“I consider it so important that I want everyone to read the following adapted from the main article of my November Real Wealth Report, which published last Friday”. – Larry Edelson

It’s not kind to President Obama, but whether you agree with my views or not, it’s an important read …

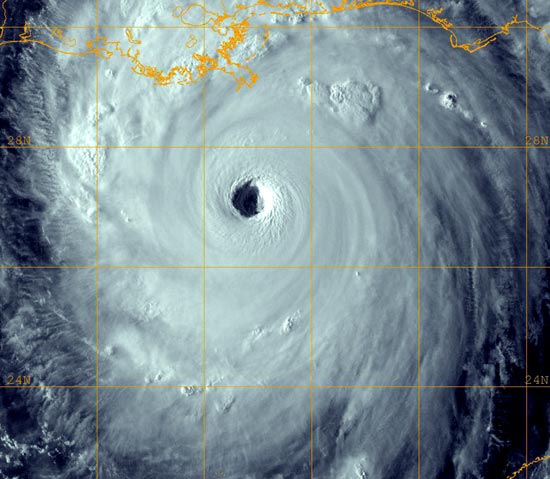

The Sovereign-Debt Crisis Coming Our Country’s Way Will Be a Category 5 Financial Storm

And Obama’s Second Term is Entirely Consistent With it

Obama’s policies of class warfare and fat tax increases on the job-producers and risk-takers in our country will tear our society apart by the seams.

It will deepen the looming sovereign-debt crisis, and eventually destroy the U.S. dollar.

The next eight months – before the crisis fully hits our economy – will be your very last chance to get your financial house in order.

Fact is, I didn’t like either presidential candidate all that much. But Obama’s policy of instigating and escalating class warfare in our country, further dividing our society and blaming almost everything on the rich is just about the worst platform any leader can have.

Just consider the history of class struggles and you will see what I mean. They almost never solve any of those problems. Instead, they often lead to terrible consequences.

Nearly every one of the revolutions in our history was largely triggered by class warfare – blaming the rich, targeting them for higher taxes and, in many cases, literally chasing them out of their country.

And what happened as a result? In the majority of cases, the revolutions turned bloody, the existing government collapsed, the underlying economy was destroyed and society crumbled to its very core.

In some cases, class warfare led to genocide, civil war and even armed international conflict and world wars.

Class warfare almost always becomes the No. 1 enemy of economic growth. That’s especially true, according to the historical record, when a mature economy experiences class warfare.

Consider the U.S. economy right now. It’s lousy; the number of people in the labor force is the lowest it’s been in 31 years. We’ve had 43 months where unemployment has exceeded 8%.

You would think President Obama would want all the help he could get to boost employment. He would want those with money and credit to take risks to stimulate job growth, new industries, new technologies, entrepreneurship and more.

But instead, Obama has made class warfare his biggest priority. That’s why he’s even insanely claimed that those with money never would have made it “without government help.”

And why he has labeled small business and job-creators as “millionaires and billionaires” — targeting them instead for higher taxes.

It’s all allegedly in the name of “fairness” and supposedly aimed at closing the budget deficit.

Yet according to the Internal Revenue Service, the top 1% of U.S. taxpayers pay about 36% of all federal income taxes, while 47% of Americans don’t pay a single dime.

It’s why President Obama will stick to his guns on the upcoming fiscal cliff negotiations, keeping tax hikes in place for the wealthy at all costs, while conceding on other measures such as spending cuts.

Mind you, President Obama defines the “rich” — those he is targeting for higher taxes — as individuals earning $200,000 a year or more, and $250,000 a year for those married filing jointly.

That’s hardly “rich” by any measure. Not in today’s world of generally rising living costs and declining real incomes, net of inflation.

Is it any wonder that …

- President Obama, in his first term, signed more than 923 Executive Orders — almost 15 times more than former President George W. Bush signed during his two terms while fighting the war on terror?

- You now have to report every penny of financial assets you own overseas?

- If you owe taxes to the IRS, they can confiscate your passport, without a court order?

- The reporting requirement for sending money overseas has dropped from $10,000 to $3,000?

It’s hardly surprising to me. Many of the Executive Orders Obama has signed have been entirely consistent with his attacks on the rich all along …

Turning the “Patriot Act” into something it was never intended to be — a scheme to systematically deny American citizens, especially those with wealth, one liberty after another.

No, it’s not likely that Obama’s policies will lead to massive bloodshed in our country or to a world war, as many other cases of class warfare have done.

But targeting the “rich” simply isn’t going to cure our country’s problems.

President Obama could confiscate 100% of their estimated $6.4 trillion in wealth and it would hardly make a dent in the $222 trillion Washington owes us, its foreign creditors, Social Security, Medicare and more.

Quite to the contrary, it will aggravate our federal deficit and our national debt by systematically robbing our country of economic growth that’s largely propelled by entrepreneurs and risk-takers, by job-creators.

Again, just take a look at the history books. During the French Revolution, class warfare leader Maximilien Robespierre enforced confiscatory taxes on the rich with the guillotine. Those that could get out of the country, left as fast as they could.

In 1290, King Edward I issued an edict expelling all money-lenders (predominately the wealthy Jews) from England. And as we all know, Hitler went after them too.

During the Bolshevik Revolution, Vladimir Lenin declared class war against capitalists, confiscating their privately owned land, banks and businesses. It destroyed the productive capacity of Russia and set off a famine that killed an estimated 5 million Russians.

In 1929, Joseph Stalin pursued a class war as well, seizing the assets of Russia’s rich farmers, causing yet another famine where an estimated 7 million people subsequently starved to death.

Mao Tse-tung attacked China’s wealthy capitalists, promoting the Cultural Revolution which resulted in an estimated 45 million Chinese people starved or beaten to death between 1958 and 1962.

More recently, in Argentina, President Cristina Kirchner seized private pensions supposedly to help cover government budget deficits. Yet government spending subsequently soared 40% as Argentines fled the country, taking their cash and wealth with them.

In Europe, France is hollowing out its economy, raising taxes

on the wealthy (those earning more than $1.2 million to a 75% tax and for those earning over $186,000, a 45% tax) — and raising taxes on assets, inheritance and dividends.

Already, many big French names are leaving France. PPR, the luxury-goods group controlling Gucci and Yves Saint Laurent, is said to be relocating executives to London. Private-equity executives Bertrand Meunier and Christophe Florin have left for jobs in Switzerland and Abu Dhabi.

Entrepreneur Pierre Chappaz, founder of websites Kelkoo and Wikio Ebuzzing, has moved to Switzerland. Marc Simoncini, one of France’s most famous dot-com investors, is threatening to move to Belgium.

French magnate Bernard Arnault – Europe’s richest man, head of the LVMH fashion and Luxury Empire, and owner of iconic brands like Louis Vuitton, Moet and Chandon, Hublot and Bulgari – recently announced he had applied for Belgian citizenship in what may be an initial move toward acquiring tax-free status in Monaco.

Here in the U.S., wealthy Americans renouncing their U.S. citizenship is exploding higher, up sevenfold since 2008.

A record 1,781 U.S. citizens gave up their citizenship last year, compared to 231 in 2008.

I expect that trend to accelerate in the months and years ahead. Obama’s class warfare strategy virtually guarantees it.

Capital will flee the U.S. like never before. It will deepen the sovereign-debt crisis by reducing federal tax receipts, making it nearly impossible to shrink the federal deficit, not to mention our country’s $222 trillion of national debts and IOUs.

In the end, by the time the U.S. sovereign-debt crisis reaches full-tilt, it will also hollow out the U.S. dollar – making it virtually impossible for the greenback to remain the world’s single reserve currency.

I wish things were different. We all do. But I am afraid they are not, and I’m convinced that President Obama will soon come to regret a second term.

His policies virtually ensure that the sovereign-debt crisis will become a full Category 5 storm when it does hit the U.S., in the middle of next year.

How to Prepare … and Why 2013

Will be Your Very Last Chance to Do So!

Based on my timing models, I believe the U.S. will become fully infected with a sovereign-debt crisis around the middle of 2013.

That means that the eight months between now and the middle of next year represent your last window of opportunity to fully prepare for the mother of all financial storms.

The good news is that you have time. You also have the markets on your side, provided you understand the forces at work.

The majority of investors won’t see the storm coming. Even fewer will be prepared. Fewer still will understand how it will pan out.

My Real Wealth Report subscribers are in a unique position — well-ahead of the game, with a deep understanding of when, why and how the storm will hit … and what its consequences will be.

We’re in the first phase now. Europe is still going down the tubes.

There’s a worldwide contraction of credit happening right now that’s overpowering most markets and central bank money-printing. This first phase is largely disinflationary, precisely as I have been warning you.

And it will remain disinflationary, until the U.S. is fully engulfed by the sovereign-debt crisis around the middle of next year.

Between now and then, you can expect more downside action in commodities and stocks, setting up buying opportunities of a lifetime …

Don’t be fooled by the declines. Take advantage of them with speculative funds using bearish vehicles that profit from declining markets.

And then, when everyone else is panicking and selling, get ready to buy virtually everything under the sun. More money can be made in the markets over the next few years than in a lifetime of work, provided you know how the sovereign-debt crisis is going to unfold.

Best wishes,

Larry

P.S. Real Wealth Report is a no-brainer for any investor who wants a different, independent point of view. That alone is worth the cost of a membership, at just $89 a year.

Add in all my recommendations — in precious metals, in natural resource-based income stocks, in currencies, in Asian investment plays and more — and the $89 membership fee is an outrageous bargain! Click here to join now.