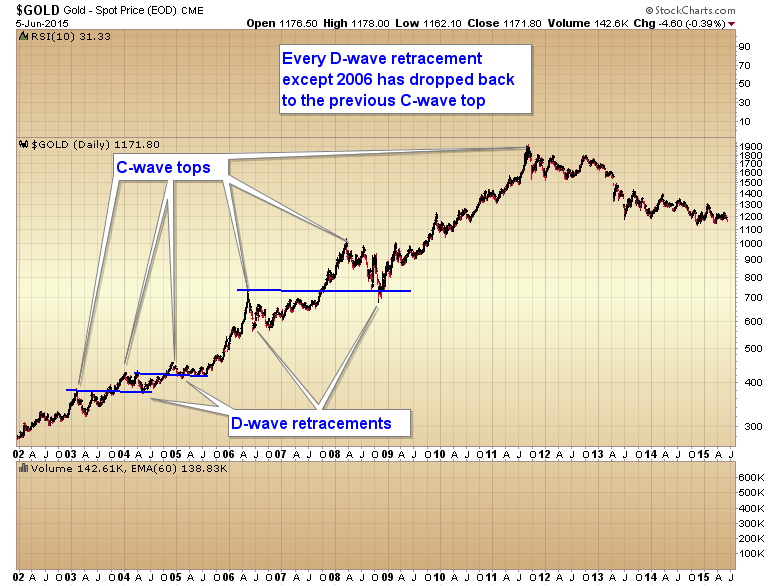

As most of you probably know by now, it’s been my belief for about a year that gold’s bear market would not end until at least testing the previous C-wave top at $1,050. Every D-wave correction in the secular bull has at least retraced to the previous C-wave top except one.

So until gold tests the $1,000-$1,050 level, I think it’s premature to call the bottom. As a matter of fact, I think over the next several months gold is going to drop down into its final 8-year cycle low, and that move down could be extremely painful. That is the problem with trying to pick a bottom in a bear market. If you are too early, the drawdown into that final low can be extremely damaging both financially and emotionally. Let me explain.

Let’s say you are long gold and miners right now, and I am correct and gold still has a move to $1,000 or lower before the bear market is over. It would mean you are going to suffer a 20% or larger decline in your metals positions over the next several months. If you are heavily into mining stocks, this could be a 30-40% drawdown. Needless to say, almost no one can survive that kind of loss on their portfolio. It’s easy to imagine yourself holding through one of these multiyear cycle lows before it happens, but I can guarantee you almost no one can actually do it in real time.

What happens emotionally is that when gold gets to $1,000, the magnitude of the decline will make it look like gold is going to $800, $700 or $600. You may think that you can hold on, but in real time it’s going to look like the losses are never going to end. $1,000 gold won’t look like a bottom so you won’t be able to hang on.

But here’s what really happens to every trader trying to hold through a drawdown of that magnitude: At some point your emotions just cannot take the day after day losses and you panic and sell. At that point you are so emotionally drained by the magnitude of your losses and shell shocked by the force of the decline that it becomes impossible to reenter the market. So when we do get the bottom, whether it comes at $1,000 or $950 or $900, you are just too emotionally damaged to pull the trigger again.

And unfortunately, that’s exactly what you need to do. You need to buy at the bottom of the bear market. Buying at the bottom of a bear market is where millionaires and billionaires are made. Some time in the next several months we are going to get that once-in-a-lifetime opportunity. In order to seize it you need to avoid the drawdown and emotional damage from the final move down into the bear market bottom.

I suspect there are many of you out there who have been holding onto positions, listening to the multitude of gold gurus telling you that any day now gold is going to turn and rocket to the moon. Yes, gold will eventually turn and head much, much higher. Personally, I think it’s going to at least $5,000. However, if you don’t avoid the last leg down in the bear market, there’s no way you will be able to hold on for the ride back up.