Bonds & Interest Rates

Let this be yet another reminder to trust, but verify, every bit of information on Wall Street.

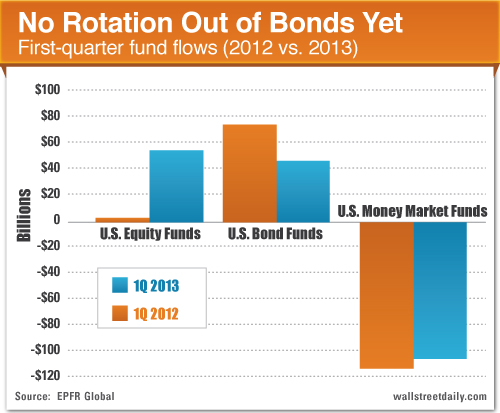

For months, we’ve heard that a “Great Rotation” is underway. That is, investors are dumping bonds and promptly putting the money back to work in equities. And this uptick in buying activity is precisely why the stock market keeps hitting new all-time highs.

Sounds perfectly logical. And Wall Street appears to be corroborating the theory.

“You have this huge migration moving from grossly overweight fixed income back into equities,” says John Stoltzfus, Chief Market Strategist at Oppenheimer.

The only problem? The data tells an entirely different story.

Here’s the proof in a single chart – and, more importantly, why Wall Street’s latest deception ironically bodes well for us…

Stocks Back En Vogue

I’ll be the first to admit that a transition is afoot.

In January, investors (finally) rediscovered stocks. U.S. stock funds reversed 20 consecutive months of outflows by attracting a record $18.4 billion.

And over the course of the first quarter, the enthusiasm for stocks intensified. According to the fund tracker, EPFR Global, investors plowed a total of $53.9 billion into stock funds in the first three months of the year.

Yet none of these purchases were fueled by the sale of bonds.

…….read more HERE

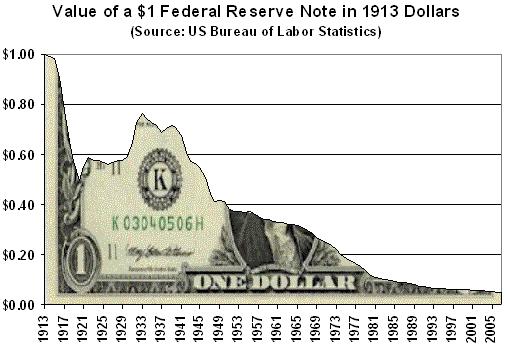

“Everything will collapse” but first “he was happy”, since “the asset values of his holdings will go up” – is the consequence Gloom, Boom, & Doom’s Marc Faber sees from the Fed’s latest ‘stimulus’ (and the fallacy and misconception of how money-printing can help employment). In a wondrously clarifying interview on Bloomberg TV this morning, Faber explained why he was ‘happy’, since “the asset values of his holdings will go up” but as a responsible citizen he is worried because “the monetary policies of the US will destroy the world.” It truly is class warfare under a veil of ‘its good for you’ as he notes: “the fallacy of monetary policy in the U.S. is to believe this money will go to the man on the street. It won’t. It goes to the Mayfair economy of the well-to-do people and boosts asset prices of Warhols.” Congratulations, Mr. Bernanke.

Must-watch (or read the transcript) – it is truly remarkable.

…..read & view much more HERE

Wage Inflation?

Skills Versus Education

Kyle Bass and Japan

Tulsa, Atlanta, Nashville, and Brussels

“The large shortfall of employment relative to its maximum level has imposed huge burdens on all too many American households and represents a substantial social cost. In addition, prolonged economic weakness could harm the economy’s productive potential for years to come. The long-term unemployed can see their skills erode, making these workers less attractive to employers. If these jobless workers were to become less employable, the natural rate of unemployment might rise or, to the extent that they leave the labor force, we could see a persistently lower rate of labor force participation.”

– Janet L. Yellen, Vice-Chair, US Federal Reserve, March 4, 2013

It is graduation time, and this morning finds me swimming in a sea of fresh young faces as a young friend graduates, along with a thousand classmates. But to what? I concluded my final formal education efforts in late 1974, in the midst of a stagflationary recession, so it was not the best of times to be looking for work. It turned out that I had a far different future ahead of me than I envisioned then. But I would trade places with any of those kids who graduated today, as my vision of the next 40 years is actually very optimistic. With all the advances in healthcare, technology, and communications that have come and will come, they will get to embrace a world full of opportunity; and yet, this generation is starting out with more than just a minor economic handicap.

This week’s letter will explore changes in the work marketplace, changes that generated quite a lot of discussion at last week’s Strategic Investment Conference. At the end of the letter I will also provide a link for qualified investors to listen in on a webinar conversation between Kyle Bass and me on another of the main topics last week: Japan. This is one you’ll want to tune in to. (Warning: this letter will read fast but print long, as there are more than the usual number of charts and graphs, though the word count is actually shorter than usual.)

And a quick note up front on Japan. As of the last two weeks, Japanese investors are now net buyers of foreign bonds, and the yen has broken through 100 to the dollar. I think what is happening in Japan is going to be the nexus of a global flow of cash that will be unlike any we have ever seen. Attention MUST be paid. It is windshield time.

David Rosenberg: A Bond Bull Turns Bearish

How do we get to full employment and improved national education from the launching point of David Rosenberg’s very recent call (at the conference and elsewhere) that we will soon see inflation and the onset of a bond bear market? I must say that he surprised a few of us with his conversion from bond bull to bond bear. But the reason why he converted surprised us even more. I am not going to be able to do justice to his impeccably reasoned, highly detailed presentation in this short space, but let me hit some highlights.

Specifically, Rosie thinks that the Fed is going to be surprised by wage-push inflation. How could we see inflation in wages in such a soft labor market? That was the first question in my mind, and the following charts give me some reasons for my question.

The present unemployment rate is still higher than at any time in the last 60 years, except after recessions. The Great Recession ended four years ago, and unemployment is still stubbornly high. Indeed, this is the slowest “jobs recovery” we have ever experienced. The current level of unemployment has never been seen four years after the end of a recession.

……continue reading and viewing charts HERE

The problem with the NY bankers is they simply want to trade with other people’s money. They have to have their wings clipped. If they want to trade, change careers and become hedge fund managers. Then you can only keep a portion of what you make not 100%, and when you are wrong, you can’t tell government the world will collapse unless they absorb your losses. Restore Glass Steagall and PROHIBIT proprietary trading in banks!!!! Now that you expect the depositors to “bail-in” the banks, how about real reform!

With the Fed, who knows what it is today since it has the legal authority to take over McDonalds or Walmart if it declares them too big to fail. They are no longer limited to banking. The Fed when formed was NECESSARY and it was sound. It was to provide an elastic money supply for the purposes of preventing bank failures buying time to meet short-term obligations without dumping long-term assets. The Fed stimulated directly by buying corporate paper and that would have made the economy much more stable.

However, this is where politicians come in with their sticky fingers. They ordered the Fed to buy government bonds for World War I stopping the buying of corporate paper that directly supported the economy and prevented high unemployment. They never restored the Fed to its original design. Each branch maintained separate interest rates so it could target regional problems. Then World War II and the Social Agenda arrived. Roosevelt usurped all independent power to Washington creating one interest rate and then ordered the Fed to support government bonds at PAR!!!! That was not removed until 1951. Why have regional branches today if they do nothing? Politicians are clueless as to what they are doing.

The Fed was never restored to what it was intended and so many things have been grafted onto it, it would never be designed in the manner it finds itself today.

The Fed was never restored to what it was intended and so many things have been grafted onto it, it would never be designed in the manner it finds itself today.

I was in the middle of the Tax Reform on Capitol Hill and was trying to save Social Security transforming it into a real trust fund managed independently. The obstacle was the internal argument over who would be the independent fund managers. The politicians wanted a piece of that pie and because nobody could ever agree on who the managers would be since they saw the vast potential for bribes (contributions) no agreement could ever be reached. I gave up trying to help. It became obvious – it was about grabbing all the soap and shampoo you will never use when you leave the hotel room -where’s mine?

International Monetary Fund officials say they are watching carefully for signs that massive flows of cash unleashed in world markets by unprecedented monetary easing might lead to asset bubbles, or to overheating in some emerging markets.

International Monetary Fund officials say they are watching carefully for signs that massive flows of cash unleashed in world markets by unprecedented monetary easing might lead to asset bubbles, or to overheating in some emerging markets.

“There is a risk of overheating of domestic economies, so we have to pay close attention to this risk,” said IMF Deputy Managing Director Naoyuki Shinohara. “There are some warning signals, but it is not up to the level to ring alarm bells,” he said.

Cash added to the global economy from monetary easing in the U.S., Japan and Europe is affecting currency values and fueling investments in commodities, property and other assets.

On Friday, the Japanese yen fell to its lowest level against the U.S. dollar in over four years, passing 100 yen to the dollar. The Japanese currency is bound to weaken given the aggressive monetary policies Tokyo is using to try and break free of years of debilitating deflation, he said. But the resulting rise in other currencies could be disruptive.

In China, a continued reliance on government-backed investment in construction, despite its pledges to shift to consumer-driven spending to fuel growth, remains a concern, Shinohara said.

“If you look at the statistics, China has not converted to becoming a consumption-oriented economy yet,” he said, noting that such heavy spending increasingly likely will go to inefficient projects. Meanwhile, heavy borrowing by local governments poses a risk in the medium to long-term, especially given the size and lack of transparency in the country’s huge informal lending sector, he said.

The key, IMF officials said, is to ensure that resources help to drive real economic growth.

In Japan, for example, share prices have surged, with the benchmark Nikkei 225 stock average jumping 2.9 percent Friday to 14,607.54, its highest close since January 2008. Other share markets have also rallied in recent months.

But data on growth, prices and investment do not reflect that degree of ebullience.

“There have been sharp improvements in world markets but they have not been matched by improvements in the world economy,” Shinohara said.

Yuko Kinoshita, assistant to the director of the IMF’s regional office for Asia and the Pacific, warned of a potential spike or “bubble trend” in asset prices.

“If these are not controlled, there could be a serious boom and bust cycle,” she said.

Even if the current government’s economic policies succeed in spurring demand, the fund’s forecasts for Japan’s real growth were a modest 1.6 percent in 2013 and 1.4 percent in 2014, partly due to expected sales tax increases that are expected to slow consumer demand.