Asset protection

January is a time for reflection and planning. While it’s easy to admit we need to lose a few pounds or watch less TV, matters related to our skills and competence strike closer to home, i.e. closer to our ego. This is where it gets delicate, and also where real learning can lead to genuine progress. Courage always precedes radical honesty, especially when WE are the subject.

In the last ten weeks since I started writing again for the Money Talks blog, this is the kind of beautiful and painful honesty I’ve heard from readers who have contacted us.

“I/we started self-managing in 20XX because our advisor/broker didn’t prevent big losses when X or Y happened, and we felt like our trust was betrayed. Since then, I’ve done pretty well investing in some things, especially if it’s related to my work, but then I get busy with work or family life, and I don’t follow my own rules. Sometimes I struggle with patience and sell too soon. Other times I freeze when a position goes south and I excuse it because I like the company or the sector. That happened in gold/oil/technology stocks, and I sat there and watched $ X just evaporate. I know how this works intellectually, but my emotions take over when it’s real money in real time. And sometimes – like now – I feel like a deer in the headlights, too scared to get invested again because the world looks like it could come unravelled any second. I’ve made some very costly mistakes over the years and we cannot afford to keep making mistakes with our retirement funds. I don’t enjoy doing it anymore, I’m not that good at it, and we’re looking for someone we can trust with our life savings. What makes your firm different?”

All these people have real courage. Some folks are much harder on themselves. It’s both a privilege and a responsibility to hear their stories. Helping real people solve real pain and avoid repeating costly mistakes is what we specialize in…and it’s why we’re passionate about what we do.

Below are some questions for you to ask yourself…and maybe even share with your spouse. This is my Gift of Radical Honesty to those with the courage to unwrap the package. What you choose to do with the gift is completely up to you.

- Do I genuinely enjoy managing our portfolio? Is it deeply satisfying, given the time I’ve invested?

- Have I really made additional gains (or prevented additional losses) that more than make up for the investment fees we’re saving by self-managing? Does this extra return (or loss avoidance) fairly compensate me for my time and energy?

- Is keeping up with market information still fun and stimulating, or has it started becoming more of a burden? Is it bordering on being an unhealthy obsession?

- Have I been “beating the markets” consistently? Is this a realistic or necessary expectation?

- Does the sense of being independent and “in control” outweigh the work required, or is “the thrill” gone?

- Have I been generating the rate of return our family requires? Do I know the return we actually need to achieve our goals?

- Am I able to consistently shut off my “investment mind” and be fully present at work, engaged with family and friends, with enough time left over for personal pursuits? Or do the markets come flooding back into my consciousness whenever I start to slow down?

- Is managing our own portfolio feeding the healthiest parts of me, or has it shifted to highlighting my weaknesses (I’ve lost enthusiasm for this, I’m not very good at this, I keep making the same mistakes, etc.)…and it’s getting painful?

- Do I find myself resenting the time it takes to properly manage our money? Or have I gradually stopped watching things closely and then had things go sour because I wasn’t paying close attention?

- Is the idea of admitting to someone that I need or want help too painful to bear, so I’m just going to try harder, buy another research subscription, and put more time into it…or is it time to ask for help?

- Is managing our own portfolio making me – and those around me – healthier, wealthier and happier?

Please watch Mike’s emails and the Money Talk blog over the next few weeks. I’ll be following this article up with questions to ask yourself about how you might select a new advisor, and questions to ask any advisors you might interview for the job.

Cheers,

Andrew H. Ruhland, CFP, CIM

“We’re all on the Titanic, but the Titanic still has maybe a few days to travel before it collapses so we might as well enjoy the journey,” Faber, also known as Dr. Doom, told CNBC’s “Squawk Box.”

“We’re all on the Titanic, but the Titanic still has maybe a few days to travel before it collapses so we might as well enjoy the journey,” Faber, also known as Dr. Doom, told CNBC’s “Squawk Box.”

….related:

Trumping DC

Canadian Bubble

Crowded Exits in Europe

Asian Angst

DC, Florida, the Caymans, and a Few Final 2016 Thoughts

“Experience is simply the name we give our mistakes.”

– Oscar Wilde

“Mistakes are the usual bridge between inexperience and wisdom.”

– Phyllis Theroux

“Economists are often asked to predict what the economy is going to do. But economic predictions require predicting what politicians are going to do – and nothing is more unpredictable.”

– Thomas Sowell

We’ve reached that wonderful time of year when financial pundits pull out their forecaster hats and take a crack at the future. This time the exercise is particularly interesting because we’re at several turning points. Any one of them could remake the entire year overnight. I should probably say up front that I am actually somewhat optimistic about 2017 – optimistic, meaning I think we Muddle Through – but that’s a lot better outcome than I was expecting five months ago. And since my annual forecast has been “Muddle Through” for about six years now (which has been turned out to be the correct forecast), then, given all the speed bumps in front of us, this could be the year where I’m spectacularly wrong. Midcourse corrections may be warranted.

I’ll have my own specific predictions later this month, along with a review of others that I find instructive. Today’s letter, though, will preface that discussion. Instead of trying to answer questions about the future, I’ll try to list those we should be asking as 2017 opens. These are the things that I sit and meditate about when I consider the future of economics, markets, and investing. Today’s economy is something like an old-fashioned Swiss watch. It’s a thing of beauty when all those delicate little gears mesh just right. If you ever take the time to actually study the inner workings of the marvelous manifestations of human ingenuity that keep us all alive, it is difficult not to come away awestruck by the ability of the human mind to craft such complexity. But if any of the gears get just a little out of whack, the entire contraption can grind to a halt.

Now, if your watch stops working, it isn’t the end of the world. You can know roughly what time it is just by looking out the window. The global economy is another matter – we can’t afford for any of its major components to break down; so it’s smart to ask, “Where are the weak points.” That’s what we’ll do today: We’ll poke at the economic mechanism as it grinds along here on New Year’s Eve 2017; then I’ll get more specific in my forecast issue.

Before we begin, let me briefly mention that our most exclusive service of all, the Mauldin Alpha Society, is currently open to new members.

I launched the Alpha Society last year as a way to connect more intimately with my most valued readers – the “idea chasers,” as I call them. If you join this inner circle of the Mauldin Economics family, you’ll pay a one-time initiation fee (plus a small annual maintenance fee) and receive all our research for life.

How fast this investment pays for itself depends on which services you’re already subscribed to, but I can guarantee you that you will completely recoup your investment in no more than two and a half years. After that time – and potentially much sooner – you’ll essentially get everything we publish for free, for as long as we publish.

Aside from saving copious amounts of money on subscriptions every year, as an Alpha Society member you’ll enjoy all sorts of useful perks – among them a generous discount on the coveted tickets to my Strategic Investment Conference (to be held this year in Orlando, Florida) and the opportunity to attend a special SIC meet ’n’ greet, hosted by yours truly, where you can share drinks and thoughts with me, our blue-ribbon speakers, and the Mauldin Economics editors.

These events are always my favorite part of the SIC. It’s where we get to pick each other’s brains about our mutual investing future. I learn so much every time we hold these get-togethers that by now I’m convinced we have some of the most brilliant subscribers of any investment research service out there.

I hope you’ll join us this year as an Alpha Society member, so we can get to know each other. Enrollment is open until January 15 or until we have filled the 300 available member slots, whichever comes first. Get all the details here.

Now, let’s look under the hood at 2017.

The biggest change will happen in Washington when Donald Trump takes office. Aside from the changes he can make on his own authority, he’ll be in position to approve the many Republican initiatives that President Obama blocked. Here are some items I’m watching.

Tax Reform: Our monstrosity of a tax system needs major reconstruction. I’ve described what I think would be ideal: a reduction and simplification of corporate taxes, a significant reduction of the individual income tax, and replacement of the Social Security tax with a VAT-like consumption tax. What will come out of the House is still unknown. If you look at House Ways and Means Chairman Kevin Brady’s bill, he uses the word tariffs, but his proposal looks suspiciously similar to the VAT that I’m suggesting, except that Republicans aren’t allowed to say “VAT” saying “I’m against it” in the same sentence. Or at least they couldn’t until both Rand Paul and Ted Cruz basically suggested a VAT. I will admit to discussing the topic with both of them, but their versions are an amalgam of ideas.

My sources are telling me House members want to pass an initial tax cut quickly and defer the more complicated changes for later in the year. The easy initial tax cut is to remove the Obamacare tax when they repeal Obamacare (the Affordable Care Act), which it appears they will do early in the session. It won’t be an immediate repeal but rather a slow, orderly retreat. But getting agreement on a replacement system is going to be contentious. The problem is the Medicare taxes don’t kick in until about $250,000 of income.

While the tax outcome could be nice for some of us, I’m afraid of the political perception problem if the first tax cuts go mainly to high-income taxpayers. Democrats will cry foul and try to force a split between the GOP’s business wing and its new populist elements. More to the point, a tax cut for the wealthy won’t stimulate the economy enough.

So I very much hope the first tax cuts either target middle- and low-income taxpayers or at least somehow encourage beneficiaries to reinvest their tax savings back into the economy. Lack of capital is not our problem; we need to stimulate demand – and tax policy can help.

Final thoughts on taxes: What Kevin Brady is saying basically sounds good, as he acknowledges that some industries will suffer massive impacts if you slap tariffs on incoming goods. Further, putting a high tariff on products that are sold at Walmart and Costco and on Amazon is massively inflationary to those shoppers (and that’s most of us). Look at the immediate and one-time negative effect on inflation in Japan when they increased their sales tax a few years ago. These policies can be tricky, and the consequences can have a big impact on consumer confidence.

You have to be very careful about applying tariffs to raw commodities that we need as inputs to our own manufacturing but that we can’t produce in sufficient quantities here at home. We don’t want our manufacturers to be hamstrung because we load them up with increased costs for their input materials, like iron ore, heavy crude, or rare earths. Those materials are in a different category than processed goods. Like I said, it’s tricky. Changes as massive as the ones being contemplated simply cannot be good for everybody. Somebody’s ox is going to get gored.

If I have one suggestion, it would be to implement the large changes over three or four years and let businesses adjust.

Energy: The Obama administration’s heavy-handed environmental regulations are a major impediment to US energy independence. Trump can change many of them quickly, because they came in the form of executive orders and rulemaking that doesn’t require congressional approval. I’ll be watching to see if the new administration approves more natural gas export terminals and pipelines, which will both create jobs and help reduce the trade deficit.

Trump can also approve some of the Arctic and offshore drilling projects that Obama would not consider. I am told that there are some $50 billion worth of oil-production projects that are ready to go, which would be a massive source of high-paying jobs.

If he wants to play hardball with OPEC, Trump could even impose a tariff on imported petroleum products that we can produce here (as opposed to the raw crude, especially heavy crudes, that we currently don’t produce). That would give domestic producers and refiners a further boost. It would also aggravate the rest of the world’s oil glut.

Sidebar: I read this week from a reliable source that in 2017 it will be 20% cheaper than it was in 2016 to drill the same well in West Texas. I keep telling you that oil production is now a technology business. I’m going to do a special letter on that subject at some point, because it is difficult to grasp just how much big data and new drilling technologies have impacted the business. It is not impossible to envision a future in which, not that many years from now, a $30 a barrel oil well will be considered profitable, especially if you can capture the attendant natural gas and ship it around the world.

With the continued improvement in vehicle gas mileage and the overall reduction in the use of oil in the US (which is an ongoing trend), energy independence is no longer a pipe dream.

Economic stimulus: The bond-financed infrastructure program I’ve advocated doesn’t seem to be on anyone’s radar, unfortunately. What I hear is mainly a tax-credit privatization program. I suppose that would help, but it won’t accomplish the same goals. And it will necessarily be smaller in scope.

We have plenty of shovel-ready projects, or could create them in short order, that would create jobs and simplify trade and travel. Some will not be very profitable in the short run, so they may not happen under a tax-credit scheme. Investors will want to finance toll roads and the like – projects that will generate predictable cash flows.

Trade: Import-dependent businesses are on pins and needles right now, hoping the Trump administration doesn’t turn toward the kind of protectionism some of the new appointees have advocated in the past. We’ll see. The president has considerable latitude in this area, so almost anything is possible.

China is the main point of contention. We already see Trump trying to use Taiwan as a bargaining chip. Beijing isn’t at all happy about that, but their options are limited. I feel sure we will see some kind of new US-China trade arrangement, but I really don’t know what to expect. The stakes here are enormous, so the situation bears close watching.

The appointment of Peter Navarro to oversee American trade and industrial policy has made more than a few of us a little nervous. I simply do not agree with his analysis of the impact of imports on GDP. I think it would make a lot of us on the free/fair trade side of the fence a lot more comfortable if somebody like Larry Kudlow is appointed chairman of the Council of Economic Advisors. He has been rumored for the job for about three weeks, but Trump has not pulled the trigger. (I know, I know, Larry does not have a PhD. But he is more than qualified. But if not him then somebody who has the same views, as a balance to Navarro.)

For the record, I explicitly agree with Stephen Mnuchin, who says he prefers to do bilateral rather than regional trade agreements. Trump should appoint 25 trade specialists and assign them to different countries and put them on planes within a few weeks of his inauguration. Trying to get agreement from 14 to 20 countries that all have competing interests makes any trade document so unwieldy that it ends up looking more like managed trade than free trade or fair trade. Not every country will want to get involved, but I’ll bet you a lot will.

Obama threatened the United Kingdom that if it left the EU it would fall to the back of the line as far as US is concerned in trade deals. Trump and Mnuchin say the UK will always be at the front of the line. Negotiations on a new trade agreement should start now so that it can be ready to sign as soon as possible.

Banking: One reason the stock market has gone bananas since the election is the prospect of banking deregulation. Wall Street has been chafing under the Dodd-Frank Act’s requirements and restrictions. The Volcker Rule on proprietary trading has clearly worsened bond market liquidity and taken a major revenue center away from the banks. I am not so worried about the revenue source, but there will always be another crisis in the future. Right now, liquidity in the bond markets can dry up in a Wall Street second – much faster than it would have done in the past. The banks really did provide liquidity, which is a useful item (as opposed to high-speed trading, which should be reined in as soon as possible).

Worse, the Dodd-Frank Act as presently constructed could actually aggravate matters if we find ourselves in another financial crisis. Dodd-Frank prevents the Federal Reserve from stepping in with liquidity and instead says that the FDIC should “resolve” any failing banks. I see the point, but the main reason we have a central bank is to provide a lender of last resort to the banking system. The FDIC simply can’t act fast enough, nor does it have the ability or the cash to act effectively in a crisis. Congress needs to fix this soon.

Finally, Dodd-Frank puts our regional and small community banks at a massive disadvantage. They get all of the costs and are restricted from their normal activities. Hardly a week goes by that I don’t see some fixed-income equivalent return in the high single digits or/low double digits from private businesses looking for cash. These are the types of deals that banks used to do to their considerable profit, and now regulators are restricting what they can do. The deals still get done, or now they are just done in the private sector. I am not complaining about that because I am part of the private sector and from time to time get to take advantage. But the greater good really does require small community banks to be able to function properly. Overhauling Dodd-Frank will be a big boon to entrepreneurs and small businesses and will create jobs.

I am all for serious restrictions on too-big-to-fail banks. I would prefer that they have to increase their capital reserves. But that doesn’t describe 99% of the banks in this country, yet we have written rules to make sure the 1%, the largest banks, don’t put taxpayers at risk (even while those rules make it more likely that they will be at risk in some future crisis).

Federal Reserve: We should also see at least two nominees to the Fed’s Board of Governors soon after Trump takes office. He may get a third one if Daniel Tarullo leaves, as some observers expect. He will get to nominate both the chair and vice chair next year, and it is likely that the remaining members will think about leaving as well when Yellen departs. But the early nominees will tell us a lot about Trump’s priorities and long-term plans – hopefully for the better. (I do hope that Richard Fisher is on the very short list for Fed chair and that Dr. Lacy Hunt is in line for one of those board seats.)

Meanwhile, the Fed is in the middle of a long-overdue policy turn. There’s still a risk that they will find they started tightening just in time for a recession, which is also long overdue. I was convinced last summer that they would push rates negative in that scenario. Negative rates could yet happen, but I think they will be less likely if the FOMC abides by their dot plots and raises rates three times this year. And I find it difficult to believe that a Trump-appointed Fed would take us into negative rates. We are going to have to find more creative ways to do things.

Wall Street is actually fine with higher rates, by the way. Yes, hiking at the short end raises their cost of funds a bit, but long-term rates have jumped even more. That results in a steeper yield curve and makes lending more profitable for banks.

Surprises: Black swans aren’t a risk limited to the world of finance; they happen in politics, too. George W. Bush had no idea that September 11 would hit less than eight months into his presidency. God forbid we get something like that again, but a similarly unforeseen crisis is possible and maybe even likely in 2017. Such an event could push aside all the best-laid plans and change everything.

Our neighbors to the north are at their own turning point. The Canadian economy was riding high in the commodity boom but has run into problems after two years of sharply lower oil prices. Since then Canada has avoided recession but has not enjoyed much growth, much like the US. I should point out that Canada is by far our biggest trading partner.

Canada also has a housing bubble that looks increasingly ready to pop. (Then again, I’ve been saying that for three or four years.) Home prices in Vancouver are unbelievable, and Toronto is not far behind. These prices have little to do with oil and everything to do with Hong Kong Chinese and other Chinese buying property. Wealthy Chinese, eager to evade their own country’s capital controls, are buying homes as offshore savings accounts. What look like astronomical prices to us are still attractive to Chinese buyers, especially if they believe (and I think with good reason) that their own currency is likely to drop relative to the US dollar over the coming years .

What happens in Canada will tell us something important about China and vice versa. Anything that keeps Chinese money from leaving the country will raise the odds of Canada’s bubble popping.

US energy policy matters to Canada, too. The country’s huge oil sands deposits would help its export balance, but in some cases the best access requires pipelines through the US, like the Keystone that Obama has held up. Trump can help Canada by letting that project go forward. We should find out fairly soon if he will.

I thought there was a good chance the Italian bank crisis would come to a head in 2016. The Italians seem to have yet again delayed the inevitable. Reality hasn’t fundamentally changed, though. Monte dei Paschi and the other troubled institutions are not going to get better on their own, nor is the new government going to miraculously gain public confidence.

Monte dei Paschi has at least 36% of its loan portfolio in the nonperforming category. The Italians have raised €20 billion for a bank bailout fund, but there is serious doubt that will be enough to cover Monte dei Paschi alone. My friend George Friedman says Goldman Sachs estimates that successful recapitalization would require €38 billion, while a senior market analyst at London Capital Group suggests the number might be closer to €52 billion. And that is just one bank.

Saving Italian banks will take multiple hundreds of billions of euros, which Italy does not have, nor do they technically even have the legal right to unilaterally bail these banks out. They would have to utilize an ECB facility that does not now exist to get that much money, and such a measure would require German approval. By the way, individual Italian investors and savers have invested at least $200 billion in junior, well-subordinated debt that paid a higher yield than bank savings accounts do; and they were told the investment was safe. Think about what would happen if $1 trillion disappeared from the savings of retirees in the US, and then double that number and you’ll be getting close to what the equivalent impact would be. Think that’s politically possible?

I keep telling you that Italy is the most dangerous economic issue on the world front. Attention must be paid.

That said, Europe is quite capable of staving off disaster. They are professionals at that. They can do it again this time if nothing else goes wrong. That’s a big if.

In the “something else” category, start with political pressures. France and Germany will both hold elections in 2017, with populist parties itching to take charge. I don’t think they will succeed in either country, but the price of holding them off could be high. Merkel may have to surrender her wish to accept more Middle East refugees. The refugee flow will not stop, though. People will instead pile up in Italy, Greece, and Turkey, all of which have their own serious problems. And Merkel is not going to want to acquiesce to Italian demands for relief on its banking issues prior to the German election in September.

Further north, it looks like the UK will formally begin the Brexit process in 2017. Implementation will consume energy and resources that the EU really needs to devote elsewhere. Also, the closer the UK gets to actual withdrawal, the more pressure other countries will face from their own anti-EU parties. The arguments against EU withdrawal will weaken considerably once the UK pulls the trigger without world-ending consequences.

Then there’s NATO. The defense alliance partially overlaps with the EU but also includes Turkey. Trump wants the other member states to increase their defense spending. He says, correctly, that they aren’t paying their fair share and has openly questioned whether the US would come to their aid in an attack. The Baltic countries and Poland are very concerned, as they are the most exposed to potential Russian aggression.

Does Putin intend to attack and try to occupy one of those countries? Think Afghanistan. I really rather doubt he will, but he can cause all kinds of problems without attacking. Fear alone is sufficiently troublesome. Meanwhile we have President Obama, despite his being on the way out the door, imposing new sanctions on Russia for alleged hacking activity. And we see Russia and Turkey actually growing closer after the assassination of the Russian ambassador in Ankara last month.

As with Italy, though, fear has consequences. Leaders can juggle only so much. When too many things happen at once, the risk rises that someone will drop a ball.

Relationships within Asia are in flux, to say the least. Trump’s phone call with the Taiwanese president and subsequent comments show he’s willing to roll back prior commitments in order to get better ones. Beijing was not pleased, to put it mildly, but I don’t see this as a crisis. I suspect Trump intermediaries are already working quietly on new deals with China. We could see some major changes in 2017.

China has other problems, too. They are holding the domestic economy together with astonishing amounts of debt. New liquidity can’t leave the country due to capital controls, but it has to go somewhere. The result is rolling asset bubbles that make even Vancouver housing prices look flat.

The transition from an economy driven by exports to one led by domestic demand is probably going as well as it can, but that’s not saying much. The process may accelerate if Trump has his way. This is one area where I fully expect him to follow through on the rhetoric. It will look crazy, but crazy with a purpose. The hard part will be giving the Chinese leaders a face-saving way to accept the demands without causing domestic instability. I am not sure Trump fully appreciates that side of it. Either side could miscalculate and set off a bad reaction.

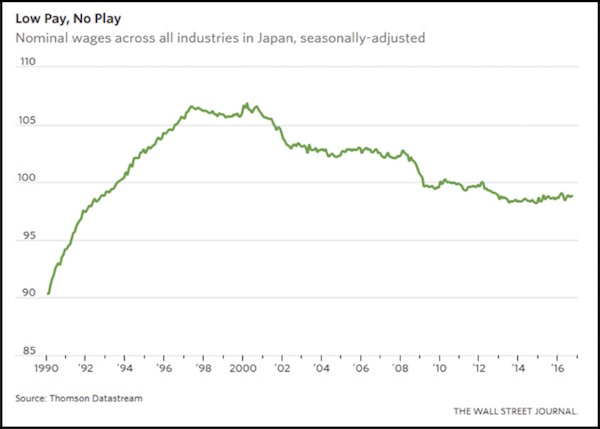

Over in Japan, something interesting is happening. The job market is unbelievably tight. I saw in a Wall Street Journal report last week that each available worker has two job offers on average. The unemployment rate is historically low. In a normal market, you would expect employers to compete for workers by raising wages, right? But it isn’t happening. Wages are flat or even falling.

Japan’s culture and some unique labor policies partly explain this, but I think the situation really shows how hard it is to escape a deflationary spiral. Deflation has changed the psychology for two generations of workers and managers. Employees are afraid to demand more, and companies are afraid to pay more.

It’s also a potentially ominous sign for the US. The Fed and many others are watching labor markets closely for signs of wage inflation. Rising wages are one of the factors that would justify tighter interest-rate policies. Yet Japan shows that unemployment can stay low for years without necessarily causing wage inflation. The BOJ would probably love to see some, but they aren’t getting it.

Japan is another potential target of Trump’s trade policy. Unlike China, Japan really is devaluing its currency. The policy is working, too, in terms of promoting exports. But those exports don’t all go to the United States. Japan sells China much of its industrial equipment and technology, demand for which will presumably drop if Trump succeeds in reducing Chinese exports.

(And while we are talking about currencies that are devaluing against the dollar, let’s note that the British pound is down 40% and the euro is down about 35%, and I don’t think it will be much longer before the euro is at parity with the USD. Are we going to declare those countries currency manipulators? China’s small currency drop is meaningless by comparison. And if China were to float its currency? My bet is the renminbi would drop by another 25 to 30% almost immediately. So much for free markets…)

While we’re talking about Asia, I have to mention India’s paper-money crackdown. Prime Minister Narendra Modi has been trying hard to control the country’s very large underground economy. In November they did an overnight cancellation of the two largest-denomination paper bills, giving people until Dec. 30 to deposit them in a bank account before the paper became worthless.

The problem, of course, is that hundreds of millions of Indian workers don’t have bank accounts. The result, at least according to news reports, has been nothing short of chaos in some places. Normal commerce simply ground to a halt. People have been existing on barter and IOUs. The debacle may cost India a point or two or more of GDP growth, according to some estimates.

Worse, it may not have even accomplished the original goal. The theory was that people hoarding large amounts of cash would be afraid to turn it in, and it would simply become worthless. That would teach them, Modi must have thought. But now it appears that almost all of the cash returned to the banking system. That means the black market was not as large as the government thought, or people found other ways to launder their cash.

I explain all that to make an important point. Government mistakes are a top risk factor now. I think Modi had good intent. I’m sure the government planned the operation as well as it could. They were attacking what they thought was a real problem with what seemed like a reasonable plan (at least to them). But it still didn’t work and might even have caused additional damage.

Imagine the damage a similar-scale policy error could cause in the US. We have an incoming government that will likely try things no one has ever tried before. We have a Federal Reserve that needs both to raise interest rates and to reduce its bloated balance sheet. We have all kinds of international challenges. I haven’t even mentioned Africa, the Middle East, Australia or Latin America. They all hold potential problems for the global economy, too.

We enter 2017 with more question marks than I can count. Even if all the policymakers are competent and have good intentions, stuff happens. Things go wrong. People don’t react the way you think they will. You end up causing more problems for the people and businesses you wanted to help.

I have full confidence in the ability of US business to produce quality products and services at fair prices. Ditto for many other countries. Their decisions are not what we need to worry about. Now more than ever, economic risk around the world emanates from our governments and central banks.

I was with Steve Forbes the other night in New York. He asked me how I was feeling and gave me a list of about seven adjectives. I told him that I was skeptically optimistic. He laughed and said that’s probably the right position. I have not been happy with the bulk of what has come out of Washington DC for the last 16 years.

Trump has the traditional 100 days to deliver something to keep the optimism going. Hopefully, a Congress that is nominally Republican controlled can agree on important measures and move more quickly than we have seen it move in quite a while. But then New Year’s Day is a moment for optimism and hope. That’s how we’ll end this letter; and next year – that is, next week – I’ll have my own economic and market forecast for 2017 for you.

DC, Florida, the Caymans, and a Few Final 2016 Thoughts

Tonight I will celebrate New Year’s Eve with close friend David Tice of Prudent Bear fame, who is getting married to his new wife Sophia in a few hours. It should be quite the New Year’s Eve party. Then Shane and I will be in Washington, DC, for the inauguration. I am on the board of a public company called Ashford Inc., which manages hotel REITS, among other things. We own several hotels in DC, including the Capital Hilton, and our chairman and my good friend, Monty Bennett, decided we would move our board meeting up a few weeks and hold it in Washington during the inauguration. I will get to see a lot of friends and of course will be at the huge Texas inaugural ball, called Black Tie and Boots, on Thursday night (if you are there or in DC, let’s meet) and am still looking for tickets for an inaugural ball on Friday night.

We will go straight from DC to the Inside ETFs Conference in Hollywood, Florida, January 22–25. If you are in the industry and coming to that conference, make a point to meet with me. Mauldin Solutions (my investment advisor firm) will have a booth at the conference, where I will try to hang out some. If you are an independent broker advisor in the area, make a point to come by and see me. I will be making some big announcements at the conference. Then I’ll be at the Orlando Money Show February 8–11 at the Omni in Orlando. Registration is free. I am also scheduled to speak at a large hedge fund conference in the Cayman Islands February 14 to 18.

During the last week of the year, I always end up thinking about what my next five years will look like. I’ve been doing that since I was 22 and leaving Rice University with a freshly printed sheepskin. I have had 45 opportunities since to analyze how effective and accurate my five-year planning is. So far I’m 0 for 45. That’s right. A guy who makes his living as an analyst and forecaster has never been able to accurately predict his own life, the one thing that he theoretically has under control. Not even once! I actually get the general direction right about half the time, which I suppose is not too bad. Well, and that’s with a pretty broad definition of direction. That said, while I would have preferred to avoid a few bumps, I am pretty happy with where I am. Not too bad for a poor country boy from Bridgeport, Texas.

There have been only a few times when I was not optimistic about the coming year, and thankfully this is again one of the optimistic times. I’m actually as pumped as I have been in a long time. I have been hinting that I will have a new portfolio construction concept ready to share with readers for some time – always at some vague time in the future – but now I can begin to narrow the date when everything should be ready for prime time to sometime in the middle of March. I have quietly been assembling an all-star cast of partners and team members.

I have lost some good friends this year. Age and disease can be a bitch. These people were all planning to keep working for a long time; then things changed. That has made me a little more reflective, but it is not changing my attitude. At 67 I am launching a business that will require at least a 10-year commitment to my partners and future clients. It will require even more travel time than I put in now. I was in the gym this morning with The Beast, trying to keep this body together and working. I say this every year at this time, but this year I mean it: I am honest to God going to get in real shape this year. I am already starting to change my lifestyle a little bit, acknowledging that perhaps I can’t do some of the things that I did when I was 30 and 40. But that doesn’t mean I can’t do everything I can do today and more tomorrow with what I have. I know that more than a few of my readers share that attitude. We are just having too #$%$ much fun to want to go sit on the porch and watch the world go by.

A little tease: I think core portfolios, the way they are designed today, are going to be in for very difficult 5–7–10 years, so my partners and I have been rethinking a better and smarter way to do core portfolios. Cheaper, better, faster-acting and reacting. Something that can work not only for accredited investors but for average investors and for those who are overseas as well. The problem, from my standpoint, is that I have to be ready to handle all the responses to our program, and do so efficiently and capably, from day one. The user experience must work seamlessly. That doesn’t happen without a lot of planning and a very experienced team.

What we are doing with portfolios today was not even possible five years ago, and what we are planning to do in five years is not yet possible today. This will not be your father’s portfolio construction model. Going to the sidelines is not an option, because you can’t grow your portfolio if you’re not involved in the markets. But nobody says you have to endure massive bear markets and huge changes in asset classes passively.

2016 has been a year of major surprises. Frankly, I think 2017 has the potential to offer even more challenges than 2016 did. When I sit with my friend George Friedman and talk about the geopolitical changes that are brewing, I realize that politicians are getting ready to be bigger players in the market than they should be. But we don’t get to choose the times in which we live. Our choice is how we live them.

One thing I can predict: Barring some physical challenge, I will still be writing this letter for free for a long time to come. It is my passion and joy. I feel a connection with each and every reader every time I hit the send button or when I meet you and we talk and share our lives. I try to read every comment that comes back and answer some of them directly, and some questions and comments become topics for letters. My partners tell me we have some 70,000 new email addresses this year, so welcome to the family. And feel free to tell others to join us. The next 20 years are going to be the most hellaciously fun time of any period in history. And we are all going to have a front-center-row seat. To paraphrase another media outlet: I write. You decide.

Thanks for being with me and making 2016 such a great year. I will be traveling a lot more this next year, hopefully to a city near you where we can share a few thoughts. Let me give you my sincere and heartfelt wish for a wonderful and happy new year!

Your raring to start the new year analyst,

John Mauldin

subscribers@MauldinEconomics.com

The world has gotten so used to ultra-low interest rates that even economists and money managers seem to be shocked by what happens when rates start creeping back towards normal levels.

The world has gotten so used to ultra-low interest rates that even economists and money managers seem to be shocked by what happens when rates start creeping back towards normal levels.

Some of the mini-bubbles that formed in an essentially free-money environment are now starting to leak. Notably:

US Housing

While the action in this sector is nothing like the raging mania of the 2000s, prices in many hot US markets are at all-time highs, while affordability is at or near an all-time low. And now rising mortgage rates are beginning to bite.

Pending Home Sales Reflect “Dispirited” Buyers

(Mortgage News) – Pending sales, which were widely expected to make a good showing in November, pulled back sharply instead. The National Association of Realtors® (NAR) said its Pending Home Sales Index (PHSI), a forward-looking indicator based on contracts for existing home purchases, declined 2.5 percent to 107.3 in November from 110.0 in October. NAR said “the brisk upswing in mortgage rates and not enough inventory dispirited some would-be buyers.” The decrease brought the PHSI to its lowest level since January of this year and it is now 0.4 percent below the index last November which stood at 107.7.

Analysts polled by Econoday had been upbeat about the November outlook. The consensus was for an increase of 0.5 percent with some analysts predicting as much as a 2.0 percent gain.

Lawrence Yun, NAR chief economist said, “The budget of many prospective buyers last month was dealt an abrupt hit by the quick ascension of rates immediately after the election. Already faced with climbing home prices and minimal listings in the affordable price range, fewer home shoppers in most of the country were successfully able to sign a contract.”

US Auto Sales

Cars and trucks have been one of the economy’s bright spots for several years — which seems to have gotten everyone just a little too excited. Auto financing practices have lately begun to resemble those of the subprime mortgage bubble: Today’s average loan is for more money, lasts much longer, and is held by a much weaker credit than ever before. Now, with interest rates rising and pretty much every potential buyer already locked into a car mortgage, the bubble optimism is evaporating.

GM Plant Closures Could Signal Trouble for U.S. Auto Industry

(NBC) – General Motors will temporarily idle five U.S. assembly plants next month in a bid to reduce bloated inventories.

The cuts focus on plants building sedans and coupes, such as the Chevrolet Cruze, Cadillac CTS and Chevy Camaro, which have been losing momentum as American motorists by the millions shift from passenger cars to utility vehicles and other light trucks.

But the move could also signal a broader slowdown of the U.S. automotive market after three consecutive years of record sales. The big questions are how fast and how far a slide the industry could be facing.

Forecasts by IHS Automotive and other research firms say sales could slide by 200,000 vehicles or more, with a variety of factors threatening to create even more of a downturn. These include rising fuel prices and increasing interest rates. Automakers could offset higher monthly payments by offering new loan and lease subsidies, but such moves would, in turn, impact industry profitability.

GM’s decision to cut production at plants in Michigan, Ohio, Kansas, and Kentucky comes as it watches inventories surge, in some cases, to nearly three times what the industry considers the norm: about 60 to 65 days’ worth of vehicles on dealer lots. The company has a 177-day backlog of Camaros, while its overall inventory grew from a 79-day supply in October to 84 days at the end of November.

China

That the world’s second largest economy — with a debt load that has quintupled in the past seven years — can be called a “mini-bubble” illustrates the size of the meta-bubble in which it has emerged.

The story in a nutshell is that China responded to the Great Recession by borrowing more money in the following half decade than any other country ever, and wasting a big part of the proceeds. Now its banking system is cracking under the strain of mounting bad debts, and newly-rich Chinese are getting their capital out of Dodge at a rate that if allowed to continue will bring on a full-scale credit crisis. Already-extant capital controls will apparently be tightened up shortly.

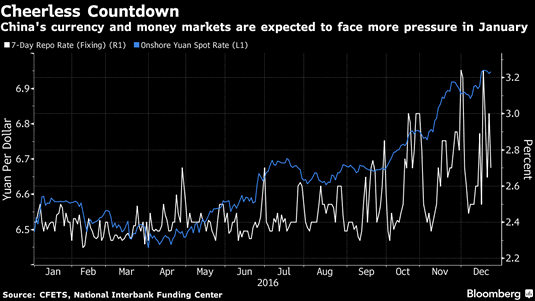

No Happy New Year in China as Currency, Liquidity Fears Loom

(Bloomberg) – China bulls could be facing a grim New Year’s eve.

China’s markets are seeing renewed pressure this month as the Federal Reserve projects a faster pace of rate increases for 2017 and its Chinese counterpart tightens monetary conditions to spur deleveraging and defend the exchange rate. The declines are capping off a tough year for investors during which bonds, shares and currency all slumped.

China’s 10-year government bond yield has surged 21 basis points in December, poised for its biggest monthly increase since August 2013, and its first annual gain since that same year, China bond data show. The yuan’s 6.6 percent decline in 2016 puts it on course for its worst year since 1994, while the Shanghai Composite Index is headed for its largest drop in five years.

The three-month interbank rate known as Shibor rose for a 50th day, its longest streak since 2010, to an 18-month high on Wednesday. The overnight repurchase rate on the Shanghai Stock Exchange jumped to as high as 33 percent the day before, the highest since Sept. 29. As banks become more reluctant to offer cash to other types of institutions, the latter have to turn to the exchange for money, said Xu Hanfei, an analyst at Guotai Junan Securities Co. in Shanghai.

The onshore yuan’s surging trading volume suggests outflows are quickening, according to Harrison Hu, chief greater China economist at Royal Bank of Scotland Group Plc. The daily average value of transactions in Shanghai climbed to $34 billion in December as of Wednesday, the highest since at least April 2014, according to data from China Foreign Exchange Trade System. The offshore exchange rate dropped 0.15 percent on Wednesday to trade near a record low, while the onshore rate was little changed.

None of these, not even China, are by themselves enough to destabilize a global financial system that’s still awash in new credit. But all three at once? Maybe.

And of course there are more potential eruptions waiting in the wings, what with the Italian bank bail-out getting harder as deposits flee those sinking ships and US stocks at record levels and thus (if – an admittedly big if – history is still a reliable guide) due for a correction.

So whether or not these current dramas amount to anything memorable, they clearly represent limits on the global financial bubble. More such limits will emerge shortly.

One thing that is going to become abundantly clear to every living soul on the planet over the next few years is how much loss of wealth is going to occur as a result of this great sovereign debt crisis that is unfolding …

And which I’ve been predicting since late 2015.

I may have been a bit early, but since its peak in July of this year, the 30-year U.S. Treasury has lost $226,984 of its value (based on $1,000,000 face value bond), an astounding 19 percent.

The velocity of the damage was even worse starting the day after the U.S. elections through December 15 — as I am penning this column early due to upcoming travel plans and the holidays …

With the 30-year U.S. Treasury losing $108,497 of its value (based on $1,000,000 face value bond), an astounding 10 percent — in just 26 trading days.

The yield on the 10-year Treasury note has shot up to 2.598 percent, a 40 percent jump since the elections. The 30-year yield has rocketed from a low of 2.616 percent on November 8 to its recent 3.18 high, a whopping 21.6 percent rise in just over a month.

That would be like gold rocketing from its recent low of $1,046 on December 3, 2015 to over $1,464 today. Or the Dow Industrials exploding higher from its recent high of 19,966.43 to 24,271 today. Astounding moves no matter how you measure it.

But it’s not just the 10-year interest rate that is rising. Rates on everything from two-year to 30-year terms are soaring. Plus, they’re not just rocketing higher in the United States. Interest rates are soaring all over the world.

So why are rates surging? The answers are simple:

First, investors all over the globe are starting to see what I’ve been telling you all along: that the sovereign bond markets of Europe, Japan and the United States is the world’s biggest financial bubble ever and it’s bursting.

First, investors all over the globe are starting to see what I’ve been telling you all along: that the sovereign bond markets of Europe, Japan and the United States is the world’s biggest financial bubble ever and it’s bursting.

There’s simply no way investors are going to keep putting money in bonds with rates so low and Western-style socialist governments’ balance sheets in such horrible shape.

The selling is hitting the bond market from virtually every angle. Overseas investors in our bond market, our creditors, are getting out as fast as they can. According to latest data, they dumped a net $403 billion in U.S. Treasuries over the past 12 months.

Second, bond investors no longer believe central banks can contain the interest rate rise. They’re right. No matter what the Fed says or does, it will not be able to control the actions of tens of millions of investors. Or the actions of the free market.

When the free market forces take over and decide that U.S. bond markets are no longer a safe place to invest, as they are doing now, it’s lights out for Treasuries.

Third, and part and parcel of the interest rate rise, is the loss of confidence and wealth investors are now experiencing in sovereign bonds. That’s the ultimate motivation for dumping bonds.

Fourth, they’re worried — rightfully so — that President-elect Trump is going to hammer trade concessions from our big trading partners who are also our biggest creditors: Germany, the European Union in general, Japan and of course, China.

Fifth, and even more worried, are precisely our largest creditor nations. The EU, Japan and China. They know darn well Trump is going to squeeze them and renegotiate our debt. So the treasuries and central banks of those countries are likely already dumping our bonds.

I for one, am overjoyed bonds are crashing

and interest rates are rising.

Not because I might be able to earn more interest on idle cash. But because of the significance of crashing sovereign bond prices.

I have pounded my fist on the table about this all year. It should be music to your ears because …

A. It means trillions of dollars will be on the move, shifting mainly out of sovereign bonds and into U.S. equities, and lighting the force behind my Dow Industrials 31,000 plus forecasts for the next two years.

B. It also means that money and credit will start to move again in the general U.S. economy, that its velocity of turnover will improve, its heartbeat, bumping inflation a tad higher.

Not hyperinflation, just old fashioned rising inflation of, say, 3 percent maximum.

And how important is that? For investors, it’s critical.

It means further increases in the major stock indices. That I’ve made abundantly clear, several times. Even a tiny boost in inflation right now is a positive for stocks.

It means a rebirth of the commodity SuperCycle. It was never dead to begin with. It merely took a long pause.

But now, with the bond market tanking and the cost of money and credit rising, causing inflation to rise, we should soon see some major strength in the entire commodity sector, which is great news for tangible asset investors.

Not to mention …

It means a rebirth of gold’s great bull market. Mind you, inflation is one of the least dependable and weakest forces to drive a bull market in gold.

The far more bullish force for gold is the loss of confidence that both small investors and big money have in government.

And that in turn is reflected in how aggressively they are dumping sovereign debt issues, and heading for safer hills.

Right now, that’s mostly into equities.

But soon that tsunami of cash leaving sovereign bond markets will also be flooding back into tangible assets, and largely into gold.

So I implore you to keep the longer-term in perspective: Commodities and stocks are going to explode higher in the months and years ahead, and they are going to do it at the same time.

Best wishes, and have a wonderful holiday!

Larry

P.S. Time to pack your “bug-out bag” and run? Or would you rather get rich? Well, some people have built a little cabin in the woods. They’ve stocked it with food, guns, and ammunition. They call it a “bolt hole.” You know what? It’s not such a bad idea! But it’s not for everyone.

I’ve got a better way to protect myself. And you do, too. The answer is to get rich. Rich enough to weather the storm and keep your assets out of danger. The best defense, in other words, is a good offense. And guess what? The K Wave itself will give you the perfect way to do that. -Make sure to click here to download my new free report Stock Market Tsunami!