Currency

Saylor: Billions will choose Bitcoin for savings

Saylor was speaking a day after United States Treasury Secretary Janet Yellen described Bitcoin as “inefficient,” comments that accompanied a price dip of over 20% from all-time highs of $58,300.

For him, however, the comments were of little consequence compared with the broader Bitcoin use case quickly encroaching into more and more people’s financial lives.

“The story here that’s not being told is that Bitcoin is egalitarian progressive technology,” he told CNBC’s Squawk Box segment.

“We’re going to see a day when 7 to 8 billion people have a bar of digital gold on their phone, and they’re using it to store their life savings with it.”

Continuing, he cited Bitcoin’s 12-year race to becoming a trillion-dollar asset — two to four times quicker than technology giants such as Amazon, Google and Apple.

“So, the world needs this thing, and I think you can expect that we’ll have a billion people storing their value — in essence, a savings account — on a mobile device within five years, and they’re going to want to use something like Bitcoin,” he added.

“Bitcoin is the dominant digital monetary network.” Full Story

Conveniently, just as we were scratching out heads over this critical question – which also answers how Bitcoin will hit $100,000 next – RBC published an initiating coverage report on AAPL (with a street-high price target of $171), in which analyst Mitch Steves explained why he believes that AAPL should focus on developing an “Apple Wallet” concept first (and leave the Apple car for later), in order to leverage its 1.5 billion installed user base and to unveil a Coinbase-like Apple Exchange later which allows bitcoin transactions and which would add about $50 billion in value.

More importantly, the RBC analyst then says that should Apple purchase just $1 billion in bitcoin, or “4 days of cash flow”, it would send even more users to “Apple Exchange”. To be sure, in the aftermath of Tesla’s announcement today, which validates the so-called “use case” and confirms that rising adoption of bitcoin among some of the most advanced companies is just a matter of time, such an outcome is even more likely.

Below we lay out some of the key highlights from Steves’ note, in which he first discusses the “low risk, high reward” Apple Wallet opportunity…

SWIFT Sets Up Joint Venture With China Central Bank Ahead Of Imminent Digital Yuan Launch

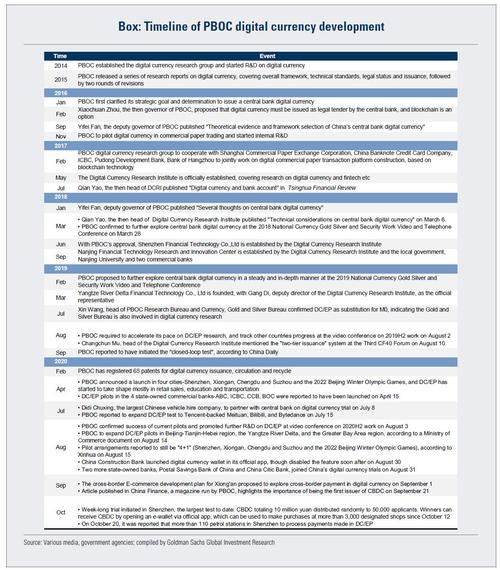

Back in August we reported that China’s Commerce Ministry had released fresh details of a pilot program for the country’s central bank digital currency (CBDC) to be expanded to several metropolitan areas, including Guangdong-Hong Kong-Macao Greater Bay Area, Beijing-Tianjin-Hebei region, and Yangtze River Delta region. This was the inevitable culmination of a process which started back in 2014 when as we reported at the time, “China Readies Digital Currency, IMF Says “Extremely Beneficial“”

Fast forward a few months when China’s preparations to rollout a digital yuan gathered pace, and we reported in October that China was poised to give legal backing to the launch of its own sovereign digital currency, “cementing its trailblazer status in virtual currencies far ahead of other countries, after already recently experimenting with large-scale trials of actual payments by consumers, which was met with mixed results.” Specifically, the South China Morning Post reported that “The People’s Bank of China published a draft law on Friday that would give legal status to the Digital Currency Electronic Payment (DCEP) system, and for the first time the digital yuan has been included and defined as part of the country’s sovereign fiat currency.”

Tesla Inc. co-founder Elon Musk returned from his self-imposed Twitter break to send a series of tweets about joke cryptocurrency Dogecoin.

“No highs, no lows, only Doge,” Musk wrote. He also posted a meme from the Disney movie The Lion King, showing the monkey shaman Rafiki holding up the cub Simba that’s photoshopped to be the billionaire with the Dogecoin logo of a Shiba Inu in his hands.

The digital asset, which was started as a joke in 2013, has risen to about 5 cents in the past 24 hours from 3 cents, according to data from CoinMarketCap. It’s the highest level since last week, when prices briefly spiked after Musk tweeted a picture of “Dogue” — a satire on fashion’s Vogue magazine — featuring a whippet in a red sweater.

Earlier this week, Musk said on social audio app Clubhouse that he doesn’t have a strong view on other cryptocurrencies and that his comments on Dogecoin are meant as jokes, adding “the most ironic outcome would be Dogecoin becomes the currency of Earth in the future.”

He wrote on Tuesday that he was going to be “off Twitter for a while.” Musk sent the Dogecoin tweets along with pictures of space rockets — references to the meme that prices are going to the moon and Space Exploration Technologies Corp. SpaceX, which Musk also founded, saw its test flight of a deep-space vehicle end in an explosive fireball during a failed landing attempt this week.

Musk also said “Dogecoin is the people’s crypto,” along with other posts such as “Sandstorm is a masterpiece,” a possible reference to the 1999 song by Darude. He removed the reference to Bitcoin from his Twitter bio page.

After languishing in relative Internet obscurity, Dogecoin is riding a wave of newfound popularity this year after being promoted by Musk, as well as internet influencers and porn stars. In late January, prices were less than 1 penny.

Dogecoin’s market value now sits at almost $7 billion, making it the 12th biggest among cryptocurrencies, according to CoinMarketCap.

It’s all Bitcoin all day in my Twitter feed these days. Quiet are the Tesla bears, the Fed-obsessed, and even the gold bugs. The HODLers are out in full force celebrating Bitcoin’s parabolic, seven-fold resurgence from the ashes of $5,000 (as of the morning of this writing). Frankly, I’m skeptical of Bitcoin. I see it as a speculative tech stock, not digital money. However, I’m not avoiding cryptocurrency. Instead, I’m trying to determine an appropriate position size and strategy consistent with my investment framework.

I’ve been around the Bitcoin hoop for a while now. I traded a minimal amount in the early days and made no significant gains (in absolute terms). At first, I got drawn into the prospect of decentralized money and banking—the theoretical and practical benefits that cryptocurrencies potentially possess. However, I expected more development 12 years into Bitcoin’s existence. To me, it still more resembles a tech stock in 1999 than a burgeoning currency—all potential; no (meaningful) practicality (yet).

While I’m certainly not the most plugged into the cryptocurrency scene, I do understand it. Given Bitcoin’s high market capitalization ($666 billion as of this writing)—eclipsing that of Walmart, Johnson & Johnson, and all but a handful of blue-chip companies—I’m surprised that Bitcoin still has so little utility in comparison with these household names. Indeed some people are using Bitcoin, but the overwhelming majority appears to be hoarding it in the hope of higher prices. CLICK for complete article