The Gold Report: The U.S. stock market has been in a bull run for a number of years. What are your thoughts on the market and what it means for precious metals?

James Kwantes: Since Donald Trump was elected president, but also for years before that, large-cap U.S. stocks have been a “can’t miss” for investors, who have been rewarded for chasing returns. It seems very toppy to me, but that doesn’t mean it couldn’t go on for a while still. In 2000, in the big tech boom, the market caps of the two or three largest technology companies equaled the market cap of something like every mining company in the world. We’re at that level again. We’re starting to see weakness in the U.S. dollar, and that’s positive for gold. These things are cyclical. Gold looks like it’s ready for the next longer-term breakout and we’re heading into a period of seasonal strength. We’re starting to see signs of strength in the junior market as well.

TGR: Would you talk about a couple of companies that you like in the precious metals area?

JK: Let’s start with the Yukon, where I recently did some site visits. When you fly into the Yukon, you see placer mining operations, where miners pull gold out of the rivers and the gravels. They look like big gravel pits from the air, and some of the operations are very large. Placer mining is a big industry in the Yukon—about 20 million ounces (20 Moz) of placer gold has been pulled out since the Klondike Gold Rush days in the late 1890s—but the Yukon has never really had a large bedrock gold mine. So the hard-rock source for all that gold is a kind of holy grail in the Klondike.

Last year, Goldcorp Inc. (G:TSX; GG:NYSE) bought Kaminak Gold Corp. and its Coffee project for $520 million. That sparked another gold rush, an exploration rush, that is seeing many of the world’s largest gold mining companies do joint venture deals with companies that have Yukon projects.

TGR: What are some of the companies you are excited about in the Yukon?

JK: There’s an interesting company called Klondike Gold Corp. (KG:TSX.V). It owns a large land position around Dawson, the epicenter of the Klondike Gold Rush, that includes some of the most productive placer mining creeks where a lot of gold is still being pulled out. Klondike Gold owns the claims above many of the best creeks.

Klondike is systematically exploring an area called Lone Star, which was the site of one of the only historical bedrock gold mines that produced high-grade gold. Klondike has hit about 2 kilometers (2 km) of gold mineralization along a structure that CEO Peter Tallman thinks may continue for as long as 7 km.

I like Klondike for several reasons. It’s very close to Dawson City, so its costs of drilling are very low. And in the Yukon that’s important. A lot of these companies require helicopters to get in and out, which is expensive. Klondike has great backing. Frank Giustra, the co-founder of Goldcorp and founder of Lionsgate Films, is a major shareholder. So is Francesco Aquilini, another Vancouver-based billionaire whose family owns the Vancouver Canucks hockey team. So Klondike has some deep-pocketed shareholders and a plan to home in on an area with lots of gold mineralization. I really like its prospects for this year.

TGR: What’s another company in the Yukon that you like?

JK: Arcus Development Group Inc. (ADG:TSX.V), a small company that is under the radar. The CEO, Ian Talbot, is a geologist and a lawyer, and was BHP Billiton Ltd.’s (BHP:NYSE; BHPLF:OTCPK) lawyer out of its Vancouver office. Arcus owns a land position directly north of Goldcorp’s Coffee deposit. The Coffee project covers a vast land position, but a lot of the gold mineralization is on the northern portion, very close to where Arcus’s Dan Man project is. Last year, Goldcorp bought 19.9% of Arcus. So even though it’s not on the radar of investors, it’s on Goldcorp’s radar. Arcus is drilling the project this year. I’d be surprised if Goldcorp didn’t buy it out at some point.

TGR: Did any other companies in the Yukon catch your attention?

JK: One company that I like in the Yukon is Strategic Metals Ltd. (SMD:TSX.V). It is a project generator with the largest claims position in the Yukon. It has projects all over the Yukon, so it’s really well poised to capitalize on this money that’s flowing into Yukon exploration companies.

Strategic is almost like a mutual fund focused on the Yukon. It owns 40% of Rockhaven Resources Ltd. (RK:TSX.V), which has a high-grade gold, polymetallic Yukon deposit of more than 1 Moz of gold in the Inferred category. Strategic owns 7% of the shares of ATAC Resources Ltd. (ATC:TSX.V). ATAC is one of the exploration companies that had a major come in: Barrick Gold Corp. (ABX:TSX; ABX:NYSE), the world’s largest gold mining company, did a joint venture deal on one portion of ATAC’s large land holdings. Both Rockhaven and ATAC have very large drill programs. Strategic also recently spun out to shareholders a new Yukon-focused exploreco called Trifecta Gold (TG:TSX.V) that is drilling at two projects.

Before Goldcorp bought Kaminak, it wasn’t easy to raise exploration money for the Yukon. Now there’s money flowing and quite large drill programs underway. It will be interesting once the results start flowing in to see if the Yukon can sustain the interest and capital flow.

TGR: Are there other companies that you’d like to talk about?

JK: Since we’re talking about gold and high-grade gold, another company that I follow in Resource Opportunities is Sabina Gold & Silver Corp. (SBB:TSX; RXC:FSE; SGSVF:OTCPK). It used to be called Sabina Silver, with a silver polymetallic project that it sold for quite a large amount of money back in 2010-2011. Sabina has been well financed through this terrible bear market that we’ve come through. I picked up coverage of Sabina during the bear market at $0.39. A new CEO had just come in, Bruce McLeod, whom I was familiar with and respected.

Sabina has the very high-grade Back River gold project up in Nunavut, again a northern project. What’s interesting about Sabina is a lot of the gold is in open pits. Sabina has in all categories more than 7 Moz of gold, and the grades are 5–6 grams/ton (5–6 g/t) gold with some zones that are much higher grade that the company is drilling. Back River is one of the last large, high-grade gold deposits globally that’s owned by a junior mining company.

But Sabina has had some trouble with permitting. The company went through a lengthy permitting process, with thousands of pages of material and mitigation plans for tailings and caribou management and everything else. The Nunavut Impact Review Board (NIRB) last year recommended to the federal government that the project not go forward. That was obviously a big blow to the company. The federal government went back to the regulator and said we want you to have another, closer look at this project. Sabina went back to the drawing board and altered its plan to address some of the concerns. NIRB reversed itself earlier this summer.

Sabina stock is now at about $2.27 or so and the company has more than $36 million in the treasury. It is drilling some of the “treasure boxes,” high-grade gold areas that could be a real sweetener for any mining company that takes over the project.

The Nunavut area is quite active. There’s a company called TMAC Resources Inc. (TMR:TSE) that’s building a high-grade gold mine nearby. Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) has some of its best operations up in Nunavut as well.

TGR: What is another company you would like to talk about?

JK: If we’re talking high-grade gold, we can’t leave out Pretium Resources Inc. (PVG:TSX; PVG:NYSE)and its Brucejack project up in the Golden Triangle in British Columbia. Before I took over the Resource Opportunities newsletter, I was an editor and reporter at the Vancouver Sun newspaper. Working as the newspaper’s mining writer was good preparation for the newsletter. Vancouver has so many mining and exploration companies, so I really had to be selective and focus only on the best projects and people. One of the people I interviewed was Bob Quartermain, Pretium’s CEO, when the company had its IPO. He was raving about the high-grade gold up on the Brucejack property.

“Pretium Resources Inc.’s Brucejack is high grade, but also has size.“

Fast forward a few years, and Pretium recently announced commercial production at Brucejack. The mine is high grade, but also has size. There have been gold mines in the Golden Triangle, which used to be quite an active mining area, with higher grades, but none of them was nearly as large as Brucejack.

It will be interesting to see how that one plays out. Of course, there was some controversy over the resource and whether the grades hold up. Now Pretium is feeding ore into the mill. So that’ll be a good one to watch for the coming years.

Also up in the Golden Triangle is a little exploration company called GT Gold Corp. (GTT:TSX.V). In its first pass at drilling, GT Gold is hitting some really nice near-surface intercepts, including 13.03 g/t over 10.67 meters. The stock has gone on quite a run. That company has a market cap of about $100 million. Companies that have properties bordering on GTT’s ground are starting to see their stock prices come up.

I do like to compare companies because in this market things can get out of whack. All the excitement goes to certain names and other ones get neglected. That can create opportunities. For example, there’s a company called IDM Mining Ltd. (IDM:TSX.V) that is building a small underground gold mine in the Golden Triangle that is very high grade. It’s taken over a project that majors had put several million dollars’ worth of work into, including about 2 km of underground workings, tunnels and so on. It just published a feasibility study. IDM, an advanced-stage company that’s now going through permitting, has a market cap of about $50M.

There’s interest and money flowing into the Golden Triangle, which is very remote and has a winter climate. But more roads have been built in the last few years and also the British Columbia government has built a high-transmission power line that goes right through the heart of the area. There’s another mine called Red Chris, a copper-gold mine that Imperial Metals Corp. (III:TSX) has opened. So there’s a lot going on up there as well.

TGR: Any other gold companies you want to touch on?

JK: Columbus Gold Corp. (CGT:TSX; CBGDF:OTCQX) is an interesting story. It has some recent news, too. Columbus owns a 45% stake in the Montagne d’Or project in French Guiana. Nordgold SE, a big Russia-based gold mining company, funded a feasibility study at Montagne d’Or, so it now owns 55%. Columbus will probably either sell its 45% stake to Nordgold, or it’ll sell it to another gold mining company. Montagne d’Or is a very large deposit, 5 Moz, with good grades, considerably higher than average gold grades being mined now globally.

“Columbus Gold Corp. has a very powerful exploration partner in Nevada.“

Columbus also has a Nevada angle. It recently announced plans to spin out the Nevada properties into a new company called Allegiant Gold. Columbus is shifting focus to its very large land package in Nevada. The exploration team it works with is Cordex, a legendary Nevada exploration team that’s now run by Andy Wallace. Cordex was founded by John Livermore, who was the key person who discovered the Carlin Trend in Nevada, one of the world’s largest stores of gold. Columbus has a very powerful exploration partner there. Columbus is narrowing in on the zones it’s going to drill. It’s another one to watch, especially if the spinout of the Nevada properties goes through as planned.

TGR: In Resource Opportunities, you also cover uranium. What’s your take on the market?

JK: I love finding things that are hated or neglected, that people don’t care about because they have been low for so long that they’re not even on the radar. And uranium fits that bill. Ever since the Fukushima disaster in 2011, it’s just been lower lows, more or less continually.

But uranium is a funny market because it’s very cyclical. In the late 2000s, there was an incredible uranium boom that took the spot price up to about $100/lb. And as the uranium price goes down, of course, it becomes less and less economic to mine. Some of the world’s largest producers are cutting production and at a certain point, that will affect the price, which will come up.

I think uranium is a really good opportunity right now, especially for companies that can go into production in the 2020 decade. And because it’s such a small market, there are not many companies that produce uranium, so when the move happens, it can happen quickly, and it can be fairly violent as well.

TGR: What uranium companies fit that bill?

“NexGen Energy Ltd. is really positioned to take a dominant place in the world’s uranium sector.“

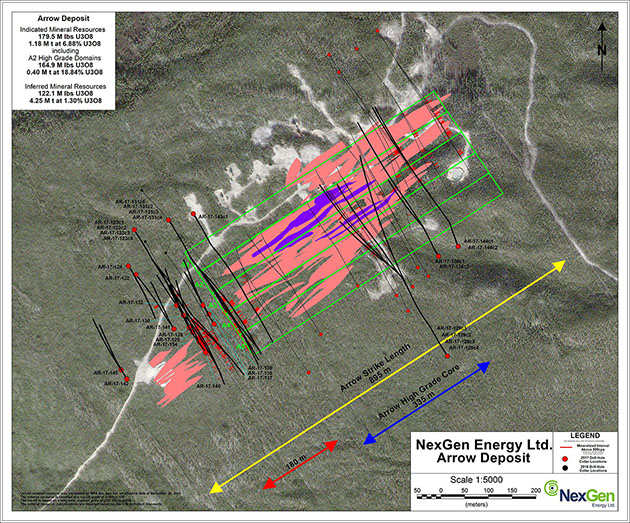

JK: NexGen Energy Ltd. (NXE:TSX; NXE:NYSE.MKT) has a spectacular—I’ll call it a discovery—but it’s actually a very large, growing high-grade deposit in the Athabasca Basin in northwestern Saskatchewan. In 2014, Resource Opportunitiespicked up coverage on NexGen Energy during that terrible bear market. It was a little junior with a land position in the Athabasca Basin, and the stock was at $0.30. For a long time nobody else covered it.

But it started hitting these spectacular, high-grade intercepts, and it’s been quite a success story. The stock is now at $2.73. NexGen just came out with a preliminary economic assessment (PEA) on the Arrow deposit showing very strong economics, including an after-tax internal rate of return of 57% (at an 8% discount rate).

For some perspective, Cameco Corp. (CCO:TSX; CCJ:NYSE), the Canadian uranium company, is one of the world’s largest producers, producing something like 15% of annual global supply. The PEA that NexGen just came out with shows that in the first five years of Arrow’s mine life, NexGen would produce more uranium annually than Cameco does now.

NexGen is really positioned to take a dominant place in the world’s uranium sector. The world’s largest mining companies are all keeping a close eye on it. The stock price has performed in a terrible market for uranium, and I think there’s upside from these levels. If NexGen gets taken over, the company that owns and develops Arrow will have a dominant position in the global uranium market. So it is quite a large prize.

TGR: Recently, NexGen announced that it had a $110 million financing with CEF Holdings Ltd. Does that give it the financial security that it needs to get to production if it decides to take the mine into production itself?

JK: One of the things that makes junior mining companies vulnerable to hostile takeovers of course is being in a weak financial position. CEF Holdings is a joint venture between CIBC, one of the big Canadian banks, and Li Ka-shing, Asia’s richest person. He’s a multibillionaire and very successful across different sectors, including mining and energy. It’s a real validation. He first took a position last year, and has now doubled down. NexGen’s cash position is about $200 million, and the company’s market capitalization is less than $1 billion. So that treasury really does give NexGen options.

And the Li Ka-shing connection is important because a lot of the demand growth on the uranium side will come from China. Uranium supply is very important for China, which is building lots of nuclear reactors due to its growing population and energy needs. China is also going big into solar power but the nuclear push is substantial.

TGR: Let’s switch to diamonds, which your newsletter also covers. Any companies you want to talk about there?

JK: As in uranium, I like to find things that people aren’t interested in or that are out of favor, and diamonds fits the bill.

I was at the annual Prospectors & Developers Association of Canada meeting in Toronto back in March, and it was a big crowd, lots of good energy. I went to a diamond presentation that had some pretty high-quality companies presenting and the room was almost empty. I found that interesting, especially because among the few people there were Chuck Fipke, a billionaire who found Canada’s first diamond mine, and Eira Thomas, who helped discover Diavik, Canada’s second diamond mine. She was also the CEO of Kaminak when it was taken over by Goldcorp. Eira is a cofounder and director of Lucara Diamond Corp. (LUC:TSX.V) and continues to have an interest in diamonds.

Some of the biggest mining companies in the world are quite interested in diamonds because a profitable diamond mine is a very powerful cash machine. For example, the new boss of Rio Tinto Plc (RIO:NYSE; RIO:ASX; RIO:LSE; RTPPF:OTCPK), Jean-Sebastien Jacques, has talked about how he loves the diamond business. And Rio Tinto just inked a joint venture deal with Shore Gold (SGF:TSX), which is exploring for diamonds in Saskatchewan. And then of course, De Beers for a long time had almost a monopoly on diamond production and marketing. It is now majority owned by Anglo American (AAL:LON), and De Beers has been a real profit generator for Anglo American.

Back in April, I did a site visit to Lucara’s Karowe diamond mine in Botswana. Lucara is a Vancouver-based Lundin Group company that is quite an interesting story. It bought a De Beers exploration project that De Beers gave up on, and started finding these very large diamonds. A couple of years ago, Lucara found a 1,109-carat diamond, the second largest ever discovered.

Lucara tried selling the historic diamond at a live auction last year. There were different factors, but it was unable to sell it last year. But Lucara also found an 813-carat diamond that sold for $63 million, a record for a rough stone.

Lucara’s Karowe mine is small. It only produces about 0.03% of diamonds globally each year, but it produces more than 60% of diamonds that are larger than 10.8 carats (called “specials”). Lucara keeps finding very large diamonds that command really high prices. The company has now paid out more in dividends than it has raised in the capital markets, and the stock yields more than 3.5% at these share price levels. Lucara has been weighed down by this 1,109-carat diamond that remains in inventory, which it named the Lesedi La Rona. I think the Lesedi will sell and for a lot of money. So Lucara is a company that generates a lot of cash flow from Karowe and has consistently increased the dividend.

On the exploration front, a company I follow is called North Arrow Minerals Inc. (NAR:TSX.V). The chairman of North Arrow is Gren Thomas, who is Eira Thomas’s father. He was the CEO of Aber Resources, which discovered the Diavik diamond mine up in Canada’s Northwest Territories.

North Arrow has the Naujaat diamond project in eastern Nunavut, which has a population of rare, valuable orangey-yellow diamonds. North Arrow recently raised $5 million from investors, including Ross Beaty who invested $2 million. Similar to the large diamonds, colored diamonds are much rarer. And North Arrow has actually cut and polished some of the orangey-yellow diamonds, and they’re quite beautiful stones. With the money raised, North Arrow has taken a small bulk sample and is doing some drilling. The orangey-yellow diamond population could put that project over the economic hurdle to allow it to become an operating diamond mine.

North Arrow has other projects across Canada as well and a very strong team, with quite an active program over the next nine months. It has discovery potential at some of its other projects, including Mel and Loki.

TGR: Thanks so much for your insights, James.

James Kwantes is the editor of Resource Opportunities, a subscriber supported junior mining investment publication. Kwantes has two decades of journalism experience and was the mining reporter at Vancouver Sun, the city’s paper of record.

Related Articles

- Six Precious Metal Explorers that May Hit It Big This Summer

- Undervalued Companies for the Precious Metal Portfolio

Disclosure:

1) Patrice Fusillo conducted this interview for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She owns, or members of her immediate household or family own, shares of the following companies mentioned in this article: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this interview are billboard sponsors of Streetwise Reports: Columbus Gold, Pretium Resources and NexGen Energy. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) James Kwantes: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Klondike Gold, Arcus Development Group, Strategic Metals, ATAC Resources, Rockhaven Resources, Trifecta Gold, Sabina Gold & Silver, IDM Mining, Columbus Gold, NexGen Energy, Lucara Diamond Corp, North Arrow Minerals. I, or members of my immediate household or family, are paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this interview: Strategic Metals, IDM Mining and North Arrow Minerals. I determined which companies would be included in this article based on my research and understanding of the sector. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this interview, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Agnico Eagle and Cameco, companies mentioned in this article.

Images provided by James Kwantes

“There are folks that are saying you know what, I don’t care, I’m going to lock in my retirement now and get out while I can and fight it as a retiree if they go and change the retiree benefits,” he said. – Executive Director for the Kentucky Association of State Employees,

“There are folks that are saying you know what, I don’t care, I’m going to lock in my retirement now and get out while I can and fight it as a retiree if they go and change the retiree benefits,” he said. – Executive Director for the Kentucky Association of State Employees,

The

The

The Federal Reserve had pumped in $250 billion into its big banks and Hank Paulson, I believe, allowed Lehman and Bear Sterns to collapse to reduce competition for Goldman Sachs eliminating two of the five investment banks. The entire affair was set in motion by the Clinton repeal of Glass-Stegall at the recommendation of the father of negative interest rates, Larry Summers.

The Federal Reserve had pumped in $250 billion into its big banks and Hank Paulson, I believe, allowed Lehman and Bear Sterns to collapse to reduce competition for Goldman Sachs eliminating two of the five investment banks. The entire affair was set in motion by the Clinton repeal of Glass-Stegall at the recommendation of the father of negative interest rates, Larry Summers.