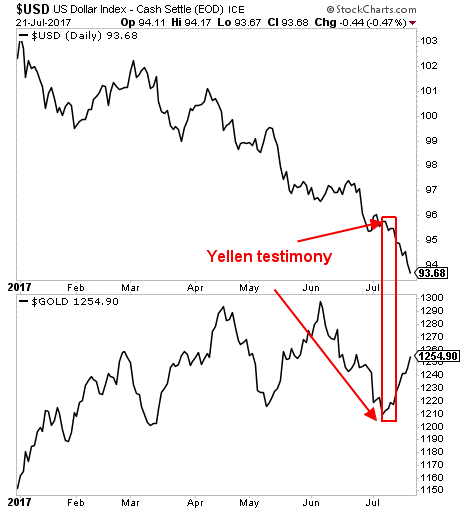

Six months ago it was hard to believe that the Greenback will be plummeting against all of its major peers. Back then the Fed was the only central bank tightening monetary policy, economic data was very supportive and most importantly Trump’s expected policies of cutting taxes as well as spending on infrastructure were meant to push the dollar higher. The USD index peaked on 3rd Jan and since then it was moving in a down trend with declines exceeding 10%.

Six months ago it was hard to believe that the Greenback will be plummeting against all of its major peers. Back then the Fed was the only central bank tightening monetary policy, economic data was very supportive and most importantly Trump’s expected policies of cutting taxes as well as spending on infrastructure were meant to push the dollar higher. The USD index peaked on 3rd Jan and since then it was moving in a down trend with declines exceeding 10%.

President Trump blamed himself for the dollar strength. He stated that it is the confidence in him causing the dollar to surge. Six months into his presidency has already passed without any significant legislative achievement and not even the ‘skinny repeal’ of Obamacare. Investors are apparently growing more concerned that his administration will not be able to agree on the rest of his agenda which is a clear sign that markets have lost the claimed confidence.

Although the U.S. GDP growth more than doubled in Q2 compared to Q1, the 2.6% expansion could not support the dollar as it came slightly short of expectations. The Federal reserve also acknowledged that the balance sheet normalization would begin relatively soon, and one more rate hike still on the table this year. Still the USD continued to slide as investors remained skeptical of another rate hike in 2017 with CME’s Fedwatch indicating only a 46.8% chance of a rate hike in December.

Despite my belief that the U.S. dollar will remain weak for the rest of the year, all metric shows that the USD is massively oversold and will likely receive a little bounce from current levels. Friday’s nonfarm payrolls will be crucial for the USD and if data did not disappoint we are likely to see a bounce. However, the headline figure will not be as important as wage growth. Wage growth has been a major factor dragging inflation levels recently and accordingly a print of 0.3% or higher is required for the dollar to come back. Traders will likely position their trades before the NFP release. Thus it is important to monitor ISM manufacturing and non-manufacturing along with the ADP release.

It is also an important week for Sterling with the Bank of England meeting on Thursday. After three MPC members voted for an immediate rate hike in June, followed by Hawkish statements from Carney and Haldane, markets started pricing in a rate hike in August. However, data was not supportive enough and inflation pulled further away from the danger zone of 3% which will most likely keep the BoE on hold for now. The base scenario for the meeting is to keep rates and asset purchase unchanged but the message from Carney and the tone of the quarterly inflation report will play a major role in GBP’s next move. If more than two members voted in favor of a rate hike and Carney continued to deliver hawkish messages, we might see the pound rallying towards 1.33.

‘Trade bullying has killed the dollar bull’: Joachim Fels

‘Trade bullying has killed the dollar bull’: Joachim Fels

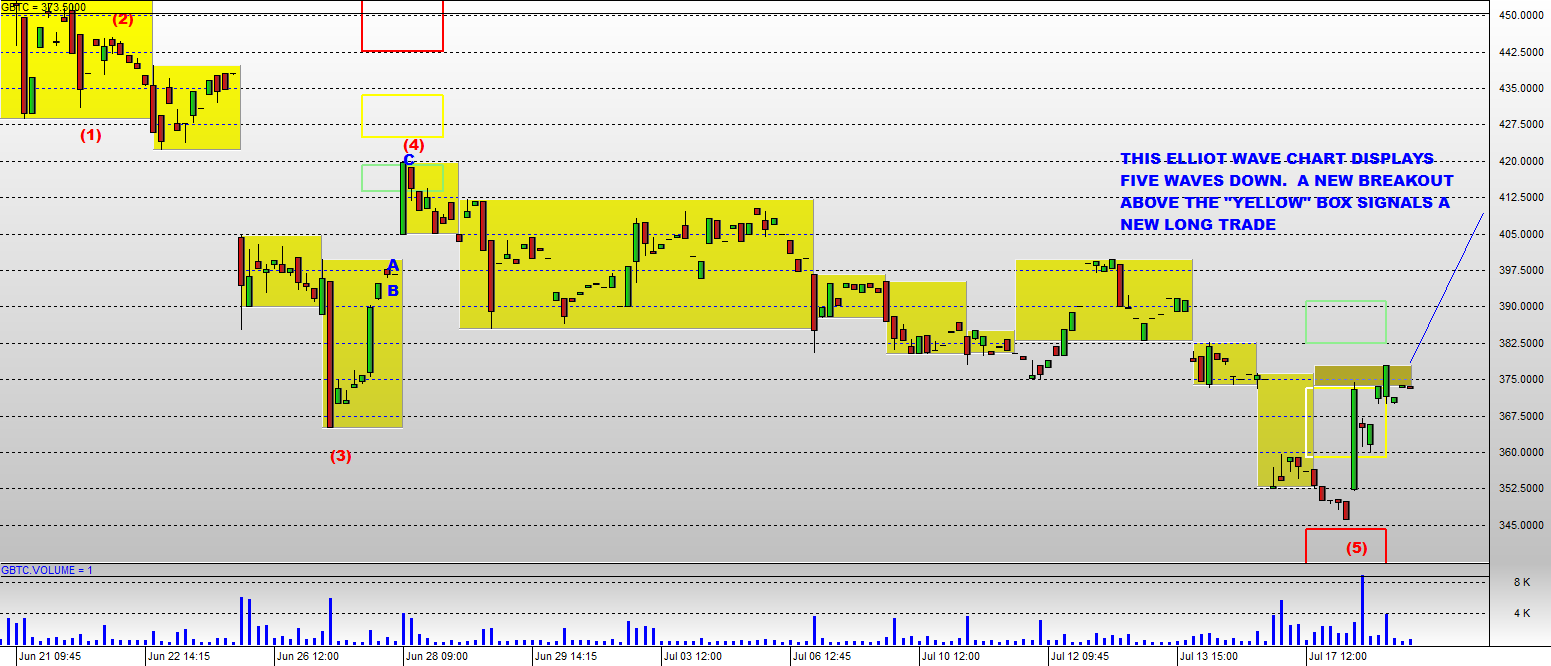

Several weeks after Goldman’s chief technician started covering bitcoin, overnight Bank of America has released what some may call an “initiating coverage” report on bitcoin which notes that while the cryptocurrency remains very volatile and risky, bitcoin has experienced a spectacular surge in liquidity in the last six months. However, BofA remains stumped when it comes to making any official forecasts BofA’s commodity strategist Francisco Blanch writes that bitcoin is uncorrelated to any financial asset, “so there is no way to explain let alone predict returns.”

Several weeks after Goldman’s chief technician started covering bitcoin, overnight Bank of America has released what some may call an “initiating coverage” report on bitcoin which notes that while the cryptocurrency remains very volatile and risky, bitcoin has experienced a spectacular surge in liquidity in the last six months. However, BofA remains stumped when it comes to making any official forecasts BofA’s commodity strategist Francisco Blanch writes that bitcoin is uncorrelated to any financial asset, “so there is no way to explain let alone predict returns.”