Tom McClellan sees a warning that ‘the great bull market in stock prices from the 2009 low is in its last stages’

German bunds are trying to deliver a message to stock-market investors: Achtung!

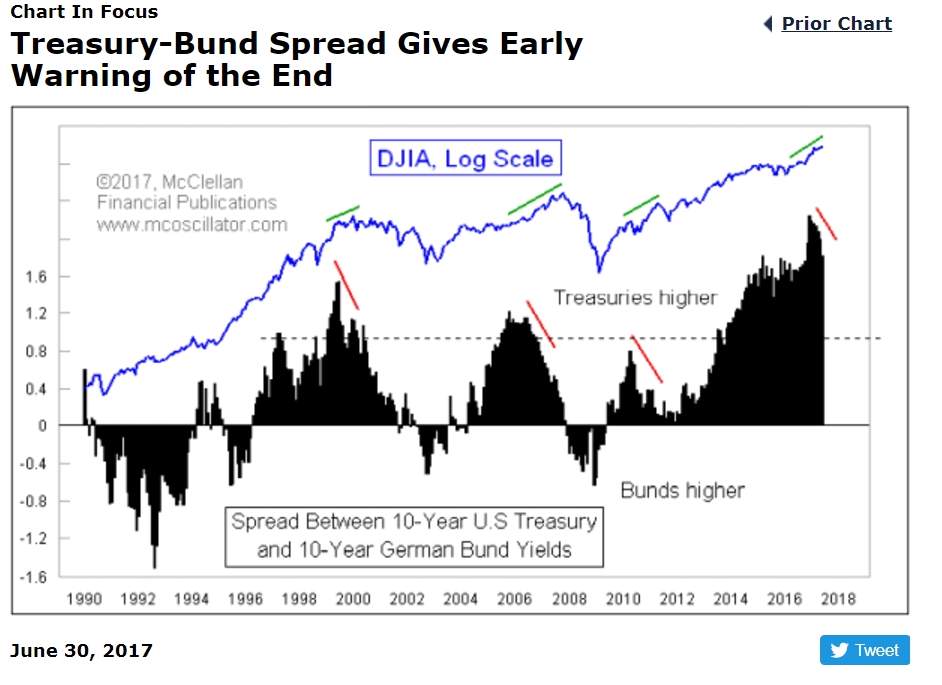

According to market technician Tom McClellan, a narrowing yield spread between German 10-year bonds, known as bunds TMBMKDE-10Y, +5.09% and their U.S. counterpart TMUBMUSD10Y, +2.24% has historically been a bad omen for equity markets.

The yield differential between bunds, which were carrying a negative yield about a year ago and reached a record spread—2.38 percentage points—on Dec. 28 with U.S. 10-year paper, has been on a tightening trend lately, illustrated by one McClellan chart (see below):