Bonds & Interest Rates

Will President-elect Donald Trump deliver on his campaign promises to dig in with an anti-globalization stance and potentially start one or more trade wars?

Will President-elect Donald Trump deliver on his campaign promises to dig in with an anti-globalization stance and potentially start one or more trade wars?

I have no doubt that he will follow through on this promise. He was clear about one goal throughout his campaign: Getting much tougher on trade relations.

The president-elect has talked up a range of aggressive actions, including:

– Labeling China a currency manipulator …

– Slapping tariffs on goods imported from China and Mexico …

– And renegotiating or walking away from trade deals like the North American Free Trade Agreement (NAFTA) and the proposed Trans-Pacific Partnership (TPP) deal that President Obama was pushing.

If President-elect Trump delivers on the protectionist measures he pitched during his campaign, investors can expect increased market volatility, especially in bonds. In fact, it’s already started.

This week alone, global bond investors have seen more than $1 trillion in value wiped out. My view: It’s the start of the sovereign debt crisis as foreign governments and central banks — worried about trade — send a message to Washington. So if Mr. Trump carries through with renegotiating trade deals or slapping tariffs on goods, guess what?

Our U.S. Treasury note and bond market will get clobbered, interest rates will soar, compounding the interest on our country’s gargantuan debts … and …

As I’ve been saying, the piper will inevitably and finally get paid.

Washington will go bankrupt, right along with the U.S. Federal Reserve, which is stuck with more than $4.5 trillion of U.S. notes and bonds.

The fact is my cycles and AI models warned of a sovereign bond crisis long before Mr. Trump even decided to run for president. We were heading down this path no matter who became our next Commander in Chief.

Best wishes,

Larry

It’s hard to overstate the degree of carnage we’re seeing in the bond market here. Treasuries are getting absolutely murdered, with long bond futures plunging five ponts in price.(see chart)

The yield on the benchmark 10-year Treasury Note, for its part, is soaring 21 basis points to 2.07%. This is the bond market’s way of saying that seven long years of interest-rate repression, never-ending QE, and overly experimental monetary policy is coming to a close. That’s bad news for things like real estate prices and REIT shares. But the money coming out of bonds could rotate into “Trump-derivative” sectors like defense and infrastructure.

Unfortunately, it doesn’t really matter which party wins the presidential election as neither one will be unable to stop the coming MOTHER OF ALL DEFLATIONS. While it is frustrating to watch just how insane this presidential race has disintegrated into, I try to not to focus on it.

Why? Because the U.S. Government will become totally powerless to deal with the future financial and economic collapse. Furthermore, most institutions will also lose the ability to function when the system cracks. This really isn’t a matter of if or when…. IT’S HAPPENING NOW.

According to a recent Zerohedge article, Dallas “Pension Fund Panic” As Major Warns Of 130% Property Tax Hike To Avoid Collapse,

“This is much like a Bernie Madoff scheme, if you ask me,” said Dallas mayor Miek Rawling discussing the collapse of the local Dallas Police and Fire Pension Fund. The Dallas pension board wants the city to contribute $1.1. billion in 2018, but to do that, they would have to increase the property tax rate by 130%.

This is just one sign of many hundreds that continue to eat away at the financial and economic system. What is ironic to witness is the complete failure of the analyst community to understand the real reason for these financial disasters. While most of the blame is put on the totally useless Mainstream Financial Networks, the majority of the alternative media analysts are clueless as well.

This is due to the alternative media’s failure to understand the underlying energy dynamics. I used to read a lot of the alternative media sites (especially the precious metals), but presently only look over a few. Many of the precious metals sites continue to harp on matters that really aren’t important anymore.

Of course, they do this because they do not want to look at the vital energy dynamics. For some reason, most of the precious metals analysts look at energy as just another industry…. much like the retail or health care industries. It doesn’t matter to them that the price of oil is now $75 below the cost of new production of $125 a barrel(according to the Hills Group work).

The falling oil price is totally gutting the U.S. and Global Oil Industry. I wrote about this in my article, The End Of The U.S. Major Oil Industry Era: Big Trouble At ExxonMobil. Without transports fuels, the world’s economy disintegrates…. and disintegrate it will.

Thus, the collapsing oil price will destroy the value of most physical and paper assets, BUT NOT GOLD & SILVER. Here is a chart of the “Global Asset Universe” by the Savills Research Group Report:

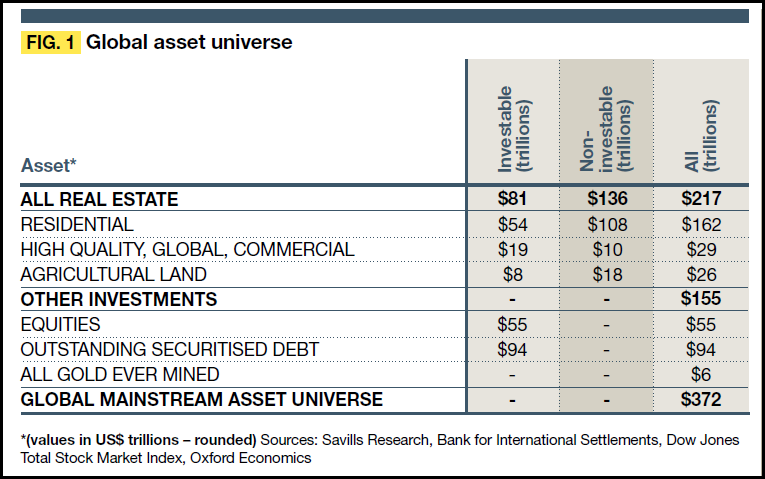

As we can see, they estimate that the total Global Real Estate Market is valued at $217 trillion, Securitized Debt (Treasuries & Bonds) at $94 trillion and Equities (Stocks) at $55 trillion. In their report, they stated that all the gold mined in the world was valued at $6 trillion. I revised that figure to only include “physical investment gold and silver” which is estimated to be $3.1 trillion. You can check how I estimated the $3.1 trillion of gold and silver in my article, How High Will Silver’s Value Increase Compared To Gold During The Next Financial Crisis?

The Savills Group breaks down the Global Real Estate market into “investable” and ‘non-investable.” According to their estimates, they list that of the total $217 trillion in global real estate, only $81 trillion are investable, while the remainder is held privately.

The value of global real estate, stocks and bonds are totally inflated based on a much higher oil price of $110-$125. Now with the price of oil at $45, the value of these assets should have collapsed a few years ago. If we consider the price of oil was $110 in 2012 and now is $45, that represents a collapse of nearly 60%.

Unfortunately, many people do not understand that the value of real estate, stocks and bonds are based on the value of energy. Instead, they blindly believe the value of these assets are based on “SUPPLY & DEMAND” or some other VOO-DOO Economics.

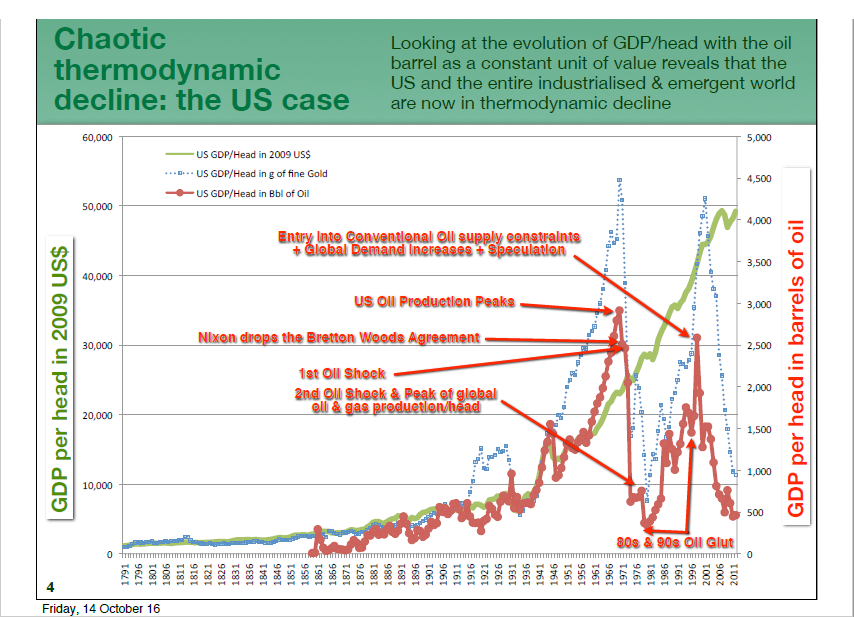

If we look at Louis Arnoux’s chart showing the U.S. GDP value per American in gold and oil units, it collapsed back in 2012. Again, the U.S. GDP and value of most paper assets should have collapsed along with gold and oil, but they didn’t:

The chart shows how U.S. GDP per American (Green) continues higher even though gold per head (Blue) and oil per head (Red) collapsed in 2012.

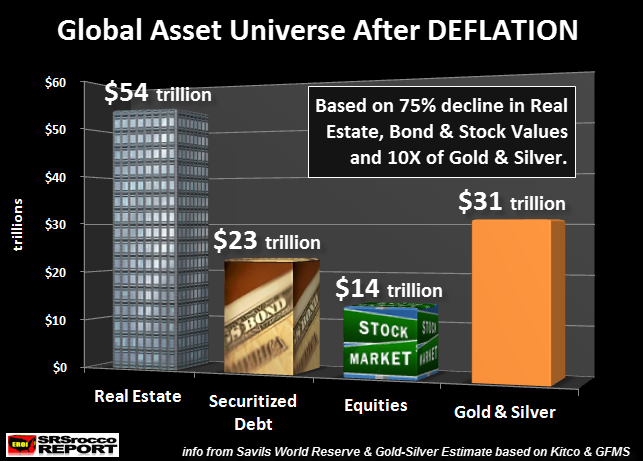

Thus, we have the Greatest Real Estate and Financial Bubble in history looking for a pin…… and the pin is the falling price and production of oil. I will explain this in more detail in upcoming articles, however if we assume a 75% collapse in the value of real estate, bonds and stocks, this would be the result:

Global Real Estate values would fall to $54 trillion, Securitized Debt would drop to $23 trillion and equity values would fall to $14 trillion. Thus, the total value of these assets would collapse by $274 trillion to $91 trillion. However, the value of physical gold and silver would surge to ten times its value to $31 trillion.

Of course, this is just an estimate, but if we consider the value of real estate, stocks and bonds falling 75%, only 10% of that $274 trillion lost is $27 trillion. Which means, just 10% of the value of these assets moving into gold and silver would push their value up to $31 trillion.

Again, this is just an estimate, but investors have no idea just how quickly the value of global real estate, bonds and stocks will fall in the future. I put a figure of a 75% collapse, but that is just in the beginning to middle stages. I would imagine, by the time the global crash is complete, these values could literally fall by 90-95%.

The current Presidential Election is a complete farce. Even though I try to stay away from politics, it becomes extremely frustrating to see the public totally brainwashed by Mainstream media propaganda.

People need to start distancing themselves from anything that is run by a centralized system, whether that be government, finance or the economy. It is time to look to more local and regional solutions as the viability of centralized systems collapse over the next 5-10 years.

Check back for new articles and updates at the SRSrocco Report.

The costs of the largest game of “Greater Fools” in economic history

The costs of the largest game of “Greater Fools” in economic history

Rarely do we investors get a market that we know is overvalued and that approaches such clearly defined limits as the bond market now. That is because there is a limit as to how negative bond yields can go. Their expected returns relative to their risks are especially bad. If interest rates rise just a little bit more than is discounted in the curve it will have a big negative effect on bonds and all asset prices, as they are all very sensitive to the discount rate used to calculate the present value of their future cash flows.

That is because with interest rates having declined, the effective durations of all assets have lengthened, so they are more price-sensitive. For example, it would only take a 100 basis point rise in Treasury bond yields to trigger the worst price decline in bonds since the 1981 bond market crash. And since those interest are embedded in the pricing of all investment assets, that would send them all much lower.

….related:

Roughly Every 80 Years, the Piper Always Gets Paid …

By this time next week, we’ll all know who the next president of the United States will be.

But it won’t matter one iota. The reason: We’re in the early stages of a sovereign debt crisis, a massive storm that hits the global economy roughly every 80 years and where the piper always gets paid.

Proof positive it’s starting: While central bankers have done virtually everything they could think of to prop up bond prices and depress interest rates to spark global economic growth …

A Great Bond Bust Is Starting to Unfold

Even negative interest rates in Europe haven’t done the trick of stoking its economy.

And now, just as I forecast last year, the bond bubble is starting to burst. Worldwide, bonds lost 2.9 percent from Oct. 1 to Oct. 27, a devastating blow in only 26 days.

The last time the bond market was dealt such a blow was May 2013, when then-Federal Reserve Chairman Ben S. Bernanke signaled the central bank might slow its unprecedented bond buying.

Naturally, Europe led the losses as investors start doubting the viability that the ECB can continue to purchase debt, without boxing itself into a corner that will lead to bankruptcy, just like it will eventually for our own Federal Reserve.

Naturally, Europe led the losses as investors start doubting the viability that the ECB can continue to purchase debt, without boxing itself into a corner that will lead to bankruptcy, just like it will eventually for our own Federal Reserve.

The central banks (and governments) of Europe, Japan and the U.S. are all toast — it’s merely a matter of time before everyone realizes it.

There is simply no way …

— Europe, Japan and the U.S. will ever make good on the social promises and safety nets that they promised their people. And …

— No way each country’s central bank will survive. All three are between a rock and a hard place, with a total $12.7 trillion in debt among them that they will never be able to get rid of without crushing the global economy and sending interest rates to the moon.

Even if sold over a decade, they’d be selling more than $1.2 trillion worth of bonds each and every year. The market can’t handle it.

Welcome to the World’s Worst-Ever Sovereign Debt Crisis

Sounds trite. And I know what you’re thinking: “But Larry, we’ve been here before and nothing has ever happened. Governments can just kick the can down the road.”

My response: That’s true. In normal times, they can kick the can down the road.

But these are far from normal times. And it’s not even the level of debt that matters right now. It’s the revolution that’s in the air. You see, roughly every 80 years or so — the piper has to be paid.

It happened in the Great Depression (which led to WWII) … it happened roughly 80 years before that in the late 1860s … before that in the 1780’s … and pretty consistently every 80 years throughout Europe’s history.

There is no free lunch. Even for governments and central banks. The piper always gets paid.

So, What Does It Mean Directly for You and Your Investments?

First, you should steer clear of ALL government bonds and anything less than a AAA corporate or municipal bond.

Second, you should not mistakenly assume the U.S. stock market is going to crash along with bond markets. It’s not. All that frightened bond-market capital is going to seek shelter in the U.S. equity markets more than any in any other country.

Chief reasons:

A. As weak as our economy may get, and as lousy as our next leader may be, the rest of the world views our equity markets as the safest place to park big money. Period.

B. We have the biggest, deepest and most-liquid equity markets on the planet, and the only markets that can handle the trillions of dollars of money seeking shelter.

C. Dozens of U.S. companies are in better financial shape than most countries.

D. The U.S. equity markets are the last bastion of capitalism. Unlike Europe and Japan — not to mention many other parts of the world — Washington would never nationalize U.S. equity markets, or even a minor portion of them.

And lastly …

E. U.S. equities are becoming an alternative to bank deposits, where you earn nothing and you’re at risk of European-style “bail-ins” should your bank fail.

Given the above five reasons, I think it’s a no-brainer that my A.I. models and supercycles show the Dow Jones Industrials vaulting to over 31,000 over the next couple years.

Third, be ready to take advantage of huge new bull markets in key commodities and commodity companies in the natural-resource markets, especially in gold, silver and energy.

Lastly, if you think we haven’t been here before, go back just over 80 years to the middle of the Great Depression. Back then between 1932 and 1937 …

All of Europe went bust, Japan went bust, China was in trouble, and guess what happened?

Gold soared on the black market, along with the dollar — so much so that President Roosevelt had to devalue the dollar and then confiscate gold …

While foreign capital inflows into the U.S. equity markets also drove the Dow Industrials up 382% … even while the U.S. economy remained mired down in 25% unemployment and a depression.

History, as the saying goes, repeats itself. And that’s why the piper always gets paid.

Stay safe and best wishes,

Larry

P.S. Get your free copy of my new report “STOCK MARKET TSUNAMI” right away, click here to download now!