It would appear the powers-that-be have just stumbled on to the ugly fact that all the bailed-in depositor money in the world won’t stop the novated, rehypothecated, collateral chain collapse contagion that Deutsche Bank’s $40 trillion-plus derivatives book’s Damocles sword hangs over the status quo. However, being the problem-solving types, the European technocrats have a ‘fair-share’ solution – back a derivative clearing-house with taxpayer money to solve the new too-biggest-to-fail problem “that no one saw coming.”

While the “rules” right nbow are that everyone from shareholders, bondholders, and depositors alike on up the capital structure are supposedly “bailed-in” to save an ailing bank, this problem is just way too big.

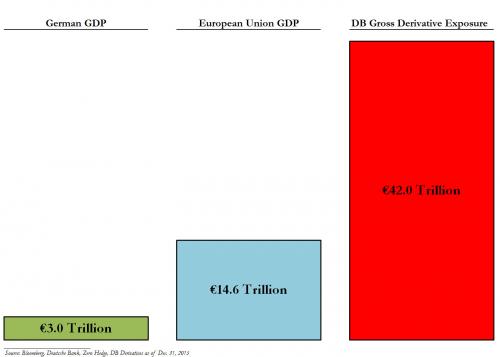

Here’s the problem… in 3 charts…

Derivatives book – yuuge…