Currency

In deference to Mark Twain, I will review the USD, general stock market, precious metals, the electric metals and various other topics. In the past two weeks Rambus has been so prolific with such high impact charts that I find it a challenge to offer value added material so I offer charts with some different perspectives.

USD-No I Am NOT Dead Yet!

Currencies tend to be a very emotional subject. I try to be objective when analyzing them, sticking to the language of the market and it’s message. It is always important to guard against the gold bug narrative, it can even influence our views of currencies. Demanding posts insisting the USD is toast and immediately headed towards history’s ash heap seem closely related to this gold bug narrative. The USD has spent the first 8 months of 2017 in a well defined downtrend, however it does not appear to be in a death spiral. Actually the shouting and insistence that it must continue down has been a fairly predictable sign that its move downward was reaching its limit. The dollar may have now completed a base and is set to continue its move higher. This is not dogma as it could reverse downward, but for now it’s making all the right moves if the trend is higher.

Please review Rambus’ October 25 post on the USD as there is no other finer analysis anywhere:

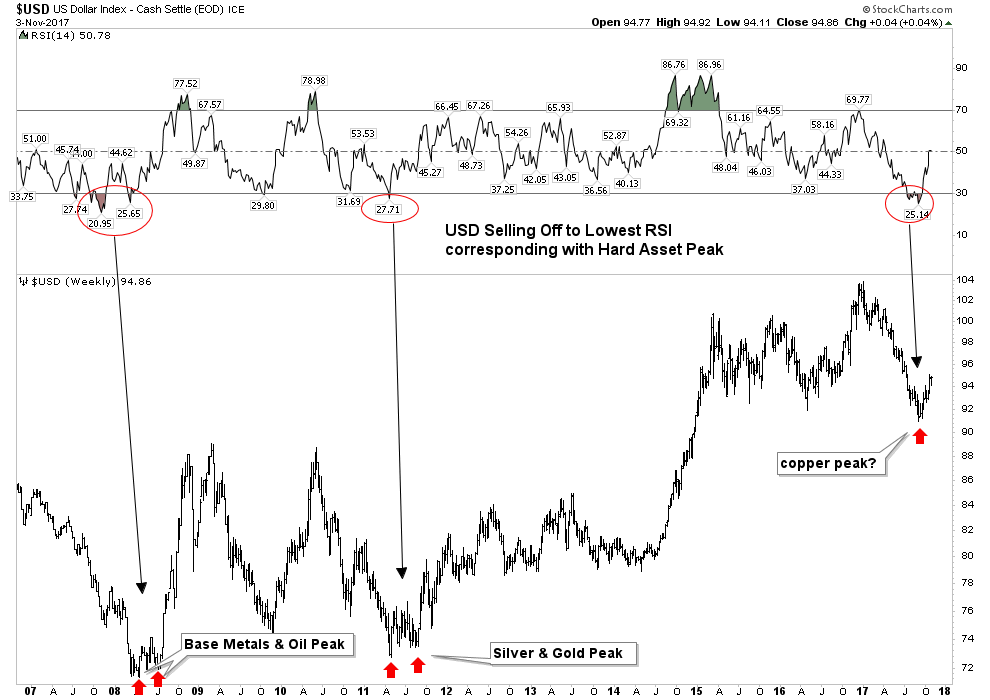

I have often made the point that we are in a post bubble contraction. It began with the financial crisis in 2007, however the central banks of the world and their interventions have truncated the natural corrective process and re-inflated the bubble due to financial engineering. Ultimately, if robust growth is to ever return to the world’s economies the PBC must be allowed to do its work in de-levering balance sheets. Historically in the previous 5 episodes over the past 340 years, PBCs have taken 15-20 years to accomplish this. So this is a slow process and the 8 month downtrend of the USD in 2017 could just be a little wiggle that turns out to be just a correction in an ongoing up-trend. Time will tell of course. In a PBC, the senior currency becomes chronically strong and acts as a magnet attracting capital flows from around the world. Over the past year this economic principle has been very hard to accept, however it may be getting ready to reassert itself. I personally don’t trade currencies, however I watch them since they drive asset classes and knowing their trend gives us a clue of where these assets will themselves trend.

It appears we are at a crucial point in currency markets as the USD is beginning to reassert itself. Lets look at the various currency charts vs the USD:

Euro- H&S neckline now broken:

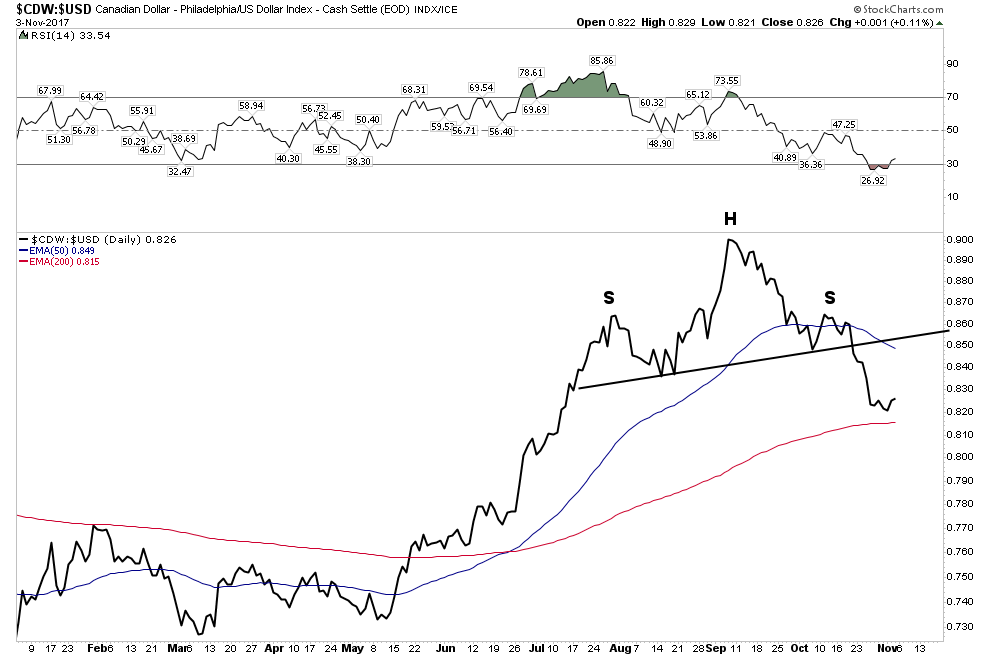

Canadian Dollar– The ultimate resource currency

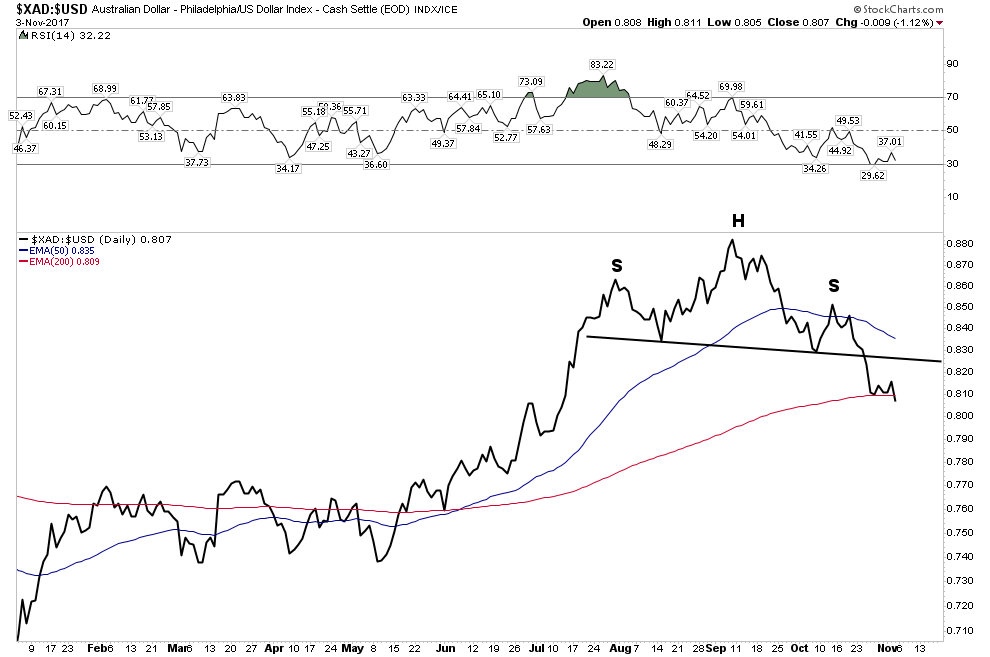

Aussie Dollar– H&S break with price now violating the 200 EMA

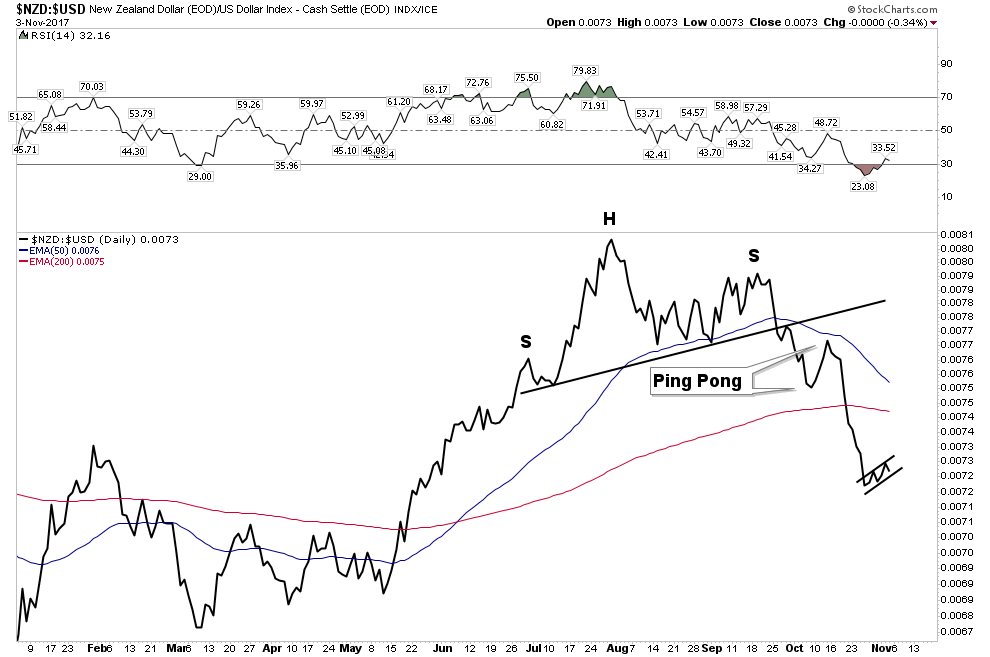

NZD– The first to show its hand

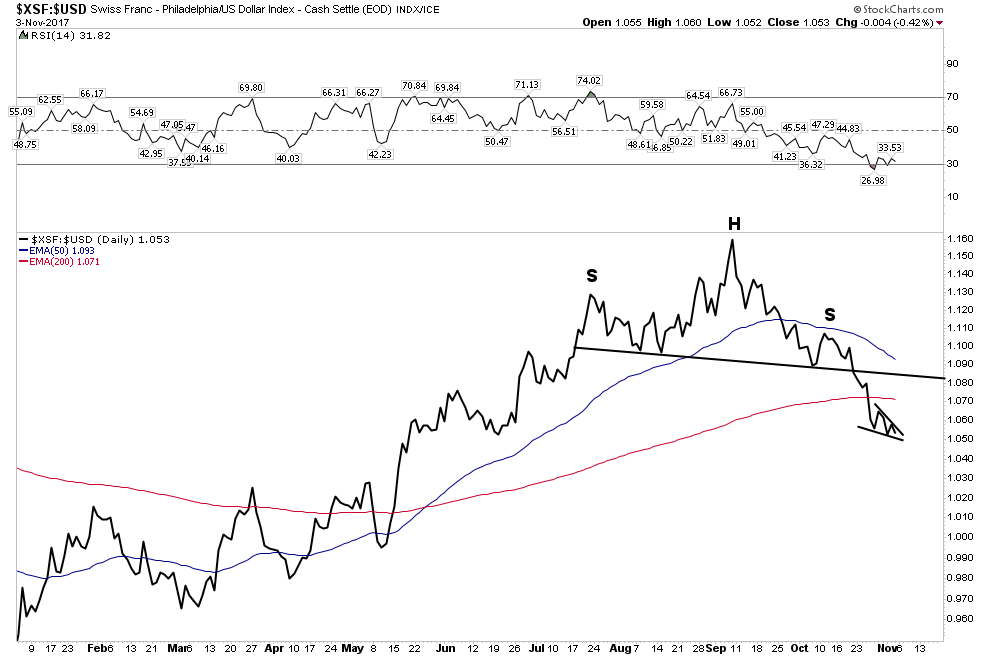

The Swissie: Et tu? Even the ultimate haven currency… 200 EMA violation.

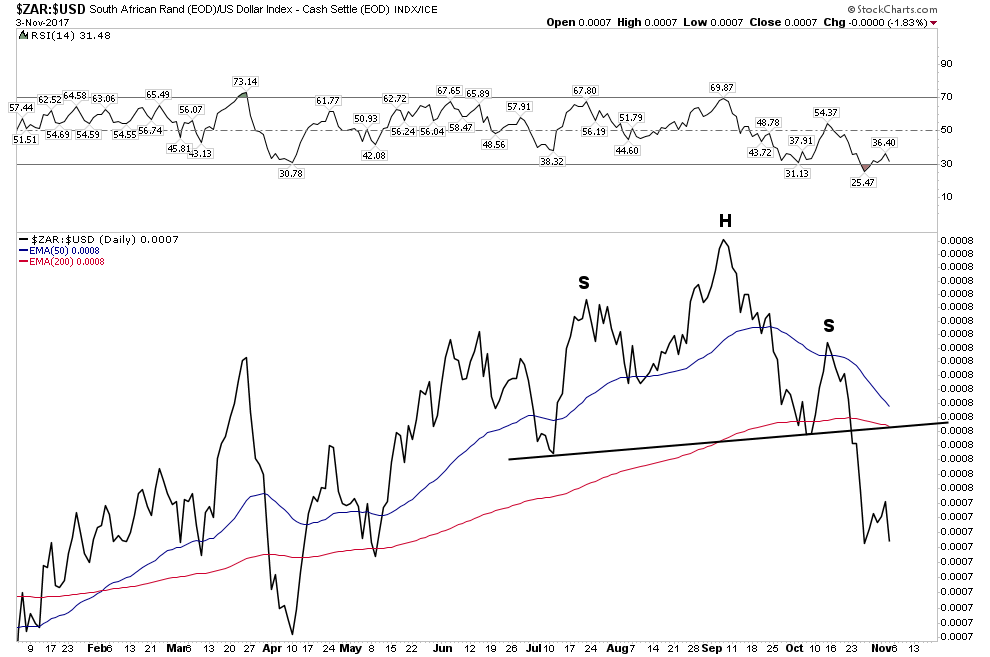

South Africa Rand:

So one can see all of these currencies are now in a broad based breakdown vs the USD. The USD took some time to gain traction and it’s NOT out of the woods yet, but these charts show that it would take some work to reverse this initial trend reversal.

In the chart below we see how the USD has broken above its lower horizontal channel line and is now attempting to overcome the resistance of the 30 W EMA. Stochastics are indicating that it has the momentum to continue its move higher.

Below is the chart that has been subject to ridicule and derision, however it depicts what could occur when the PBC reasserts itself. It is certainly not a guarantee, however it shows what may lie in store.

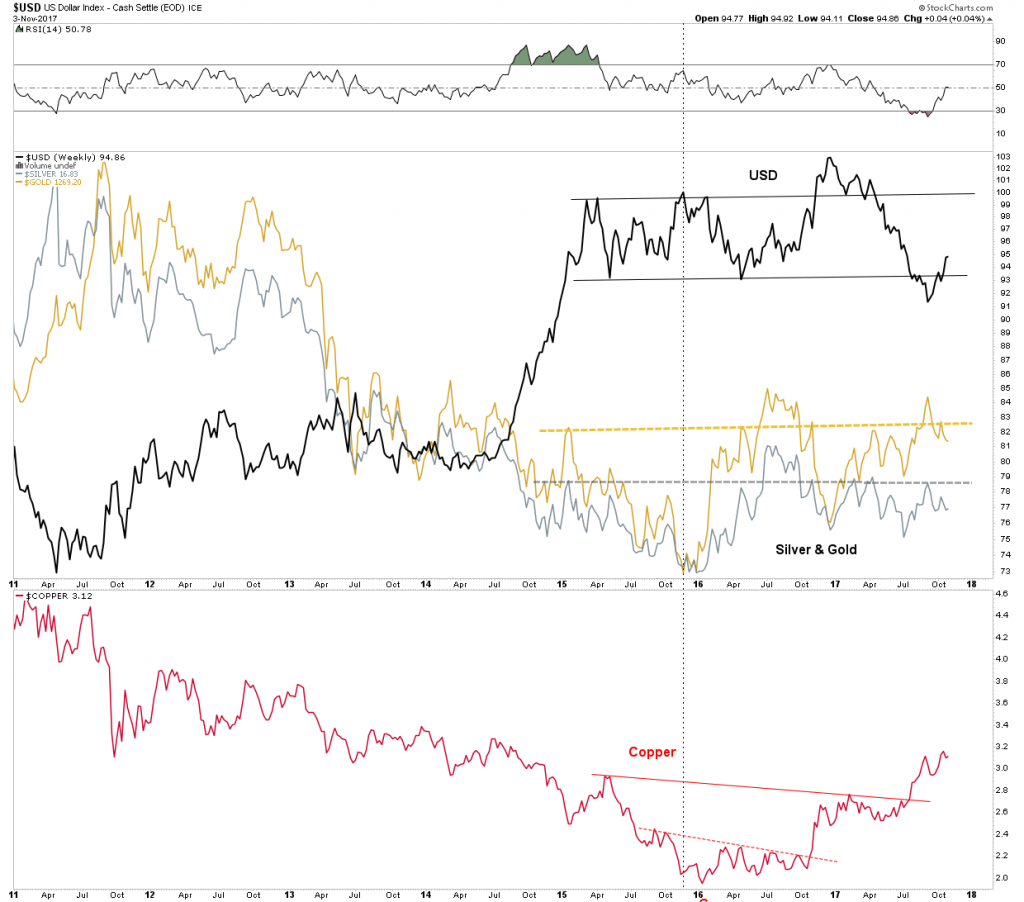

This next chart shows the relationship between the USD and the three metals: gold, silver and copper. It is hinting that if the USD continues to rally it could make it difficult for these three metals to advance much further:

Finally, this USD chart poses the question: are the industrial metals getting ready to end their run for now? It seems that in the past when the USD reversed from being oversold on the weekly that was the message:

The Stock Market- From Here to Infinity?

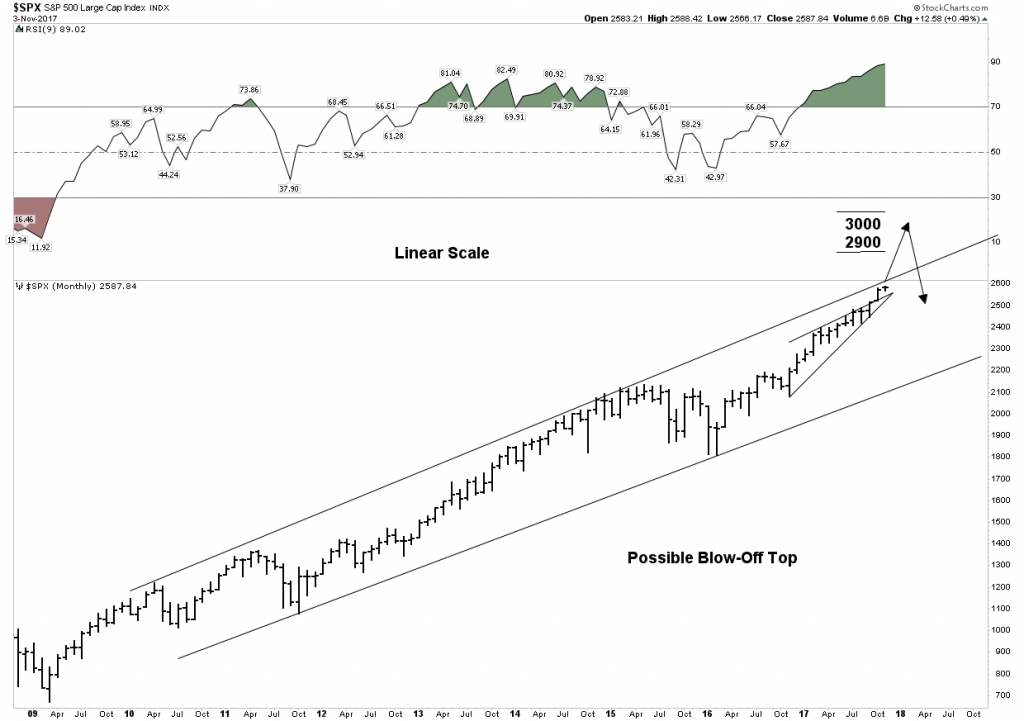

Rambus has shown that the move upward in the stock market continues to be unimpeded. I would concur with the caveat that early next year it may peak and end the 9 year bull market, so far the second longest in history. Momentum is still powering higher, however internal deterioration has begun to be evident. Here is one possible scenario for the ultimate top:

Above is a linear scale view of the 9 year bull market. It depicts a blow off top penetrating the upper trend channel with a target of 2900-3000. We see 3 phases to this bull market and the blow off would end the final phase III “mania”. Note the extreme reading in the RSI lending credence to this outcome.

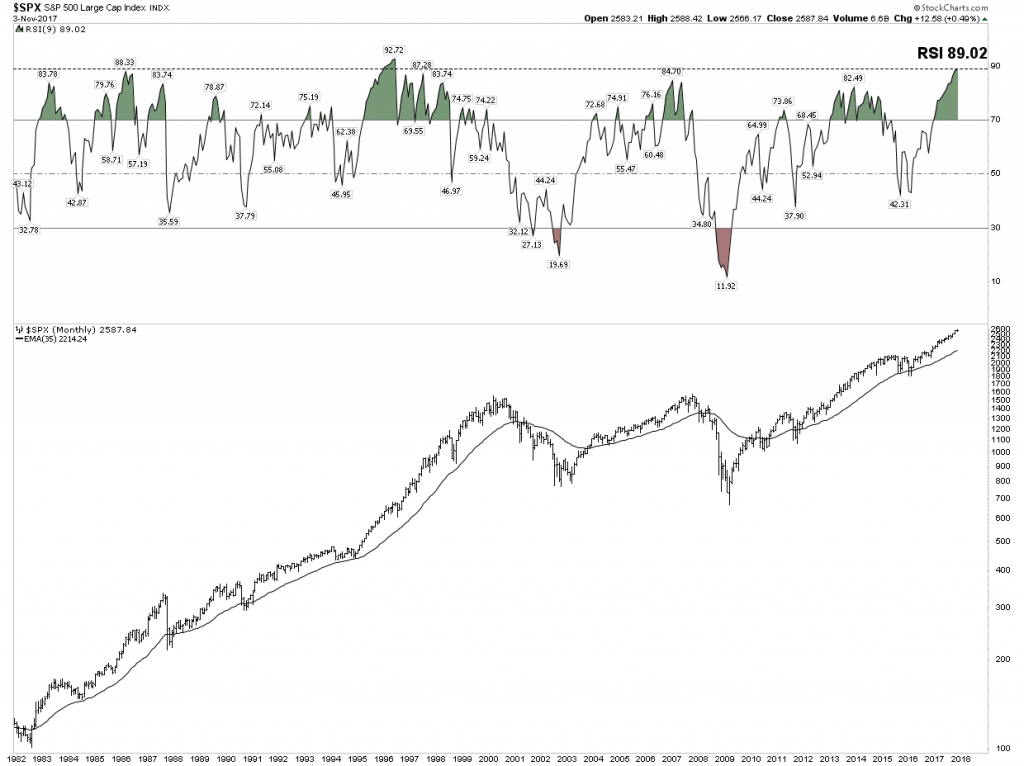

Below is a chart which highlights just how overbought and extended this market has become. It is a monthly view of the entire 36 year secular bull market. Note the RSI is now the second highest in the entire bull market. It is saying this relentless rise has reached a point where the RSI will limit its move.

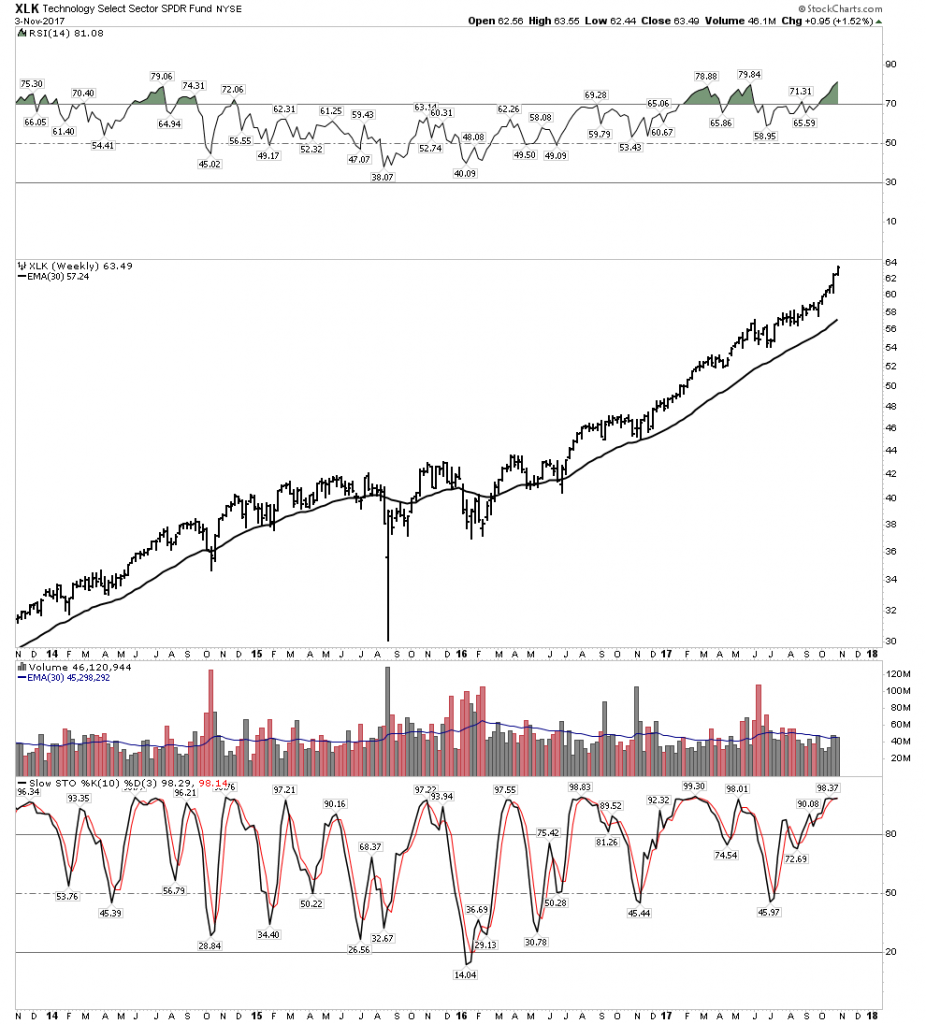

I would like to show just how narrow the advance has become. We all know how the FANG stocks have led the market. The XLK includes a heavy weighting made up of the FANGS and FANG-like stocks. The rise been relentless:

Note how extended stochastics and RSI have become. Also note how volume is trailing off despite this recent blow off move.

SPX-Equal Weighted Index

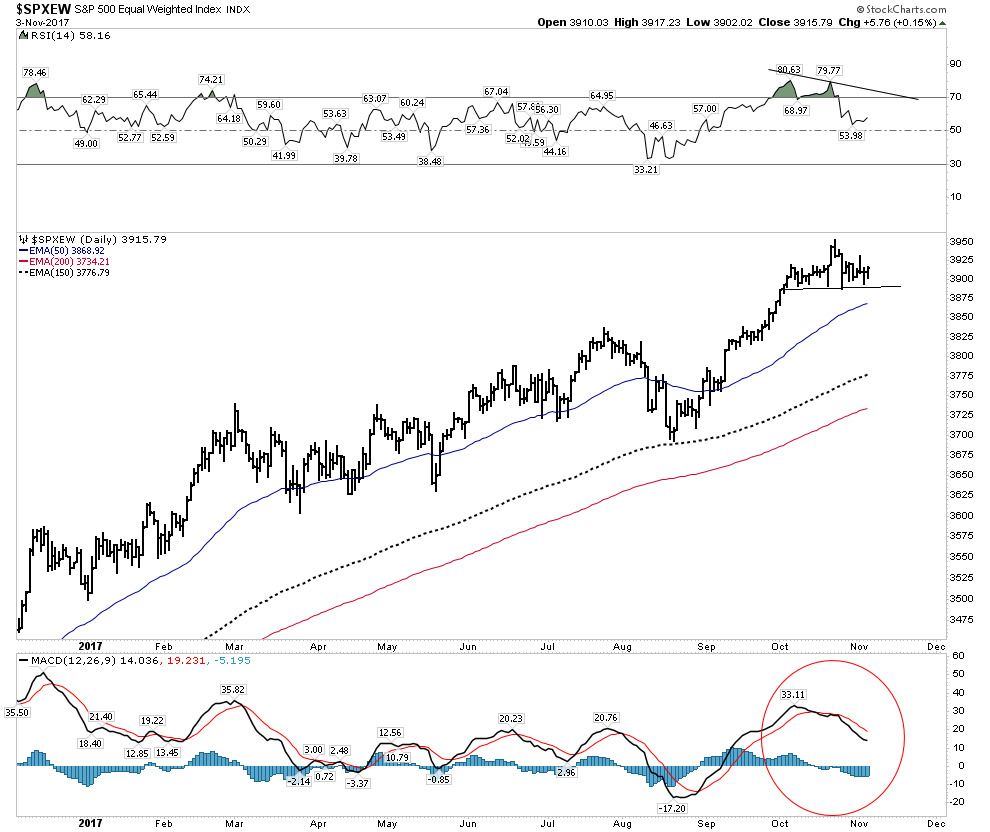

Below is the SPX represented as an equal weighted index. It values all 500 stocks equally vs the normal cap weighted measure. Here we see the trend solidly upward, however note that RSI is waning and it may be putting in a H&S top. MACD momentum is also indicating weakness.

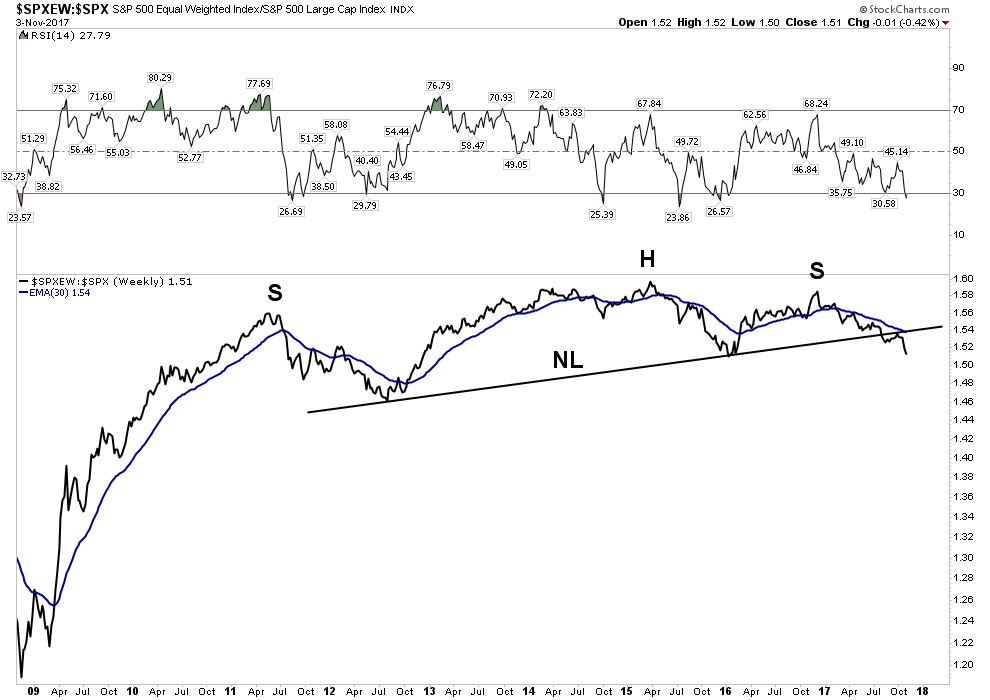

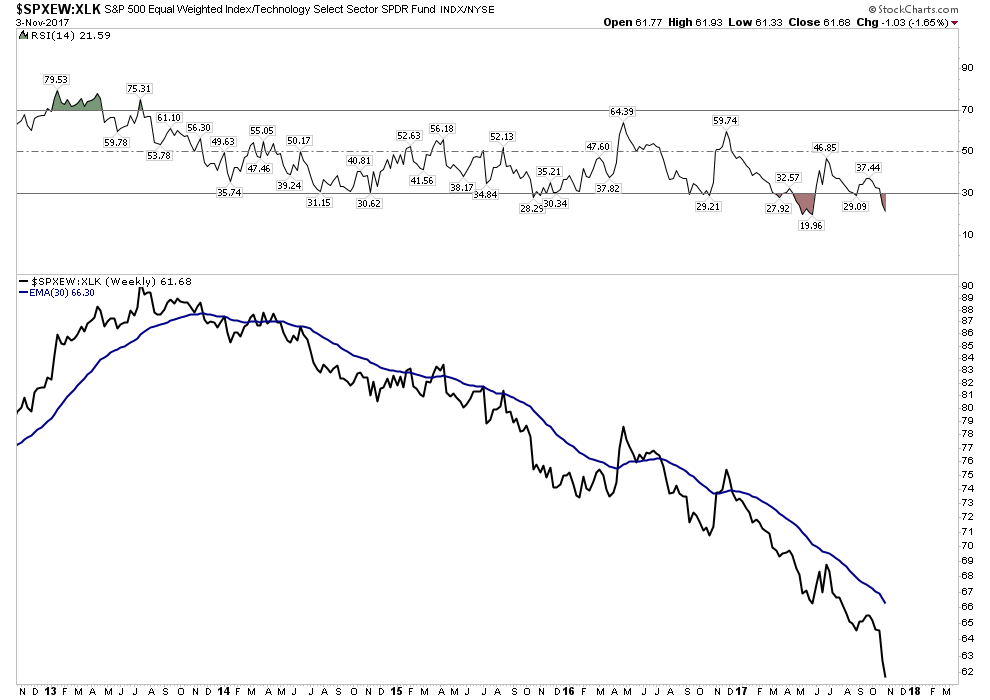

Now let’s go back and view the entire 9 year bull market and subtract out the cap weighted influence of the index as opposed to just neutralizing it. You will see it reveals the core of the market has not really gone anywhere for 7 years and it has recently broken its NL, followed up with a BT and is now resuming its downtrend.

Finally, let’s remove the effect of the super momentum driven XLK for the past 5 years and what is revealed is something really shocking. That of course is a total implosion of the core of the market relative to the momentum driven XLK. The message here for us to understand is that this market is being driven by money flows into an increasingly narrow sector of the market. This is a classic final phase characteristic of a blow off market. It is not announcing an end tomorrow, but it tells one what season we are in.

Let’s look at a few charts that you should be aware of. Again, the message is not that the end is here, but the internals are deteriorating:

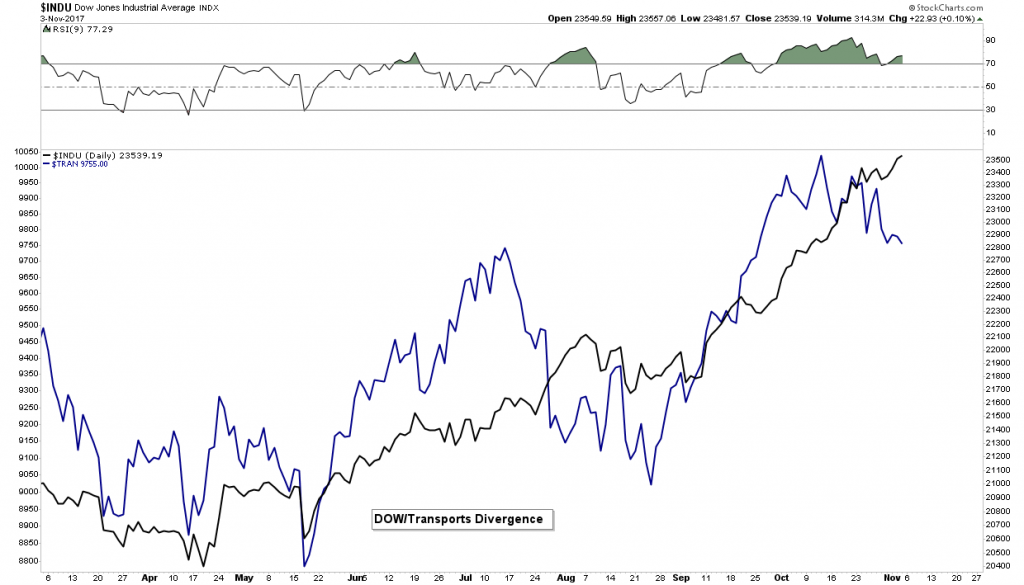

Dow Theory- Non Conformation

It’s only been in effect for three weeks, however this divergence needs to be corrected by the transports resuming its uptrend. Without a reversal upside, it signals trouble ahead:

…..continue looking at 35 more fascinating 35 charts Rambus has put together in this report HERE after which comes his:

Conclusion

The general markets continue to power higher with momentum firmly intact. If you are playing this sector you are making money, but be careful as numerous signs point to a top within 2-4 months. Meanwhile the PM sector is getting beaten up, but therein may lie the opportunity of a lifetime, especially now that we know the new FED chair is just another Brainless Keynesian who thinks there will never be any repercussions to endless money printing. Perhaps it’s time to take our eye off of the shiny object and buy what is real value, the precious and the electric metals.

Tuesday 31 October 2017

Quotable

“ For theories and schools, like microbes and corpuscles, devour one another and by their strife ensure the continuity of life.. ”

__ Marcell Proust

Commentary & Analysis

Hawks unleashed could rock the markets

Run pug run; hawks are in the house!!

The chief hawk in this narrative is Stanford Economics Professor John Taylor ( JT ); aka the creator of the Taylor Rule for monetary policy. Should President Trump pull a surprise out of his hat this week ( Would it be a surprise if President Trump didn’t surprise??), and appoints JT head of the US Federal Reserve Bank the market will most likely get rocked in a big way as the monetary hawks emerge from their well guarded cages..

According to the Taylor Rule, the current target for the fed funds rate should be about 2.94%% instead of the paltry 1.15%% it is now. Mr. Taylor’s appointment wouldn’t suggest an immediate 200 basis point rate hike from the Fed; but it would suggest future rate hikes will be faster and more furious than now anticipated.

Thus , here is how the market would likely react:

1) The US dollar would soar in value. Already the relative US dollar yield is crushing its competitors. Expectations of even higher yields would likely suck in even more hot money, making the euro an excellent funding currency, especially after Mr. Draghi so emphatically made it clear the ECB was going to hold off on hiking for much longer than many expected. Note, the last time there was this big of a difference in the 2 year benchmark spread between the eurozone and United States was back in January of 2000 and then the EUR/USD exchange rate was around 0.9700.

EUR/USD vs.. 2 – year Benchmark EU – US yield spread Weekly:

2) Gold would take a swan dive. We have already been expecting gold to correct lower; but if JT joins the party, gold would likely be crushed in a very big way.. There is a solid negative correlation between gold and interest rates, as rising rates tend to make gold appear less attractive given it lacks yield. And over time, there has been a strong negative correlation between gold and the US dollar also. After all, gold is priced in dollars (at least until China someday changes that)…

Gold vs. Dollar Index vs US 2 – year Yield: Gold’s negative correlation (not always; not perfect; but over time … )

3) Bonds would get battered. Just the thought of a 200 – basis point differential between where the Fed is now and where it should be according to the Taylor Rule would likely batter bonds in a big way initially. Whether the fundamentals flow – through to sustain a bond beat down is an open question..

10 – year Treasury Note Futures (ccontinuous) Weekly: Below the 55 – week moving average; MACD has turned over; and even a standard retracement from the low back in 2000 suggests bond prices are heading lower.

Keep in mind, I am playing the “ what if ” game here when I share these charts .

The bet is President Trump names existing FOMC member, known entity, Jarome Powell as the next Fed chairman. So , no worries for Mr. Market. Well, no worries assuming JT doesn’t sneak into the Vice Chairman slot..

Centralized banking and all other forms of intermediary rentier skims are presented as solid. If history is any guide, these supposedly solid entities may well melt into air.

QUESTION: G’day guys.

Thanks for a great seminar in Hong Kong!

I’m reading through your 1 world currency report and find it very interesting, going back to primary school teachings about barter systems and some funny monetary acceptances that have been in place many years ago. Like 14.5 kg copper plates as a currency only back in the 1600’s in Sweden. Or 1-ton barrels of tobacco. Very interesting and tough to carry in your wallet.The major teaching I received from the Hong Kong Seminar was to look at the currencies (something I’ve had plenty of lessons dealt over the years trying to trade) in regard to products and assets in the many different countries around the world.

My question now we are seeing bitcoins and possibly diamonds and other mediums we are not yet aware of yet replacing gold as a new vehicle to move cash or wealth into a better-performing countries assets.

With the collapse about to occur in Europe and Britain included monetary wise. Instead of buying gold in relation to USD one should buy gold against the Euro’s or Pounds when the time is right?

Or has a gold lost its lustre today and the contagion to gold may not occur to the extremes that have occurred in the past?

Will Europe money tell the story? The smart money is moving to the DOW. Will it return to gold when the people lose their confidence?

Thanks for the interesting and new way of looking at the markets Marty. I’m doing better with Socrates though still a novice.

Take care and wish I was coming to the next conference. Hope it’s a beauty.

A

ANSWER: Gold has lost its movability aspect as they hunt money for taxes. Twenty years ago you could hop on a plane with a briefcase of gold with no problem. From that perspective, gold has lost its international portability. This is obviously why people are turning to diamonds, rare ancient coins, and the like – movable assets. We are even witnessing real estate starting to decline now in New York City. The high-end real estate market (not the low-end) was making new highs as big money was trying to get off the grid. Realtors were reporting to us that the majority of such high-end deals were all for cash – no mortgages.

ANSWER: Gold has lost its movability aspect as they hunt money for taxes. Twenty years ago you could hop on a plane with a briefcase of gold with no problem. From that perspective, gold has lost its international portability. This is obviously why people are turning to diamonds, rare ancient coins, and the like – movable assets. We are even witnessing real estate starting to decline now in New York City. The high-end real estate market (not the low-end) was making new highs as big money was trying to get off the grid. Realtors were reporting to us that the majority of such high-end deals were all for cash – no mortgages.

Gold would certainly be a better hedge against the Euro than the dollar in the short-term. It has outperformed the dollar because you always have to look at the currency. However, money will NEVER shift from the stock market all into gold. Everyone has their pet investment in what they feel comfortable. Gold is a retail product – not institutional. The Institutions can trade ETFs, gold stocks etc., but they will never take possession of gold.

What we are facing in truth is a currency reset. That means that ALL tangible assets rise against the currency in whatever country we are talking about. The goldbugs always hate the dollar and many of them have turned away from gold and into cryptocurrencies.

You will always have people who will prefer stocks, others gold, and others real estate. That is just the way it is. To each their own.

…also from Martin Armstrong:

Roman Republican Hoard for Sale of Victoriati

The US Dollar rally: accelerated this week. I’ve been short other currencies against the USD since early September and took partial profits this week even thought I think the USD rally has more to go. Double click chart for larger version

Diverging monetary policy: between the USA and other countries has been a key FX driver. On the September 8 Key Turn Date the 10 year treasury yield was at its lowest level since Trump’s election…but since then it has rallied to 5 month highs. Real yields have also been rising. The 2 year Treasury yield is at a 9 year high. Part of the reason for rising American interest rates (and a rising USD) is that traders are positioning for a more hawkish Fed. US Financial conditions are the easiest in 20 years…paving the way for the Fed to keep tightening.

Fed Chair: Fed Governor Powell is the front runner to replace Yellen but Trump might surprise markets and nominate both a Chair and Vice-Chair (Powell and Taylor?)

Tax cuts: Stock markets, interest rates and the USD have been rising in anticipation of Trump’s tax reform plans.

Euro: EURUSD hit a 2 ½ year high at 1.2150 on September 8 and has fallen about 5% since then as a result of 1) diverging monetary policy (ECB maintains accommodative policies while the Fed tightens,) 2) Political concerns (where Catalonia goes others are likely to follow) and, 3) unwinding of huge speculative long EURUSD positions.

CAD: Hit a 2 ¼ year high at 83 cents on Sept 8 (after the second Bank of Canada interest rate increase on Sept 6) and has fallen about 5 ½ cents since then as a result of 1) diverging monetary policy (markets anticipate that BOC will “pull back” after having gone “too far too fast” while the Fed continues to tighten, 2) Political/economic concerns (Trump may scrap NAFTA, Canadian economy softening after interest rate increases and huge CAD rally) and 3) unwinding of long speculative CADUSD positions which had reached multiyear highs by early September…and then got even bigger as CAD fell!

USD universally strong: USD has been rising against nearly all currencies and gold since that very important Sept 8 date: the USDX is up ~4.5%, AUD is down ~6%, NZD is down ~6%, MEX is down ~7%, YEN is down ~5%, and gold is down ~$100 or 7%.

Stock markets: American markets keep making new highs (with any dip seen as a buying opportunity.) Tax reform has a number of “positives” for American companies including repatriation of overseas money…which could be used for share buy backs. It’s interesting to watch the TSE march steadily higher since Sept 8 as the CAD has fallen…to see that the German DAX has rallied sharply to New All Time Highs this week as the Euro fell…similar to how the British stock market rallied last year when the pound fell following the Brexit vote.

WTI: the front month contract traded to $54 this week, its best in 8 months, up $12 (28%) from the June lows. It’s interesting to see crude oil rally while the USD is rallying as market psychology embraces the bullish WTI narratives (Saudi “we will do whatever it takes”) while ignoring the bearish ones! I have traded WTI mostly from the short side the past 3 years but have been basically aside the past couple of months.

China congress: the congress is over, Xi has consolidated his power. Two weeks ago I suggested that there was probably a lot of “managing” of the news before and during the congress to avoid any embarrassment and I wondered what could “bust loose” once the congress was over. Maybe the 10 cent decline in copper Friday after hitting a 3 year high last week is one of those “bust loose” things. I think China is the world leader in the volume of copper traded.

How to understand currency trading: I’ve been trading currencies for 40 years and one of my favorite chestnuts is that currency trends run WAY further than seems to make any sense, and then turn on a dime and go the other way. I think the Sept 8 Key Turn Date was one of those “turn on a dime” dates.

PI Financial Corp. is a Member of the Canadian Investor Protection Fund. The risk of loss in trading commodity interests can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. In considering whether to trade or the authorize someone else to trade for you, you should be aware of the following. If you purchase a commodity option you may sustain a total loss of the premium and of all transaction costs. If you purchase or sell a commodity futures contract or sell a commodity option or engage in off-exchange foreign currency trading you may sustain a total loss of the initial margin funds or security deposit and any additional fund that you deposit with your broker to establish or maintain your position. You may be called upon by your broker to deposit a substantial amount of additional margin funds, on short notice, in order to maintain your position. If you do not provide the requested funds within the prescribe time, your position may be liquidated at a loss, and you will be liable for any resulting deficit in your account. Under certain market conditions, you may find it difficult to impossible to liquidate a position. This is intended for distribution in those jurisdictions where PI Financial Corp. is registered as an advisor or a dealer in securities and/or futures and options. Any distribution or dissemination of this in any other jurisdiction is strictly prohibited. Past performance is not necessarily indicative of future results.