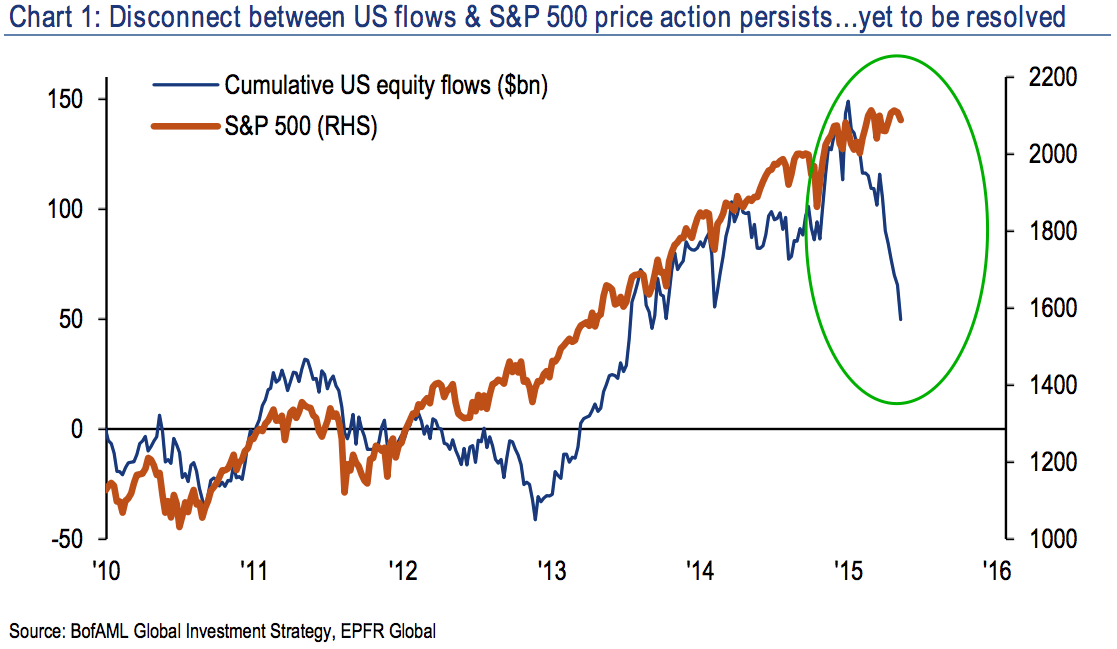

The disconnect in the US stock market just keeps getting bigger

A new Bank of America Merrill Lynch survey published Thursday finds that US investors have pulled $99B out of equities year to date — including net outflows in 11 of the past 12 weeks — despite stock prices continuing to break new record highs.

This week also saw the biggest outflows from equity ($17.2bn) and high-yield bond funds ($2.6bn) so far this year. This data follows a similar report from BAML last month which showed investors pulled $79 billion from the stock market this year and 9 of 10 weeks to that point.

And as this imbalance grows, Bank of America writes that the risk of something we haven’t seen in the market in years will continue to grow: a correction.’