Todd Market Forecast for Friday December 8, 2017

Available Mon- Friday after 3:00 Pacific.

DOW + 118 on 499 net advances

NASDAQ COMP + 27 on 330 net advances

SHORT TERM TREND Bullish

INTERMEDIATE TERM Bullish

STOCKS : The market was greeted with a better than expected non farm payroll number and the result was a rally. In the old days, you might have seen a drop on a good report because it was feared that the Fed might be more tempted to raise rates

But, this Fed is fairly dovish and doesn’t like to surprise the financial markets. Right now a quarter point increase is anticipated at the FOMC meeting next Wednesday and this is pretty much baked into the cake.

Traders are back on board after getting sucker punched by ABC’s Brian Ross who was suspended for bad reporting. You may recall it was his false story that caused a 350 point decline and stopped us out of a good position. I hope some of you will send him a letter. I know I am.

GOLD: Gold was down another $3. Yesterday I semi joked that the bitcoin rage had robbed it of its speculators, but today several people were echoing that theme. Are they reading my letter without paying for it?

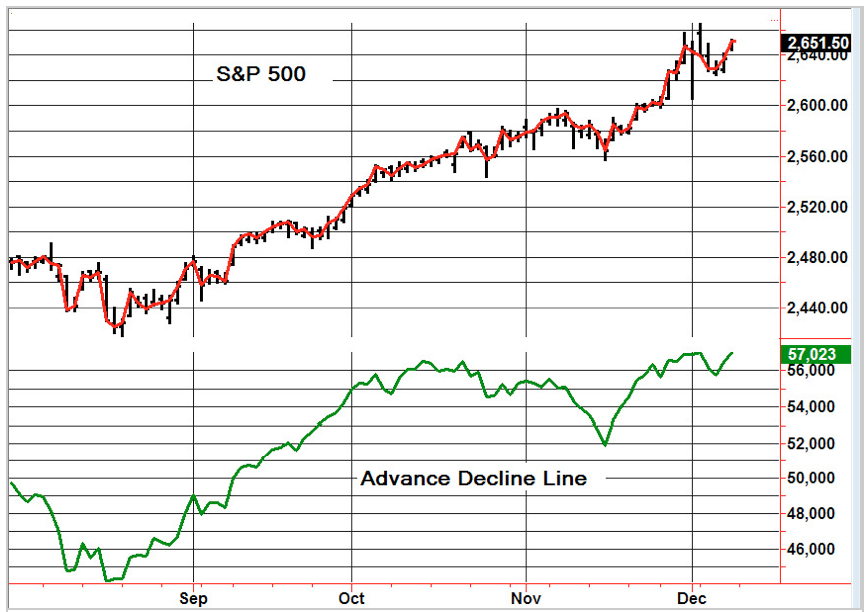

CHART: The S&P 500 made another all time closing high on Friday and there is nothing more bullish than an uptrending market. We also like the fact that the advance decline line confirmed the action by also making an all time high. Breadth normally deteriorates before a top of any significance.

BOTTOM LINE: (Trading)

Our intermediate term system is on a buy.

System 7 We are in cash. We bought the SSO at 107.07. Stay with it on Monday.

System 8 We are in cash. Stay there for now.

System 9 We are in cash.

NEWS AND FUNDAMENTALS: The non farm payrolls added 228,000 jobs. The expectation was for 190,000. Consumer sentiment came in at 96.8, lower than last month’s 98.5. On Monday we get job openings (JOLTS).

INTERESTING STUFF: Any man can make mistakes, but only an idiot persists in his error.—- Marcus Tullius Cicero— 106 BC to 46 BC.

TORONTO EXCHANGE: Toronto jumped another 80.

BONDS: Bonds had a minor bounce.

THE REST: The dollar is surging. Crude oil moved higher.

Bonds –Bearish as of Dec, 7.

U.S. dollar – Bullish as of Nov. 28

Euro — Bullish as of October 10.

Gold —-Bearish as of November 29.

Silver—- Bearish as of November 29.

Crude oil —-Bearish as of Nov. 27.

Toronto Stock Exchange—- Bullish as of September 20, 2017.

We are on a long term buy signal for the markets of the U.S., Canada, Britain, Germany and France.

Monetary conditions (+2 means the Fed is actively dropping rates; +1 means a bias toward easing. 0 means neutral, -1 means a bias toward tightening, -2 means actively raising rates). RSI (30 or below is oversold, 80 or above is overbought). McClellan Oscillator ( minus 100 is oversold. Plus 100 is overbought). Composite Gauge (5 or below is negative, 13 or above is positive). Composite Gauge five day m.a. (8.0 or below is overbought. 13.0 or above is oversold). CBOE Put Call Ratio ( .80 or below is a negative. 1.00 or above is a positive). Volatility Index, VIX (low teens bearish, high twenties bullish), VIX % single day change. + 5 or greater bullish. -5 or less, bearish. VIX % change 5 day m.a. +3.0 or above bullish, -3.0 or below, bearish. Advances minus declines three day m.a.( +500 is bearish. – 500 is bullish). Supply Demand 5 day m.a. (.45 or below is a positive. .80 or above is a negative). Trading Index (TRIN) 1.40 or above bullish. No level for bearish.

No guarantees are made. Traders can and do lose money. The publisher may take positions in recommended securities.