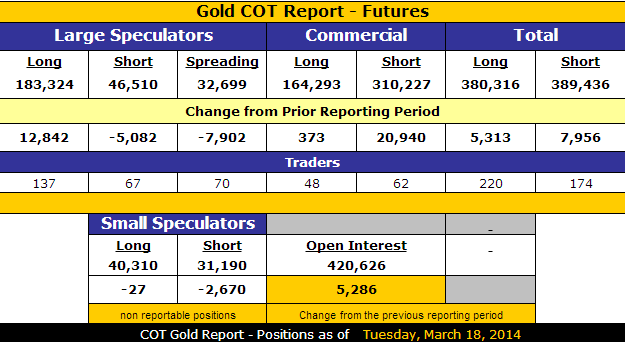

The simplest explanation for this week’s bearish reversal in gold is that too much hot money has rushed into the space in recent weeks – this week’s Commitments of Traders report clearly illustrates just how overheated gold futures have become recently:

This is the largest “Commercial” net short position in gold futures since last March – which just happened to precede the massive plunge in gold during April.

The large downside reversal also ended up printing a bearish outside reversal candlestick on the weekly chart:

As bearish as all of this may sound, as long as this week’s low holds ($1320) there is ample opportunity for digestion between $1320-$1350 which should set up the charts for the next push higher (targeting the August 2013 highs and possibly much more).

also from CEO –