Bonds & Interest Rates

The narration of reflation and ‘Great Fiscal Rotation’ imply that the Fed will hike interest rates in a more aggressive way in a response to accelerated growth and higher inflation. We have already covered the Fed’s likely policy in 2017 in the previous edition of the Market Overview, but let’s discuss the impact of higher interest rates for the U.S. dollar and gold once again. It is widely believed that higher interest rates are bullish for greenback and bearish for the yellow metal. Is that really so? Some analysts do not agree with that opinion, pointing out that the U.S. dollar did not rally during Fed tightening cycles. Therefore, the hawkish Fed may be actually good for gold, they argue.

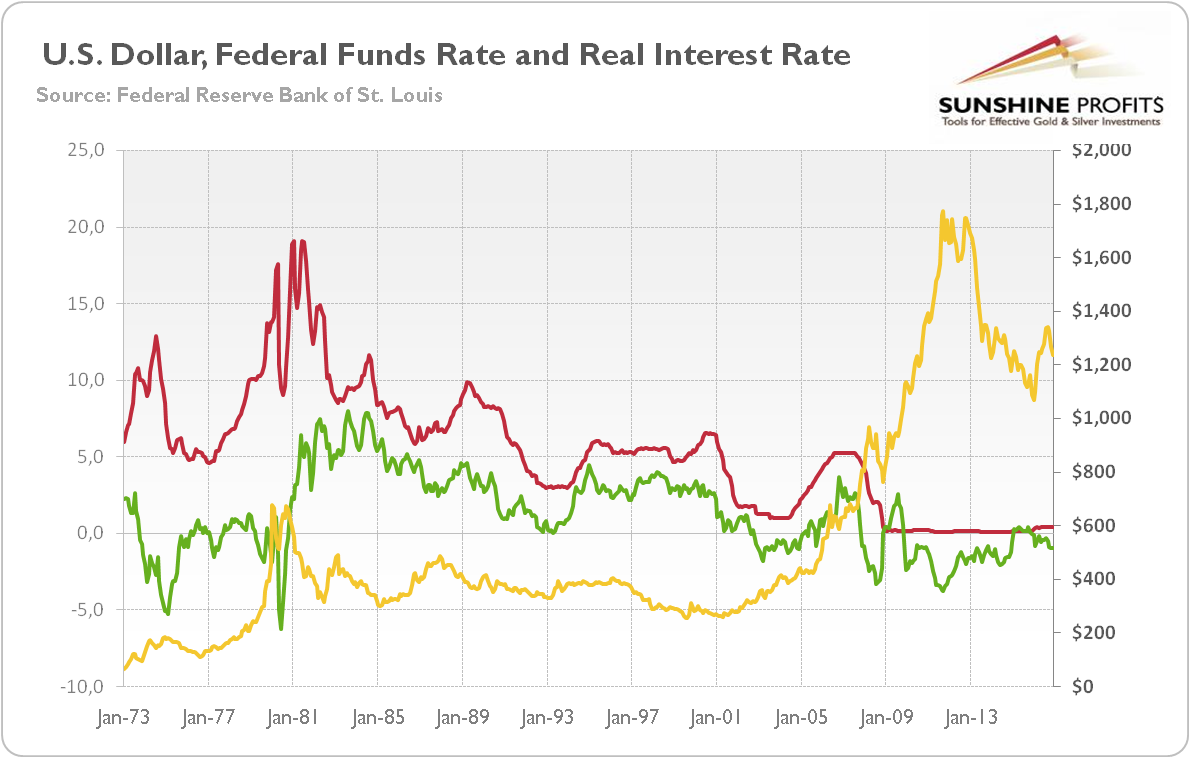

They are right, in some senses. Just look at the chart below: the tightening cycle which took place in 2004-2006 was actually bearish for the greenback and bullish for gold, while the U.S. dollar was essentially traded sideways during ZIRP.

Chart 1: The broad trade weighted U.S. dollar index (green line, right axis) and the effective federal funds rate (red line, left axis, in %) from 1973 to 2016.

However, the three previous tightening cycles corresponded with the bullish dollar. Actually, the federal funds rate does not matter. As we have emphasized many times, what really counts for gold prices are the real interest rates, not the federal funds rate. The chart below illustrates that truth (we use the 1-year treasury yield adjusted for the CPI, since the yields at 10-year inflation-protected treasuries are available only since 2003).

Chart 2: The price of gold (right axis, yellow line, London P.M. Fix), the federal funds rate (red line, left axis, in %) and the real interest rates (green line, left axis, as 1-year treasury yield less CPI year-over-year, in %) from 1953 to 2016.

It shows that there are many others important drivers of the greenback and gold than the federal funds rate. A lot depends on the broader macroeconomic situation in which the Fed acts. For example, the previous tightening cycle coincided with the bear market in the U.S. dollar, because the fiscal position of the country deteriorated. Moreover, in the past, the Fed actively determined the market conditions. Now, the U.S. central bank is data-dependent, so it is more passive or retroactive. Why does it matter? Well, the Fed hiked its interest rate in December 2016 after real interest rates actually surged. If the Fed is behind the curve and just follows the data, why should we look at the federal funds rate instead of the market interest rates? Investors look ahead and adjust to their expectations of the future developments, including the Fed’s moves.

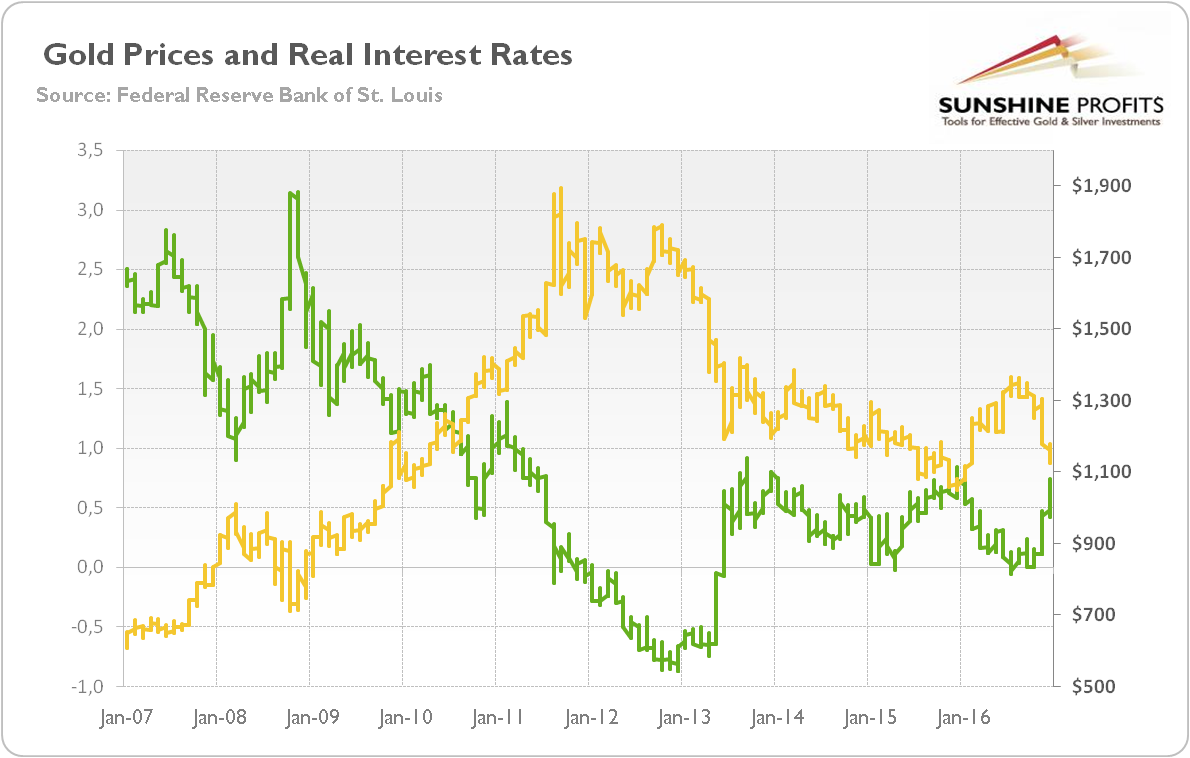

So, let’s focus on the real interest rates. For the last 10 years, there was a really strong negative correlation between them and the price of gold, as the chart below shows.

Chart 3: The price of gold (right axis, yellow line, London P.M. Fix) and the real interest rates (green line, left axis, as yield at 10-year inflation-indexed Treasury, in %) from 2007 to 2017.

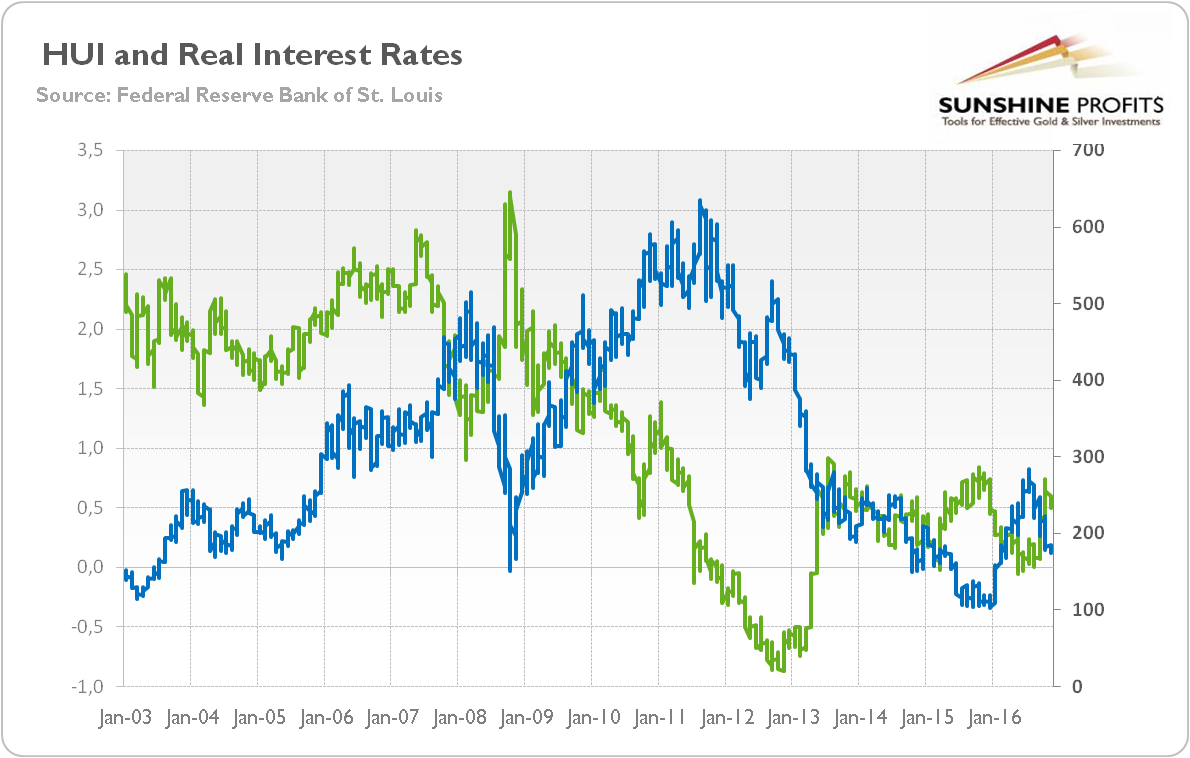

The correlation between real interest rates and silver or mining stocks is weaker, but still significant as one can see in the two charts below.

Chart 4: The price of silver (right axis, blue line, London Fix), and the real interest rates (green line, left axis, as yield at 10-year inflation-indexed Treasury, in %) from 2003 to 2016.

Chart 5: The HUI (right axis, blue line), and the real interest rates (green line, left axis, as yield at 10-year inflation-indexed Treasury, in %) from 2003 to 2016.

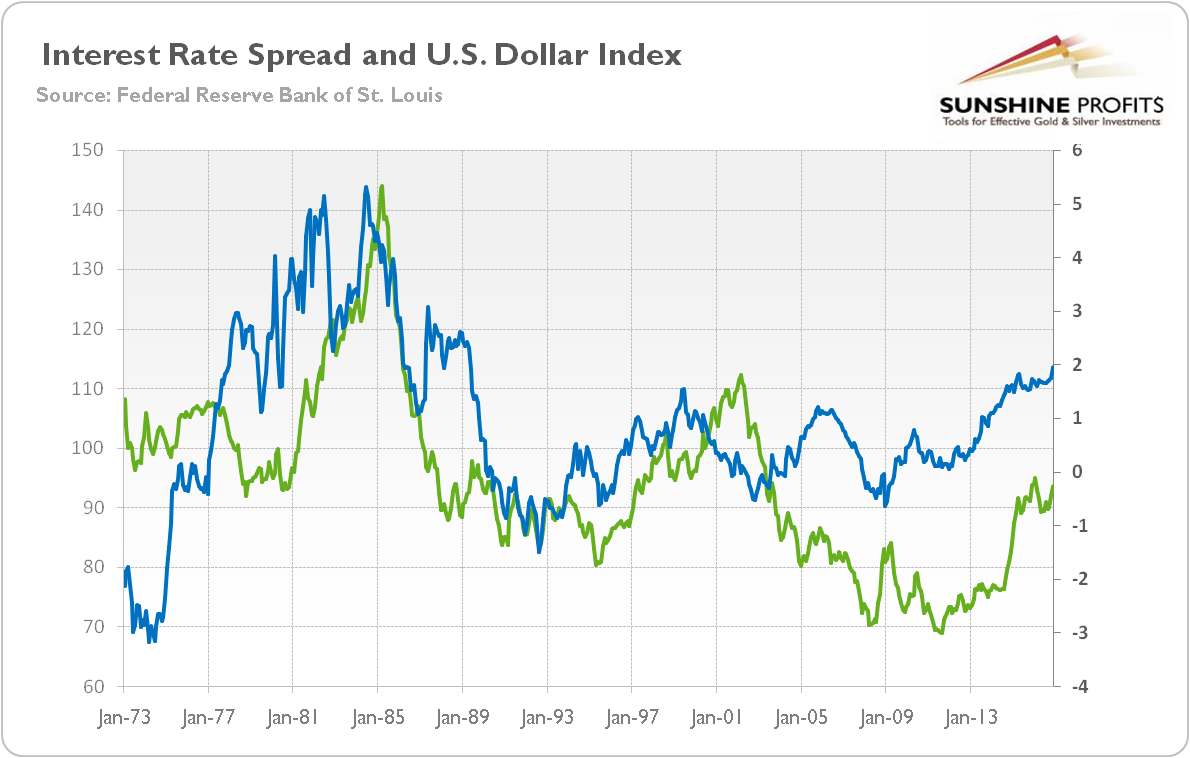

And what about the link between interest rates and the U.S. exchange rate? According to the economic theory, the rise in interest rates leads to inflow of capital, which strengthens the currency. Let’s check it. Since the euro accounts for majority of the U.S. index, we will analyze the correlation between the U.S. dollar index and the difference between the U.S. and German interest rates. The chart below shows important positive correlation between these two variables (perhaps, the relationship would be even stronger, if we use interest rates for the whole euro area and the EUR/USD exchange rate).

Chart 6: The U.S. Dollar Index (green line, left axis) and the difference between long-term U.S. and German interest rates (blue line, right axis) from 1973 to 2016.

The bottom line is that market interest rates are an important driver of U.S. dollar’s strength and, thus, gold. The Fed’s monetary policy is extremely important, as we constantly emphasize, but it affects the real economy through the market interest rates, as well as other channels (exchange rate, asset prices and so on). Therefore, gold investors should not examine only the federal funds rate, but always look at the broader macroeconomic picture.

And what does it all mean for the U.S. dollar and the gold market? Well, there is no rule how the greenback behaves during a Fed tightening cycle. However, if the U.S. economic growth accelerates compared to the euro area (and Japan), while the divergence in monetary policies conducted by the Fed and other major central banks continues (as a reminder, the Fed is likely to make a hike a few times this year, while the ECB and the BoJ will probably not move their interest rates upward, at least not in a similarly aggressive way), the U.S. dollar should strengthen further. As such, it will be a major fundamental headwind for the price of gold.

If you enjoyed the above analysis and would you like to know more about the impact of the current macroeconomic trends on the gold market, we invite you to read the February Market Overview report. If you’re interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It’s free and you can unsubscribe anytime.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

…also from Arkadiusz: Is Gold a Hedge against Trump’s Impeachment?

March rate hike odds are unchanged (below 40%) and the yield curve has flattened since The Fed’s February statement (despite heavy jawboning and higher inflation data) and so the Minutes were expected to help ease the markets to not be surprised. And they were...MANY FED OFFICIALS SAW HIKE `FAIRLY SOON’ IF ECONOMY ON TRACK. However, the Minutes also showed ‘balance’ by not proclaiming concern over inflation – *MANY FED VOTERS SAW ONLY MODEST RISK OF SIGNIFICANT INFLATION and FED OFFICIALS SAW DOWNSIDE RISKS FROM FURTHER DOLLAR STRENGTH.

Here is the key excerpt in which the Fed says a rate hike may be needed “fairly soon” if all goes according to plan..

We have become pawns in the game of Chess being played by the Federal Reserve Bank. Who is their opponent? Anybody else who makes a move.

We have become pawns in the game of Chess being played by the Federal Reserve Bank. Who is their opponent? Anybody else who makes a move.

Week in, week out, everyone’s eyes and ears seem fixed on what the Federal Reserve Board will say or do. Mostly, it is about what they say. That’s because they can’t really do much of anything.

Except inflate the supply of money and credit. Which they have been doing for over one hundred years. And they are good at it, too. The historic erosion in value of the US dollar should merit more acclaim – or outrage. Unfortunately, the Fed is good at shifting the focus of concern to their opponent(s).

In their various statements, members of the Federal Reserve Bank often refer to their policies, decisions, and efforts in ways that make them sound sincere about their attempt to “manage the economy”. And, admittedly, they are sincere in that attempt. The trouble is, it is an impossible task.

The US Federal Reserve has led us down a primrose path by virtue of their self-proclaimed intention to manage and modify the stages of the economic cycle (prosperity, inflation, recession, depression).

….related by Larry Edelson: Why you shouldn’t fear rising interest rates …

Yellen’s Last Hike and the Next Fed Chair

Yellen’s Last Hike and the Next Fed Chair

Janet Yellen, you’re fired!

For the past 20-30 years, the Federal Reserve has been dominated by academics largely out of MIT. Jim Bianco at Bianco Research says that’s all going to change under Trump, starting with Fed chair Janet Yellen.

Here’s what he recently told FS Insider:

Yellen’s Last Hike

“I’ve jokingly said that when it comes to the story with the Fed this year, it’s that the Fed will raise rates in June and then Janet Yellen will be fired by Trump right after that. Her term is up in January 2018. What we’ve learned about Trump is what he says he means and what he means he says, and he has said repeatedly during the campaign that he doesn’t like Janet Yellen, doesn’t think she’s done a good job. She’s done, she’s out. And she’s got another year to go…so that’s what I mean when I say the Fed will raise rates the middle of the year and then Trump will fire Yellen.”

….continue reading more of what Bianco has to say HERE

…related:

Wolf Richter: Central Banks Quietly Backing Out of Negative Interest Rate Policies (NIRP)

I’ve got to hand it to the majority of pundits out there. They just never learn to think for themselves. They keep dishing out the same nonsense, over and over again.

For instance, the notions that rising interest rates will kill off equity market gains, particularly in the U.S. … or choke off a real estate recovery … or kill the gold market for good — are myths. Period.

It might be true if interest rates were at record highs and well above the rate of inflation. But they are not. Interest rates are coming off of historic record lows in many parts of the world — even below zero in some countries — and they are far below the rate of inflation.

That’s important to understand. As rates rise from essentially 5,000-year-low levels — no matter what any central bank does — many investors will run for cover. But the only market that rising interest rates will truly hurt is the value of sovereign bonds. In other words, it will demolish governments’ ability to ever borrow again (a good thing).

Consider what’s happening right now with real estate. Why would rising mortgage rates — at this point in the economic cycle and recovery — be bad for property prices?

Consider what’s happening right now with real estate. Why would rising mortgage rates — at this point in the economic cycle and recovery — be bad for property prices?

They won’t be bad. For the simple reason that as mortgage rates start to rise, all the pent-up demand for property will come out of the woodwork and start buying — in anticipation of further increases in the cost of borrowed funds.

That’s precisely what is happening in the U.S., in particular, where a housing recovery is well underway.

Consider the latest data from brokerage Douglas Elliman Real Estate, where January 2017 was an excellent month for high-end sales in Connecticut and where sales from $1 million all the way up to $5 million increased significantly compared to January 2016.

Overall, total inventory is down to 447 houses which is 13 lower than last year at this time, while total sales are up 16.

That’s the high end. Meanwhile, the overall ownership rate in the U.S. is at its lowest level since 1965!

But that will change quickly as mortgage rates start to rise and all that pent-up demand comes out of the woodwork.

This is happening in the suburbs of America as well. Rising interest rates are motivating homeowners and investors to act now, rather than later, when the cost of borrowed funds will be even higher.

That’s just the property markets. Rising interest rates are also going to prove positive for equity markets. While equity markets in the U.S. and Europe remain vulnerable to a short-term pullback, rising rates will be a bullish factor over the long haul.

It means economic activity is picking up. It means the velocity of money turnover is improving, and it means increasing demand for credit — all of which are bullish fundamental forces for equities.

Not to mention the war cycles, which are driving trillions to our shores.

Ditto for commodities. The notion that gold will simply roll over and die and that a new bull market leg higher is impossible with interest rates rising, is brain-dead.

Just consider the last big bull market in gold, from 1973 to 1980, when interest rates were soaring as was the price of gold and most commodities.

Sure, inflation was roaring higher then too. But that doesn’t negate the fact that gold soared with higher interest rates.

Instead, it proves my point: Until interest rates get well ahead of inflation — which is something we will not see for years based on my models — they will not be negative for gold!

That said, right now, most commodities still have some work to do on the downside before they bottom, which they will do this year in the first quarter.

But bottom they will — and they will rise again — along with rising interest rates.

Like many of you, I am watching gold like a hawk. It’s already following my AI models nicely, staging a rally, coming off an extended cycle low.

The best news: Basis the active April gold futures contract, we now have a close above the $1,220 level, a weekly buy signal.

Time to back up the truck? My answer: No. Wait until I give you the final major buy signal. That’s what I am personally waiting for before I load up for my family. So, I give you the same advice I am acting on.

And rest assured that when that signal comes, I will be recommending a nice combination of physical precious metals, ETFs, including leveraged ETFs, and for some of the best profit potential out there, select mining shares.

Subscribers to my Real Wealth Report and Supercycle Trader will get the signal first, and simultaneously.

Best wishes,

Larry