Bitcoin – Enters the Next Stage in the Bull Market

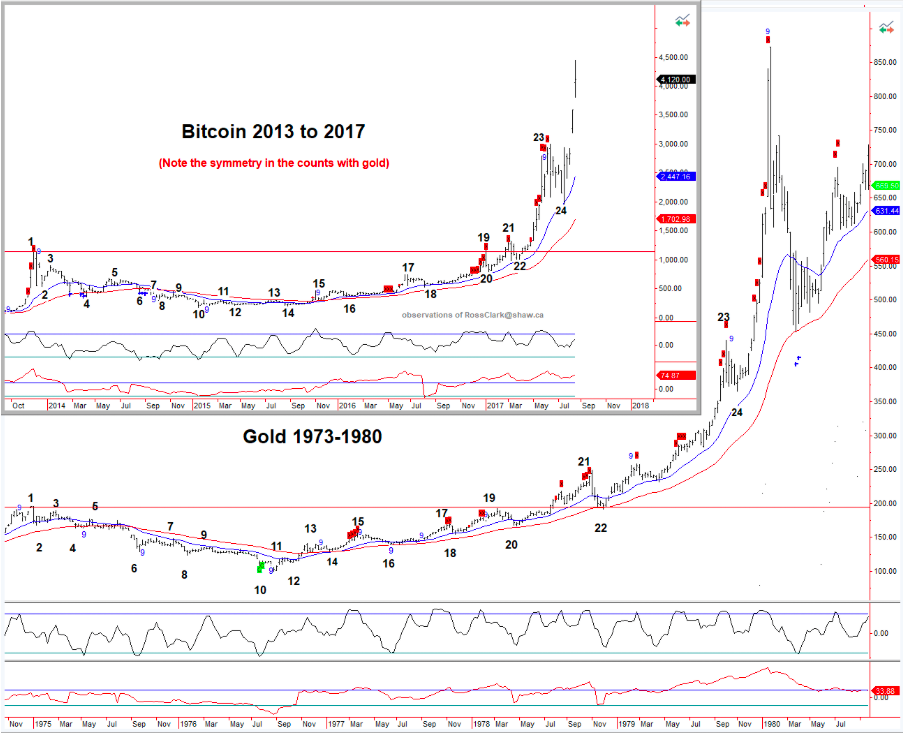

The breakout from the three-year saucer in Bitcoin continues to progress in a familiar fashion. The July pullback to the 20-week moving average, holding well above the March high, matches the normal pause in the growth phase we’ve seen in previous bubbles.

We have various means of measuring the upside potential, however it is best to let it run its course. It was Exhaustion Alerts in multiple times frames that allowed us to recognize the tops in Canopy Growth, the Shanghai Composite, the Biotech Index and Silver in the last six years. Bitcoin remains on our radar screen for such alerts, but shows no sign of a climax as of now. The May highs have become the critical support.

….also: Click for .mp3 Audio of Bob Hoye Interview with Host Chris G. Waltzek Ph.D.

Highlights

- Bob Hoye of Institutional Advisors rejoins the show with an in depth discussion on the financial markets and the Bitcoin (BTC) revolution.

- Since his last visit, BTC has more than doubled soaring from under $2,000 to over $4,500 and the crypto market cap has topped $145 billion.

- Bob suggests the current price could be nearing an ultimate top.

- The host presents a competing scenario with the help of the work of a top Elliott Wave technician in London.

- The analyst expects BTC to correct to $3,650 before staging a run to $5,000.

- The host is convinced that BTC is en route to $10,000 and then $50,000 over the next several years.

- The cryptocurrency domain is poised to rival the world’s largest market, the $5 trillion FOREX.

- Archaic rules are holding back BTC investment, the currency of the future, putting millions of American’s at risk of opportunity costs.

- All 7 billion global inhabitants, plus semiconscious machines / computers, have access to a virtual checking accounts, via public library computers.

- Key takeaway – people are reclaiming their economic / political freedoms from the elite.

- His work indicates that high-end residential housing may have peaked along with most bond markets.

- Plus, the gold market is expected to benefit from slowing momentum in US equities, as investors convert paper profits into tangible precious metals assets.

Click for .mp3 Audio of Bob Hoye Interview