Currency

The Australian dollar surged almost two percent on Tuesday after the country’s central bank dropped its bias towards easing interest rates and toned down its long-term call for the currency to weaken.

The dollar, yen and euro were all broadly stable, reflecting a drop in the volatility that has accompanied the flood of money out of emerging economies in search of traditional safe havens in the developed world.

The Aussie has fallen by almost a fifth in the past 12 months as a commodities boom expired, growth in China began to slow and the central bank campaigned for a weaker currency to help stir economic growth. – full article HERE

Tuesday 4 February 2014

Quotable

“Everything that seems to us imperishable tends towards decay; a position in society, like anything else, is not created once and for all, but, just as much as the power of an empire, is continually rebuilding itself by a sort of perpetual process of creation, which explains the apparent anomalies in social or political history in the course of half a century. The creation of the world did not occur at the beginning of time, it occurs every day.”

Marcel Proust

Commentary & Analysis

I floated the idea in Currency Currents a year or so ago, suggesting maybe the euro was becoming the new yen given its economic backdrop relative to the price action. I.E. no matter the seeming malaise across Europe, its currency continued to remain supported, relatively. The yen of did something similar if you look back: it rallied for years even though Japan’s debt kept rising and its GDP kept falling and its interest rates went to zero (threw a monkey wrench into the whole yield spread argument). Two questions here: Will Europe become mired in the same deflationary trap as Japan’s economy once was? And if so, will its currency react the same way—rally?

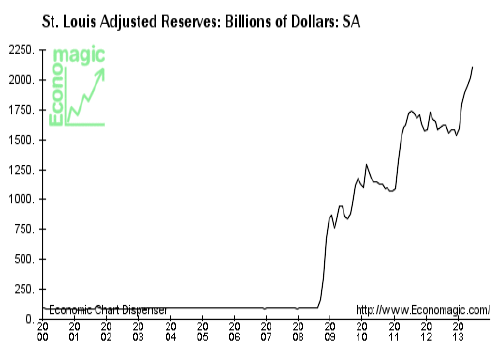

I am not picking on Europe here, so let’s be clear. Everyone knows US policymakers are doing all they can to follow down the same debt and monetary death trap Japan has already blazed. Remember about three or four years ago when Ben “Blitzkrieg” Bernanke assured us the Fed had plenty of tools available to generate inflation? The implicit meaning was the central bank will do all it can to help the Federal government turn its bonds into certificates of confiscation. Well Ben, you’ve done your part by pumping up reserves in the banking system by 2516% since the credit crunch…

…and what do you have to show for it: Falling inflation rates across the G6…not the same as deflation but proves Ben’s toolbox isn’t all that.

Black Swan Capital’s Currency Currents is strictly an informational publication and does not provide personalized or individualized investment or trading advice. Commodity futures and forex trading involves substantial risk of loss and may not be suitable for you. The money you allocate to futures or forex trading should be money that you can afford to lose. Please carefully read Black Swan’s full disclaimer, which is available at http://www.blackswantrading.com/disclaimer

Australia’s central bank kept its cash rate at a record low of 2.5 percent on Tuesday but changed their tune by saying further cuts were not in the cards. The also dropped the reference to the currency being “uncomfortably high” that had been a weight on the Australian Dollar.

Australian dollar futures are up 1.5 cents this morning to 80.88.

Drew Zimmerman

Investment & Commodities/Futures Advisor

604-664-2842 – Direct

604 664 2900 – Main

604 664 2666 – Fax

800 810 7022 – Toll Free

QUESTION: Mr. Armstrong; I understand you will be speaking in Vancouver tonight. Given the size of the audience, could you at least answer one question about the currency. You said the dollar would decline following gold’s lead. It is true that the currency has declined by more than 10%, but it did not make a new high in 2011 with gold. Can you explain the implication for that looking forward?

Thank you for always remembering Vancouver

RB

ANSWER: You have to keep in mind that cyclical forces function both INTRADAY as well as on a CLOSING BASIS. We have the same variation in gold with the intraday high forming in 2011 but 2012 was the highest yearly closing. In the case of the C$, it is true that the intraday low came 5 years from the high on a perfect bear market cycle. There was a brief reaction and a turn back down for the Greenback. However, 2011 was the reaction low but the LOWEST annual closing for the entire move was that of 2012, the same as we saw in gold. So the model was satisfied and the C$ fell 11%. The primary target resistance for the Greenback stands at the 118 level. From every perspective, the Greenback is rising in a sea of political confusion. No one can believe it and the short positions are staggering against the Greenback. Nevertheless, it has to rise to clean out the shorts that cannot grasp that CONFIDENCE establishes value – not supply.

…more from Martin: Everyone is Following You Everywhere

A little over a year ago when the world was discussing the realms of currency wars and central banks purposely imposing policy in order to devalue their exchange rates with trading partners, it was the policy makers that argued that their approach was directed domestically, and a weaker currency was simply an indirect consequence. As long as the policy intent was not, for example to weaken their currency, or to better the country’s respective terms of trade by cheapening their exports, it was deemed acceptable.

Today, however, we are seeing the other side of that coin as western central bankers once again look out for their respective countries best interest, and in an uncoordinated approach adjust their monetary policy and stimulus. And it’s the worlds emerging economies, who were the engine of growth for the global economy as it climbed back from the worst recession since the Great Depression, that are feeling the pain.

It was only by coincidence, not by design, that central bankers around the world coordinated policy in order to spur economic growth. It prompted fears of currency wars or a “race to the bottom” in terms of devaluing their exchange rate. I think it’s clear now that did not yet happen. But if the tremors we are witnessing in currency markets over the last few days have illustrated anything, it’s that nothing destabilizes risk assets like the boisterous equity markets of 2013, more than uncertainty and instability in foreign exchange markets. And that’s exactly what’s to come as the world’s central banks once again operate in this unilateral non-structured fashion.

Over the course of the last week we saw action from central banks all over the world in attempts to stabilize their financial sectors. As the markets perceive the United States and the US Federal Reserve to be tightening their policy by altering their stimulus and decreasing their bond purchases by a successive $10 billion per month, the emerging market economies have no choice but to follow suit. It’s simply a stronger dollar attracting capital and foreign investment back towards the US, and other advanced.

economies. In the last week, countries like Turkey have had to raise their key policy interest rate from 7.75 percent to 12 percent in an emergency meeting. Although not as drastic, South Africa and India raised their rates also. And this doesn’t discredit that the home grown problems some of these countries already face may be the root cause of their suffering; moreover, a strengthening US dollar only acts to exacerbate their problems.

It’s almost paradoxical though how emerging economies through the efforts of the G20 were relied upon to fuel a recovery for the industrialized nations of the world. Many countries saw their exchange rates significantly strengthen against the US dollar, with Brazil being the textbook example as the Real appreciated by as much as 48 percent. No questions this strangled their export sector, especially given they represent resource based open economies which thrive on strong international markets. But now, a rift if being created as no consideration is yet to be given from the western world. A dollar tug of war is creating a global imbalance. And what’s surprising is that with a strengthening dollar, we are seeing the rebirth of the safe haven characteristics of gold.

Only in periods of extreme turmoil do we see gold and the US dollar trade higher in tandem. And that’s not to suggest that we have entered a period of extreme turmoil, but it certainly shows the potential for gold. To some extent it’s argued the industrialised nations can immune themselves from an emerging market crisis; nonetheless, periods of economic uncertainty have always been favourable for gold. That’s when insurance is needed more than ever. Alternatively, a weak US dollar also bodes well for the yellow metal. I don’t want to attempt to forecast a crisis, but this tug of war, juggling act, or whatever we want to call it is what will see gold bottom in 2014.

Robert Levy