Bonds & Interest Rates

POITOU, FRANCE – “My father told me to plant trees,” said a neighbor last night.

POITOU, FRANCE – “My father told me to plant trees,” said a neighbor last night.

“It was right after I bought this place. Of course, I was young… I was busy… I didn’t have time to plant trees.

“Now, I tell my sons to plant trees while they’re still young. So they can enjoy them later.

“Funny, as you get older, and the less future you have available, the better you know it.”

Closed Book

What follows is a meditation on something we cannot know – tomorrow.

The future is a closed book, insofar as it is possible to know what will happen. But that doesn’t mean the future won’t happen.

And although it is terra incognita – a place you’ve never been before – that doesn’t mean you shouldn’t pack your old familiar toothbrush and a warm sweater; it might be a lot like home.

Aesop wrote his fables. The French have added to them with a few of their own. Here’s one about the future:

Long ago, an old man decided to turn his farm over to his son and his wife.

“I have just one condition,” he told them. “You have to let me stay with you as long as I live.”

This was readily agreed. But the son’s wife and the old man didn’t get along. Finally, the wife persuaded her husband to throw him out. And so he did.

But taking pity on the old man, the younger man turned to his own son: “Go and get a horse blanket for your grandfather so he’ll at least have something warm to wrap around him.”

A few minutes later, the young boy came with a blanket, but his father could see that it was only half a blanket.

“Why did you cut the other half off?” he asked.

“Oh…” replied the boy. “That’s for you when you get old.”

All of a sudden, a pattern came into view. And the future didn’t seem so unknowable.

Like a tall tree, the future casts its shadow backward over the present.

If you think it will rain later in the day, you take an umbrella in the morning. If you think stocks will go up, you buy now. If you think you have only two years to live, there is no point buying a refrigerator with a 20-year guarantee.

Gift to the Future

The invention of money greatly increased man’s interest in tomorrow.

You could grow tomatoes, sell them for gold coins, and enjoy your harvest years into the future. Or you could borrow the coins now… and pay for them with next year’s tomato crop.

But what if there was a drought next summer? What if you didn’t live through the winter? What if a fungus or a swarm of locusts attacked the crop?

Savings are always a gift to the future. Debt is always a burden on it.

Suppose you were to plant black walnut trees. It could take 50 years before they mature. It will be a gift to your children. But what if a pest kills them?

What if people no longer want natural wood a half-century ahead? What if you borrowed the money to plant them?

The further ahead you look, the more risks you can’t see. Logically, the farther out you go, the more you are likely to run into something that will upset your plans.

So the longer term the debt… the less likely you are to be paid back.

Logically, too, the more debt there is outstanding, the more likely that some will never be paid back.

Gift to the Future

The invention of money greatly increased man’s interest in tomorrow.

You could grow tomatoes, sell them for gold coins, and enjoy your harvest years into the future. Or you could borrow the coins now… and pay for them with next year’s tomato crop.

But what if there was a drought next summer? What if you didn’t live through the winter? What if a fungus or a swarm of locusts attacked the crop?

Savings are always a gift to the future. Debt is always a burden on it.

Suppose you were to plant black walnut trees. It could take 50 years before they mature. It will be a gift to your children. But what if a pest kills them?

What if people no longer want natural wood a half-century ahead? What if you borrowed the money to plant them?

The further ahead you look, the more risks you can’t see. Logically, the farther out you go, the more you are likely to run into something that will upset your plans.

So the longer term the debt… the less likely you are to be paid back.

Logically, too, the more debt there is outstanding, the more likely that some will never be paid back.

Treacherous Path

Which brings us back from the future…

And there, in front of us, is the heaviest ton of bricks the future has ever had to shoulder – nearly $20 trillion of U.S. government promises, not counting the roughly $200 trillion of off-the-books obligations.

No one seems to be worried about it. The stock market is going through one of the periods of lowest “volatility” – price swings – ever recorded. Stocks are hitting record highs… and interest rates are still at epic lows.

But ahead, the path – poorly lit and strewn with rocks and banana peels – is treacherous. Somewhere in mid-September, for example, lies a major trap – a debt “ceiling” Congress imposed on itself.

But it’s not just the feds who face obstacles. Consumer debt to disposable personal income is at an all-time high. Mortgage payment to disposable personal income is also at an all-time high.

Over in the auto sector, used car prices – the chassis on which auto credit rests – are losing their bolts. Subprime auto defaults are already soaring. Bloomberg:

It’s classic subprime: hasty loans, rapid defaults, and, at times, outright fraud.

Only this isn’t the U.S. housing market circa 2007. It’s the U.S. auto industry circa 2017.

A decade after the mortgage debacle, the financial industry has embraced another type of subprime debt: auto loans. And, like last time, the risks are spreading as they’re bundled into securities for investors worldwide.

Student debt, meanwhile, has doubled since 2009; it now totes to $1.4 trillion.

What kind of way is this to treat them? Alas, the future has cast a dark shadow over America’s young people.

And according to a study by the New York Fed, student debt is having consequences far beyond just transferring wealth from young people to the old cronies in the education sector.

It’s undermining America’s most important industry: housing.

How so?

Burdened with student debt, young people cannot afford to buy houses. This leaves the bottom rung of the housing ladder unoccupied.

There are starter homes available but few solvent starters to take them… which makes the whole housing market weak and vulnerable.

August, September, October… shadows lengthen. Someone stumbles.

More to come…

Regards,

Bill

Will Yellen Stay or Go?

Quantitative Tightening

Consensus Forecasts

Lightning Round

Chicago, Lisbon, San Francisco, Denver, and Lugano

All over America, kids who were fortunate enough to go to summer camp are busy telling mom and dad what they did. Their stories will be suspiciously incomplete, but that’s OK. We know they learned something.

Well, I went to camp this summer, too. I go every year, and I always learn more than I can manage to remember. Camp Kotok is an invitation-only gathering of economists, market analysts, fund managers, and a few journalists. It takes place at the historic Leen’s Lodge in Grand Lake Stream, Maine. We fish, talk, eat, drink, and talk some more. It’s a three-day economic thought-fest (and more rich food and wine than is good for me or anyone else at the camp). For me, that’s about as good as life gets.

(Aat the end of the letter in the personal section I’ll describe a typical day at my summer camp. Not exactly arts and crafts and games. Unless poker counts as a game.)

Come along with me as I share some of my main takeaways from the camp and then, in a “lightning round,” touch on on a few various shorter topics.

David Kotok of Cumberland Advisors started the event after narrowly escaping death in the World Trade Center on 9/11. It was a way for him and a few friends to get away from the city, appreciate life, and talk about things that matter. Now the gathering has grown to about 50 of us. We meet under the Chatham House Rule, which means we can’t quote each other directly without permission. That helps promote an open exchange of ideas. And it’s definitely open. It is interesting to see the difference in the level of communication in an environment where people are not worried about being quoted when they trot out a new idea they have recently started thinking about. Testing those ideas against one’s peers, who might have different views about the same topic, is a valuable process.

David relaxes the rule for certain parts of the event, and that’s part of what I’ll share with you today. The Saturday night dinner always includes a debate on some contentious issue, with participants who are known to disagree. Martin Barnes from Bank Credit Analystalways moderates. He is one of the few who can quiet that room, with his imposing height, his booming Scottish brogue, and his offbeat sense of biting humor.

This year’s debate topic was the Federal Reserve. Specifically, we discussed the Fed’s future leadership and policies. Both are very much in question right now, and much depends on the answers. Time will tell what happens, but here is what some experts think.

Will Yellen Stay or Go?

The first debate question was deceptively simple. Who will be running the Fed next year, and will it matter? How will new leadership change anything? Janet Yellen’s current turn at the chair expires in February. Trump could renominate her but hasn’t yet announced a decision or even given a hint.

This is speculation, but President Trump had some kind words for Yellen in a recent Wall Street Journal interview. Anonymous sources quoted in the media say Trump economic advisor and former Goldman Sachs executive Gary Cohn is also in the running. Other names come up, but those two are leading for now.

I am not sure what to make of President Trump’s generous remarks, especially after his less than laudatory remarks about the Yellen Fed on the campaign trail last summer. It may just be that wiser heads got to him and pointed out that she is going to be Fed chair through February. No matter what he plans to do, there is really no point in a sitting president antagonizing a Fed chair when he would like her to not turn off the easy-money spigot too soon – in spite of what he said during the campaign.

Camp Kotok attendees had mixed views. Even most of those with a preference doubted the choice would matter very much. The Fed’s policy course under Yellen will be hard for Cohn or anyone else to change. One person made a very interesting point, though. We know President Trump admires successful business leaders. That might give Cohn an edge, since he was COO at Goldman Sachs. But then again, installing a Goldman Sachs alum at the head of the Fed really doesn’t square with his campaign speeches.

It wouldn’t surprise me to see a “dark horse” emerge as the nominee. Let’s hope we get for Fed chair – and then also for the Fed governors – individuals as qualified as Trump’s Supreme Court nominee. Trump will get to fill at least six of the seven potential open seats by this time next year. No other president has been able to put his stamp this firmly on the Fed since Woodrow Wilson appointed the original Federal Reserve Board of Governors in 1913: Trump’s nominees will control the Fed. The Fed chair and vice chair plus three board governors were appointed by Obama, but as part of the normal process of governors’ terms expiring. Fed governors are appointed for 14 years in an effort to keep any one president from being able to appoint all the governors. But in recent years, because of resignations, the situation has shifted; and now Trump has a remarkable opportunity – and will own the outcome. Good, bad, or indifferent, it will be the Trump Fed.

For the record, Yellen has also left open the possibility of staying on the Board of Governors after her term as chair is over. Those are separate appointments. She can technically remain on the board until January 31, 2024. She’s 70 now, and I doubt she’ll hang around till 2024, but it’s possible. But going from being Fed chair to just another governor would be unusual, especially considering the rather large speaking fees and book royalties that ex-Fed chairs can command. Then again, we know Supreme Court justices delay retirement so that a president they like can appoint their successors. I think Yellen is reminding Trump that she still has that option.

The same is true for Vice Chair Stanley Fischer. His board term lasts until January 31, 2020; so if he chooses to stay, he could be around until either Trump’s second term or someone else’s first.

The other two serving Board of Governors members are Jerome Powell, whose term isn’t over until January 31, 2028, and Lael Brainard, whose term ends on January 31, 2026. They can both elect to stay, but the expectation is that Brainard will also resign after Yellen departs. There is really no speculation as to what Jerome Powell will do. If he likes doing what he does – and he does run some very interesting committees – he may wait until he sees who else is on the reconfigured board and figures out whether he can get along with them.

Now, with regard to the importance of these appointments, businesspeople think differently from economists. They pay attention to market signals rather than political criteria. One person said Cohn at the Fed might “clean house,” as Rex Tillerson is doing at the State Department. The Fed has over a thousand PhD economists on staff, and it’s not at all clear that the combined weight of their expertise leads to better policy decisions. (When that point was made at the camp, the discussion got heated, more so than I recall seeing in past years, but with good reason. There were any number of economists in the room, and they had a lot of PhD-holding friends who were still at the Fed. So they squawked loudly; and, as you might imagine, Martin Barnes had to restore order.)

The bottom-line consensus on Yellen vs. Cohn: Both are tolerable. Markets might like Yellen better simply because she is at least a known quantity. Cohn might bring a different attitude and make personnel changes, but his impact wouldn’t show up in monetary policy for some time. But there were more than a few campers who preferred to see someone else appointed. Including your humble analyst.

However, when I discussed Trump’s next two probable nominees to the board (Randal Quarles, a Treasury Department official in the George W. Bush administration, and Marvin Goodfriend, a former Fed official who is now a professor of economics at Carnegie Mellon University), there was general agreement with me that those two names suggested there would not be a serious change in direction at the Federal Reserve Board next year. So when the next crisis hits, you can expect more QE and perhaps even negative rates, if you take Goodfriend’s speeches and research seriously, which I would.

The next question we dealt with was, should we be concerned about quantitative tightening? Is the market too complacent?

Here I’ll use my edited version of my associate Patrick Watson’s notes on the debate:

Jim Bianco (bond market maven/guru and analyst): Assume QT begins in September. Will not be immediate problem in 4Q, but may be in 2018. What really matters isn’t the Fed but the collective balance sheets of all central banks, which are still growing worldwide for now. Problems more likely when we see net global QT. In other words, bigger market impact will come when ECB decides to start QT. This will likely raise interest rates, could get 150 bps on long end by 2019. Problematic for risk markets. [We will touch on the issue of reserve-bank balance sheets in a moment.]

Bob Eisenbeis (Atlanta Fed chief economist, who attended FOMC meetings for ten years): Thinks market can easily digest the suggested tightening levels over five quarters. Amounts are trivial to Treasury market. But part of impact will depend on Treasury choices over re-funding what Fed doesn’t buy. Agrees with Bianco that international is bigger issue than Fed.

Danielle DiMartino (former assistant to Richard Fisher at the Dallas Fed and author of recent bestseller Fed Up) thinks none of this matters because QT won’t happen. We will get to recession first. Global bond markets assume the same, so Fed is performing a risky experiment if it does QT.

Megan Greene (chief economist at Manufacturers Life): Everyone worried about inflation when QE started. It showed up only in asset prices. QT might have opposite effect, which would mean a potential reversal of asset prices – but impact mitigated if Fed keeps making its plans clear. Maybe we will see a slight steepening. It depends on how much and on how long they keep going.

From the floor, Harvey Rosenblum (chief economist at the Dallas Fed for many years until he resigned a few years ago): Will we become Zimbabwe, or Japan? So far Japan winning. Is inflation being mismeasured, and is it really much lower than the Fed believes? If so, and the Fed realizes it, QT could come back off the table. If they don’t realize it, they could make a major policy error. (Many recessions can be laid at the foot of the Federal Reserve and its policy errors. Only in hindsight, of course. For the record, I believe QT is a policy error. Just saying…)

(Sidebar: You scoff at the idea that inflation is lower than anticipated? If you take out food, energy, and the oddly figured “owner’s equivalent rent,” inflation is about 0.6%. Yes, I know, if you assume away the real world, you can make your model do anything you want. But for the bulk of the economy, inflation is not a worry and is actually falling. When we get to “peak rents,” we could easily see inflation drop below 1%. And during a recession? Can you say deflation? The Fed panicking and massive QE? Get ready for an interesting ride.

Each year, most camp participants fill out a survey (and some of us place small side bets, typically five dollars a choice) on a number of different economic indicators. Let me just give you the average predictions as to where things will be one year from now.

• Three-month LIBOR: 1.64% from 1.30% today and 0.82% a year ago – that’s a doubling in the rate in two years.

• Ten-year Treasury note: 2.57%

• WTI crude oil: $50.20 (but the range was all over the place, from $30 to $76)

• S&P 500: 1,340, with surprisingly few really bearish views

• Gold: $1,340, and while there were a few outliers in both directions, people were generally looking for a strong movement upward.

• Dollars per euro: $1.14

• Dollars per UK pound: $1.23

• Yen per yollar: 115 (and surprisingly, my suggested number was not the highest prediction)

• Unemployment rate: 4.4%

• Core CPI: 1.9%

• US GDP: 2.12%, again with a very wide range, but interestingly, nobody was predicting a negative GDP or an outright recession.

In short, the average predictions pretty much repeated the current consensus of the market, which is to say, they are averages that reflect a complacent outlook. But I can tell you, there was a wide range on most of the predictions, and that disparity in views certainly came out in the discussions.

Lightning Round

Takeaway 1: Almost everyone expects a serious market correction before the end of the year. Most of the people I talked to were concerned about market complacency; and even if they were bullish, which many of them were, they were surprised that we’ve gone this long without a correction. Could one be starting this week? We’ll see…

Takeaway 2: In talks with people I seriously respect, I found more concern about valuations and spreads in the bond market than about valuations in the stock market. As I sat with a few people and “war-gamed” what the next recession will look like, a general agreement emerged that the credit markets will be far more volatile than they were last time, even though banks are better capitalized today than they were 10 years ago. The problem is simply that credit markets have no liquidity and valuations are extraordinarily stretched. And not just in the US.

One of the participants told me to look at this chart:

Dear gods, when European junk bonds pay the same as US Treasurys do, there is really something out of whack in the world. Look at that spike in European junk in 2009 and the one back in 2002. European junk bond investors have never been more complacent. The reach for yield is staggering. The participants in that market think that Draghi and the European Central Bank have their backs. If the situation starts to get volatile, they expect the ECB to step in. But the ECB would have to change its mandate in order to buy junk bonds, and that means getting the more conservative members of the eurozone to agree. I hesitate to bet on that. This could be the European equivalent of the Big Short in the next global recession.

Takeaway 3: Much of the private discussion centered around how much the Fed will tighten this year. Some thought the Fed wouldn’t raise any further, and some thought we would get at least one or two more rate hikes. The consensus seemed to be that a December rate hike is on the table unless we get some really unsettling data between now and then. It certainly doesn’t look as though we’ll see a hike in September, though. If there is one, it will be a surprise to everyone I talked to.

Takeaway 4: There was a conversation between a very serious Fed watcher and a former Fed economist. The question was, what would happen if the Fed’s balance sheet went negative, i.e., if they were selling their bonds back into the market at a loss? The answer was that the Fed is not required to record losses on asset sales against capital. There is an agreement with the US Treasury that says the Fed can create a negative asset account, but at that point it withholds remittances until the balance sheet is positive again. The Fed would be technically insolvent, but that wouldn’t matter because it’s backed by the US Treasury.

Takeaway 5: One gentleman who has been coming to the camp for several years runs a fund and is an expert on frontier markets. Because I have been to 62 countries – many of them on the very frontier of the frontier markets, I’m always interested in talking with him. And now that I’m managing my own portfolio of managers, I’ve noticed that we have several different frontier-country ETFs in our portfolios. This piques my interest even more. So I always ask him what his favorite frontier market is, and what he sees happening in that space. For the last three or four years he has been consistently big on Vietnam.

This year he surprised me by answering “Serbia.” I probably shouldn’t have been surprised, as almost the entire Central and Eastern European sector is hot, hot, hot. When I asked why, he pointed out the country has really made itself investor-friendly but that plus is not all that easy to trade, so there’s a lot of undervalued potential in what is essentially a well-educated and growing economy. And he still loves Vietnam and also mentioned Myanmar and a few countries in East Africa.

As you might expect, he has to travel more these days and to places that really aren’t vacation spots in order to do proper due diligence. He has to do things that you and I might not want to do, which says that if you ever want to invest in those markets, you need to find someone like him to do your traveling and decision-making for you.

The takeaways don’t end here, but we’ve run out of room today.

Chicago, Lisbon, San Francisco, Denver, and Lugano

I mentioned above that I would give you a typical day’s schedule at Camp Kotok. Depending on how dedicated a fisherman (or woman) you are, you get up and have breakfast in the morning with the staff, who make you pretty much anything you want. They make extraordinarily good pancakes. I will admit that while pancakes are normally off my diet, I indulge this one time of the year along with my regular scrambled eggs and maybe some bacon.

Then you find your guide, who takes you to his boat, and you get out on whatever lake we are fishing that day. Depending on when you head out, there are friends to greet but not much real economic discussion, except on Friday morning when the unemployment numbers come out. A fair number of attendees stick around the lodge for that number and then try to get on the internet to send out quick takes to their readers and/or clients. So the fishing gets started later for some of us.

We all meet for lunch somewhere, which the camp staff has been preparing for us; and the guides clean and cook whatever we catch, which is paired with too many fattening hors d’oeuvres. We dine on lots of fried fish and every now and then some fried eel and/or lake salmon if anybody happens to catch one. For the healthy-minded among us, the staff steams some of the fish along with vegetables. And of course there’s a generous quantity of wine. Lunch lasts at least two+ hours, making for some of the best conversations around the lake camps. Some people go back out and fish a bit more, but generally people call it a day by three or four and head back to the lodge or cabins to clean up and get ready for dinner.

Attendees begin gathering around 5:00 or 6:00. Tempting hors d’oeuvres in abundance (I don’t know where they get that smoked duck, but it is awesome) take the edge off your hunger. And the conversations start. I try to make it a point to sit at every dinner with a different group of people. And while I have old friends, of course, I enjoy getting to talk with people that I don’t normally run into. I remember a particularly wonderful conversation a few years ago with a former Fed regional president that went on later than it should have because we were having so much fun sharing. Somehow the informal setting makes us all more relaxed and open. Then you go to your comfortable but rustic cabin (after all, this is a fishing camp even if it is one of the nicest in the area), and you wake up the next morning and do it again.

Some people do it for two days, but most do it for three or four. A few hardy fanatic fishermen come on Wednesday; more arrive the next day or the next. Nearly everyone stays Friday and Saturday; there are generally special events planned for Sunday (range shooting or canoeing the St. Croix River at the Canadian border were the events this year), but you can always find a guide to take you back out on yet another lake in the area. Saturday night generally sees a table or two of poker. I make it a point not to play. While there have been a few times when I’ve been one of the big winners, more often than not I reach my loss limit and bow out. I would rather sit out on the deck and talk on a beautiful evening.

And while it may sound like the emphasis is on fishing and food, the real highlights are the conversations.

Looking ahead, I don’t do much traveling till the end of September, and then I will be in Chicago, Lisbon, San Francisco, Denver, and Lugano. I have a few more events that are being lined up. Next week I will go into more detail. Right now it is time to hit the send button. You have a great week.

Your back on a pretty strict diet analyst,

John Mauldin

Job approval numbers for Japan’s Prime Minister Shinzo Abe are in freefall. Abe’s support has now fallen below 30%, and his Liberal Democratic Party recently suffered heavy losses stemming from a slew of scandals revolving around illegal subsidies received by a close associate of his wife. But as we have seen back on this side of the hemisphere, the public’s interest in these political scandals can be easily overlooked if the underlying economic conditions are favorable. For instance, voters were apathetic when the House introduced impeachment proceedings at the end of 1998 against Bill Clinton for perjury and abuse of power. And Clinton’s perjury scandal was indefensible upon discovery of that infamous Blue Dress. The average citizen, then busily counting their chips from the dot-com casino, were disinterested in Clinton’s wrongdoings because the 1998 economy was booming. Clinton remained in office, and his Democratic party gained seats in the 1998 mid-term elections.

Therefore, Abe’s scandal is more likely a referendum on the public’s frustration with the failure of Abenomics.

When Shinzo Abe regained the office of Prime Minister during the last days of 2012, he brought with him the promise of three magic arrows: an image borrowed from a Japanese folk tale that teaches three sticks together are harder to break than one. The first arrow targeted unprecedented monetary easing, the second was humongous government spending, and the third arrow was aimed at structural reforms. The Prime Minister assured the Japanese that his “three-arrow” strategy would rescue the economy from decades of stagnation.

Unfortunately, these three arrows have done nothing to improve the life of the average Japanese person. Instead, they have only succeeded in blowing up the debt, wrecking the value of the yen and exploding the Bank of Japan’s (BOJ) balance sheet. For years Japanese savers have not only seen their yen denominated deposits garner a zero percent interest rate in the bank; but even worse, have lost purchasing power against foreign currencies. The yen has lost over 30 percent of its value against the US dollar since Abe regained power in 2012.

Meanwhile, the Japanese economy is still entrenched in its “lost-decades” morass; and growing at just over one percent year over year in Q1 2017. Japan’s dramatic slowdown in growth, which averaged at an annual rate of 4.5 percent in the 1980s, fell to 1.5 percent in the 1990s and never recovered. In addition to this, higher health care costs from an aging population have driven government health care spending to move from 4.5 percent of GDP in 1990, to 9.5 percent in 2010, according to IMF estimates.

Incredibly, this low-growth and debt-disabled economy has a 10-Year Note that yields around zero percent; thanks only to BOJ purchases.

Prime Minister Abe’s plan to address this recent scandal-driven plummet in the polls is to increase government spending even more and have the BOJ simply step up the printing press. In other words, he is going to double down on the first two arrows that have already failed! However, the Japanese people appear as though they have now had enough.

Japan’s National Debt is already over a quadrillion yen (250% of GDP). And the nation would never be able to service this debt if the BOJ didn’t own most of it. The sad truth is that the only viable alternative for Japanese Government Bonds (JGBs) is an explicit or implicit default. And, a default of the implicit variety has already occurred because the BOJ now owns most of the government debt—total assets held by the BOJ is around 93% of GDP; JGBs equal 70% of GDP.

Japan is a paragon to prove that no nation can print, borrow and spend its way to prosperity. Abenomics delivered on all the deficit spending that Keynesians such as Paul Krugman espouse. But where is the growth? Japanese citizens are getting tired of Abenomics and there are some early indications that they may vote people in power that will force the BOJ into joining the rest of the developed world in the direction of normalizing monetary policy.

The reckless policies of global central banks have left investors starving for yield and forcing them out along the risk curve. But interest rates are set to rise as central banks remove the massive and unprecedented bid on sovereign debt—perhaps even in Japan. A chaotic interest rate shock wave is about to hit the global bond market, which will reverberate across equity markets around the world. Is your portfolio ready?

By Michael Pento

The dramatic failure of the U.S. Senate’s last-ditch Obamacare repeal effort leaves Republicans so far without a major legislative win since Donald Trump took office. No healthcare reform. No tax reform. No monetary reform. No budgetary reform.

The dramatic failure of the U.S. Senate’s last-ditch Obamacare repeal effort leaves Republicans so far without a major legislative win since Donald Trump took office. No healthcare reform. No tax reform. No monetary reform. No budgetary reform.

The more things change in Washington… the more they stay the same.

Despite an unconventional outsider in the White House, it’s business as usual for entrenched incumbents of both parties. The next major order of business for the bipartisan establishment is to raise the debt ceiling above $20 trillion.

Since March, the Treasury Department has been relying on “extraordinary measures” to pay the government’s bills without breaching the statutory debt limit.

By October, according to Treasury officials, the government could begin defaulting on debt if Congress doesn’t approve additional borrowing authority.

Treasury Secretary Steven Mnuchin wants Congress to pass a “clean” debt limit increase. That would entail just signing off on more debt without putting any restraints whatsoever on government spending.

Fiscal conservatives hope to tie the debt ceiling hike to at least some budgetary reforms. But even relatively minor spending concessions will be difficult to obtain from the bipartisan establishment.

Democrats and a few left-leaning Republicans together have an effective majority in the U.S. Senate. They wielded their legislative might by defeating the GOP’s watered down Obamacare repeal bill, with the decisive “no” vote cast by ailing Republican John McCain.

It was exactly the sort of media spotlight moment Senator McCain has craved throughout his long political career.

The narcissistic Senator’s shtick is to posture as a selfless crusader for noble causes that his fellow Republicans just aren’t high-minded enough to get behind.

Yet for all his sanctimony, McCain is just as politically opportunistic and just as hypocritical as many of his Senate colleagues. The Senator from Arizona ran for re-election last time around on repealiång Obamacare. Yet when given the opportunity, he voted to keep it in place.

He campaigns as a conservative when it suits his political needs and portrays himself as a maverick when he wants media accolades. He legislates as neither a conservative nor a maverick but as an entrenched establishment incumbent. That can also be said of other big-name Republicans.

Trump’s Budget Cut Proposals Declared “Dead on Arrival” by Spending-Drunk Congress

When President Trump’s Budget Director Mick Mulvaney unveiled a proposed budget that, for the first time in decades, asked Congress to make tough cuts to an array of spending programs, establishment Republicans joined Democrats in branding it “dead on arrival.”

Congress didn’t even consider the idea of spending cuts to be on the table for negotiation. That’s how entrenched deep state loyalties are in Congress.

Instead of working with Trump’s budget, the Republican-controlled Congress promptly began hammering out a spending bill that added billions to what the administration requested – $4.6 billion more for agriculture, $4.3 billion more for interior and environmental programs, $8.6 billion more for the departments of Transportation and Housing and Urban Development.

No cuts to refugee and foreign aid programs. Even the much-maligned National Endowment for the Arts made it through the House Appropriations Committee unscathed.

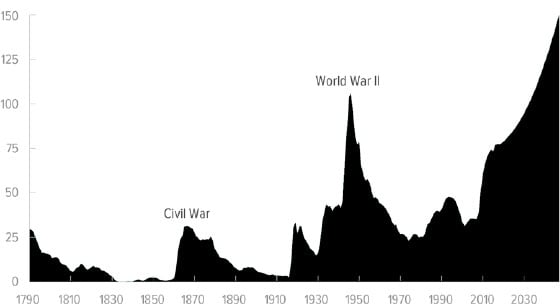

The bottom line is that there will be no spending restraint in Washington, and therefore no way out of the coming debt crisis. The Congressional Budget Office projects that publicly held federal debt as a percentage of the economy will soon surge past all previous wartime spikes.

National Debt (Publicly Held) as a Percentage of GDP

Source: Congressional Budget Office

The official national debt of nearly $20 trillion is just the tip of the iceberg. It represents a small proportion of the total unfunded liabilities the political class has racked up over the past few decades (pointedly, after President Richard Nixon repealed the last remnants of gold redeemability for the U.S. dollar and replaced it with pure fiat).

Taxpayers are on the hook for perhaps $100 trillion more in unfunded entitlement and pension IOUs.

Plus, state and local government pensions are underfunded by several trillion dollars. They haven’t blown up yet because the rising stock market and steady bond market seen over the past several years has enabled pension fund administrators to kick the can further down the road. They are projecting unrealistically high market returns into the future – and still coming up short.

Federal Reserve Makes It All Possible

Trillions upon trillions of dollars have been promised that simply won’t exist… unless the Federal Reserve creates them out of nothing. The Fed’s unlimited power to expand the currency supply enables politicians to commit acts of fiscal malfeasance with political impunity.

A legislator might get voted out of office for raising taxes, but probably not for adding to the budget deficit. Most voters don’t perceive any immediate consequences to a rising national debt or the expansion of the currency supply. That’s why “borrow and print” is a politically convenient way for lawmakers to stealthily raise taxes.

Government spending extracts resources from the economy regardless of whether that spending is paid for through taxes or through the deceit of borrow and print.

What excessive borrowing today does is set up political demand for massive inflation of the currency supply down the road. The inflation tax can be just as devastating to a person’s wealth as any tax collected by the IRS.

But Janet Yellen has a little problem and his name is Uncle Buck. The US dollar index and its pairing vs. several global currencies are on the verge of collapsing below important support levels. This update on currencies from this week’s NFTRH 457 explains why I am short the euro and prepared for the USD to find support and bounce. Now, at this point that is just a contrarian’s fantasy because the market says USD is in trouble. But have a look at the post and see if you might agree with some of its premises, especially where sentiment and Commitments of Traders are concerned.

So here we have the Fed, overseeing a massive bull market in stocks and ostensibly in accommodation removal mode. My premise since the election of Donald Trump has been that the Fed could now slowly and routinely remove the monetary policy stimulants it had injected into markets nearly non-stop during the Obama years because that admin’s goals depended on monetary policy (i.e. monetary stimulation, because there sure was precious little real economic stimulation going on) whereas the new Republican policies would depend upon fiscal stimulation. I would argue, however, that “fiscal stimulation” may be code for ‘dollar devaluation’ to spur exports and boost manufacturing.

So a big question now is whether the Fed, despite its slow tightening regime and stated intention to implement future rate hikes and reduce the size of its balance sheet (USD-supportive actions) actually means business, leaving the Trump admin to its fiscal policies; or whether the Fed will ‘play ball’ with this admin in a different way.

Core to the Trump fiscal agenda would be a weak US dollar. We just may get a look at Yellen’s cards today. If FOMC rolls over and keeps things well and dovish despite the weak USD, we’d have a clue that they are on board the weak dollar express. But what if the Fed chooses to support the dollar through some subtle jawboning about future hikes and balance sheet reductions? I have no real dog in this fight. I’m just trying to make sure NFTRH is on the right side of it.

Looking at it from a different angle and taking out the political while only considering market-oriented inputs, here is a big picture look at previous Fed tightening cycles. The stock market topped on the last two occasions that the Fed Funds Rate (FFR) caught up to and slightly exceeded the 2 year Treasury yield. But a more acute signal was when the 2yr began to decline and negatively diverge the FFR (note the red lines on the chart below).

Looking at the chart one might say that the 2yr and FFR have a long way to go before they reach a topping area equivalent to the 2007 example; but one might also look at the S&P 500’s mega hump and ask… ‘Really? That was 7 years of Zero Interest Rate Policy!’ The above is a picture of a distortion built on years of out-of-whack monetary policy (note how the 2yr began to rise in 2013 and the FFR did not start following it upward until late 2015). Maybe 1-2% is all that the Mega Hump and all that hot air can take on this cycle. It is the relationship between the 2yr and the FFR that will be important. At a current 1% to 1.25% the Fed is approaching the 2yr’s 1.4% but the market appears fine for now (and a bull trend is a bull trend until it no longer is).

A central question going forward is whether or not the Fed will choose to support the dollar and head off inflation, or wait to see the white’s of its eyes? Since the election the stock market has been very much tied to a dollar depreciation theme (and has, since 2011 been a primary beneficiary of the Fed’s inflationary operations). The last big rise in USD preceded a significant corrective phase in the markets (2015 into 2016). So which cards will Yellen show with respect to Uncle Buck and his current precarious state?

Gary Tanashian

For a limited time I’d like to offer first-time subscribers a free trial month of NFTRH Premium, no strings, no nuthin’; just your full satisfaction or you can cancel at any time during the first month (through your PayPal account) to avoid monthly billing thereafter. Not only do you get macro work like the above, you also get regular charting of most US stock sectors (including leading individual stocks), the same for precious metals and commodities and ongoing, consistent coverage of global markets, currencies, bonds, related indicators and so much more.

For consistent, high quality analysis (a weekly report and in-week market and technical ‘trade setup’ updates) that keeps subscribers on the right side of markets, consider an affordable premium subscription to NFTRH.

“Great call picking the [gold stock] bottom last week Gary!” –Frederick L 9.6.16