Bonds & Interest Rates

Following winners is natural. These names represent the investing themes liked by readtheticker.com: Richard Wyckoff, Jesse Livermore, Richard Ney, William Gann, Jim Hurst, Sir John Templeton, Peter Lynch and William J O’Neil. These are the best gunslingers!

Investing Quote…

“Keep the number of stocks you own to a controllable number. It is hard to herd cats, and it is hard to track many securities. Take your losses quickly and do not brood about them. Try to learn from them but mistakes are as inevitable as death.” ~ Jesse Livermore

“Until an hour before the Devil fell, God thought him beautiful in Heaven.” ~ Arthur Miller, “The Crucible” [Contrarian Investing]

“Markets are designed to allow individuals to look after their private needs and to pursue profit. It’s really a great invention and I wouldn’t under-estimate the value of that, but they’re not designed to take care of social needs.” ~ George Soros

“Because of the extreme challenge, one must commit full attention to it.” Market speculation is “no different than trying to be a successful doctor or lawyer … you simply must devote yourself full-time to the study of your craft.” ~ Bernard Baruch

“The financial markets generally are unpredictable. So that one has to have different scenarios… The idea that you can actually predict what’s going to happen contradicts my way of looking at the market.” ~ George Soros

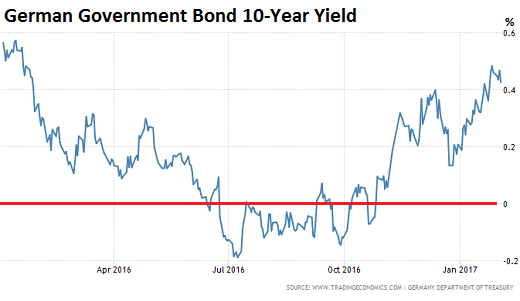

One of the ironies of the fact that central banks appear to be throwing in the towel on negative interest rate policies (NIRP) is that their elite economist allies appear not to have gotten the memo. A noisy contingent is pushing to eliminate cash, and one of the big justifications is to allow central banks to engage in NIRP more effectively.

One of the ironies of the fact that central banks appear to be throwing in the towel on negative interest rate policies (NIRP) is that their elite economist allies appear not to have gotten the memo. A noisy contingent is pushing to eliminate cash, and one of the big justifications is to allow central banks to engage in NIRP more effectively.

Markets are suspecting that central banks are in the process of exiting this fabulous multi-year party quietly, and that on the way out they won’t refill the booze and dope, leaving the besotted revelers to their own devices. That thought isn’t sitting very well with these revelers.

Fixed income is supposed to be a conservative strategy for generating income.

Fixed income is supposed to be a conservative strategy for generating income.

And if you do it right – by owning some individual bonds – you’ll be just fine.

But bond funds aren’t the same as individual bonds.

And that’s why, starting this week, I’m purging bond funds from my personal portfolio.

…related:

I used to make fun of the FOMC rate hike “decision” language in the mainstream media because under the Obama administration and its economic policies overseen by the Fed’s monetarypolicy, there really was no decision, was there? It was ZIRP-eternity, interrupted by a lone and token rate hike in December 2015 (the Dec. 2016 hike does not count because the transition to a new administration and policy regime was already known; in effect, the Fed has already made its first hike under Trump).

According to the traders who make up the Fed Funds futures, there is no decision tomorrow, either. From CME Group, we have virtually no one predicting two successive rate hikes.

….related: 2017’s Real Milestone (Or Why Interest Rates Can Never Go Back To Normal)

Sure, the oil markets have responded to the OPEC and Non-OPEC agreement to cut production. But perhaps not quite like the cartel anticipated!

Sure, the oil markets have responded to the OPEC and Non-OPEC agreement to cut production. But perhaps not quite like the cartel anticipated!

While media headlines are chock-full of reports that parties to the agreement are complying with the cuts, this time it’s different.

And that’s because they’ve underestimated the supply coming out of a new swing producer: The United States.

And that’s going to drive oil prices down in a big way. Consider …

<1> Cumbersome U.S. inventory and surging production. U.S. oil inventories are at their highest seasonal level in 30 years and production is running at its fastest clip in nine months.

And I think this is just the start. Especially on a surge in U.S. oil drilling rig activity, which last week saw the biggest one-week jump in nearly four years.

<2> Surge in corporate spending and oil-patch investment. A recent poll of more than a dozen U.S. players showed an average 60% increase in capital expenditures for oil exploration and production planned for this year! This view was echoed by global investment bank Barclay’s calling for a 50% increase in American E&P spending.

There’s also a flurry of investment activity in the shale-rich Permian Basin.

And don’t forget: U.S. drillers have become nimble and well-funded with some shale producers generating a handsome profit at $45 per barrel. When they’re making money like that, the last thing on their minds is cutting production.

<3> Worrisome Speculator Positioning in the oil market. Initial excitement surrounding the OPEC production cut sparked aggressive buying interest into the oil market. In fact, figures compiled by the Commodity Futures Trading Commission (CFTC) show small speculators holding their largest long position on record …

These traders are considered the weak hands — generally underfunded and the last to enter the market. In fact, I use them as a contrarian indicator — what not to do.

As you can see from this chart, these weak hands are all in.

And that tells me to stay away.

In addition, given the current extreme reading, when these weak hands move to cover — in this case, sell their positions — oil will get hammered.

This is similar to late 2014 when oil topped $100 and small speculators held record net-long positions. They were forced to cover and kicked off a crash in oil prices.

Not surprisingly, this view is supported by my AI model: Oil prices should move sharply lower into late February.

I have advised members to strategically position themselves for lower oil prices at various points in recent weeks: Putting them in positions to take full advantage of a looming decline.

Don’t be left behind: Take a look at my Real Wealth Report and other trading services today.

Best wishes,

Larry