Summary

Despite similarities to 2015, energy sector weakness won’t bring a bear market this time around.

While retail and energy are weak, other key areas are still strong.

Copper strength points to continuing long-term bull market.

Financial markets have been relieved that the past few days have passed without more inflammatory rhetoric from either President Trump or Kim Jong-un. The U.S. stock market recovered from sharp losses last Thursday, Aug. 10, when tensions were high between the two countries. The Dow Jones Industrial Average was up for the last four trading sessions (as of Aug. 16) in response to the easing of tensions, retracing most of its losses from last week.

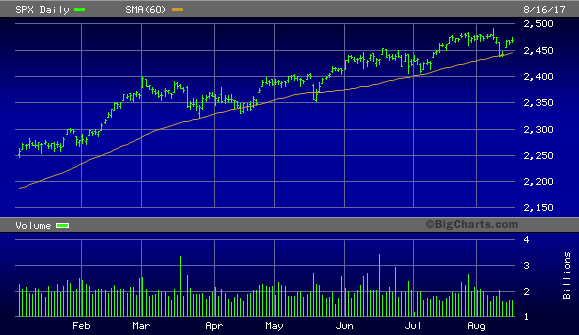

Although there has been a decent bounce in most major indices after last week’s dip, the internal health of the NYSE broad market remains a concern in the immediate term (1-3 weeks). In the past few months, whenever the S&P 500 (SPX) has sold off and fallen to the 60-day moving average, there has been a technical bounce followed by either a sharp rally or some more consolidation and then another rally. See the chart below.