Currency

US dollar bulls had all the fun last week. The 17-member single currency came under a three-prong attack – two from the world’s primary reserve currency and the other one was a calculated self-inflicted wound. Stateside, non-farm payrolls and GDP for Q3 both exceeded expectations. Furthermore, Draghi and company at the ECB decided to cut its cash rate![]() -0.25% to new historical lows. So far, the verbatim list has contributed to the rally of the ‘mighty buck’ against the hapless EUR and other G10 currencies … full article

-0.25% to new historical lows. So far, the verbatim list has contributed to the rally of the ‘mighty buck’ against the hapless EUR and other G10 currencies … full article

The death of the dollar is coming, and it will probably be China that pulls the trigger. What you are about to read is understood by only a very small fraction of all Americans. Right now, the U.S. dollar is the de facto reserve currency of the planet. Most global trade is conducted in U.S. dollars, and almost all oil is sold for U.S. dollars. More than 60 percent of all global foreign exchange reserves are held in U.S. dollars, and far more U.S. dollars are actually used outside of the United States than inside of it. As will be described below, this has given the United States some tremendous economic advantages, and most Americans have no idea how much their current standard of living depends on the dollar remaining the reserve currency of the world. Unfortunately, thanks to reckless money printing by the Federal Reserve and the reckless accumulation of debt by the federal government, the status of the dollar as the reserve currency of the world is now in great jeopardy.

As I mentioned above, nations all over the globe use U.S. dollars to trade with one another. This has created tremendous demand for U.S. dollars and has kept the value of the dollar up. It also means that Americans can import things that they need much more inexpensively than they otherwise would be able to.

The largest exporting nations such as Saudi Arabia (oil) and China (cheap plastic trinkets at Wal-Mart) end up with massive piles of U.S. dollars…

The largest exporting nations such as Saudi Arabia (oil) and China (cheap plastic trinkets at Wal-Mart) end up with massive piles of U.S. dollars…

Instead of just sitting on all of that cash, these exporting nations often reinvest much of that cash into low risk securities that can be rapidly turned back into dollars if necessary. For a very long time, U.S. Treasury bonds have been considered to be the perfect way to do this. This has created tremendous demand for U.S. government debt and has helped keep interest rates super low. So every year, massive amounts of money that gets sent out of the country ends up being loaned back to the U.S. Treasury at super low interest rates…

And it has been a very good thing for the U.S. economy that the federal government has been ableto borrow money so cheaply, because the interest rate on 10 year U.S. Treasuries affects thousands upon thousands of other interest rates throughout our financial system. For example, as the rate on 10 year U.S. Treasuries has risen in recent months, so have the rates on U.S. home mortgages.

Our entire way of life in the United States depends upon this game continuing. We must have the rest of the world use our currency and loan it back to us at ultra low interest rates. At this point we have painted ourselves into a corner by accumulating so much debt. We simply cannot afford to have rates rise significantly.

For example, if the average rate of interest on U.S. government debt rose to just 6 percent (and it has been much higher than that at various times in the past), we would be paying more than a trillion dollars a year just in interest on the national debt.

But it wouldn’t be just the federal government that would suffer. Just consider what higher rates would do to the real estate market.

About a year ago, the rate on 30 year mortgages was sitting at 3.31 percent. The monthly payment on a 30 year, $300,000 mortgage at that rate is $1315.52.

If the 30 year rate rises to 8 percent, the monthly payment on a 30 year, $300,000 mortgage would be $2201.29.

Does 8 percent sound crazy to you?

….read page 2 HERE

Four reasons to waste your time with the deeply historic, deeply human value ascribed to gold.

People love to debate, but sadly sometimes it crosses a line and turns argumentative. That’s what is happening right now with the debate over gold.

There have been several high-profile articles, most recently in the Wall Street Journal, saying you should eliminate gold as a worthwhile part of your portfolio, primarily because of this year’s lower price.

Against that idea, many bloggers and private investors, wondering why gold priceshave fallen, say that it shouldn’t have dropped, that there must be some conspiracy driving down prices when money-printing and our still-weak economy should be driving gold higher. But that still puts current price performance front and center in the debate over whether it should or shouldn’t feature in your portfolio. So it misses several key points about why gold is uniquely valuable as an investable asset.

We’d like to look here at some of the common arguments now offered for why gold should not figure in your investment strategy. Yes, working at BullionVault, the physical gold and silver exchange, we’re biased. But there are also people who always say gold doesn’t warrant your investment dollars.

To have any intelligent understanding of your own position, you need to welcome debate. That way you can challenge your own opinions and, if you find they’re correct, improve your arguments, too, such as whether gold investing continues to warrant attention.

1. Gold Does Not Yield Anything

When you buy any commodity outright. you can no longer deposit it with a bank or investment company to earn interest. If you are looking to yield a dividend or interest, then physical gold ownership will not yield anything. Yet that is only half the story.

Gold ownership yields security for the investor, the type of security a person seeks from insurance. It is the only physical form of insurance that exists to counterweight your investments in bonds and stocks, and that is also a liquid, easily traded asset. Gold is also noncorrelated with those more “mainstream” markets, meaning that its price moves independently of where other investment prices are heading. So the goal for most investors in holding gold is first as a safety net for their other assets. This metal has held value for thousands of years, and will hold value for thousands more.

2. Gold Is Worth Only What the Next Investor Will Pay for It

This statement is weak from the onset. There are no stocks, bonds, commodities or goods that are worth more than the next person will pay. That being said, gold has something that the others do not. Gold is 100% transparent, in that, unlike other easily traded investments, it is only one thing: a pure and precious rare commodity that requires little space for storing great value.

This commodity has acted as money for thousands of years. In fact, after World War II, the Bretton Woods agreement used gold to bring stability and sanity to the world’s currency markets once more. If that history of human use doesn’t give intrinsic value to gold, why would you give that title to any other asset?

People had their life savings in Lehman Brothers stock. Other people invested in mortgage-backed securities or were holding Argentine bonds or got sold the claims ofBernard L. Madoff Investment Securities LLC.

Stocks and bonds, though there are many facts available about them, are never 100% transparent. It is much like a hiring a baseball player. You may have his statistics and you may place him in the perfect spot on the best team in the league. Yet he may perform poorly due to an unknown injury or a problem with the change of venue or any other number of unknown reasons. This is the same for stocks and bonds. Though we have their statistics, we never know when some problem may cause some of these instruments to fail.

3. Gold Is Neither a Good Hedge for Stocks, Nor Inflation

Anyone looking at the 1980s and ’90s and concluding that gold is a poor inflationhedge misses the point. You didn’t need an inflation hedge when cash in the bank paid 5% above and beyond the rate of inflation each year, as it did on average for U.S. and U.K. savers for the last 20 years of the 20th century.

But gold doesn’t make a good hedge for stock market investments either, according to a long-running thread of comment. The frequent comparison is usually to the stock market overall, or the Dow Jones industrial average. Never mind that gold and stocks have, over extended periods, gone in opposite directions. That measure is not a just number to use, because the stock indexes frequently change. This is also true of the overall market, where stocks are delisted if they underperform or go bankrupt. If these types of stocks were kept on, how would the indexes and averages have changed? The stock market of 1989 did not have the same listed companies as that of 1996, 2000 or 2013.

In contrast, the gold of 1989 was the same gold of 1996, 2013 and even 2000 BC. Gold does not change, and its supply cannot be expanded (or reduced) at will. This is why gold functions so well as a form of exchange and transfer of value. It holds value due to its permanent unchangeable form. World history has shown us again and again that in the final analysis; only gold, out of all investable assets, holds value in catastrophic situations.

You can lose value owning gold if you buy high and sell lower, but you never lose it all. You could easily pick out a point in any chart of the stock market where an investor could have bought and then another time where you may have sold and lost money. There is no point to this kind of example, because it never speaks to an individual’s overall performance with their assets. They may have liquidated their stock at the low price because they needed the cash to invest in a particular business or real estate opportunity. All assets including gold have to be looked upon as part of a strategy for the investor and not as independent pieces of life’s asset management puzzle.

4. Gold Is an Article of Faith, Not Rational Investing

Some people denigrate gold to a relic of the past in terms of its economic importance. The most recognized of today’s detractors is perhaps Nouriel Roubini, the famed NYU economist who repeats John Maynard Keynes’ cry of the 1930s that gold is a “Barbarous Relic”. Still others go further, saying that choosing to own investment gold is anti-social. The argument is that there is no longer any need for gold as a form of exchange, nor as a store of value. Governments and central banks have done away with the need for gold. So apparently, gold’s only value today lies in the jewelry and electronics trades.

In addition, other analysts write about gold being a faith-based investment and mock it as a type of religion. There are certainly those who invest on faith, and they can be loud, giving the impression that investors in gold are extreme. But this can also be said about the defense of the U.S. Dollar. That currency in the end is only a piece of paper that has no other use than that ascribed by the government. If you put fire to a dollar bill it will turn to ashes and float away. But if you put fire to gold, at the right temperature, you get a liquid metal that not only is useful to the arts but important in the electronics and high-technology industries.

“We may one day become a great commercial and flourishing nation,” wrote George Washington, the first president of the United States of America, on the subject of paper money in a letter to Jabez Bowen, Rhode Island, on Jan. 9, 1787. “But if in pursuit of the means we should unfortunately stumble again on unfunded paper money or similar species of fraud, we shall assuredly give a fatal stab to our credit in its infancy.

“Paper money will invariably operate in the body of politics as spirit liquors on the human body. They prey on the vitals and ultimately destroy them.”

It is difficult for those in power to try to overcome this truth, embodied by all of recorded economic history. And it becomes more ludicrous as governments also hold gold bullion in vast amounts.

The modern central banking system, now more than 100 years old, may seem to shape this perception. Yet in the last decade, central bankers themselves, albeit in Asia and other emerging economies, have been significant buyers of the yellow metal. Western governments as a group have stopped selling gold.

Why? Economic chaos causes distrust among governments and central banks, leading those in power to seek out avenues to strengthen their position with other parties. The position central banks look for to strengthen their balance sheet and ensure their place in the global economy is gold. The United States rose to dominance worldwide alongside its dominant gold reserves. Now becoming a market economy, and hoping to become the next big global economy, China is also building its central bank gold reserves. It becomes obvious that gold has a very deep, very human value, ascribed to it by history and by all major powers today.

Value isn’t the same as price, of course, which explains, perhaps, how gold investing remains such a mystery to some people.

Adrian Ash is head of research, and Miguel Perez-Santalla is vice president of business development for BullionVault, the physical gold and silver exchange founded a decade ago and now the world’s No. 1 provider of physical bullion ownership online. There you can buy fully allocated bullion already vaulted in your choice of London, New York, Singapore, Toronto or Zurich for just 0.5% commission today.

Employment was little changed for the second consecutive month and the unemployment rate remained at 6.9% in October.

Compared with October 2012, employment increased by 1.2% or 214,000, with gains in full-time and part-time work. Over the same period, the number of hours worked rose by 1.4%.

Of Note:

In October, employment among men and women aged 55 and over was little changed. However, compared with 12 months earlier, employment for this group was up 144,000 (+4.4%), the result of both employment growth and population ageing.

Drew Zimmerman

Investment & Commodities/Futures Advisor

604-664-2842 – Direct

604 664 2900 – Main

604 664 2666 – Fax

800 810 7022 – Toll Free

Crash Proof Your Portfolio

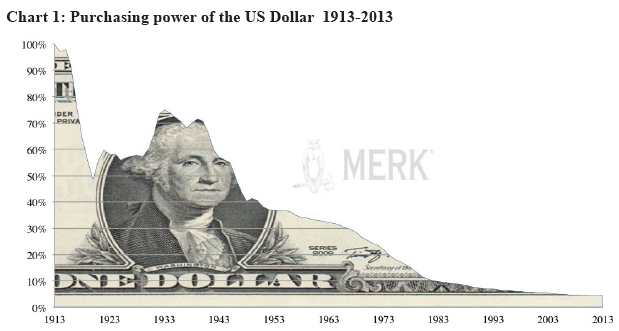

The U.S. debt burden and accommodative monetary policy may be exerting downward pressure on the U.S. dollar. The stock market may be in bubble territory. Bond fears abound. Where can one hide: where to invest to both Profit and Protect?

….read Where & How HERE