Asset protection

You might be surprised to learn that up to 45% of caregiving is provided by men! The traditional role associated with women is changing rapidly with caregiving being shared by both men and women, often with different responsibilities and types of care provided.

You might be surprised to learn that up to 45% of caregiving is provided by men! The traditional role associated with women is changing rapidly with caregiving being shared by both men and women, often with different responsibilities and types of care provided.

Shifting trends in longevity, career commitments and health diagnosis have changed the way we age. Instead of the Sandwich generation we now have the Club Sandwich generation where there are 4 generations with those in their 40’s to 70’s being caught in caring for parents and grandchildren.

A major issue with the change in longevity is the increased time spent in advanced age with the likelihood of some health issues that may be short term (knee replacement) or longer term with cardiac, diabetes or other chronic conditions. It used to be that the timeframe after retirement was short and more intense when health issues occurred, but with the development of so many health resources and treatments we have changed the trajectory of aging and dying. Given that most of us will live into our 80’s, how have we planned or prepared for this time?

Financial planning has become the norm for most people with this process often starting in the 20’s and 30’s to ensure control and security over future finances. Did you stop to consider that the most critical aspect in determining how you spend your assets could be your health? What planning have you done for health? Even with lots of financial resources the most important resource is the human resources you have in your personal world.

With increasing geographic distances between family members, the issue of caregiving becomes more costly and complicated. Most women are now in the workforce and no longer available as primary caregivers to family members. Aging parents become a team working together to support one another and the deficits are often not noticeable until an acute event occurs. With aging being the greatest risk factor for dementia and women having a higher rate than men, this means more men are becoming caregivers to their spouses in the later years. Everyone can understand that being a caregiver in the later years has significant impact on the ‘healthy’ spouse and can often cause health issues for the caregiver. Now families have 2 people to care for.

There is a growing trend of younger families asking how they can support their aging parents to have control and be empowered in making decisions in advance of health challenges so that families can honor decisions already expressed, rather than being burdened with decision making. In turn, they realize that they, too, need planning in place for the unexpected and to ensure their children are cared for should the need arise.

We have choice as to how we deal with unexpected health changes:

- We can get up the courage to make some proactive plans as a Gift to Our Family

- We can wait until some problems to occur and use this as an opportunity to plan

- We can wait for the crisis and all that occurs with that

Comprehensive Health Planning is relatively new and engages families in a meaningful and rewarding way. It removes many unknowns and creates guides for ‘what to do’ should they need to step forward.

Where do you stand?

Janet Bullard

Proactive Health Care Advisors

tock Trading Alert originally sent to subscribers on December 8, 2016, 6:52 AM.

Briefly: In our opinion, no speculative positions are justified.

Our intraday outlook is now neutral, and our short-term outlook is neutral. Our medium-term outlook remains neutral, following S&P 500 index breakout above last year’s all-time high:

Intraday outlook (next 24 hours): neutral

Short-term outlook (next 1-2 weeks): neutral

Medium-term outlook (next 1-3 months): neutral

Long-term outlook (next year): neutral

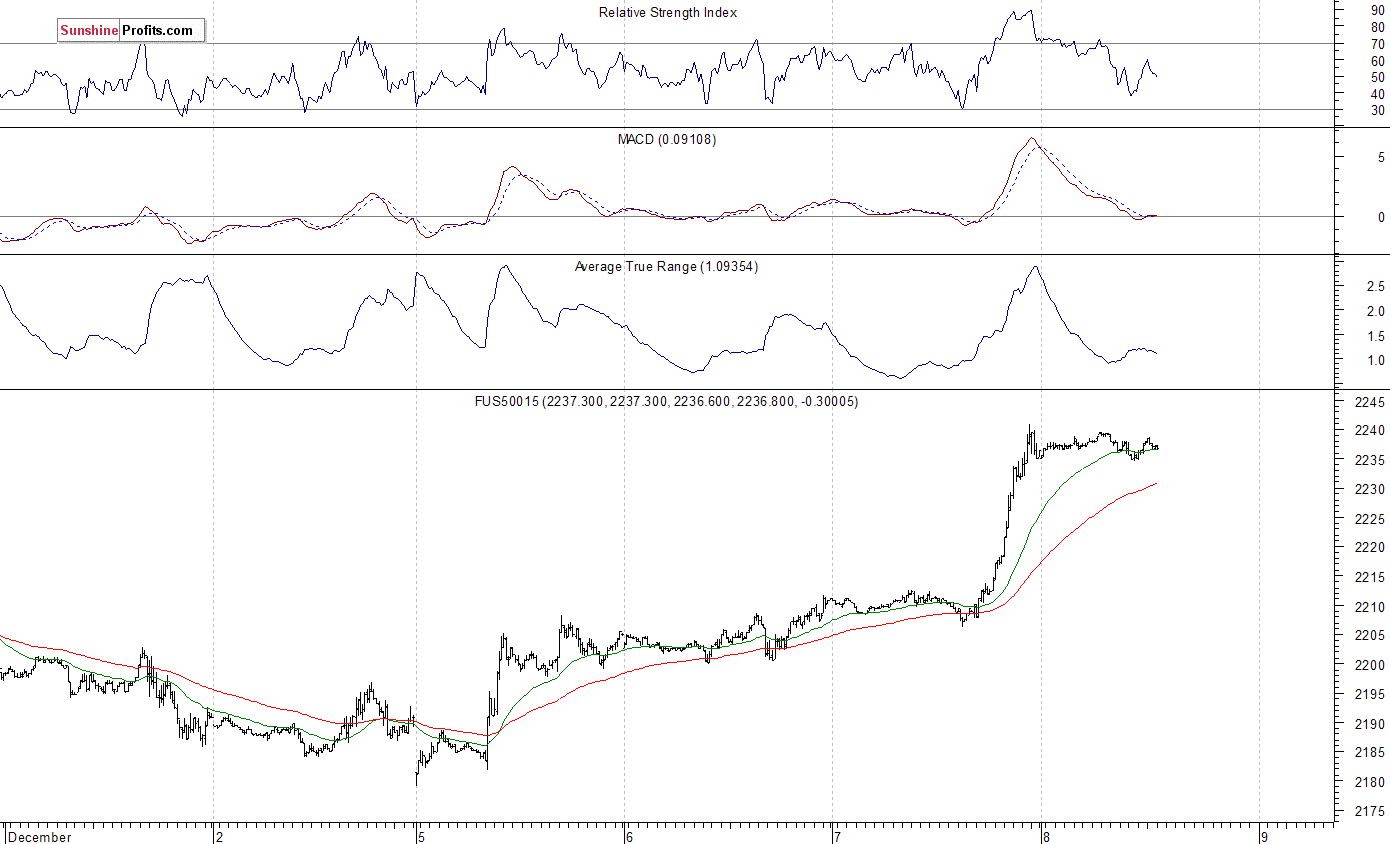

The main U.S. stock market indexes gained between 1.3% and 1.6% on Wednesday, accelerating their short-term uptrend, as investors’ sentiment improved. The S&P 500 index has reached new all-time high at the level of 2,241.63. The nearest important support level is at around 2,215-2,220, marked by previous resistance level. The next support level remains at 2,200. The market broke above its medium-term upward trend line, as we can see on the daily chart:

Expectations before the opening of today’s trading session are virtually flat. The European stock market indexes have gained 0.1-0.3% so far. Investors will now wait for the Initial Claims number release at 8:30 a.m. The S&P 500 futures contract trades within an intraday consolidation following yesterday’s rally. The nearest important level of resistance is at around 2,240, marked by new record high. On the other hand, support level is at 2,230-2,235, and the next support level is at 2,210-2,215, marked by recent local highs:

The technology Nasdaq 100 futures contract follows a similar path, as it currently trades within an intraday consolidation following yesterday’s rally. However, it remains relatively weaker than the broad stock market, as it trades below last months’ local highs along 4,900 mark. The nearest important level of resistance is at around 4,850. On the other hand, support level is at 4,780-4,800, marked by previous resistance level, as the 15-minute chart shows:

Concluding, the broad stock market has reached new all-time high yesterday following a breakout above short-term consolidation. We still can see technical overbought conditions. However, there have been no confirmed negative signals so far. Our speculative short position has been closed yesterday, at the stop-loss level of 2,240 (S&P 500 index). We lost 63 index points on that trade, betting against short-term uptrend off early November local low. It is always important to set some exit price level in case some events cause the price to move in the unlikely direction. Having safety measures in place helps limit potential losses while letting the gains grow. Currently, we prefer to be out of the market, avoiding low risk/reward ratio trades. We will let you know when we think it is safe to get back in the market.

Thank you.

Paul Rejczak

…..also: WORLD ECONOMIES IN TROUBLE: Middle East Oil Exports Lower Than 40 Years Ago

One of the most popular articles we posted this fall was a detailed How-To checklist for investors dealing with a lump sum, either from an inheritance, the sale of a business, or as a decision to be made within an existing portfolio. The piece, written by Andrew Ruhland of Integrated Wealth Management (click here to read Dealing With Lump Sums), resulted in a large number of queries – many from listeners asking about issues related to Defined Benefit Pensions.

In response, Andrew and his team have produced a comprehensive article for individual investors dealing with these issues. Click on the link below to request a copy. It is particularly valuable if you:

1) Are past the age to roll-out your Defined Benefit Pension’s commuted value:

2) Are eligible to roll-out the commuted value of your DBP before a certain age-related deadline:

3) Have already rolled-out the commuted value of your DBP and are now responsible – directly or indirectly – for the successful management of your pension nest-egg.

Originally published on December 5, 2016, 6:51 AM

Briefly: In our opinion, speculative short positions are favored (with stop-loss at 2,240, and profit target at 2,060, S&P 500 index).

Our intraday outlook is bearish, and our short-term outlook is bearish. Our medium-term outlook remains neutral, following S&P 500 index breakout above last year’s all-time high:

Intraday outlook (next 24 hours): bearish

Short-term outlook (next 1-2 weeks): bearish

Medium-term outlook (next 1-3 months): neutral

Long-term outlook (next year): neutral

The U.S. stock market indexes were virtually flat on Friday, as investors hesitated following recent stock prices decline, economic data releases. The S&P 500 index remained below the level of 2,200. However, it is still close to its Wednesday’s new all-time high of 2,214.10. The nearest important level of resistance is at 2,200, and the next resistance level is at 2,210-2,215, marked by record high. On the other hand, support level is at 2,190, marked by previous level of resistance. The next important level of support remains at 2,170-2,180. The market continues to trade along its medium-term upward trend line, as we can see on the daily chart:

Expectations before the opening of today’s trading session are positive, with index futures currently up 0.4-0.5%. The European stock market indexes have gained 0.4-1.4% so far. Investors will now wait for the ISM Services number release at 10:00 a.m. The S&P 500 futures contract trades within an intraday uptrend, as it retraces its recent move down. The nearest important level of resistance is at around 2,210-2,215, marked by record highs. On the other hand, support level remains at 2,180, marked by local lows:

The technology Nasdaq 100 futures contract follows a similar path, as it currently retraces its recent move down. The nearest important level of resistance is at around 4,780-4,800, and support level remains at 4,700-4,720, marked by short-term local lows, as the 15-minute chart shows:

Concluding, the broad stock market continued to fluctuate on Friday, as the S&P 500 index remained below 2,200 mark. We still can see technical overbought conditions. Therefore, we continue to maintain our speculative short position (opened on November 16 at 2,177 – opening price of the S&P 500 index). Stop-loss level is at 2,240 and potential profit target is at 2,060 (S&P 500 index). You can trade S&P 500 index using futures contracts (S&P 500 futures contract – SP, E-mini S&P 500 futures contract – ES) or an ETF like the SPDR S&P 500 ETF – SPY. It is always important to set some exit price level in case some events cause the price to move in the unlikely direction. Having safety measures in place helps limit potential losses while letting the gains grow.

To summarize: short position in S&P 500 index is justified from the risk/reward perspective with the following entry prices, stop-loss orders and profit target price levels:

S&P 500 index – short position: profit target level: 2,060; stop-loss level: 2,240

S&P 500 futures contract – short position: profit target level: 2,055; stop-loss level: 2,235

SPY ETF (SPDR S&P 500, not leveraged) – short position: profit target level: $206; stop-loss level: $224

SDS ETF (ProShares UltraShort S&P500, leveraged: -2x) – long position: profit target level: $18.38; stop-loss level: $15.64 (calculated using trade’s opening price on Nov 16 at $16.6).

Thank you.

Today’s videos and charts (double click to enlarge):

Gold, Oil, & Bonds Video Analysis

Precious Metal ETFs Video Analysis

SF Juniors Key Charts Video Analysis

SF Trader Time Key Charts Video Analysis

Thanks,

Morris

About Super Force Signals:

Our Surge Index Signals are created thru our proprietary blend of the highest quality technical analysis and many years of successful business building. We are two business owners with excellent synergy. We understand risk and reward. Our subscribers are generally successfully business owners, people like yourself with speculative funds, looking for serious management of your risk and reward in the market.

website: www.superforcesignals.com