Todd Market Forecast for Thursday October 26, 2017

Available Mon- Friday after 3:00pm Pacific.

DOW + 72 on 98 net advances

NASDAQ COMP – 7 on 52 net advances

SHORT TERM TREND Bullish

INTERMEDIATE TERM Bullish

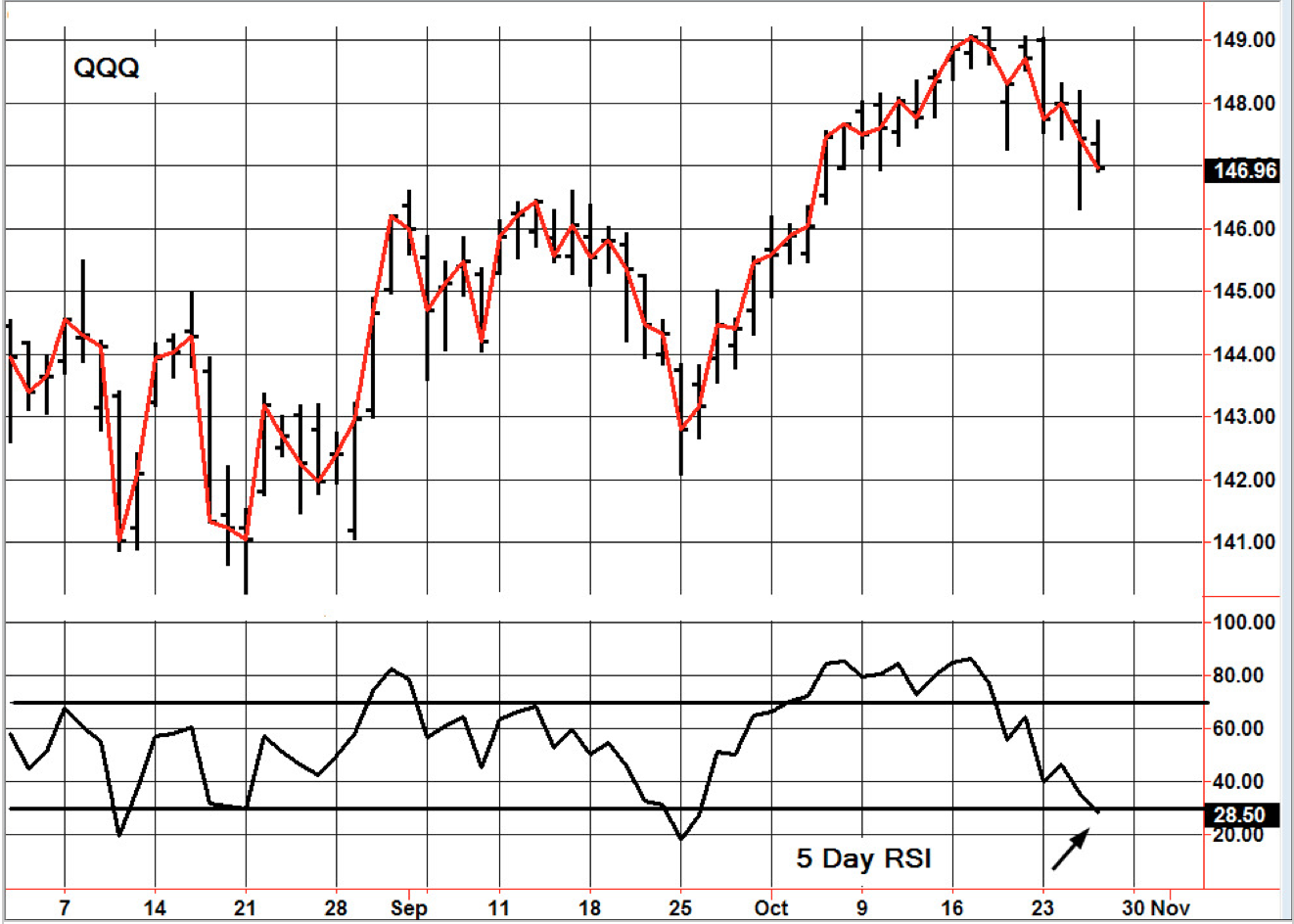

STOCKS: In our update for yesterday, we said that we were already close to a rebound. We got it with the Dow and S&P 500, but the action of the NASDAQ Composite was a bit lackluster. However, there may be help on the way. Check out the chart.

Word was that the ECB would keep its policies loose and this helped European markets and this spread to the U.S. Also, profits were quite good.

A number of companies, including Amazon, reported solid earnings after the close.

GOLD: Gold was down $11. A sharp rally for the dollar helped push down gold.

CHART: The QQQ has been in a downtrend for a week and one half, but it is getting oversold (arrow).

BOTTOM LINE: (Trading)

Our intermediate term system is on a buy.

System 7 We are in cash. Stay there for now.

System 8 We are in cash. Stay there for now.

System 9 We are in cash.

NEWS AND FUNDAMENTALS: The trade deficit came in at $64.1 billion worse than the expected $63.9 billion. Pending home sales had zero increase. The consensus was for a rise of 0.4%. On Friday we get GDP and consumer sentiment.

INTERESTING STUFF: “Each problem that I solved became a rule which served afterwards to solve other problems.”- Rene Descartes (1596-1650), “Discours de la Methode”

TORONTO EXCHANGE: Toronto gained 36.

BONDS: The bond market continued its down trend.

THE REST: The dollar surged. Crude oil moved to a rally high.

Bonds –Bearish as of October 24.

U.S. dollar – Bullish as of October 20.

Euro — Bullish as of October 10.

Gold —-Bearish as of October 17.

Silver—- Bearish as of October 17.

Crude oil —-Bullish as of October 10.

Toronto Stock Exchange—- Bullish as of September 20, 2017.

We are on a long term buy signal for the markets of the U.S., Canada, Britain, Germany and France.

Monetary conditions (+2 means the Fed is actively dropping rates; +1 means a bias toward easing. 0 means neutral, -1 means a bias toward tightening, -2 means actively raising rates). RSI (30 or below is oversold, 80 or above is overbought). McClellan Oscillator ( minus 100 is oversold. Plus 100 is overbought). Composite Gauge (5 or below is negative, 13 or above is positive). Composite Gauge five day m.a. (8.0 or below is overbought. 13.0 or above is oversold). CBOE Put Call Ratio ( .80 or below is a negative. 1.00 or above is a positive). Volatility Index, VIX (low teens bearish, high twenties bullish), VIX % single day change. + 5 or greater bullish. -5 or less, bearish. VIX % change 5 day m.a. +3.0 or above bullish, -3.0 or below, bearish. Advances minus declines three day m.a.( +500 is bearish. – 500 is bullish). Supply Demand 5 day m.a. (.45 or below is a positive. .80 or above is a negative). Trading Index (TRIN) 1.40 or above bullish. No level for bearish.

No guarantees are made. Traders can and do lose money. The publisher may take positions in recommended securities.