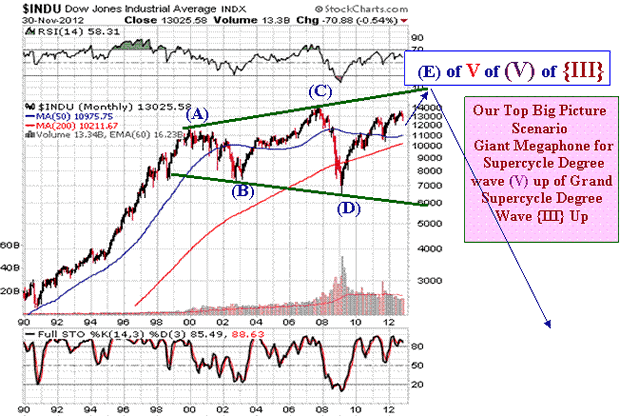

U.S. Stock Market – I’ve no desire to not look a gift horse in the mouth after refraining from taking bearish stances on the U.S. stock market since March of 2009. While I continue to suggest the most likely path I envision going forward was depicted in the chart above, you will note that it allows for the market to still see another 10% or so rise before a vicious bear market decline takes hold. That’s why after making a new, all-time high, I’ve suggested a scale-up sell approach as a prudent approach for those who own general U.S. equities (and instead used companies whose majority of business is derived outside the United States).

U.S. Bonds – Worse investment for the next decade.

U.S. Dollar – For the 1% or so of high-risk speculators who can truly afford the financial risks and mental anguish of future’s trading, the 83 – 84 area on the U.S. Dollar Index to me looks like an area to establish a short position.

Gold – While Friday’s hunch proved correct, it won’t matter much unless we can get above $1,600 and stay there. If and when we do, then I think the overwhelming number of bears can capsize their boat and we could see an abandon ship cry go out. Remember, gold is hated by most who work in the financial arena and much of the media that reports on it, so stop looking for them to throw you any bone on how the bear trade may be going bad.

Mining and Exploration Stocks – Another week of not going down is needed to stem the free fall. Gold rising above $1,600 can be a much needed added boost. Don’t lose sight that there’s going to be a wall of selling for quite some time as its almost a universal position now among retail investors to get out and never come back to junior resource stocks. Volume will need to come in before price movement can advance.

Grandich Client Companies

Alderon Iron Ore – I had a chance to speak with Mark Morabito this weekend before he left for a multi-week trip to Asia. As of Saturday, he knew of no reason why the final check from strategic partner HBIS wouldn’t be coming by weeks end. His comment to me was “… if I thought there was going to be a problem, I wouldn’t be off to Asia. I can tell you that part of my trip is to speak about our relationship with HBIS going forward, meet with potential new partners via an additional off-take agreement and institutional investors…”

Donner Metals – Good news continues to flow from DON during the worse junior resource market in my 30 years in and around the financial arena. DON is looking forward to building on its success and I hope to have a Q & A with one of its senior management about this in the not-too-distant future.

Excelsior Mining – Mark Morabito asked that I be a little patient as he hopes one or more possibilities MIN is working on can bear fruit soon. What choice do we really have anyway?

Geologix Explorations – A critical report is due out shortly. The anticipation is it can show GIX to be a holder of a very viable project with strong upside potential. Stay tuned.

Oromin Explorations – I had an update from OLE at weeks-end and this is the gist of what I came away with:

- The main goal is to conclude a purchase of the company.

- If for some reason a sale of the project isn’t doable, many parties have expressed serious interest in supporting OLE going into production

- The jv partners of OLE are all willing to accept equity in any sale

- OLE management did the loan deal versus an equity financing because it believes it can successfully conclude a purchase of its main asset and such a loan was a better choice for shareholders. They believe it won’t become a problem if they aren’t sold and need to employ other strategic strategies

- They have engaged outside firms to assist with investor relations

Given what has happened in the junior resource market, I, along with other OLE shareholders can’t be thrilled to see a 40%+ drop in the share price. However, I believe it’s not because of anything just at the feet of OLE but a market in general reality.

It’s important to appreciate that as crazy as it may sound, the debacle in the junior market may have led to OLE to stand out more than before. It’s evident that early to late stage exploration companies are going to have a tough go at it for a while. But how many construction ready 3-5 million ounces (with potential for more), hi-grade deposits are available today? Knowing how the financing and institutional segment of the industry works, I suspect they will greatly narrow the focus of what they will put their money in for the foreseeable future and I believe OLE is among the very few type of deals that still look viable in their eyes.

Because I receive more emails about OLE than all other clients combined, I like to save time by again suggesting you avoid basing your decisions on something you read on a chat forum. I will never begin to understand how someone claiming to be a shareholder but spends their entire time on one of these forums complaining about the company remains a shareholder. What possible motive do they have when there’s an easy remedy for them – SELL!

People ask me how do you know when to sell? When you couldn’t first buy today what you currently own, who then do you expect to do so and to keep doing so until you get back to where you started? Hope is a wonderful mental strategy but a lousy investment one.

Precipitate Gold – As I noted since I began working for them, I pull a little extra in hoping this is the exception to the rule in junior resource stocks. In the short time I’ve been associated with it, nothing has suggested it can’t be.

Ridgemont Iron Ore – Back to square one so don’t expect anything. I’ve a two million share buy order in at a penny so I can average down my cost and bet on Morabito finding a new avenue for the company. It will be a long haul even if he can.

Sunridge Gold – Simply put, when you look at what now appears to be its sixth deposit, the worth of such deposits versus the current market valuation, it literally makes no sense. But given the country they operate in and the state of the industry, one can at least try to understand such a low valuation. This may change despite all of this when their key study is out by the end of April.

Timmins Gold – Like so many other emerging producers, it got thrown out with the bath water. IMHO, it may become a takeover target down at these levels.