Highlights:

Base metals had a strong finish in 2017, a year when the copper and zinc prices increased by over 30%, the highest in over 3 years for copper and in 10 years for zinc. Nickel also outperformed, rising by 28%. The performance in 2017 was underpinned by supply disruptions for copper, lack of production growth for zinc, and declining global inventories, within the context of a positive outlook for Chinese, and global growth.

- Strong copper demand in 2018. It is estimated that China’s copper demand (which accounts for around 50% of global copper demand of 23.5Mt) could grow by up to 3% in 2018, from around 2% in 2017. Codelco, Chile’s state-owned copper miner, sees a sustained increase in copper deficits, supported by growing copper deficits. As a result, the company says the copper price may test records above $10,000/t ($4.50/lb) in 2018.

- Potential for supply tightness. Over 30 labour contracts, covering 5Mt of mine supply of copper are due to expire in 2018, mostly in Chile and Peru. Notably, the Escondida contract expires in June. In China, scrap import restrictions and closures related to winter pollution will contribute to tightness in the copper market.

- Zinc continues to have the best fundamentals among the base metals. Global zinc stocks were down 59% in 2017, ending the year at 8.2 days of consumption. Chinese zinc imports increased by 43% in the first 11 months of 2017, and continue to be strong.

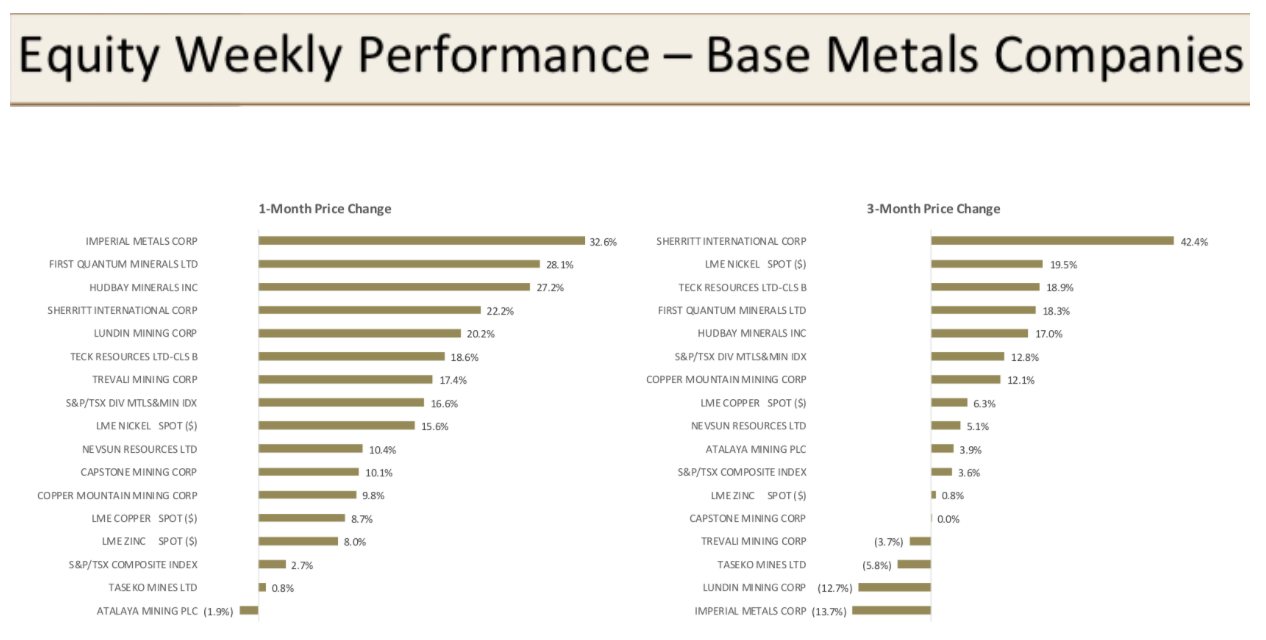

- Outlook is positive. We expect strong global manufacturing output, supported by resilient European and U.S. PMIs, as well as sustained metals demand from China to provide further impetus for a metals rally in 2018Weekly Performance.

Precious metals had a strong start to the year, with the price if gold rising above the $1,300 on December 29th amid a falling U.S. dollar and the prospects of another interest rate hike less following worse-than-expected payroll data this morning. This follows a positive 2010 for precious metals with gold (up 11%) and silver (up 4%) finishing at $1,3XX and $17.XX per ounce respectively. Palladium soars. Platinum prices rose almost 50% on the back of robust demand for catalytic converters and limited supply. Palladium prices tested the $1,100 per ounce level on Thursday, with some commentators speculating it could overtake gold, before settling at $1,090 (up X%) on Friday. In contrast, platinum prices finished the year where they began at $907 per ounce

….click here for the full report