Asset protection

Dr. Marc Faber discusses the global markets as he once did on all major business channels, at Barron’s, and other mainstream print media before he was dismissed for controversial comments (see below).

Marc Faber is an international investor known for his uncanny predictions of the stock market and futures markets around the world.Dr. Doom also trades currencies and commodity futures like Gold and Oil.

Racist Remarks: Faber drew criticism on October 17, 2017, after including controversial and widely criticized as racist remarks in the latest print edition of his investment newsletter.

In the October edition of Faber’s Gloom, Doom and Boom Report, he criticized “liberal hypocrites” and ongoing efforts to tear down “monuments of historic personalities.” He opined that the U.S. grew successful because white people held power.

“Thank God white people populated America, and not the blacks,” Faber wrote, according to an excerpt of the print newsletter obtained by Business Insider. “Otherwise, the U.S. would look like Zimbabwe, which it might look like one day anyway, but at least America enjoyed 200 years in the economic and political sun under a white majority. I am not a racist, but the reality – no matter how politically incorrect – needs to be spelled out as well.”[30] He further defended statues of Confederate figures calling them “honorable people whose only crime was to defend what all societies had done for more than 5,000 years: keep a part of the population enslaved.”[31]

Faber defended his comments in a subsequent statement to Business Insider, adding that he is “naturally standing by this comment since this is an indisputable fact”.

“If stating some historical facts makes me a racist, then I suppose that I am a racist. For years, Japanese were condemned because they denied the Nanking massacre,” Faber said.[32]

Faber was subsequently asked to resign from the boards of Ivanhoe Mines, Sprott Inc. and NovaGold Resources. U.S-based Sunshine Silver Mining Corp, Vietnam Growth Fund managed by Dragon Capital, and Indochina Capital Corporation also dismissed him, Faber told Reuters. CNBC, Fox Business, and Bloomberg TV said that they do not plan to book Faber in the future. Faber continues to stand by his remarks.[33][34]

Last week, I wrote an article about how I view the potential effects of an economic collapse on American society. Unfortunately, many of our readers took it as an opportunity to post their perspectives on Trump and the democrats.

Yes, I know the country is exceptionally divided. However, I brought this issue to light not because I see one party as being the savior for this country over the other. Rather, I brought this issue to light to show you that we are on a path of history repeating itself, as we have forgotten the lessons learned from the pain of the past.

We all have to recognize that the United States took a big step down that slippery slope of socialism with the passage of The New Deal. Since then, it does not matter which party has been in power, as we have extended those socialistic policies when the masses thought it was “needed.” Thus, each generation since The New Deal has seen expanding socialistic policies. While you can argue whether you approve or disapprove of this progression, to ignore that we are on this path is foolish.

Moreover, the reaction to the financial market shock experienced during the Great Recession has shown us that our government is willing to go further down the path of socialistic policies. So, I really do not have much doubt in my mind that this will be the go-to answer when we get into bigger trouble in the 2030’s no matter who is in power.

But, I digress. The main point of this update is a follow up on my last article to explain the potential that the market still has overhead before we top out in the coming years.

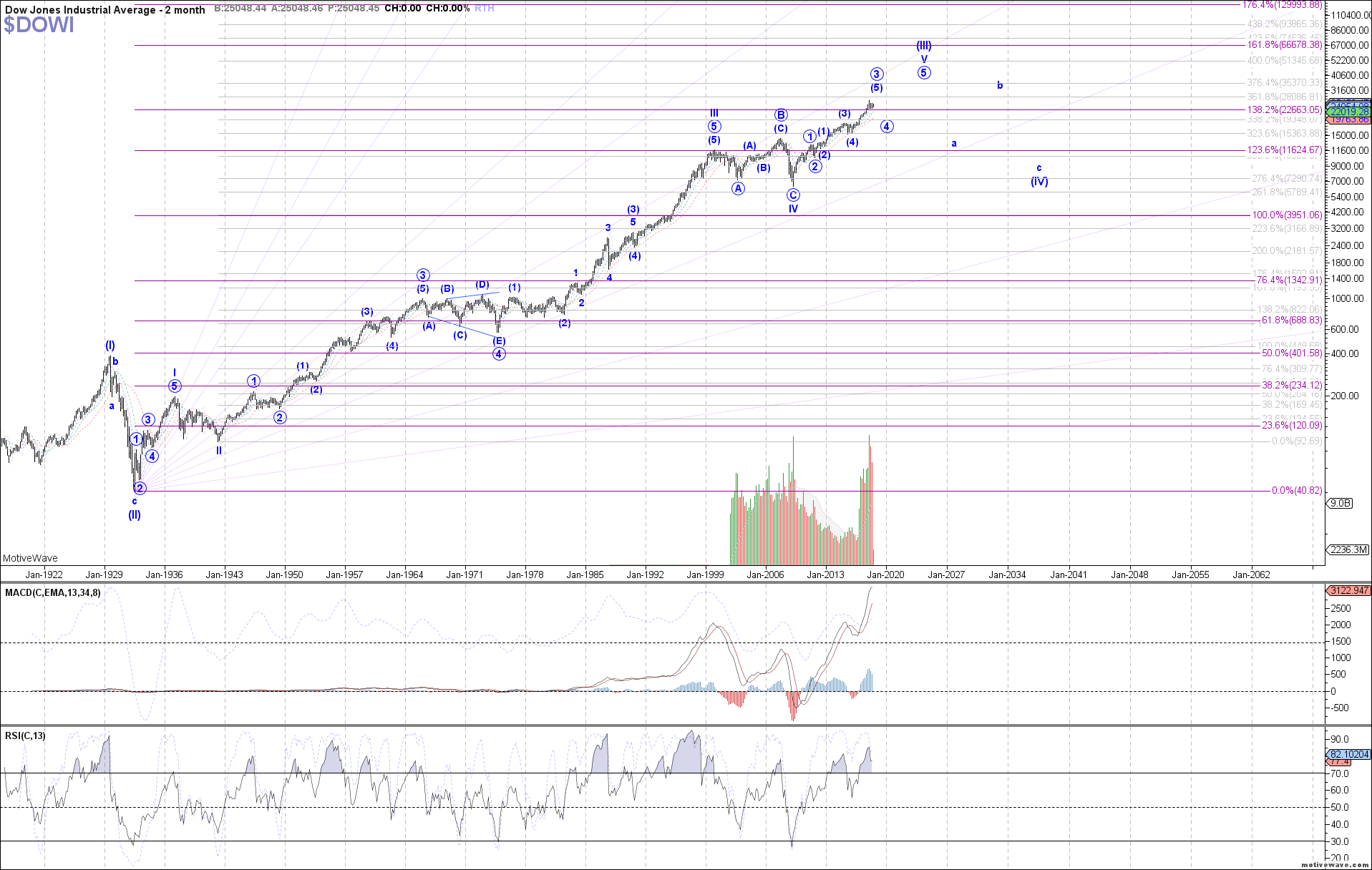

Click HERE For Full Size Image

As you have seen from our very long-term perspective in this chart, which covers over 100 years of time, we still think there is upside left in this market in the coming years. However, before we are going to set up for that final run in the early 2020’s, I still think we will see a 20-30% correction begin in 2019.

But, once that 20-30% correction completes, our expectation is that the DOW can reach at least 35,000 on the rally into the mid-2020’s, with a potential blow off top taking us as high as the 66,000 region. In fact, the 66,000 region is the ideal target on the larger degree structure.

While that is quite a large range, much will depend on how that rally takes shape after we complete the expected 20-30% correction. So, it is a bit premature to be able to hone in on the exact target region upon which to focus. But, as noted, our minimal expectation at this time is the 35,000 region, whereas the ideal target has been 66,000.

So, as you can see, based upon our analysis which has kept us on the correct side of this market for many years, we still believe that this bull market has further to run. However, we are expecting a sizeable correction to begin in 2019 before that last leg of this bull market which began at the 2009 lows takes hold. And, after this last leg into the mid-2020’s completes, then we will likely begin a 10-20 year bear market which can take the DOW back towards the 10,000 region.

See expandable chart on the Dow.

Avi Gilburt is a widely followed Elliott Wave technical analyst and founder of ElliottWaveTrader.net (www.elliottwavetrader.net), a live Trading Room featuring his intraday market analysis (including emini S&P 500, metals, oil, USD & VXX), interactive member-analyst forum, and detailed library of Elliott Wave education.

Slowly but surely, cash is moving away from banks as depositors increasingly shift funds to products that pay higher yields.

That much has become abundantly clear during the current earnings season whereby the big banks have reported an acceleration in deposit outflows especially from wealthy individuals as interest rates continue rising across the board. Main Street depositors have started following suit as well after the Fed hiked short-term rates for the 7th time in less than three years…. CLICK for the complete article

U.S. equity futures are flat, alongside European and Asian stocks as global markets recovered some ground on Tuesday after oil prices stabilized and as trade war fears subsided with attention still squarely focused on Trump’s Putin summit, even as global tech stocks, Nasdaq futs and FAANGs – or is that FAAGs now – felt the pressure from yesterday’s NFLX earnings bomb…. CLICK for the complete article

The current U.S. Administration’s tough stance on immigration has attracted a lot of criticism from U.S. tech companies that rely heavily on skilled foreign workers from around the world, and the situation has become dire enough to prompt giant Microsoft to announce that it might have to move jobs out of the United States…. CLICK for the complete article