Todd Market Forecast for Tuesday June 27, 2017 6:00 P.M. Eastern, 3:00 Pacific.

DOW – 99 on 850 net declines

NASDAQ COMP – 101 on 900 net declines

SHORT TERM TREND Bullish

INTERMEDIATE TERM Bullish

STOCKS: Our short term gauges have a very good record, but they’re not perfect. This is especially true if an unexpected event hits the markets.

Today, news that the Senate would not vote on the Republican health care bill until after the 4th of July called into question the Trump agenda which had supported the markets. It obviously means that Senate leaders are having trouble lining up votes.

In addition, Mario Draghi of the ECB made some comments about inflation that sent European and U.S. bonds sharply lower and European stocks were also hit.

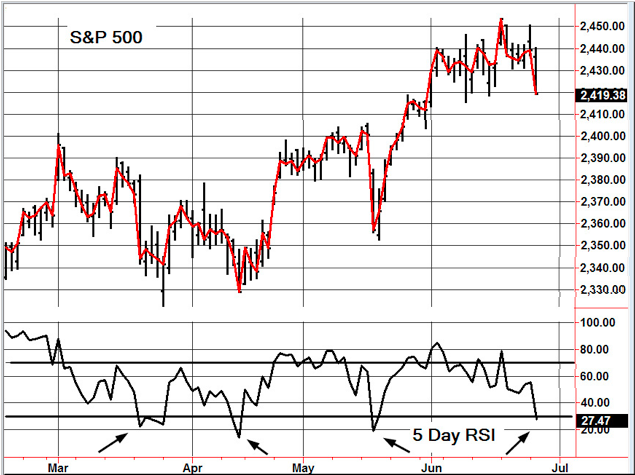

But help may be on the way. Check the chart.

GOLD: Gold could only manage a gain of $4, in spite of the dollar’s collapse. This should get interesting.

CHART Five day RSI is back to oversold levels. This is normally a positive for the next couple of weeks.

BOTTOM LINE: (Trading)

Our intermediate term system is on a buy.

System 7 We are in cash. Stay there.

System 8 We are long the SSO from 91.04. If the S&P 500 is lower at 12:45 EST on Wednesday, sell at the close. More in “interesting stuff” section below.

System 9 We are in cash. Stay there.

NEWS AND FUNDAMENTALS: The Case-Shiller Home Price Index rose 0.3%, less than the expected rise of 0.6%. Consumer confidence came in at 118.9, better than last month’s 117.6. On Wednesday we get the trade deficit and oil inventories.

INTERESTING STUFF: I have been using the breadth statistics, in other words, the advancing issues vs declining issues for exiting our trading positions. —–However, these stats aren’t readily available to everyone so we will move more toward looking at the S&P 500 change.

Advance – decline stats used to be on CNBC and other financial stations, but have become less available in recent years. This is good. Breadth indicators are very effective, but especially so if fewer people are using them. —–And we will continue to utilize them in our analysis.

NEWS AND FUNDAMENTALS: The Case-Shiller Home Price Index rose 0.3%, less than the expected rise of 0.6%. Consumer confidence came in at 118.9, better than last month’s 117.6. On Wednesday we get the trade deficit and oil inventories.

TORONTO EXCHAN GE: Toronto was down 35

BONDS: Bonds were down sharply.

THE REST: The dollar collapsed on Tuesday. Crude oil surged.

Bonds –Change to bearish as of June 27.

U.S. dollar -Change to bearish as of June 27.

Euro — Change to bullish as of June 27.

Gold —-Bullish as of June 23.

Silver—- Bullish as of June 23.

Crude oil —- Change to bullish as of June 27.

Toronto Stock Exchange—- Bearish as of June 14, 2017.

We are on a long term buy signal for the markets of the U.S., Canada, Britain, Germany and France.

Monetary conditions (+2 means the Fed is actively dropping rates; +1 means a bias toward easing. 0 means neutral, -1 means a bias toward tightening, -2 means actively raising rates). RSI (30 or below is oversold, 80 or above is overbought). McClellan Oscillator ( minus 100 is oversold. Plus 100 is overbought). Composite Gauge (5 or below is negative, 13 or above is positive). Composite Gauge five day m.a. (8.0 or below is overbought. 13.0 or above is oversold). CBOE Put Call Ratio ( .80 or below is a negative. 1.00 or above is a positive). Volatility Index, VIX (low teens bearish, high twenties bullish), VIX % single day change. + 5 or greater bullish. -5 or less, bearish. VIX % change 5 day m.a. +3.0 or above bullish, -3.0 or below, bearish. Advances minus declines three day m.a.( +500 is bearish. – 500 is bullish). Supply Demand 5 day m.a. (.45 or below is a positive. .80 or above is a negative). Trading Index (TRIN) 1.40 or above bullish. No level for bearish.

No guarantees are made. Traders can and do lose money. The publisher may take positions in recommended securities.