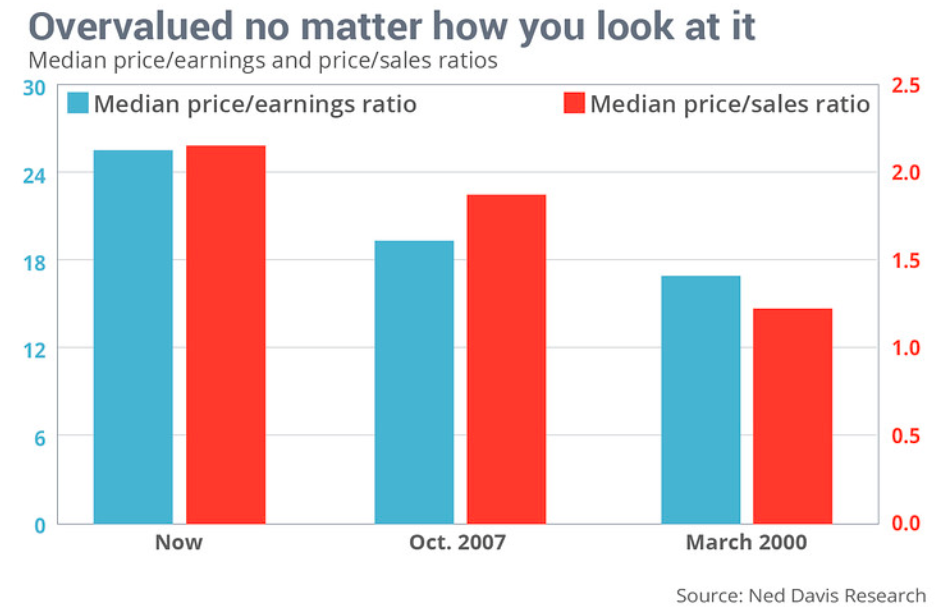

Currently, stocks are extremely overvalued by multiple methods.

- The first way is by looking at Cyclically Adjusted P/E Ratios commonly known as CAPE, Shiller P/E, or P/E 10 ratio.

- The second is by looking at median P/E and P/S (Price to Sales) measures

We will look at both, but here’s a description of CAPE.

CAPE is a valuation measure applied to stock market indexes. It’s defined as price divided by the average of ten years of earnings (Moving average), adjusted for inflation. The essential idea is earnings are mean-reverting making forward looking earnings frequently too optimistic, and current PEs too high following steep corrections.