Bonds & Interest Rates

Every dictator knows that a continuous state of emergency is the best means to justify tyrannical policies. The trick is to keep the fictitious emergency from breeding so much paranoia that routine activities come to a halt. Many have discovered that its best to make the threat external, intangible and ultimately, unverifiable. In Orwell’s 1984 the preferred mantra was “We’ve always been at war with Eurasia,” even though everyone knew it wasn’t true. In its rate decision this week the Federal Reserve, adopted a similar approach and conjured up an external threat to maintain a policy that is becoming increasingly absurd.

Every dictator knows that a continuous state of emergency is the best means to justify tyrannical policies. The trick is to keep the fictitious emergency from breeding so much paranoia that routine activities come to a halt. Many have discovered that its best to make the threat external, intangible and ultimately, unverifiable. In Orwell’s 1984 the preferred mantra was “We’ve always been at war with Eurasia,” even though everyone knew it wasn’t true. In its rate decision this week the Federal Reserve, adopted a similar approach and conjured up an external threat to maintain a policy that is becoming increasingly absurd.

The Federal Reserve yielded to international pressure, making the very same mistake that it made during 1927. Back then, there was a secret meeting and the Fed agreed to lower U.S. rates to try to help Europe to deflect capital inflows back to Europe. The exact opposite unfolded in the aftermath when even more money abandoned Europe and flowed directly into the U.S. share market.

In 1927, the Fed lowered U.S. rates in the middle of an economic debt crisis, which is the same path taken today. It is very curious how history repeats. We have just witnessed the Fed yield to international pressure once again. In doing so, they are condemning the elderly and U.S. pension funds to financial doom by setting in motion the next financial crisis.

also from Martin:

Sovereign Debts: How Defaults May Unfold

Summary

Summary

The Fed is considering raising interest rates this week.

The Fed desperately wants to raise interest rates, not because the economy is so strong but so that they can have a policy buffer in preparation for the next recession.

But after too many years of waiting and coddling the markets, they are now very late in seeking to make such a move.

A misstep on Thursday could effectively close the window on their ability to raise rates going forward.

Some major banks — which over the past few decades have grown into the biggest financial entities the world has ever seen — appear to have hit a wall, and are now shedding tens of thousands of workers. Some recent examples:

Some major banks — which over the past few decades have grown into the biggest financial entities the world has ever seen — appear to have hit a wall, and are now shedding tens of thousands of workers. Some recent examples:

Barclays plans to cut more than 30,000 jobs

(CNBC) – Barclays plans to cut more than 30,000 jobs within two years after firing Chief Executive Antony Jenkins this month, The Times reported on Sunday.

This redundancy program, which could reduce the bank’s global workforce below 100,000 by 2017 end, is considered as the only way to address the bank’s chronic underperformance and double its share price, the newspaper said, citing senior sources.

These job cuts are likely to affect staff at middle and back office operations, where largest savings are achieved, the Times said.

The paper said that a potential candidate, who would replace Jenkins, is expected to ax jobs much faster and more deeply than the ousted boss.

Deutsche Bank to cut workforce by a quarter

(Reuters) – Deutsche Bank aims to cut roughly 23,000 jobs, or about one quarter of total staff, through layoffs mainly in technology activities and by spinning off its PostBank division, financial sources said on Monday.

That would bring the group’s workforce down to around 75,000 full-time positions under a reorganization being finalised by new Chief Executive John Cryan, who took control of Germany’s biggest bank in July with the promise to cut costs.

Deutsche’s share price has suffered badly under stalled reforms and rising costs on top of fines and settlements that have pushed the bank down to the bottom of the valuation rankings of global investment banks. It has a price-book ratio of around 0.5, according to ThomsonReuters data.

Deutsche is mainly reviewing cuts to the parts of its technology and back office operations that process transactions and work orders for staff who deal with clients.

A significant number of the roughly 20,000 positions in that area will be reviewed for possible cuts, a financial source said. Back-office jobs in the group’s large investment banking division will be concentrated in London, New York and Frankfurt, the source said.

PostBank has about 15,000 positions, pointing to roughly 8,000 layoffs at Deutsche once the unit’s spinoff is completed as planned in 2016.

UniCredit plans to cut around 10,000 jobs

(Reuters) – UniCredit (CRDI.MI), Italy’s biggest bank by assets, is planning to cut around 10,000 jobs, or 7 percent of its workforce, as it seeks to slash costs and boost profits, a source at the bank told Reuters on Monday.

The planned cuts will be concentrated in Italy, Germany and Austria, several sources said, adding that they include 2,700 layoffs in Italy that have already been announced.

A UniCredit spokesman declined comment beyond noting that the bank’s CEO Federico Ghizzoni had on Sept. 3 said there were no concrete numbers on potential lay-offs, after a report said it was considering eliminating 10,000 positions in coming years.

UniCredit, which has 146,600 employees across 17 countries, is under pressure to boost its profits as low interest rates are expected to keep hurting its earnings in coming years.

Such a sudden, widespread retrenchment can mean several things:

-

Technology is making a lot of back office staff redundant. That’s reasonable and to be expected. Automation of knowledge work will be one of the big stories of the coming decade and finance is a prime target. A quick look at the growth of crowdfunding (from zero in 2009 to an estimated $50 billion in peer-to-peer loans in 2016) tells you all you need to know about the future of conventional bank lending.

-

The profitability of core banking operations is going to crater in the coming year and these guys are trying to get out in front of it — while hoping to hide the deterioration within massive workforce reduction write-offs.

-

The availability of good jobs for European college graduates — already too low — is going to shrink further. It’s virtually impossible for a finance-dependent system to grow while major banks are shrinking, so Europe will remain stuck in neutral while its governments pile up ever-greater debts and more peripheral countries join Greece on the public dole. And the euro will, at some point, be devalued suddenly and drastically.

-

The other big banks can’t be in much better shape, since they’re all operating in the same zero-interest rate, low-growth world. In the US, where auto loans have been a singular bright spot, what happens when cars stop selling? We may be about to find out. See U.S. factory output declines on sharp drop in auto production.

-

The global recovery is a mirage. Six years in, with stock and bond prices near record levels, demand for support staff in deal-driven entities like banks should be rising. Layoffs on this scale are bottom-of-a-recession events.

Add it all up, and significant Fed tightening looks like a hard sell. The opposite is much more likely.

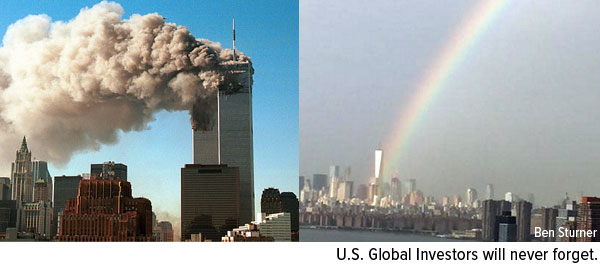

Today is an emotional day for Americans. In an instant, on a beautiful blue sky morning 14 years ago, all of our lives changed forever.

Today is an emotional day for Americans. In an instant, on a beautiful blue sky morning 14 years ago, all of our lives changed forever.

September 11 is a day when we pause and reflect on where we were when—when the towers came crumbling down, when our nation’s capital came under attack, when so many lives were cut short, when so many heroes rushed in.

I was in Manhattan with colleagues that day, attending a financial industry conference uptown. At the time, we didn’t know how fortunate we were that our meeting had been changed from 9:00 a.m. to 11:00 a.m. I was en route when everything stopped, and soon after, I saw all the people covered in dust and walking home across the bridge. The cell phones in the city stopped working, but because mine had a San Antonio area code, I was able to get through to the office to let everyone know we were safe.

….continue reading this very comprehensive SWOT analysis of all markets from Stocks, The Economy and Bond Market, Gold, Energy, China, Europe, Leaders, Laggards. Its long and detailed weekend reading – Money Talks Editor