While there are fortunes being made in art and collectibles by rich investors, this particular powerful bull market is being driven by modestly funded millennials. A quick look at the chart of this developing bull market certainly indicates it has much further to go – R. Zurrer for Money Talks

A Big-Money Bull Market

It’s the market for sneakers. Yes, sneakers.

Google “Air Jordans” and you’ll see a good example of what I mean.

What you’ll find is thousands of websites like SoleCollector.com that are dedicated to tracking shoes, including those that are put out under the Air Jordan brand.

And people are making big money from buying and selling these sneakers.

For example, you could have made 900% on a pair of Air Jordan 2 Retro “Don C” shoes.

Or 426% on a pair of Air Jordan 10 Retro “Double Nickel” shoes.

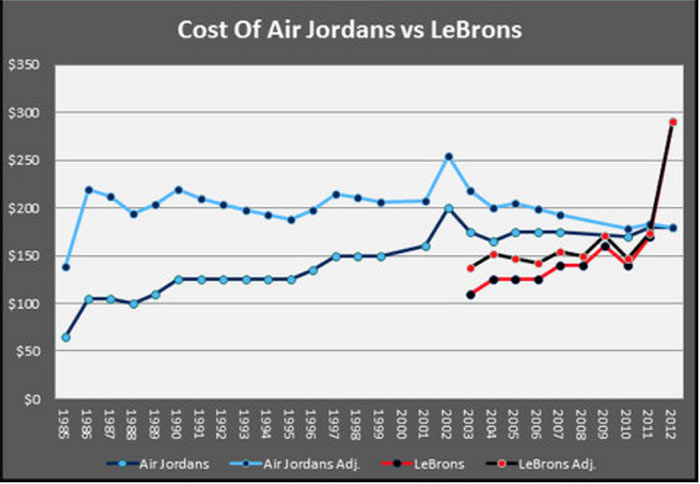

Sneakers are a new category of collectibles that’s come about in the last 20 years. And prices are skyrocketing for the most collectible ones, like LeBrons.

No wonder then the business of the companies that make sneakers have been soaring for years now.

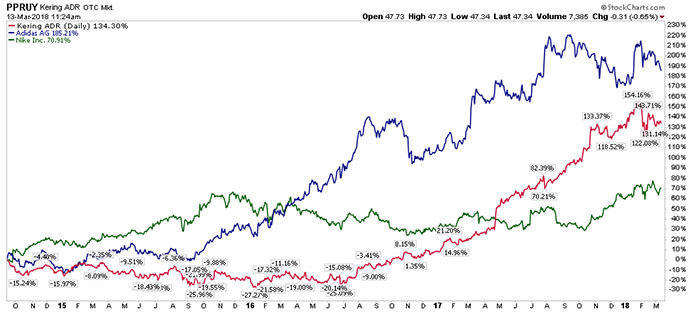

The three main companies in the sneaker business are Nike, Adidas and Puma. These are big, global brands that are doing great business, and their stocks are soaring higher too.

Market For Sneakers

Kering (OTC: PPRUY), which is the company that owns Puma, is up 134%, while Adidas AG (OTC: ADDYY) is up 185% and Nike Inc. (NYSE: NKE) is up 71%.

These returns are crushing the S&P 500, which is up just 40% in the same time period.

Now, the reason why sneakers are so hot is because of something I’ve told you about before — the coming of age of the millennial generation.

You see, it’s their buying that’s bidding up the price of Air Jordans and LeBrons … and in turn, it’s that same buying that’s making sneaker company business sales jump, and their stocks rocket higher.

I believe that the sneaker market is going to keep running higher as millennials gorge on their sneaker collections. And that in turn is going to keep revving the stocks of most sneaker companies higher.

Regards,

Paul Mampilly

Editor, Profits Unlimited