Asset protection

2018 will be a year of major volatility in many markets. Stocks are now in a melt-up phase, and before the major bear markets start in virtually all countries around the world, we are likely to see the final exhaustion moves which could be substantial. T

he year will also be marked by inflation increasing a lot faster than expected. This will include higher interest rates, much higher commodity prices, such as food, oil and a falling dollar. And many base metals will strengthen. Precious metals finished the 2-3 year correction (depending on the base Currency) in 2015 and are now resuming the move to new highs and eventually a lot higher.

…also from King World:

ALERT: This Is What Will Trigger The Big Surge In Gold And The Mining Shares

An estimated $8.7 trillion, 11.5 percent of the entire world’s G.D.P., is held offshore by ultrawealthy households in a handful of tax shelters, and most of it isn’t being reported to the relevant tax authorities

After explosive leaks from an offshore firm last year, others in the sector insisted it was a bad apple. Now that claim can be tested.

The Paradise Papers expose a business model that lets the few asset-strip the many. Governments have powerful tools to stop this – but do they have the will?

This morning I noted that I did not appreciate seeing Jeremy Grantham’s note dismissed even in the slightest way and without rancor by a Biiwii author. His intro was “Here we go with the “melt-up” meme again.”, which I felt was not appropriate for our purposes, coming as it did from a writer who was cautionary all through 2017.

Look, I was pretty sure I was going to be wrong about a Q4 market top long before Q4 ended. I was led to believe that through subsequent information and analysis, most notably delivered by the 3 Amigos, who will ride bullish until their respective journeys end. At the time of the Q4 cycle forecast however, we noted that a roll over into a significant correction (at least) could actually be healthy for the market’s overall long-term bull. We also noted how a building mania would either precede the bull’s end or make the next correction much worse than had we had a top of some kind in Q4 2017.

Look, I was pretty sure I was going to be wrong about a Q4 market top long before Q4 ended. I was led to believe that through subsequent information and analysis, most notably delivered by the 3 Amigos, who will ride bullish until their respective journeys end. At the time of the Q4 cycle forecast however, we noted that a roll over into a significant correction (at least) could actually be healthy for the market’s overall long-term bull. We also noted how a building mania would either precede the bull’s end or make the next correction much worse than had we had a top of some kind in Q4 2017.

Now, I was thinking today how most people under 40 do not even know the details of what caused the great bubble of 1999 to burst in 2000. Back in 2000 they were basically kids or very young adults not yet interested in what we older folks were interested in. I was interested in, for example, why my IRA got cut in half when my financial adviser had declared that the nice folks at MFS and Putnam would never lose money like I would. In 2001 I set about really understanding these financial markets and in 2002 I ripped our funds away from said financial adviser and never looked back.

The crash of 2008? Why, anyone now under 30 was just a kid then as well. Were they out chasing skirts or paying attention to things like credit bubbles and leveraged debt products? I vote skirts for a majority. Today we have an old fogy (Grantham) with lots of experience giving us his viewpoints and I for one found them very interesting, and in line with what I am thinking.

What is happening now seems predictable to we older timers, it’s obvious! We see it coming miles away so it can’t really be true; can’t really be an up-melting bubble! Well, yes it can because you tell me – even backing out all the cryto gamblers – what proportion of today’s market participants are either a) under 40 b) under 30 or c) investing on political bias?

Answer: Shit loads of them. They are not running the thought process we older people might be running. They have not, viscerally at least, experienced this before. That thought alone keeps me on the melt-up bubble theme, much though I feel like it is all too obvious.

What I have personally done this time is to learn from the past and from my habit of selling too soon and trying use the Amigos, among other indicators, to remain in the game – or as Grantham noted, “dancing” – until I see the whites of an untenable and risky bubble’s eyes. In other words, I am trying to be more comfortable with momentum than I have been in the past. The other thing I have long-since learned is that manias end, and I hope to have taken sufficient profits by that time, aided by my indicators like the Amigos (stocks/gold ratio, nominal L/T interest rates & the yield curve).

Grantham thinks 6 months to 1-2 years. Regardless, indicators like the Amigos and others will tell that story. This is all a manifestation of the monetary inflation the Fed has promoted over the last 9 years and the fiscally-driven inflation that Trump and the Republicans are promoting now. We should have plenty of warning signals before it flames out. Then Katie, you’d better be ready to bar the door.

NFTRH.com and Biiwii.com

If you look at the stock and asset markets, as Donald Trump tends to do (and as Barack Obama did, too), you’d think all is fine with the world. The Dow Jones Industrial Average rose about 24 percent this year. The Dow Jones U.S. Real Estate Index rose 6.20 percent. The price of one Bitcoin rose about 1,646 percent.

If you look at the stock and asset markets, as Donald Trump tends to do (and as Barack Obama did, too), you’d think all is fine with the world. The Dow Jones Industrial Average rose about 24 percent this year. The Dow Jones U.S. Real Estate Index rose 6.20 percent. The price of one Bitcoin rose about 1,646 percent.

On the flip side of that euphoria however……

Today’s videos and charts (double click to enlarge):

SFS Key Charts & Video Update

SF60 Key Charts & Video Update

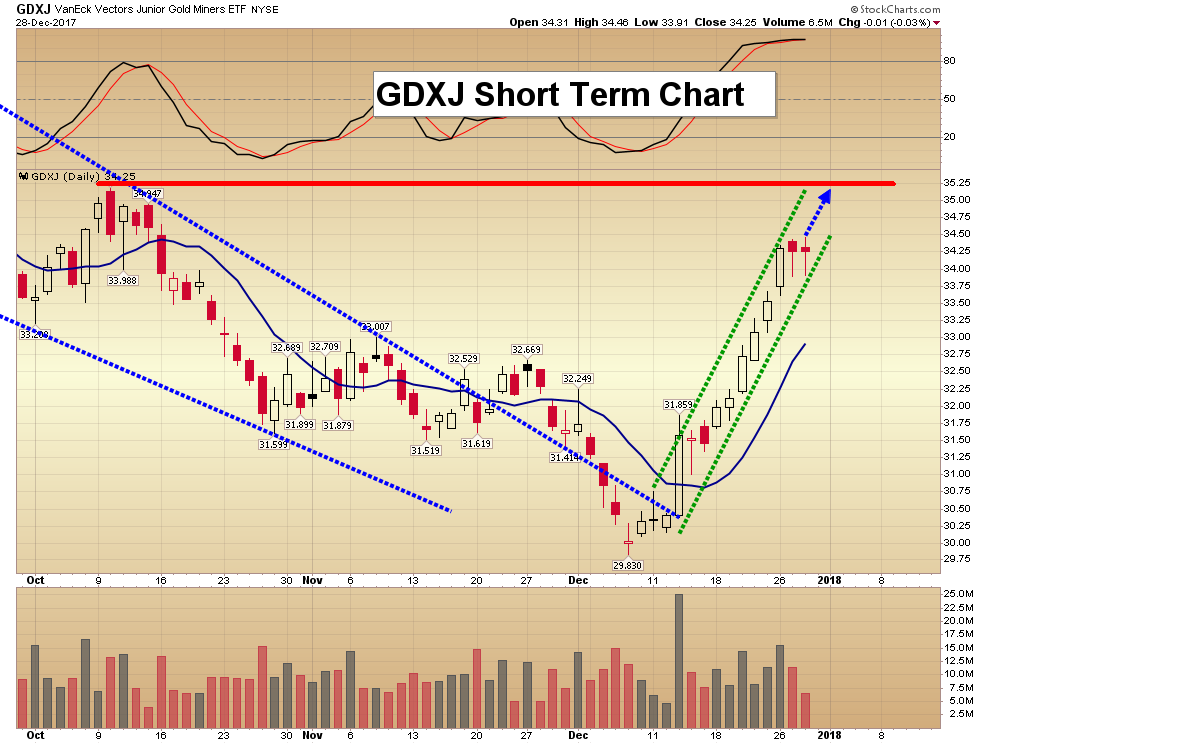

SF Juniors Key Charts & Video Analysis

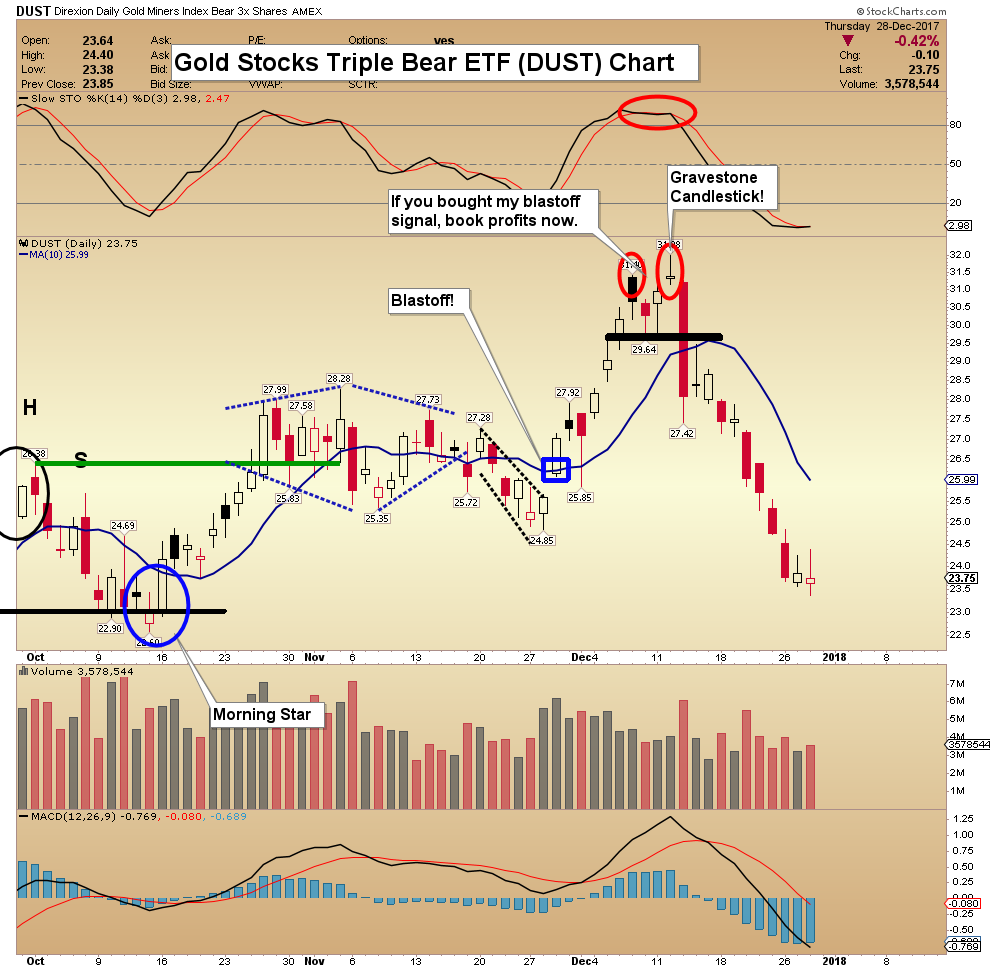

SF Trader Time Key Charts & Video Analysis

Morris

| Friday, Dec 29th 2017 Super Force Signals Unique Introduction For 321Gold Readers: Send an email to trading@superforcesignals.com |