Bonds & Interest Rates

On Bonds:

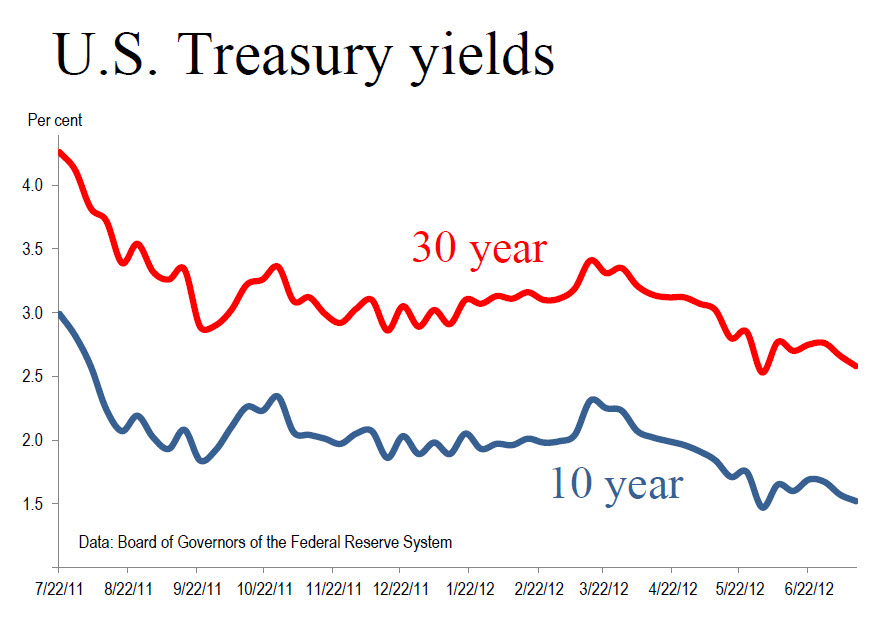

Treasury yields peaked out in 1981 with the ten years at 15.8 percent and now we’re below 1.5 percent , some of my friends who are the super bears on assets prices and on inflation , they think that we will have deflation they think that yields would drop to say less than one percent on the ten years and less than 2 percent on the thirty years , so it may happen but say it is like if you said at the end of 99 the NASDAQ is a bubble well it still went up between December 99 and March 2000 by thirty percent and offers people a hell lot of money in NASDAQ stocks , so all I am saying is I do not think that from a longer term perspective to own US treasuries is a desirable investment but if you asked me , can they rally somewhat more , YES possible I just won’t buy them at this level I think the risk out weights the return potential – (Ed Note: Marc’s comments on a Global Crash begin at the 9 minute mark in the video below. All of his comments end at the 10:10 mark)

On China:

The difference between China and the US , the US had credit bubble built on consumption in other words the debt level on the household sector level the government level went up dramatically to finance consumption in the case of China at least it financed investments in infrastructures research and development and so forth that is a key difference , now if you have a capital spending bubble like in china the downturn can be very severe because you’re running to over capacities and then when you print money you produce even more over capacities and the fact is simply that if you look at reliable statistics say which country is the largest export market for Taiwan and South Korea ? it’s China and if you look at exports from Korea and Taiwan they’re all flat year on year so that is quite reliable , you look at electricity production in China it’s up one percent year on year and so forth and so on , so the statistics would actually suggest that Chinese economy is much weaker than what the official statistics suggest , it does not mean that all Chinese growth model will collapse entirely , but I’d like to mention one thing , in China we still have One Party System and we have an incredible level of corruption and that could lead to social unrest at some point , by the way we can have social unrest anywhere in the world given the high unemployment that we are facing in most countries , but that could derail growth in China for a while and then we have geopolitical problems coming up , the south china sea and so forth and so on so there are many things that could go wrong.

Europe is in Recession

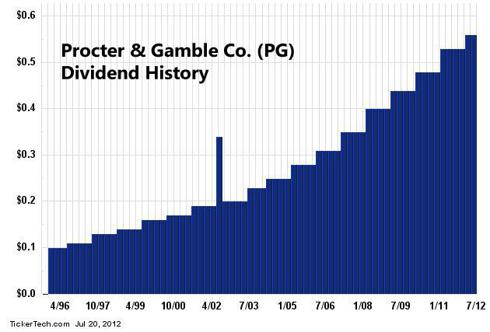

This group of stocks has paid reliable dividends for over 20 years. One of my favorites in this space has paid over 144 consecutive dividends and raised its payout for 37 straight years.

They’re the creme de la creme of the income universe. (Ed Note: The Tax friendly equivalent in Canadian Stocks, like Penn West Petroleum @ 8.33%, Sun Life Financial @ 7.11%, Enerplus @ 15.13% and TransAlta @ 7.18% are at S&P/TSX 60 best Dividend Yielding Stocks.)

Each one has increased its dividend every year for at least two decades… some sport track records with over 50 years of consecutive dividend increases.

All told, these stocks are some of the most reliable dividend payers on the planet.

I’m talking about the S&P 500 “Dividend Aristocrats” and their kissing cousins, the S&P “High Yield Dividend Aristocrats.”

In order to become a member of these elite groups, a company must not only pay a regular dividend, it must also enjoy a stellar track record of growing that dividend every year for at least 20 years.

With such stringent membership criteria, only about 70 U.S. companies make the grade. (Ed Note: Given the amount of money tied up in the Bond markets dwarfs the amount tied up in Stock markets, if investors start start looking for safe higher North American yields, those few high quality dividend stocks are going to be an attractive candidates. With the US 10 Year Treasury Note at hitting a low of 1.3908 % in the last 24 hours, and the equivalent Spanish 10 Year Bonds jumping to a new high of 7.52% on monday , its clear that fears of a wilting economy and Government finances can drive investors to look for something else to invest in besides government Bonds).

As you’d expect, a wide variety of industries are represented. You’ll find an overweighting of consumer staples such as Procter and Gamble (NYSE:PG)

and Kimberley Clark (NYSE: KMB), and a healthy chunk of electrical utilities, such as Consolidated Edison (NYSE: ED) and Northwest Natural Gas (NYSE: NWN).

But there’s one group that makes the list that you would probably never expect: insurance.

All together, six of some 70 aristocrats sell insurance. Even more interesting, five of these six companies are property and casualty insurers. The exception is Aflac, which is mainly a life insurer.

What is it about property and casualty insurers that allows them to keep increasing their dividends in good times and bad for at least a quarter of a century?

The answer surprised me. Here’s what I found out…

Today, insurance is usually life or non-life, also known as property and casualty.

Property insurance covers loss or damage to physical property, such as houses and cars. Casualty insurance covers the legal cost if the insured person were to cause someone else physical injury or damage another’s property. Liability insurance is a common example.

You might expect property and casualty insurers such as Dividend Aristocrat — RLI (NYSE: RLI ) — to be cash-flow machines… churning out streams of highly predictable earnings quarter after quarter.

Nothing is further from the truth.

Their earnings streams are notoriously volatile. Major unpredictable risks, such as natural disasters, have a huge impact on earnings.

So why do I like property and casualty companies then? As in all industries, some companies far outperform others. RLI is one of them — as measured by the combined ratio, the key industry metric of underwriting profit.

The combined ratio combines two metrics. It measures underwriting expenses as well as the amount paid out in claims, both as a percentage of net premiums earned.

A combined ratio of 100 means the company is breaking even on its underwriting activities. The lower the ratio, the higher the company’s underwriting profit.

In 2011, RLI’s combine ratio was an outstanding 78.4… Well below the industry average of 107. RLI has seen sixteen straight years of underwriting profitability, with an average combined ratio of 87 over the period.

And while property and casualty companies may break even or lose money on their underwriting activities, that is only part of their financial story.

These companies accumulate millions and even billions of dollars of investment capital, which provides investment income that makes a vital contribution to their per-share earnings.

For example, RLI earns investment income and realizes gains from a $1.9 billion portfolio, comprised 74% of high-quality debt with an average “AA” credit rating, and 26% in equity.

Given that the investment portfolio comprises the lion’s share of earnings, management’s decision on whether or not to realize capital gains or losses by selling investments can cause tremendous earnings volatility from year to year.

How can volatile earnings grow dividends?

First, insurance companies keep their payout ratio relatively low, so it can inch up the dividend regardless of earnings. RLI had a payout ratio of 25.0% of in 2009, 19.2% in 2010, and 19.5% in 2011.

Meanwhile, insurance companies keep building shareholders’ equity, which they can dip into on a temporary basis to supplement the dividend if there were a short-term earnings shortfall.

That’s one reason RLI has been able to pay a dividend for 144 consecutive quarters and raise its ordinary dividends for 37 consecutive years.

For the past two years, the insurer has also returned excess earnings to shareowners in the form of one-time special dividends. In 2010, the special December payout was $7 and in 2011 it was $5.

Over the past four quarters, the company paid out $1.14 in ordinary dividends. Factoring in last year’s special dividend, shares of RLI provide a remarkable yield of 9.8% at today’s price — an outstanding yield for a member of the “Dividend Aristocrats.”

Of course, as with every investment, there are risks to be considered. If management decides to break with its two-year policy of paying out a special dividend from excess capital, the stock would no longer be suitable as a high-yield income play.

But that said, many insurance companies have a surprisingly good track records when it comes to dividend payouts. If you’re looking for a high-yield stock with a reliable dividend track record, then an insurer like RLI may be suitable for you.

[Note: For more high-yield ideas, make sure to watch the latest presentation StreetAuthority’s research team recently put together. In it, they’ve identified 5 of the best income stocks for the next 12 months. To learn about these stocks, click here now.)

Good Investing!

![]()

Carla Pasternak’s Dividend Opportunities

P.S. — Don’t miss a single issue! Add our address, Research@DividendOpportunities.com, to your Address Book or Safe List. For instructions, go here.

The Age of Deflation is Intensifying:

Last week I wrote about how interest rates on some European government debt was trading at a negative yield…that is…you buy short term German or Swiss bonds and you get your money back…minus a safekeeping charge. This week the number of European countries with government securities trading at negative yields grew to include Germany, Switzerland, Holland, Finland, Denmark and Austria….while the yield on Spanish 10 year government bonds rose to 7.3%…their highest level since the introduction of the Euro.

This week the value of the Euro fell to a 2 year low against the US Dollar, a 12 year low against the Yen, a 21 year low against the CAD and a 23 year low against the AUD.

Credit Quality Spreads Widen:

The market is focused on Spain…where the debt problems only seem to be getting worse…while at the same time citizens of countries that might provide financial help, particularly Germany, seem to be increasingly unwilling to do so….this is making the “Euro debt crisis” an even tougher problem to solve…fear is driving capital from the periphery to the center in an attempt to find relative safety…the yield spreads between problem countries and perceived safe havens continues to widen.

The Crisis Could Get Much Worse – Quickly:

Despite the fact that several European financial crisis have come and gone over the past couple of years it now feels as though the crisis could suddenly take a dramatic turn for the worse…the debt problems seem to be getting much bigger and the solutions seem to be getting much harder to find. A dramatic turn for the worse would have a contagion effect on global markets…which would inspire central bankers to take dramatic action…have no doubt, when push comes to shove central bankers will fight deflation with stimulus.

A Real Crisis Could Produce a Real Solution:

Perhaps a really dramatic crisis will force the politically unpalatable action necessary for a lasting solution to the European debt crisis…such a solution would certainly include default/bankruptcy in some form…either a debt write-off or a dilution of liabilities through the adoption a new currency.

If The Stock Markets Aren’t Much Worried – The Credit Markets Certainly Are:

Until Friday the major European and North American stock markets had made good gains for the week…they appeared oblivious to the European credit market stresses, and to the growing evidence of a global economic slow down. Perhaps the markets sensed more central bank stimulus was coming soon, although Fed Chairman Bernanke seemed to rule that out during his Congressional presentations…or perhaps the stock markets were benefiting from capital flows seeking safety….however they turned sharply lower Friday as the Spanish debt crisis intensified.

Despite the European stresses and the evidence of a global economic slowdown the DJI has rallied nearly 1,000 pts from its June 4 lows to this week’s highs…the British, German and French stock markets have also made good gains while the AUD has rallied over 8 cents, and the CAD is up 3.5 cents. However, if the stock markets aren’t worried the credit markets certainly are…witness the negative yields in perceived European safe haven countries and note that the yields on all US Government debt are at or near all time record lows…even while the US Treasury issues new debt at a record pace.

Two Big Risks Ahead For Investors As The Macro-Economic Deflation Intensifies:

1) Asset prices decline, and

2) Taxes on “rich” people will go up. This will make it harder to preserve capital…and it won’t much matter which political party is in charge…the “math” of the debt problems supersedes political dogma…way more money has been borrowed than will ever be repaid…and somebody…maybe everybody…is going to get stuck with the “bill.” As veteran analyst Richard Russell says of a bear market, “He who loses the least wins.” My long term savings remain very conservative and liquid and I’ve also been very cautious lately with my short term trading accounts.

First, let me state that if you are looking for someone who has called the US treasury market correct this past decade, look no further than Lacy Hunt.

I had a nice conversation the other day with Lacy Hunt at Hoisington Investments. We agree on many aspects of the global economy and I have a few excerpts of Hoisington’s latest forecast below.

While I have been US treasury bullish (on-and-off ) for years (more on than off), and I can also claim to have never advocated shorting them (in contrast to inflationistas running rampant nearly everywhere), Lacy has correctly been a steadfast unwavering treasury bull throughout.

Will Hoisington catch the turn?

That I cannot answer. However, one look at Japan suggests the actual turn may be a lot further away than people think.

For a viewpoint remarkably different than you will find anywhere else, please consider a few snips from the Hoisington Quarterly Review and Outlook, for the Second Quarter 2012 (not yet publicly posted but may be at any time).

….read this report and more beginning at Abysmal Times Confirm the Research HERE

07/18/12 Madrid, Spain – You can’t help but feel sorry for the bankers. Yesterday, one of them was so upset and humiliated he tended his resignation — at a Senate hearing.

One after another the bankers mount the scaffold. Goldman, JP Morgan, Barclays…and now HSBC. One loses money. Another rigs LIBOR rates.

One fiddles an entire nation’s books. And another helps terrorists, drug dealers and money launderers with their banking needs.

That last charge is the one leveled against HSBC yesterday, causing the bank’s chief of compliance to quit, on the spot. Here’s the accusation:

…using a global network of branches and a US affiliate to create a gateway into the American financial system that led to more than $30bn in suspect transactions linked to drugs, terrorism and business for sanctioned companies in Iran, North Korea and Burma.

This spectacle may be entertaining, but in our view, it is fundamentally meaningless.

Here’s what really happened:

The feds created a funny money, back in the early ’70s. Unlike the gold-backed dollar, this one was almost infinitely flexible. It would allow the financial system to create trillions-worth of new cash and credit, vastly expanding the amount of debt in the system…and greatly increasing the profits of the banking sector.

The financial industry — the dispenser of the need money — set to work, creating fancy new ways to move the new money around. Each time it closed a deal, it made a profit. Naturally, it was encouraged to find all manner of clever ways to make deals.

Then, when the credit bubble blew up in ’08-’09 many of these tricks of the trade didn’t look so clever. They looked sinister. Stupid. Or crooked.

“When the tide goes out,” says Warren Buffett, “you see who’s been swimming naked.”

It is not a pretty sight.

Billions of dollars were lent to people who shouldn’t have been allowed to borrow lunch money. And now, there are losses — trillions worth.

The real question — the only question of great significance since the blow-up — is: who will take the losses? Or, to put it another way: How will the system be cleaned up? Who will decide who wins and who loses?

Mr. Market or Mr. Politician?

Let investors and speculators take the losses…or put them on savers and taxpayers?

Who will lose? The rich? Or the rest?

We’ve given you our answer many times: let Mr. Market sort it out. He’s completely impartial. He’s honest. He’s fast. And he works cheap.

In a flash, back in September-December of ’08, he probably would have wiped up the floor with the bankers. In a real crash, few of the big banks would have remained standing. Investors and lenders who had put their money in them…and who had invested in the things their phony credits supported…would have lost trillions. The rich wouldn’t be so rich anymore. And we’d now be in some phase of real recovery with many new financial institutions.

But we’re not in a position to impose our will on the world. And the politicians are. So, they’ve decided to do it another way. Instead of allowing Mr. Market to do his work they make their own choices…generally trying to direct the losses towards groups of people who don’t make campaign contributions…and don’t know what is going on. That is, towards the masses…and the unborn…

The idea has been to kick the can as far down the road as possible…borrowing and printing trillions more dollars to prop up the financial system…while also parading a few bankers through the streets with nooses around their necks. The press insults them. The mob spits upon them. The public spectacle continues…

…and nothing really changes.

Regards,

Bill Bonner,

for The Daily Reckoning

Read more: A Crisis Veiled in Public Spectacle http://dailyreckoning.com/a-crisis-veiled-in-public-spectacle/#ixzz214kPGzyg