Currency

This month’s calendar has been chock a block with one important meeting or vote or conference after another. Any one of these could have had a large impact on the endless Euro crisis. The most impressive result (sarcasm implied) from all these meetings and votes is the overall lack of impact. For all the wild swings in both debt and equity markets things have changed little in the past month and the European muddle through continues.

Greece has a new, pro-bailout, government with three coalition partners. The election turned out better than feared but the real work lies ahead. All of the parties in the election promised a much looser austerity program either through negotiation or simply by reneging on the deal. The winning coalition promised Greeks they could have their baklava and eat it too, to a lesser extent. Based on probably accurate leaks out of Athens the plan is to approach EU institutions looking for a two year extension to hit deficit targets. This would require about $20 billion in additional loans above the two Greek bailout packages in place already.

This news is not going over well in Berlin. Greeks took comments about trying to work with a pro bailout government to mean there would be some sort of completely new deal. Not likely. The Greek government has zero fiscal credibility, particularly since the winning party that dominates the cabinet is exactly the same one that had the biggest hand in creating the problem. Most Europeans, but particularly Germans, simply do not and will not believe Greece will stick to any deal.

German Chancellor Merkel is being vilified for being such a hardliner but she lives in a democracy and poll after poll shows German’s hate the idea of lending money that cannot be policed later. This is the core issue for the EU and has been since its inception. Most member governments are unwilling to give up any real fiscal sovereignty. This means that lender states have little or no control over what happens to their funds after the cheque is cashed. It was no secret this was a big problem when the EU was being created. Intricate rules and prohibitions were laid down that were meant to keep member countries on roughly the same plane when it came to deficit levels, etc.

Of course, these rules were broken by virtually every member state, including Germany itself. So many EU countries breached the maximum deficit level as a percentage of GDP rules that it’s hardly surprising these rules are now viewed as mere suggestions.

This mess would always have taken years to work through. The timeline is now longer, if anything. That is partially due to the multi-year contraction in most of the debtor economies. Even with harsh cuts it will take more time to balance budgets and there is no likelihood of surpluses that can reduce debt loads until debtor economies actually start growing again.

This news hasn’t gone over well with creditor nations. An understandable reaction since a long timeline inevitably means more loans to some of the debtor nations. Nonetheless, it’s becoming obvious that the creditors are not going to get a one way deal here. There is going to have to be some compromise before this drama ends. Unless creditor countries are willing to sweeten things, if only to improve sentiment in the peripheral countries, it will be hard for debtor economies to pull out of their tailspins.

Current hopes rest with the EU meeting that is currently taking place. This is the eighteenth meeting since the crisis erupted which should tell us what the chances of success are. The most important topic is some sort of EU level bank oversight and deposit insurance. This will take years to create but even putting together credible time line and laying out what sort of bank oversight is being worked towards will help.

As we have noted many times, the current danger point is Spain and it’s the victim of a real estate bubble, not bad governance per se. As this issue was being finished there was news of a compromise that will help the Spanish sovereign bond market. The EU has agreed that the latest loan package will not have preference. This is significant since it could and should give buyers of Spanish sovereigns more comfort since it will not place 100 billion euros of debt ahead of them if something goes wrong.

Italy’s government is more guilty of pure mismanagement but it matters not; the EU does not want to see the Italian bond market go south. It’s just too big to fix. Many of the leading banks are also too big for their home countries to deal with. Ireland and Iceland are the poster children for too big to fail banks (though, in retrospect, both countries probably should have let them fail anyway) but many other countries have banks that represent systemic risk, including Germany.

Bank oversight is not a bailout so much as something obvious and sensible that should have been put in place the day the Euro was created. Promising not to demand preference for the current loan package to Spain is a huge relief to the market but the most important part of the compromise is the promise to set up an EU banking authority.

In typical EU fashion the details on the banking authority were scant and the timelines will undoubtedly be longer than the market wants but it’s a big step in the right direction. One of the chief problems in Europe is the direct ties between bank recapitalization and sovereign debt levels. Up to now, whenever a country that could not recapitalize its banks went to the EU the money would have to be borrowed and distributed by the government. If this new bank authority is able to lend directly to financial institutions then every bank recapitalization will not automatically result in an equal increase it the home country’s sovereign debt level.

That is a huge change if the EU actually pulls this off. That said, this is Europe we’re talking about. There will be lots of meetings and position papers and bureaucratic wrangling involved before the details are agreed to. There is still room for things to go pear shaped if Germany and other creditor nations impose conditions so harsh that they cancel out the positive effects. That possibility could cap gains but this does feel like a real shift in the political landscape. The arrival of a large anti-austerity block headed by French President Hollande has changed the equation.

The Euro crisis is not over. Germany and its austerity block allies have yielded on a couple of important points but don’t expect a complete about face. There shouldn’t be one because Merrkel and her allies are right. The only long term solution is lower debt levels and structural changes to economies that make them more flexible and responsive to changing conditions. The former is going to take years to accomplish even under best case scenarios. The latter may too since confronting entrenched interest groups takes more political courage than most Euro area leaders seem to possess.

Expect more turbulence in the Euro market. Battle lines have been drawn between the pro and anti-austerity camps and there are many more fights ahead. The debt crisis and uncertainty about how to navigate it has done enormous economic damage to the Eurozone that will take a long time to repair. Even mighty Germany has put out recent economic readings that imply it is starting to stall. That may well be the real reason Merkel finally showed some flexibility. It would have been better by far if this had happened two or three years ago.

Hopefully this does not embolden the anti-austerity group to the point where they forget cost cutting and reforms are still a necessity. French President’s Hollande’s renewed promise to lower the retirement age in France was not a positive sign. Aside from being just plain stupid under current economic conditions it’s also exactly the kind of grandstanding that could stiffen the resolve of creditor governments and mess up further progress.

Economic readings outside of the Euro area have mainly come in better than expected. Not great, but good enough to add some pressure to the Euro on top of its internal issues. Announcement of the compromise deal is generating one the largest one day move in the Euro this year. Gold has been trading with a very high positive correlation to the Euro so it’s getting plenty of lift too and the entire commodity complex is following suit. This is all to the good but traders can be forgiven for remaining somewhat cautious. When it comes to Europe this is a movie we have all seen may times before. The devil is in the details when it comes to multi-lateral agreements. EU rescue funds still don’t and won’t have enough money to literally rescue Italy for instance. It’s unlikely it every will so the key will be regaining and retaining investor confidence. The EU must get bond traders on side and keep them there. If they can do that the world economy should be able to muddle through.

Even with that the summer doldrums won’t provide a lot of trading opportunities unless and until another company makes what looks like a major find. Volumes will climb only slowly but continued movement in the right direction politically in Europe may finally give us a set up for a meaningful fall rally in the resource sector. Let’s all cross our virtual fingers and hope the Eurocrats don’t find yet another creative way to wrest defeat from the jaws of victory.

Ω

©2010 Stockwork Consulting Ltd. All Rights Reserved.

Published by Stockwork Consulting Ltd.

Box 85909, Phoenix AZ , 85071 Toll Free 1-877-528-3958

hra@publishers-mgmt.com” data-mce-href=”mailto:hra@publishers-mgmt.com“>hra@publishers-mgmt.com http://www.hraadvisory.com

The HRA – Journal, HRA-Dispatch and HRA- Special Delivery are independent publications produced and distributed by Stockwork Consulting Ltd, which is committed to providing timely and factual analysis of junior mining, resource, and other venture capital companies. Companies are chosen on the basis of a speculative potential for significant upside gains resulting from asset-based expansion. These are generally high-risk securities, and opinions contained herein are time and market sensitive. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer, solicitation or recommendation to buy or sell any securities mentioned. While we believe all sources of information to be factual and reliable we in no way represent or guarantee the accuracy thereof, nor of the statements made herein. We do not receive or request compensation in any form in order to feature companies in these publications. We may, or may not, own securities and/or options to acquire securities of the companies mentioned herein. This document is protected by the copyright laws of Canada and the U.S. and may not be reproduced in any form for other than for personal use without the prior written consent of the publisher. This document may be quoted, in context, provided proper credit is given.

There is no shortage of criticism of central bankers and their policies. But there is at least one thing that they are getting right, according to Peter Schiff, CEO of Euro Pacific Precious Metals: central banks around the globe are buying and holding more gold. And when it comes to that trend, Schiff advises investors to do as central bankers do, not as they say. Most people don’t own any gold, he said, and they need to start buying.

With over two decades of experience in finance, Schiff has taken on many roles. He is a financial commentator, a broker, and an adviser. Schiff is also an author. In a recent article, he wrote that he devoted a whole chapter in his latest book, The Real Crash: America’s Coming Bankruptcy – How to Save Yourself and Your Country,to the merits of the gold standard. That caught the attention of Gold Investing News (GIN).

In an interview, Schiff told GIN that publicly, central bankers talk about why they don’t like gold or think it’s a barbaric relic, yet they apparently want more of it. It is a trend that he believes will accelerate as central banks figure out that fiat, or paper money, needs something behind it, something tangible.

“It can’t be just a piece of paper,” he said. “Gold is the most logical choice as a reserve for the paper.”

….read the Entire Interview HERE

Editor’s Note: Mr. Vialoux is scheduled to appear on Michael Campbell’s radio show at approximately 12:05 PM Eastern (9:05 Pacific) tomorrow. Available on the net at http://www.cknw.com/

Interesting Charts

Currency was the driver for world equity markets yesterday. The Euro fell sharply following comments by European Central Bank President Draghi that European economies continue to weaken. Conversely the U.S. Dollar Index moved higher. Both remain in a six week trading range.

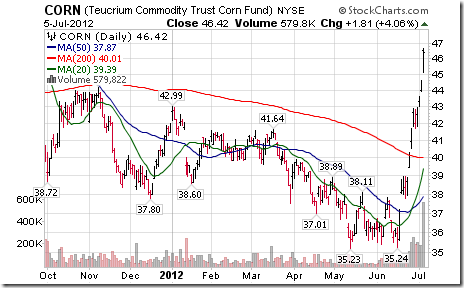

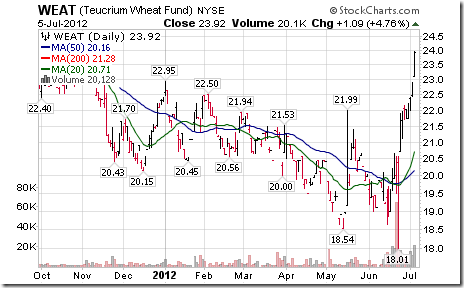

Grain prices continue to shoot skyward with no signs of a peak yet.

Hey I am glad you are with us, I am excited about this, every once in a while I get lucky and get Don Coxe to agree to come on this show. He is a Canadian investment advisor for BMO Financial out of Chicago but he has a tremendous track record and he is really widely read by institutions around the English Speaking World. Don is the guy who was absolutely accurate in predicting, and it sounds so funny so early in advance after a 20 year bear market in commodities, he said you know what, we are just about to have this magnificent Bull Market in Commodities in 2000-2001. Another thing he also said that anything that China wants to buy he is going to buy first, and that of course is part of that commodity boom.

Europe is heading into a full-scale disaster. Even the Dollar Bounces Back, Pessimism Persists in Europe.

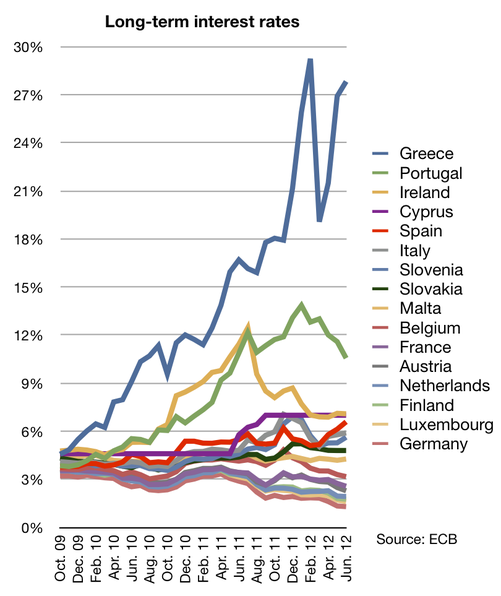

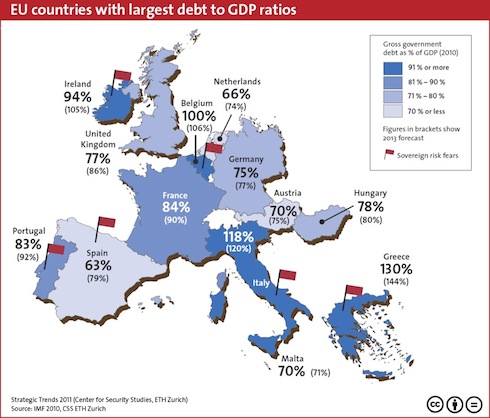

You see, the debt problems in Europe are not simply related to Greece. They are SYSTEMIC. The below chart shows the official Debt to GDP ratios for the major players in Europe

As you can see, even the more “solvent” countries like Germany and France are sporting Debt to GDP ratios of 75% and 84% respectively.

These numbers, while bad, don’t account for unfunded liabilities. And Europe is nothing if not steeped in unfunded liabilities.

Let’s consider Germany. According to Axel Weber, former head of Germany’s Central Bank, Germany is in fact sitting on a REAL Debt to GDP ratio of over 200%. This is Germany… with unfunded liabilities equal to over TWO times its current GDP.

To put the insanity of this into perspective, Weber’s claim is akin to Ben Bernanke going on national TV and saying that the US actually owes more than $30 trillion and that the debt ceiling is in fact a joke.

What’s truly frightening about this is that Weber is most likely being conservativehere. Jagadeesh Gokhale of the Cato Institute published a paper for EuroStat in 2009 claiming Germany’s unfunded liabilities are in fact closer to 418%.

And of course, Germany has yet to recapitalize its banks.

Indeed, by the German Institute for Economic Research’s OWN admission,German banks need 147 billion Euros’ worth of new capital.

To put this number into perspective TOTAL EQUITY at the top three banks in Germany is less than 100 billion Euros.

And this is GERMANY we’re talking about: the supposed rock-solid balance sheet of Europe. How bad do you think the other, less fiscally conservative EU members are?

Think BAD. As in systemic collapse bad.

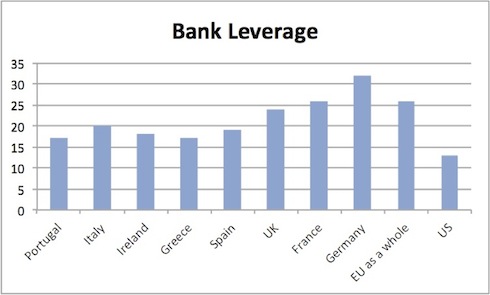

Indeed, let’s consider TOTAL debt sitting on Financial Institutions’ balance sheets in Europe. The below chart shows this number for financial institutions in several major EU members relative to their country’s 2010 GDP.

| Country | Financial Institutions’ Gross Debt as a % of GDP |

| Portugal |

65% |

| Italy |

99% |

| Ireland |

664% |

| Greece |

21% |

| Spain |

113% |

| UK |

735% |

| France |

148% |

| Germany |

95% |

| EU as a whole |

148% |

Source: IMF

As you can see, financial institutions in Germany, France, Italy, Spain, the UK, and Ireland are all ticking time bombs.

Indeed, taken as a whole, European financial institutions have more debt than Europe’s ENTIRE GDP. Let’s compare the situation there to that in the US banking system.

Taken as a whole, the US banking system is leveraged at 13 to 1. Leverage levels at the TBTFs are much much higher… but when you add them in with the 8,100+ other banks in the US, total US bank leverage is 13 to 1.

The European banking system as a whole is leveraged at nearly twice this at over 26 to 1. That’s the ENTIRE European Banking system leveraged at near Lehman levels (Lehman was 30 to 1 when it collapsed).

To put this into perspective, with a leverage level of 26 to 1, you only need a 4% drop in asset prices to wipe out ALL capital. What are the odds that European bank assets fall 4% in value in the near future as the PIIGS continue to collapse?

These leverage levels alone position Europe for a full-scale banking collapse on par with Lehman Brothers. Again, I’m talking about Europe’s ENTIRE banking system collapsing.

This is not a question of “if,” it is a question of “when.” And it will very likely happen before the end of 2012.

The reason that this is guaranteed to happen before the end of 2012 is that a HUGE percentage of European bank debt needs to be rolled over by the end of 2012.

I trust at this point you are beginning to see why any expansion of the EFSF or additional European bailouts is ultimately pointless: Europe’s ENTIRE BANKING SYSTEM as a whole is insolvent. Even a 4-10% drop in asset prices would wipe out ALL equity at many European banks.

On that note I believe we have at most a month or two and possibly even as little as a few weeks to prepare for the next round of the EU Crisis.

With that in mind, I’ve begun positioning subscribers of my Private Wealth Advisory for this very possibility. We’ve already locked in over 30 winning trades this year by finding “out of the way” investments few investors know about and timing our positions to benefit from the various developments in Europe. When you combine this with our 2011 track record, we’ve had 66 straight winners and not one closed loser since July 2011.

Indeed, we just locked in two gains of 8% and 10% in less than two weeks’ time.

So if you’re looking for the means of profiting from what’s coming, I highly suggest you consider a subscription to Private Wealth Advisory. I’ve been helping investors navigate risk and profit from the markets for years. I can do the same for you. Indeed, my research has been featured in RollingStone Magazine, The New York Post, CNN Money, the Glenn Beck Show, and more. And my clients include analysts and strategists at many of the largest financial firms in the world.

Indeed, interest is growing to the point that we’re not considering closing the doors on this newsletter and starting a waiting list. So if you’ve been putting off subscribing, you need to get a move on to reserve on of the remaining open slots.

To learn more about Private Wealth Advisory and how it can help you make money in any market…

Best Regards,

Graham Summers

Chief Market Strategist

Phoenix Capital Research