The stock markets have enjoyed a “Trump bump.” Despite a recent “Trump fade,” North American stock markets are positive for the year and economic numbers have been fairly solid. Stock market volatility is low and recently the S&P 500® experienced a 110-day run without a 1% correction. Ev- erything just feels good. Enjoy it while it lasts.

It is not that there are ominous clouds on the horizon. There is nothing out there pointing to a sudden correction, but that does not mean that the stock market cannot correct. It can correct at any time. When everything seems just right, it is the surprises that can re-direct the stock market downwards. A healthy stock market tends to absorb the negative surprises well, with only a minor correction before heading higher once again. Or even, interpreting a typically negative event, with a positive spin. This is the type of market that we have been experiencing.

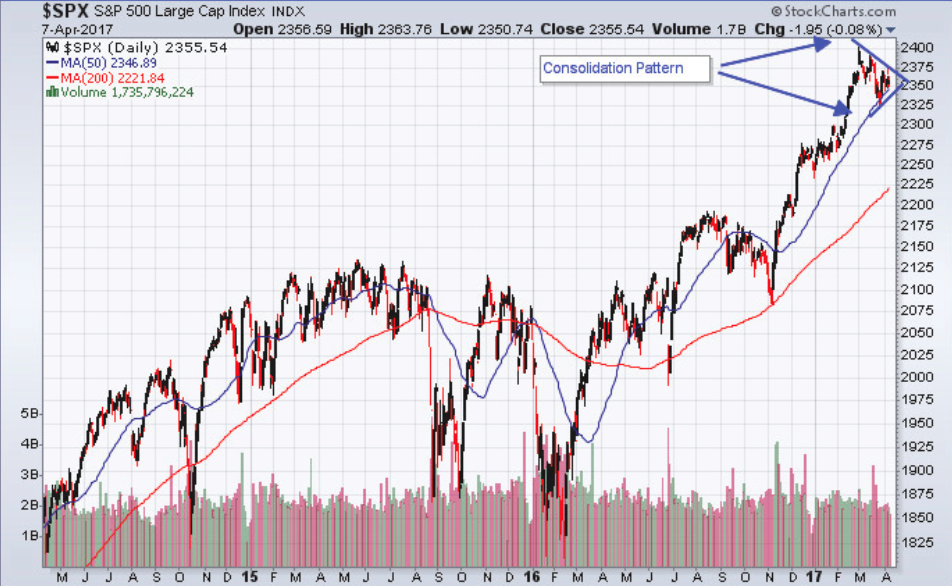

S&P 500 Technical Status

The S&P 500 is currently in a consolidation pattern with a “high” set at the beginning of March. Although the S&P 500 has had a series of lower highs, we have not established a pattern of lower lows. This pattern is neither bullish nor bearish, but it does show that the S&P 500 is looking to establish direction. A solid break above 2400 would show

that the stock market is decidedly bullish. A break below 2325 would be bearish.

Unfortunately, we are only weeks away from the period when the stock market often starts to fade as it enters into the six-month unfavorable period at the beginning of May. From a seasonal point of view, there is not a lot of time and the stock market may provide some muted gains, but the risk remains to the downside. Positive reaction from investors to strong earnings may provide some support to the market, but investors should start to become cautious at this point.