Bonds & Interest Rates

On the heels of the move by the Bank of England to lower rates and increase QE, look at who is really getting crushed by the BoE’s move.

On the heels of the move by the Bank of England to lower rates and increase QE, look at who is really getting crushed by the BoE’s move.

A portion of today’s note from Art Cashin: The BOE Makes Its Moves – The Bank of England made a series of moves this morning. I will defer to my friend, Peter Boockvar of the Lindsey Group, who as usual has a quick and typically lucid analysis. Here’s a bit of what he wrote:

related:

…., ready for ‘whatever action necessary’

…., ready for ‘whatever action necessary’

The Bank of England cut interest rates on Thursday for the first time since 2009, revived its bond-buying programme and said it would take “whatever action is necessary” to achieve stability in the wake of Britain’s vote to leave the European Union.

The central bank said it expected the economy to stagnate for the rest of 2016 and suffer weak growth throughout next year. It cut its main lending rate to a record low 0.25 percent from 0.5 percent, in line with market expectations.

But it also launched two new schemes, one to buy 10 billion pounds of high-grade corporate bonds and another – potentially worth up to 100 billion pounds – to ensure banks keep lending even after the cut in interest rates.

…continue reading for markets reaction HERE

more news:

U.S. jobless claims rise marginally; layoffs increase in July

Although gold dust is precious, when it gets in your eyes it obstructs your vision.

Hsi-Tang

Economists stated that main trigger for the financial crisis of 2008 was the issuance of mortgages that did not require down payments. The ease at which one could get mortgages in the past is what drove housing prices to unsustainable levels. Post-crisis all banks vowed to end the practice forever, or that is what they wanted everyone to believe. When the credit markets froze, we openly stated that the 1st sign that banks were getting ready to lower the bar again would come in the form of Zero percent balance transfer offers that had all but vanished after 2008. A few years after 2008, banks started to mail these offers out, and now everywhere you look you can find 0 % balance transfer offers ranging from 12 months to 18 months. The next step after that would be for banks to lower the 20% down payment required to something much lower. Currently, Bank of America and a few other banks are offering 3% down mortgages.

Economists stated that main trigger for the financial crisis of 2008 was the issuance of mortgages that did not require down payments. The ease at which one could get mortgages in the past is what drove housing prices to unsustainable levels. Post-crisis all banks vowed to end the practice forever, or that is what they wanted everyone to believe. When the credit markets froze, we openly stated that the 1st sign that banks were getting ready to lower the bar again would come in the form of Zero percent balance transfer offers that had all but vanished after 2008. A few years after 2008, banks started to mail these offers out, and now everywhere you look you can find 0 % balance transfer offers ranging from 12 months to 18 months. The next step after that would be for banks to lower the 20% down payment required to something much lower. Currently, Bank of America and a few other banks are offering 3% down mortgages.

Now Barclays Bank has become the first British bank to turn back the hands of time; it has started to issue 0% down Mortgages under a program called “family springboard”. There is, however, one small difference. In this instance, a parent would put 10% of the down payment into an account. If payments are made in a timely fashion, this amount is returned in three years with interest.

In the US we like to do things bigger and better than everyone so, it is just a matter of time before this type of mortgage debuts here. As we have stated many times in the past, every bull market ends on a Euphoric note; to get to this level the small player also needs to have easy access to hot money. So far this access has been restricted to the large corporations and the very rich. However, we feel that it is just a matter of time before the spigots will be opened to the small players. The 1st sign of this will be the debut of the 0% mortgage.

The supply of housing is already quite tight in the in U.S. U.S existing home inventory stands at 2.12 million, down from 2.14 Million last month and down almost 130K year over year. At the current sales pace, there is roughly a five-month supply of homes on the market. A 6 month supply is viewed as a healthy balance between demand and supply. Home prices have been slowly rising over the past few years, and the average home price is projected to rise by 5% in 2016%.

Home prices are already rising without the debut of the Zero percent down mortgage, so one can only imagine how much more they will rise when these mortgages become available in the US. Higher home prices have the tendency to make home owners feel better off as they view the paper profits as real money. This leads them to take on more risk, and one of the best places to do this is the stock market.

We believe that lending standards for mortgages and personal loans will be lowered significantly in the months and years to come, setting up the bedrock for the next stock market bubble. Until the masses embrace this bull market, it is going to run a lot higher than the most ardent of naysayers could ever dream off. Over the course of the next few years, we expect both housing and the stock market to trend higher. This bull will run into a brick wall one day but that day is not here yet.

Conclusion

Our main point here is to illustrate that the hot money spigots will be opened even more and that the supply of hot money is not going to end anytime soon. In fact, the Fed is already looking at ways to increase it significantly, after all, that is the only thing that has been powering this economy; end that and the illusion comes to a grinding halt. For now, it is the big corporations and the very wealthy that have had access to this cheap money. When the small guy finally gets his hands on this cheap money, he will do what he always does, start to speculate and hope he strikes it big. Furthermore, rising home prices will create the illusion of wealth, and when people feel they have money, they tend to take on more risk. After all, that’s what they did before the markets collapsed in 2008.

While we spent most of the time on talking about the housing market, the point to keep in mind is that this bull market will probably run a lot higher, because it is still one of the most hated bull markets in history. No bull market has ever ended on a negative note, and the cards are lining up to provide this market with the ingredients it needs to take it to the bubble level. The masses will embrace this market just as the corporate world has done for the past eight years once and they do this market is going to soar even higher.

Hasten slowly and ye shall soon arrive.

Milarepa

In other scrambles for safety and return, Large Investors Become Major Buyers of Bitcoin

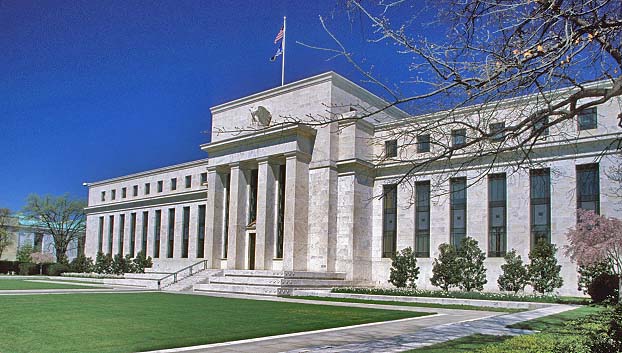

The U.S. Federal Reserve is expected to keep interest rates unchanged this week, deferring any possible increase until September or December, as policymakers hold out for more evidence of a pickup in inflation.

The U.S. Federal Reserve is expected to keep interest rates unchanged this week, deferring any possible increase until September or December, as policymakers hold out for more evidence of a pickup in inflation.

Central to the debate at the Fed’s July 26-27 policy meeting will be how to reconcile upbeat U.S. economic data, highlighted by strong job gains in June, with a global growth slowdown and other headwinds threatening the inflation trajectory.

For San Francisco Fed President John Williams, one of the 17 members participating in the central bank’s rate-setting deliberations, all that is needed is a bit more confidence that inflation is indeed headed toward the Fed’s 2 percent target.

The inflation measure the Fed prefers to track is currently at 1.6 percent.

With monthly job gains well above the level needed to prevent an uptick in unemployment, and no signs of a rise in productivity, some Fed policymakers are likely to argue for a quick increase in rates to avoid a surge in inflation.

“That is the danger – and you can be sure that the hawks are going to be arguing that,” said Alan Blinder, a Princeton University professor and a former Fed vice chairman. “I have a hunch that they will talking in July about September.”

Other policymakers, like influential New York Fed President William Dudley, have signaled they would rather wait for more tangible signs of a rise in inflation before pulling the trigger on a rate increase.

“There’s not a lot of reason to raise rates until inflation goes up,” said Kevin Logan, chief U.S. economist at HSBC in New York.

The U.S. central bank is scheduled to issue its latest policy statement at 2 p.m. EDT (1800 GMT) on Wednesday.

HEADWINDS

The Fed raised its benchmark overnight interest rate in December for the first time in nearly a decade, and signaled four rate hikes were coming in 2016 as it moved to “normalize” the ultra-stimulative monetary policy adopted in response to the 2007-2009 financial crisis.

But headwinds in the global economy, financial market volatility and uncertainty over the impact of Britain’s decision to leave the European Union forced it to delay a rate hike and scale back the number of projected hikes to two for the year.

Still, absent a shock to markets or a reversal in U.S. economic data, even dovish policymakers like Dudley have signaled that their cautious approach to normalizing monetary policy likely allows for at least one rate hike this year.

After Wednesday, the Fed has three more policy meetings scheduled this year – in September, November and December. A November rate hike is seen as highly unlikely, as that meeting comes one week before the U.S. presidential election.

Economists polled by Reuters expect the Fed to hold rates steady until after the election.

“Rate normalization has fallen down the Fed priority list and will remain there until the dust is well settled on the financial markets and the economy,” Jefferies economists predicted in a note last week.

The European Central Bank (ECB) announced it will decide in the coming months whether monetary policy should be eased any further. Clearly, Draghi is completely losing control for he cannot entertain the remote possibility that negative interest rates will only cause hoarding and capital flight, and not stimulation. People only borrow when they see an opportunity. They do not borrow like governments with no rational thought whatsoever.

The European Central Bank (ECB) announced it will decide in the coming months whether monetary policy should be eased any further. Clearly, Draghi is completely losing control for he cannot entertain the remote possibility that negative interest rates will only cause hoarding and capital flight, and not stimulation. People only borrow when they see an opportunity. They do not borrow like governments with no rational thought whatsoever.

In the coming months, Draghi said a better assessment of the situation would become possible. However, Draghi also said at the press conference for the Governing Council meeting that there is a change in policy because the ECB rule prevents them from buying negative yielding bonds. With German 10-year moving negative, that means Draghi cannot buy anything from Germany. Draghi came out and said that if necessary he will use all “available instruments” meaning the rule to prevent the ECB from buying negative bonds will be abandoned.

The key rate was left as expected at a record low of zero percent. Draghi reiterated that interest rates will remain low, far beyond the end of the bond purchase program. The bond purchases in the amount of EUR 80 billion per month until at least March 2017 will continue until the inflation once again reappears. He has demonstrated that Europe is really screwed. He will not even consider that he is bankrupting pension funds while creating the next crisis and the elderly can no longer live off of interest. He has totally disrupted the world economy and has completely lost all sense of how to manage the economy.

More from Martin Armstrong: French Parliament – Nullified – Get Ready for More Civil Unrest

also from Mauldin Economics: Europe Is a Minefield