Asset protection

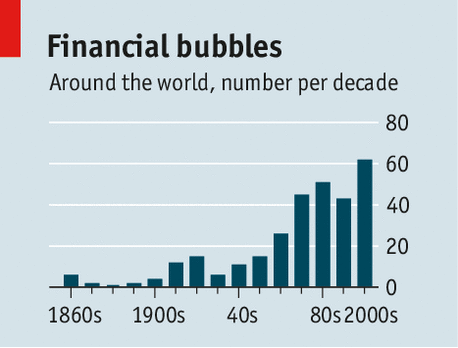

“We are now living through the mother of all financial bubbles. We’ve been living with it so long now that we have to take three giant steps backwards to even detect its broad outlines.

“We are now living through the mother of all financial bubbles. We’ve been living with it so long now that we have to take three giant steps backwards to even detect its broad outlines.

As a reminder, a bubble exists when asset prices rise beyond what incomes can sustain. Florida swampland in the 1920’s, tech stocks in the late 1990s, or Toronto real estate today — all are fine examples of this.

The US government and the private banking cartel known as the Federal Reserve, in cahoots with a very compliant and complicit mainstream media, are doing everything in their vast and considerable power to convince us that we are living in an golden era of risk-free prosperity. And that tomorrow will be even better.

Now, regular readers of PeakProsperity.com’s reports will know there’s a mountain of evidence contracting this. But it’s critical to understand that this is the same public perception management style as we’ve recently seen at Oroville: Deny, deny, deny… and then finally admit the obvious.

So let’s take those three giant steps backwards and see if we can spot the flaw in the ‘everything is awesome!’ meme that the Fed et al are trying to paint for everyone by flooding the “markets” with so much thin-air liquidity (between $150-$200 billion a month) that nobody has any clue what anything is truly worth anymore:”

If the U.S. stock market begins to move lower, it could trigger an ‘avalanche’ type move, according to The Gloom, Boom & Doom Report’s Marc Faber.

Marc Faber, the editor of “The Gloom, Boom & Doom Report,” predicted the rally’s disruption won’t be caused by any single catalyst. His argument: Stocks are very overbought and sentiment is way too bullish for the so-called Trump rally to continue. “Very simply, the market starts to go down. As it goes down, it will start triggering selling, and then it will be like an avalanche,” said Faber recently on “Futures Now.” “I would underweight U.S. stocks.”

…related:

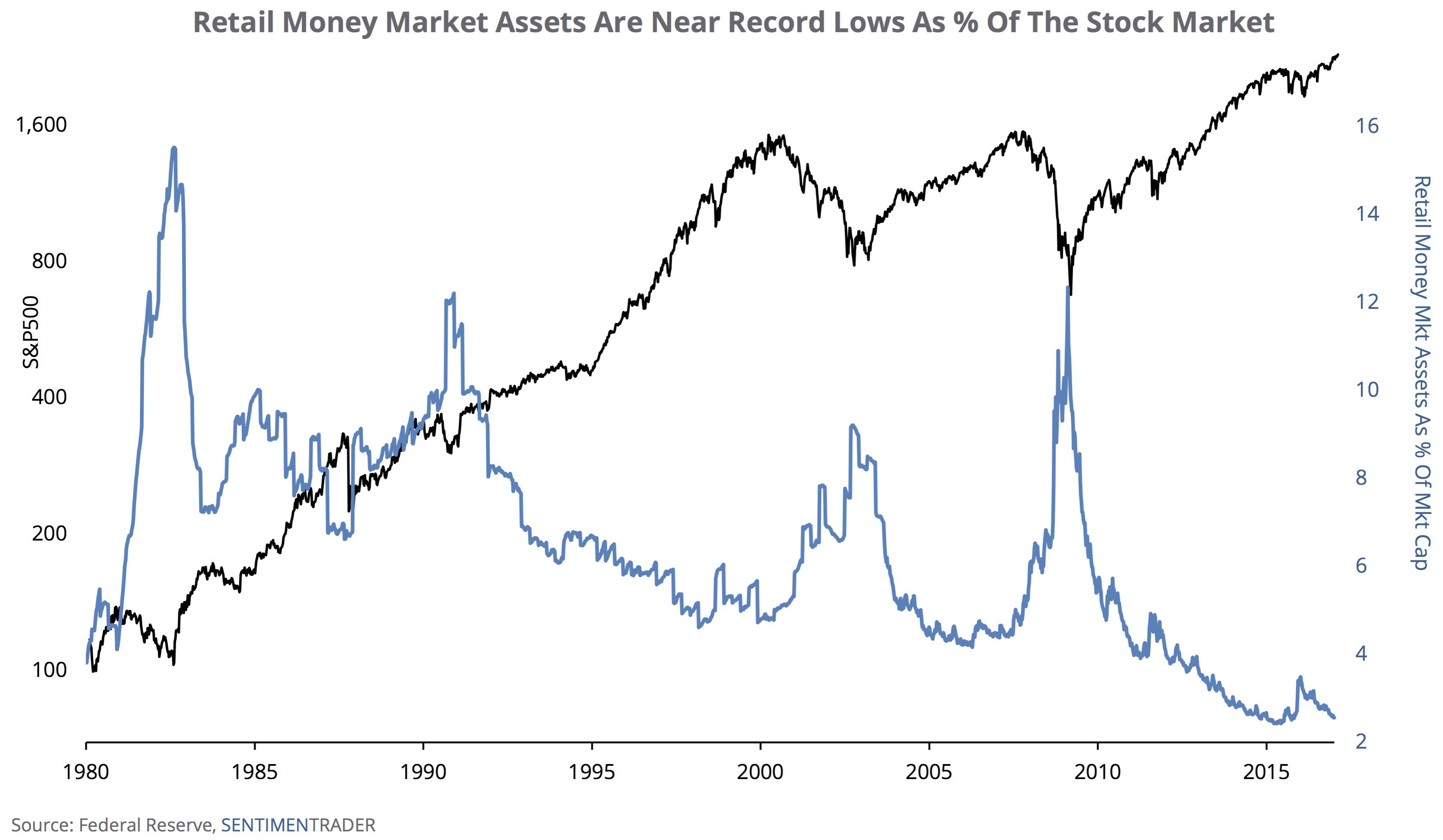

With the Dow Jones hitting new all-time highs and tech stocks skyrocketing this past year “Mom and pop need to shake the couch cushions to buy more shares. Spare cash held by retail investors has fallen to one of the lowest levels ever relative to the value of the U.S. stock market…

…also from King World News:

Reflation Trade Creates Historic Breakouts – What This Means For The Gold & Silver Markets

Every few years, it seems, one or another mismanaged eurozone country falls into one or another kind of crisis. This leads to speculation about the end of the common currency, which in turn spooks the global financial markets. Then the ECB conjures another trillion euros out of thin air, buys up and/or guarantees all the offending country’s bonds, and calm returns for a while.

Every few years, it seems, one or another mismanaged eurozone country falls into one or another kind of crisis. This leads to speculation about the end of the common currency, which in turn spooks the global financial markets. Then the ECB conjures another trillion euros out of thin air, buys up and/or guarantees all the offending country’s bonds, and calm returns for a while.

At least, that’s how it’s gone in the past.

The latest crisis has more than the usual number of flash-points and could, therefore, be something new and different. Currently:

Greece. This charming but apparently ungovernable country only got into the eurozone in the first place because its corrupt leaders conspired with Goldman Sachs to hide the true condition of the government’s finances. It quickly blew up and has been on intensive care ever since. Now the latest bailout has become deal-breakingly messy:

‘From bad to worse’: Greece hurtles towards a final reckoning

(Guardian) – With another bailout set to bring more cuts, quitting the euro is back on the agenda.

The country’s epic struggle to avert bankruptcy should have been settled when Athens received €110bn in aid – the biggest financial rescue programme in global history – from the EU and International Monetary Fund in May 2010. Instead, three bailouts later, it is still wrangling over the terms of the latest €86bn emergency loan package, with lenders also at loggerheads and diplomats no longer talking of a can, but rather a bomb, being kicked down the road. Default looms if a €7.4bn debt repayment – money owed mostly to the European Central Bank – is not honoured in July.

Amid the uncertainty, volatility has returned to the markets. So, too, has fear, with an estimated €2.2bn being withdrawn from banks by panic-stricken depositors since the beginning of the year. With talk of Greece’s exit from the euro being heard again, farmers, trade unions and other sectors enraged by the eviscerating effects of austerity have once more come out in protest.

This is the irony of Syriza, the leftwing party catapulted to power on a ticket to “tear up” the hated bailout accords widely blamed for extraordinary levels of Greek unemployment, poverty and emigration. Two years into office it has instead overseen the most punishing austerity measures to date, slashing public-sector salaries and pensions, cutting services, agreeing to the biggest privatisation programme in European history and raising taxes on everything from cars to beer – all of which has been the price of the loans that have kept default at bay and Greece in the euro.

The arc of crisis that has swept the country – coursing like a cancer through its body politic, devastating its public health system, shattering lives – has been an exercise in the absurd. The feat of pulling off the greatest fiscal adjustment in modern times has spawned a slump longer and deeper than the Great Depression, with the Greek economy shrinking more than 25% since the crisis began.

Even if the latest impasse is broken and a deal is reached with creditors soon, few believe that in a country of weak governance and institutions it will be easy to enforce. Political turbulence will almost certainly beckon; the prospect of “Grexit” will grow.

Italy. A few months ago the centrist president, Matteo Renzi, resigned after losing a referendum (don’t bother with the details, they were never very interesting and in any event have been overtaken by events), making a new election necessary. There was a chance that Renzi would be returned to office, which would reset the clock on Italy’s inevitable descent into Greek-style chaos. But yesterday he resigned, throwing the upcoming elections into disarray and opening the door to eurosceptic populists. Combine political turmoil with a moribund banking system and Italy becomes a prime candidate for Big European Crisis of 2017.

Italy’s Renzi resigns as party leader, in tussle over how to counter rise of 5 Star

(MarketWatch) – Italy’s governing center-left Democratic Party was locked in a fierce battle Sunday over the best way to pull the country’s economy out of the doldrums and blunt the momentum of antiestablishment politicians—as mainstream politicians across the Continent struggle to come up with winning strategies in a year of major elections across the European Union.

Former Prime Minister Matteo Renzi, who resigned as premier after losing a referendum vote on constitutional changes in December, formally stepped down as leader of the party after facing sharp criticism for his inability to stem the mounting popularity of the rival 5 Star Movement, a euroskeptic party that wants Italians to have a national vote on whether to leave the eurozone.

5 Star, which opposed Renzi’s proposals in the plebiscite, and the Democrats are running neck-and-neck in public-opinion polls. Both parties have pushed for fresh parliamentary elections this year. The country is now being run by a caretaker administration.

France. Each new immigration horror story adds a bit to the popularity of the anti-immigration National Front, and increases the odds that party leader Marine Le Pen makes a strong showing in upcoming elections. The odds are still against her actually winning, but as the polls tighten, French bonds are sold off by nervous traders, widening the spread between French and German yields. A widening yield is a sign of approaching trouble:

Political Turmoil Returns To Europe: French-German Spread Blows Out

(Zero Hedge) – European political fears have returned this morning, leading to a blow out in French government bond yields, pushing the 10y yield now higher by 5bps and 5y up 8bps, as early losses extend after latest poll shows support for anti-euro presidential candidate Marine Le Pen rising

As a result, the French-German 10Y govt spread has jumped to 85 bps, following an accelerated selloff, to the widest level since July 2012.

And those are just the front-burner problems. The Dutch are also holding general elections next month in which their version of Donald Trump will likely be the leading vote-getter. Germany has two elections this year, and opposition parties are gaining on Chancellor Angela Merkel. So there will be no shortage of scary headlines from the Continent going forward.

Why should non-Europeans care about any of this? Because the EU is the biggest economic entity on the planet and the euro is the second most widely-held currency. Turmoil there means turmoil everywhere else, though the form is hard to predict. A euro crisis might send terrified capital into US stocks and bonds, extending the bull market in domestic financial assets – and making the current US administration look like a bunch of geniuses. Or it could spook capital out of financial assets altogether, crashing stocks and bonds while boosting the price of real things like farmland, solar farms and precious metals. Or it could buoy all US assets, with “anywhere but Europe” becoming the dominant investment theme for a while.

OR the ECB could try to paper over the mess by devaluing the euro even further, setting off a trade war with the US, Japan and China, all of whom need weaker not stronger currencies to hide their own financial mismanagement.

….also:

Conclusion: full article HERE

Conclusion: full article HERE

Lesson #1. Trade disruptions. Global trade and currency markets are heart muscles of the world economy with connecting tissues that extend to interest rates, bond markets, banking, insurance and more. If, for example, Trump initiatives reset trade patterns and exchange rates, you could see a cycle of global actions and reactions that includes some key features of the 1970s and 1980s.

Lesson #2. Powerful forces. Once that kind of megacycle is set into motion, it can continue for decades, and no one can stop it. Our colleague Larry Edelson says it’s the cycle itself that drives government policy, not the other way around. But disruptive policy changes from Washington can certainly play an important role in precipitating a major turn of events.

Lesson #3. Rising prices. One of those major turns could bring back inflation. It may start slowly and may take time to hit with full force. But any major changes that make foreign imports more expensive or weaken the U.S. dollar could be catalysts.

Lesson #4. Gold. Even without much inflation, gold is bound to be among the leading beneficiaries. I repeat: After the Nixon Shock, it surged from $43 to $850 per ounce. An equivalent rise from today’s gold price would take one ounce of the yellow metal to over $24,000. Certainly, no one is predicting anything that extreme. But it just goes to show the power behind the cycle that fueled — and was fueled by — the Nixon Shock.

….read the entire article HERE