According to historical official records, the price of gold should be 20 times higher than the current market price. While many precious metals investors have heard about the revaluation of gold to back the outstanding fiat currency, my analysis focuses on monetary gold stocks versus global GDP (Gross Domestic Product).

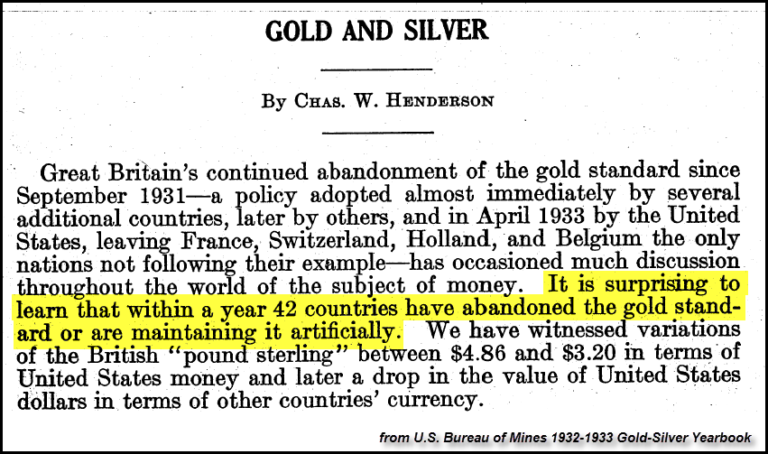

To understand how the global GDP versus monetary gold stocks has changed, we need to look at information and data published in the U.S. Bureau Of Mines 1932-33 Gold-Silver Mineral Yearbook:

As we can see from the text above, Britain abandoned the gold standard in 1931. However, the most interesting part of the text above was, “It is surprising to learn that within a year 42 countries have abandoned the gold standard or are maintaining it artificially.”

Thus, in all actuality, the world abandoned the gold standard in the early 1930’s, even though the United States Gold-backed Dollar became the world’s reserve currency via the Bretton Woods Agreement in 1944.

Now, the Central Banks and Financial elite had a very good reason to drop the gold standard. The financial and banking elite would profit immensely by printing money and charging interest, but only if money wasn’t gold or backed by gold. Because, the increase in above ground gold stocks was limited to its annual gold production. In addition, the industrial revolution had a profound impact on global economic growth.

In the past, international trade was mainly settled in gold or bills of exchange. However, global economic growth was surging as the industrial revolution was now being powered by coal and oil. These two energy sources enabled the world to increase economic growth at a massive scale and pace versus human and animal labor… which was the foundation of economic markets for thousands of years.

OIL ECONOMICS 101: A Barrel Of Oil = 2,875 People Working An Eight Hour Day

For example, a barrel of oil provides the equivalent of 23,200 man-hours of labor (source). If we divide it by the typical eight-hour work day, a barrel of oil equals the labor of 2,875 people. By taking that a step further, let’s look how daily U.S. oil consumption equates to human labor:

19 million barrels per day oil X 2,875 people = 54.6 billion people per day

…..continue for more analysis and 6 charts HERE