The nation is approaching the “fiscal cliff.” This is a negative for the market. On January 13, Congress will have to vote on whether to increase the national debt, which is now over $16 trillion and counting. Fiscal cliff and debt ceiling are both momentous decisions for Congress, problems that they’d rather not face.

The stock market also has its problems. Last week the Industrial Average closed above its May 1st peak — the Industrial move was not confirmed by the Transports. This leaves the stock market in limbo, and it leaves investors in a quandary. My choice for an investment position is — gold coins (bullion) and GLD and enough cash to pay your bills. If the Fed acts to stimulate the economy, it would be bullish for gold. If the nation goes over the fiscal cliff, such an emergency would probably be bullish for gold. If Congress fails to raise the debt limit, it should be bullish for gold (another emergency).

If absolutely nothing happens, the prevailing forces of deflation will kick in, and that would be bearish for all commodities and probably bearish for gold. But wait — if the whole scene turns deflationary, that would be a situation that Bernanke would not tolerate (the Fed is terrified of deflation), and Bernanke would almost surely flood the system with truck loads of fiat money — that would be bearish for the dollar and bullish for gold.

Big picture — emerging nations are slowing down. China’s economy is slowing, Europe is in recession, employment in the US has stalled and unemployment remands high. In the face of this, the world forces of deflation are continuing. The US could now be suffering long-term structural damage, as the Fed has feared.

This all militates toward Fed action, but many question whether Fed action will do much good. The European Central Bank unveiled a bond-buying program last Thursday, and China announced major infrastructure projects last week.

The Fed can bull the markets, but it can’t directly create jobs. During the Great Depression, the government created jobs through its alphabet agencies such as the CCC and the WPA. I wouldn’t be surprised if the current government chooses that path again. In the meantime, the stock and bond markets are in a quandary. The trend, if there a trend– where is it?

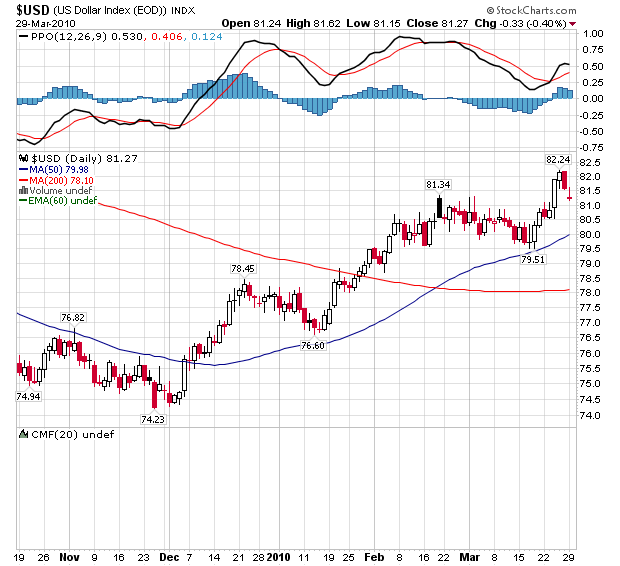

Below, the US dollar is looking bearish and has just broken below both moving averages. A cheaper dollar is bullish for gold.

Is world commerce slowing down? You wouldn’t know it from ‘Dr. Copper,’ which is busting out from a good base and is now above both MAs.

Below is a chart I’m keeping an eye on. It’s the YIELD on the bellwether 10-year T-note. I think we’ve seen the low on this critical note. As bond yields rise, it’s going to put competitive pressure on stocks, which is one reason why I’m still very conservative. This is no time to be a wild man in the stock market. With the chart below imbedded in my thinking, I now advise more cash and less gold in the mix.

As my friend, Bob Prechter once said, ‘There’s nothing wrong with cash — it gives you time to think.’ The only question in my mind is — is it better to have your currency in paper, or is it better to have it in gold, better known as real tangible money? Personally, I trust gold more than I trust paper, but that’s just me and hard experience.”

To subscribe to Richard Russell’s Dow Theory Letters CLICK HERE.

Letters are published and mailed every three weeks. We offer a TRIAL (two consecutive up-to-date issues) for $1.00 (same price that was originally charged in 1958). Trials, please one time only. Mail your $1.00 check to: Dow Theory Letters, PO Box 1759, La Jolla, CA 92038 (annual cost of a subscription is $300, tax deductible if ordered through your business).

IMPORTANT: As an added plus for subscribers, the latest Primary Trend Index (PTI) figure for the day will be posted on our web site — posting will take place a few hours after the close of the market. Also included will be Russell’s comments and observations on the day’s action along with critical market data. Each subscriber will be issued a private user name and password for entrance to the members area of the website.

Investors Intelligence is the organization that monitors almost ALL market letters and then releases their widely-followed “percentage of bullish or bearish advisory services.” This is what Investors Intelligence says about Richard Russell’s Dow Theory Letters: “Richard Russell is by far the most interesting writer of all the services we get.” Feb. 19, 1999.

Below are two of the most widely read articles published by Dow Theory Letters over the past 40 years. Request for these pieces have been received from dozens of organizations. Click on the titles to read the articles.