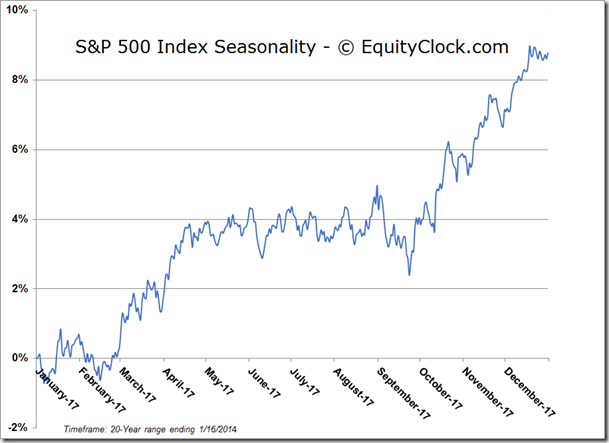

These two charts by Equity Clock visually underscore what’s likely ahead for Canadian Stock Market Investors:

While the Stock Markets may not be set to rise higher, a long forgotten commodity is. Take a look at Sugar and Jon Vialoux’s comment highlights the gains that normally occur in the coming months in this sold out commodity. Currently trading at 12.36 down from its high of 35.92 in Feb 2011:

“A turning point may be evident for the price of Sugar as it enters its period of seasonal strength. The price of sugar is attempting to chart a double bottom around $0.12; momentum indicators are showing signs of curling higher from oversold levels. Sugar seasonally gains between the beginning of June and the beginning of August, gaining over 11% during the period. Both June and July have seen positive returns for the price of the commodity 75% of the time over the past 20 years. Upside potential for the price of sugar points to the 200-day moving average, currently around $0.145, or over 18% above Monday’s closing price.” – Jon Vialoux’s charts on sugar below.

Jon’s whole report for June 2nd HERE