Currency

The dollar is on course to lose its reserve currency status. This is not something that will happen overnight, it will be a process, but at some point there is likely to be a “sea change” in perception, as the world grasps that this is what is happening, which will trigger a cascade of selling leading to its collapse, whereupon gold and silver will rocket higher.

A big reason for the dollar finding support in recent years and doing relatively well versus its peers has been the perception that the US is the last and best “safehaven” in a world beset with instability and terrorism etc , but that perception is changing as US society starts to polarize in a dangerous manner. In addition, the continued provocations and threats by the US towards China and Russia has driven them into making preparations to ditch using the dollar, and these preparations are well advanced, and have included buying huge quantities of gold. Thus the dollar is looking increasingly vulnerable. On the long-term 20-year chart for the dollar index we can see that it is still at a fairly high level after its gains during 2014 and 2015, but appears to be marking out a “Broadening Top” pattern. On this chart we can also see that if it proceeds to fall hard soon, it won’t be the 1st time – it suffered a brutal decline between the start of 2002 and early 2008 – and that was before it was threatened with the loss of its reserve currency status, so the looming bearmarket could clearly be much, much worse.

On the 4-year chart we can examine the Broadening Top in much more detail. The rally to a peak at the end of last year was due to euphoria over Trump’s election, but it since dropped right back across the pattern as reality has reasserted itself, and of course Trump himself has now been totally emasculated by the Deep State, evidenced by a string of U turns on his campaign promises, the latest being on Afghanistan last week. He is now nothing more than a figurehead, a Deep State puppet, and it will be rather pitiful to watch his diehard supporters clinging on to the belief that he will actually make any difference.

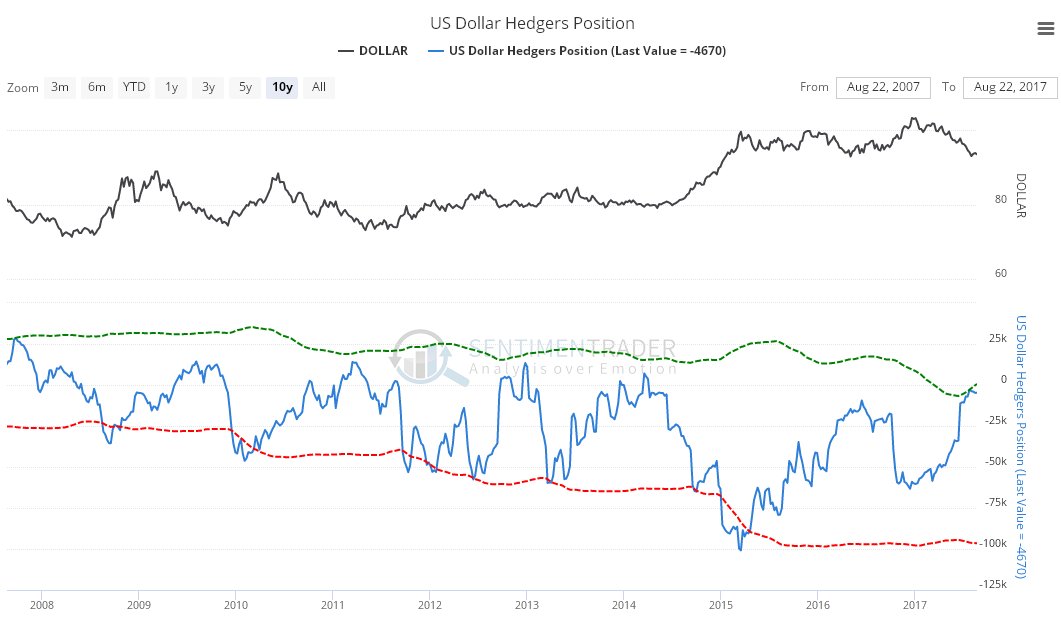

In recent weeks the dollar has come rattling all the way back down to the support near to the earlier lows towards the bottom of the Broadening Top, driven lower at an accelerating rate by the parabolic downtrend shown, and while this could soon force a breakdown from the top pattern, it’s a tough call because the support in this area and down to the lower boundary of the pattern is strong, and a high short position has built up, so these two factors together could break the dollar above the parabola leading to a short to medium-term relief rally. However, the long-term outlook remains grim, whether this happens or not, and if it does happen, US readers should seize the opportunity to switch out of US dollar denominated assets into something like the Canadian – the Canadian dollar should do particularly well because if the US dollar does plunge, hard assets like gold and silver will soar, and the Canadian economy is resource based. Canada is also attractive for US investors because it is a relatively stable economy close to home. The Hedgers chart for the dollar certainly looks bullish for the short to medium-term as it shows the positions of the large Commercial Hedgers, who are usually right. As we can see, they have almost completely cleared out their short positions, which are now at levels that have in recent years have always lead to a rally. This is part of the reason for us turning cautious on the Precious Metals sector short-term last weekend, and an additional reason is the continued growth in Commercial short positions in gold and silver. This doesn’t mean we are turning bearish, rather, it may throw up another opportunity to buy our favorite gold and silver stocks at even better prices in the weeks ahead.

Click on chart to popup a larger clearer version. The 4-year chart for dollar proxy UUP provides some additional evidence that the dollar is headed for the rocks, since its Accum-Distrib line is very weak, being already at a lower level than it was at in mid-2014 when UUP was at a much lower level…

On the 1-year chart we can zoom in on the parabolic uptrend in force from the start of the year. For a while, about a week or two ago, it looked like it had broken out above the parabolic uptrend, but Friday’s rather sharp drop suggests that it remains in force, and its position requires adjusting to be more generous. After adjusting the downtrend it now looks like the dollar just completed a bear Flag that allowed the earlier oversold condition to partially unwind. If this is true, then it is now likely to continue falling down to the lower boundary of the Broadening Top, the red line, and there we should again watch out for a snapback rally, since we can presume that the short position will have built up to an even higher level by then, although having broken down through a lot of support in the 92 area, it may be beyond help by this point and simply plunge, once that happens the Precious Metals will finally take off higher in a decisive manner.

Meanwhile gold’s incubating major new bullmarket is like a new model under a tarpaulin at an auto show – you know it’s under there, but you don’t know exactly when they will whip the cover off and unveil it…

The war cycles continue to ramp-up across the globe. And this latest wave of geopolitical unrest continues to rise at an unsettling pace. Just like my mentor and friend, Larry Edelson, predicted.

Long before Larry passed away early this year, he wrote about these cycles. How they are accelerating and coming together in a way not seen since the late 1800s. And how they are likely to increase in intensity each and every year all the way into late 2020.

Europe almost perfectly embodies everything Larry predicted. It certainly has not escaped the geopolitical problems engulfing the world. Lately, it seems like it’s enduring more than its fair share.

The main reason — the European Union’s loose policies toward legal immigration. And a new influx of economic and war refugees is being associated with a rising number of deadly terrorist attacks.

Now, I’m not saying that all migrants or refugees are terrorists or that they even have the potential to become one. My point is simply that the EU’s immigration policies make it easier for a potential terrorist to cross EU borders by posing as a migrant.

Just last week, Barcelona, Spain, was one of the latest cities to experience a terrorist attack. A van in La Rambla Square mowed down pedestrians, leaving 13 dead and more than 100 injured.

Then in Turku, Finland, migrants seeking asylum stabbed 10 people, killing two. This happened after one of the suspects found out his status had been turned down.

And these are just the most-recent headlines. The European refugee situation is clearly out of control. And will most likely only get worse before it gets better.

Is the European Union’s immigration policy destroying its unity? You bet.

Cash-strapped … and, in many cases, near-bankrupt … countries in southern Europe are paying a huge price for the EU’s loose immigration policies. And this has led to growing conflict throughout Europe.

The South’s eastern counterparts (Poland and Hungary) are flat out refusing to take in refugees. The move has sparked hostility among other EU members, with some leaders calling for sanctions against the countries who refuse to open their borders.

Take Italy, for example. The country is the poster child for the looming sovereign-debt crisis. It recently saw a record surge in refugees from North Africa. Italy has accepted nearly 100,000 refugees in the first six months of the year. And I expect that number to rise.

And not surprisingly, Italy has the lowest capacity to absorb migrants among the major EU economies. That’s according to a new report published by Goldman Sachs.

From the indicators Goldman uses, Italy appears to be the least economically and socially integrated of all the EU bloc countries. These findings are noteworthy considering both this year’s surge in trans-Mediterranean migration to Italy and the country’s dire public-finance situation.

From the indicators Goldman uses, Italy appears to be the least economically and socially integrated of all the EU bloc countries. These findings are noteworthy considering both this year’s surge in trans-Mediterranean migration to Italy and the country’s dire public-finance situation.

And when Italy can no longer handle the load, I expect other cash-strapped EU nations to take the overflow, including Spain and Greece.

And let’s not forget about the election next year that could change the landscape once again …

Italy’s migration crisis will be a central issue when the country goes to the polls next May. Italians are growing resentful of how economic hardships have been amplified by the influx of immigrants. All of which could lead to a rise in nationalism.

The bottom line: Italy and other over-indebted EU countries are being pushed to their financial limits. They cannot possibly survive with this burden alone, as money for their own citizens must now be diverted to the refugees. All the while, the fat cats in Brussels refuse any monetary support.

I expect the migration from North Africa and the Middle East into Europe will not only continue but also to intensify.

This will cause both economic and social harm to the European Union. And over the next few years, I expect the situation to get worse. Indeed, this could be one of the catalysts that ultimately breaks apart the union.

As the European Union becomes engulfed in the migrant crisis, the region’s debt problems with come to a head – leading to a terrific buying opportunity for U.S. equities as we will see money flows leave Europe and head across the Atlantic to U.S. shores.

Best wishes,

David Dutkewych

This article is not politically motivated – the writer has no political agenda or affiliation – and the motivation for producing it is to enable you to understand the pivotal role that gold will play in thwarting the Empire’s imperialist ambitions, and how this means that the price of gold – and silver – will skyrocket, and sooner than many think possible. When you know that this is set to happen, and you understand the key reasons why, you will be able to position yourself to profit greatly from this profound and seismic global shift.

I have been pointing out the crisis we face moving forward. The gist of this is the total fiscal mismanagement of government for which we, the people, are always blamed. This hunt for taxes has led down the path of arguments for eliminating currency. While people think Bitcoin is an answer, they do not understand government’s hunt for taxes no less the lack of a true rule of law. The government need only pass a law that anyone who fails to report what they have in Bitcoin is criminal and they get to confiscate all your assets.

Switzerland has its “wealth tax” which they argue is nothing just 0.02%. However, it requires you to report all assets worldwide. They then know precisely what you have and it is merely one vote away at anytime to raise the tax or impose criminal penalties for failure to report everything. Yet, once Switzerland has that info, under G20 they must share it with all other governments.

We have stood by and watched India cancel all high denomination notes. Try walking around with €500 notes in Europe and they look at you funny or won’t accept them. ATM machines have been reduced in Europe to taking a maximum of €200 in cash at best. This is all th hunt for taxes because government cannot function ethically no less morally.

Now the German Federal Minister of Finance, Wolfgang Schäuble, is proposing to control all large cash transactions claiming this will prevent black money transactions and money laundering. Of course, they see these two issues not as typical crime like drugs, but tax avoidance.

Schäuble is coming up with an alternative for the resistance to eliminating cash is rising globally. He knows he cannot abolish cash. If you cannot eliminate cash, then Schäuble said there should be an upper limit placed on cash transactions, from which cash transactions must be registered and reported to the tax authorities. This is also happening in Europe where you cannot pay for a hotel bill greater than €1000 in France. Schäuble said cash transactions must be registered declaring who are the parties to the transaction on each side to prevent the black money transactions, money laundering and terrorist financing.

Schäuble is coming up with an alternative for the resistance to eliminating cash is rising globally. He knows he cannot abolish cash. If you cannot eliminate cash, then Schäuble said there should be an upper limit placed on cash transactions, from which cash transactions must be registered and reported to the tax authorities. This is also happening in Europe where you cannot pay for a hotel bill greater than €1000 in France. Schäuble said cash transactions must be registered declaring who are the parties to the transaction on each side to prevent the black money transactions, money laundering and terrorist financing.

It has become painfully obvious that the real winner in the Terrorism War was Osama bin Laden. What this single man did was change the entire world into a hunt for taxes destroying our liberty and right to privacy. He destroyed our liberty like no other invader in history. Osama bin Laden has certainly made the list of the top 10 most influential people in history, but has not surpassed Karl Marx.

Schäuble previously said he was against eliminating cash and imposing ceiling on cash payments as were the French and Italy. Schäuble is joining the ever increase microscope to hunt down citizens for taxes always using Bin Laden as the excuse. Even the IMF recently published a handbook on how the reduction of cash could be implemented as silently as possible. Australia is stalking children going to private schools and has declared “cash is for criminals!”

This trend is only going to end in revolution. Historically, all revolutions are about money.

…also from Martin:

Aug 15, 2017

- For gold to perform well against the US dollar, it needs to perform well against the Japanese yen.

- Please click here now. Double-click to enlarge.

- Since 2011 gold has traded sideways against the yen. Since 2013 it has been coiling in a very positive symmetrical triangle pattern.

- An upside breakout would usher in a major move higher for gold against both the yen and the dollar.

- Since 2013, the Indian market has been dealing with major duty, import rule, and hallmarking issues. The process has weighed on demand since 2012.

- India’s gold market has undergone an enormous restructuring in response to these issues. The good news is that the restructuring is essentially complete now.

- That paves the way for higher imports on a much more consistent basis.

- China has made significant progress in tying gold price discovery more to physical demand versus supply.

- Trump has also had major success in pushing the dollar lower against most of the world’s currencies.

- These are not just one-time events. Events like tension in Korea can move gold $20 – $50 in a short period of time. A $100 – $200 move is possible if the tension intensifies (which it hasn’t).

- Unfortunately, these gains are no more sustainable than the gains from the 1980 Russian invasion of Afghanistan were sustainable.

- When the tension subsides, all the gains from these one-time events tends to be lost.

- To move $1000 higher or more, gold needs to see a quasi-permanent ramp-up in the physical market demand against static or limited supply growth, and that’s happening right here, right now.

- Trump’s actions on the dollar are a long-term process. He is now beginning a trade war with China. From a gold price discovery perspective, this is vastly more important than tension involving Korea.

- Please click here now. Double-click to enlarge this gold chart.

- Gold looks fabulous. After rallying about $90, gold is consolidating its gains. A new minor support zone at $1260 – $1280 is in play. Both traders and accumulators can be buyers in this support zone, in anticipation of a sustained rise above $1300.

- Please click here now. Double-click to enlarge this daily chart of the Dow. If the US stock market suffers a major crash in September or October, there tend to be “cracks in the dike” in August.

- That’s what’s happening now. The uptrend is still intact, but getting tested. The next technical event to watch for is an RSI non-confirmation. This happens when the Dow makes a new high, but the RSI oscillator (shown at the top of the chart) does not.

- Investors can lighten up in August and essentially take a two month stock market holiday. That’s what I do. It reduces emotional stress.

- My focus is more on the Asian stock markets than America, and I’ve sold about 30% of my positions into this price strength. If there is a crash, investors can buy aggressively, with a focus on banks and Asian markets.

- Asian consumers carry debt that is similar to US citizen debt, but they have a lot of savings and strong saving rates as a percentage of income. US citizens have almost no savings and abysmal saving rates.

- Asian markets will rebound from any crash with the resiliency shown by US markets during the late 1800s. In contrast, US markets are in danger of descending into a stagflationary gulag if they crash. I’m a buyer of US markets if they crash, but not with much risk capital compared to my Asian market allocation.

- Please click here now. A number of influential money managers are following GDX right now, including Jeff Gundlach. The triangle formation they are following is important, but what is more exciting is the bullish volume action.

- Volume is rising on rallies within the triangle, and ebbing on declines. That’s very positive. Bullion and mining stock investors should be very comfortable right now. Technical breakouts appear imminent and fundamentals are strong!

Thanks!

Cheers

st

Apr 15, 2017

Stewart Thomson

Graceland Updates

website: www.gracelandupdates.com