Condensate is making uneconomic gas wells profitable for producers in the shale basins of northern BC and Alberta, and creating some great investment opportunities for informed investors.

The Shale Revolution has transformed America’s energy scene. After decades of decline, US oil production is again on the rise. The turnaround has been even more dramatic on the natural gas front: shale wealth has transformed the country from an importer to an exporter and pushed prices to historic lows.

Eagle Ford producers drilled their wells looking for oil or gas. Condensate was an unexpected bonus – but it now makes up as much as 40% of the hydrocarbons produced from the formation.

Since it is produced alongside oil and since it is in fact oil, producers lump condensate with oil when reporting production volumes. As a result, it seems like US oil production is shooting through the roof. But while domestic output is certainly rising, lumping condensate in with crude is misleading because not every hydrocarbon molecule is created equal – especially through the eyes of a refinery.

What Is This “Freak of Nature” Gas Play?

And in this new briefing, I take you through, point by point, why I think this one natural gas stock, a pure play on gas, could be the single best trade in the sector – junior, intermediate or senior.

Keep reading here to learn more…

The refineries can handle shale oil. They cannot, however, handle much condensate.

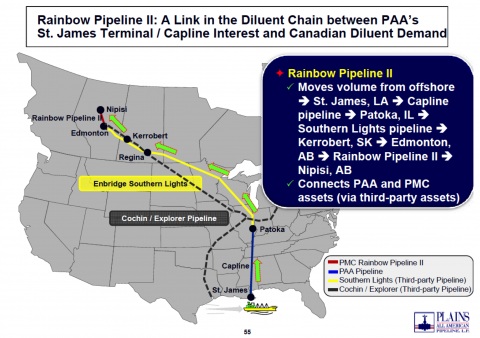

From Houston, the condensate from Kinder’s line moves through the company’s Explorer pipeline to Hammond, Illinois.

Condensate capacity from the US to Canada should increase dramatically—but it is over a year away. Oil and gas marketers in Alberta tell me oilsands production is rising fast enough to use a lot more condensate—but only time will tell if the market stays in balance, over-supplied, or under-supplied.

– Keith