Sent to subscribers on April 27, 2017, 7:22 AM.

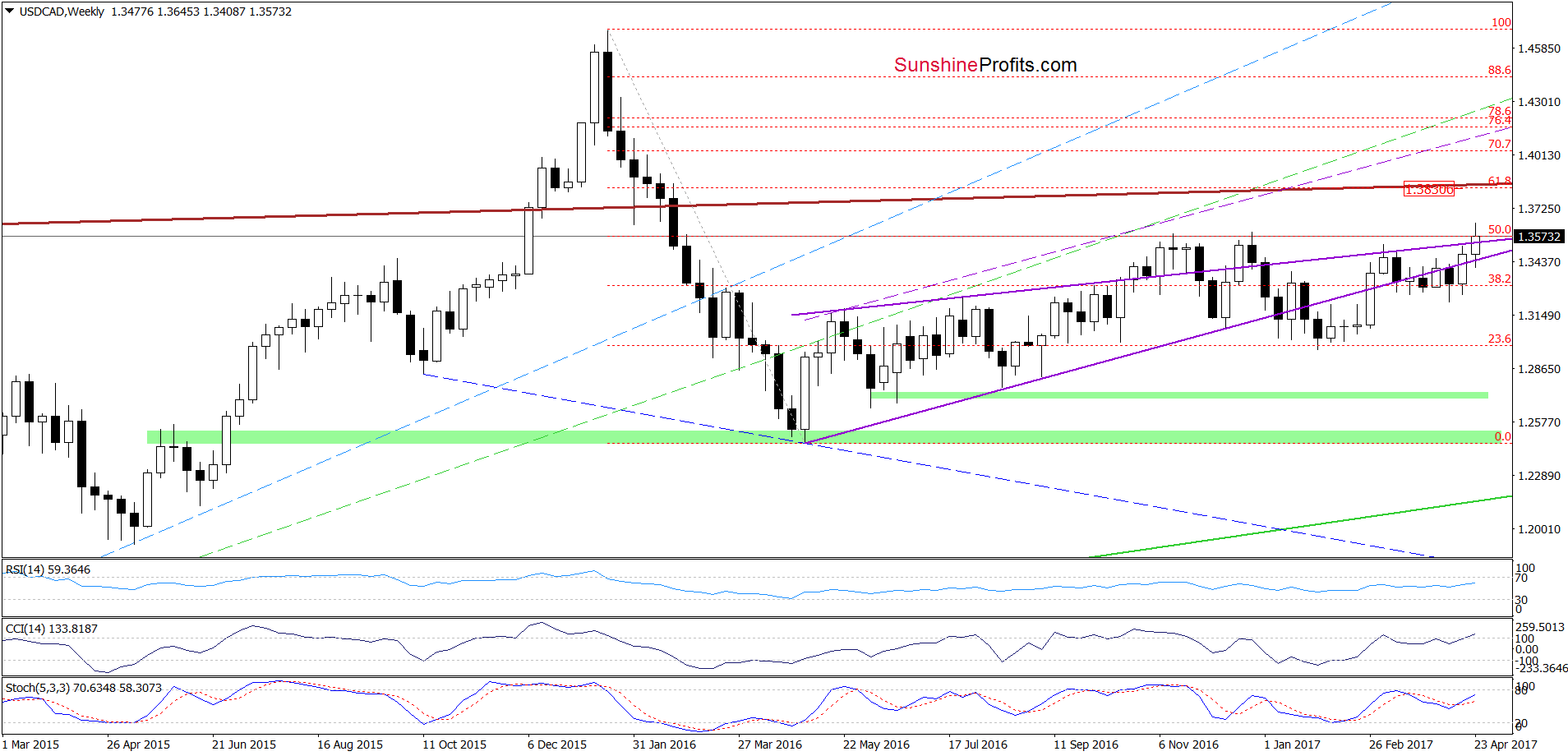

Earlier today, the greenback moved lower against the Canadian dollar, which pushed USD/CAD below the December high and the previously-broken resistance zone. Is it enough to trigger further deterioration?

In our opinion the following forex trading positions are justified – summary:

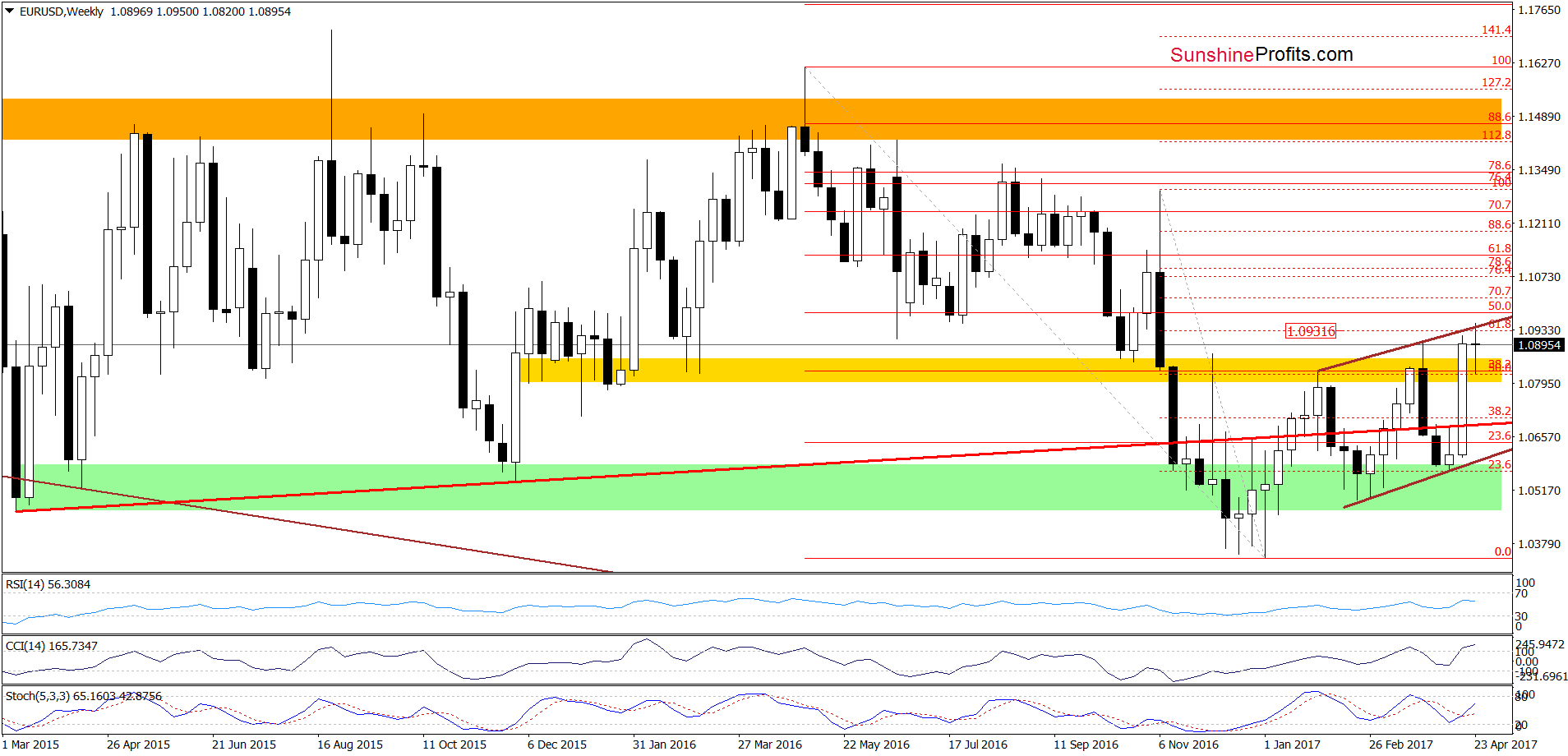

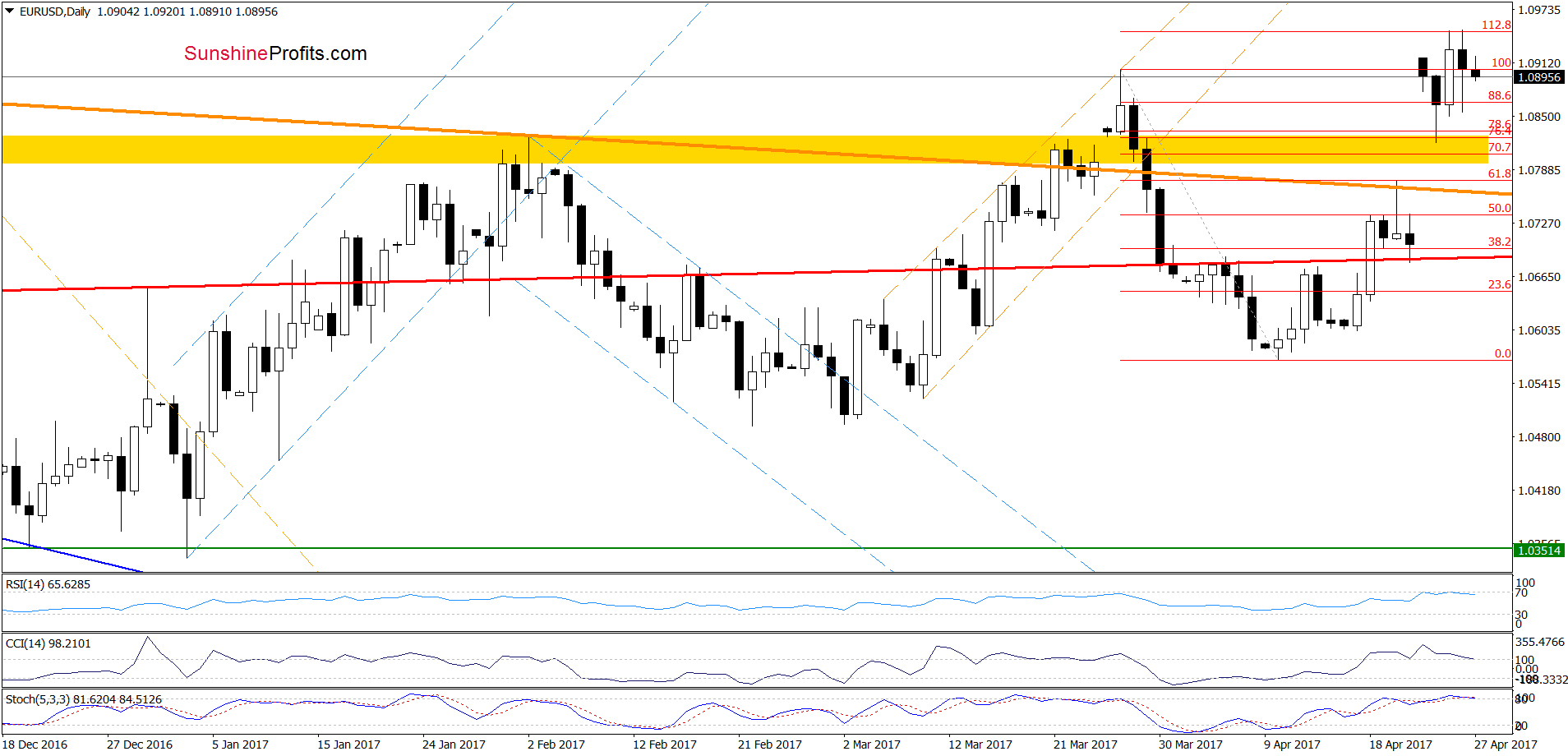

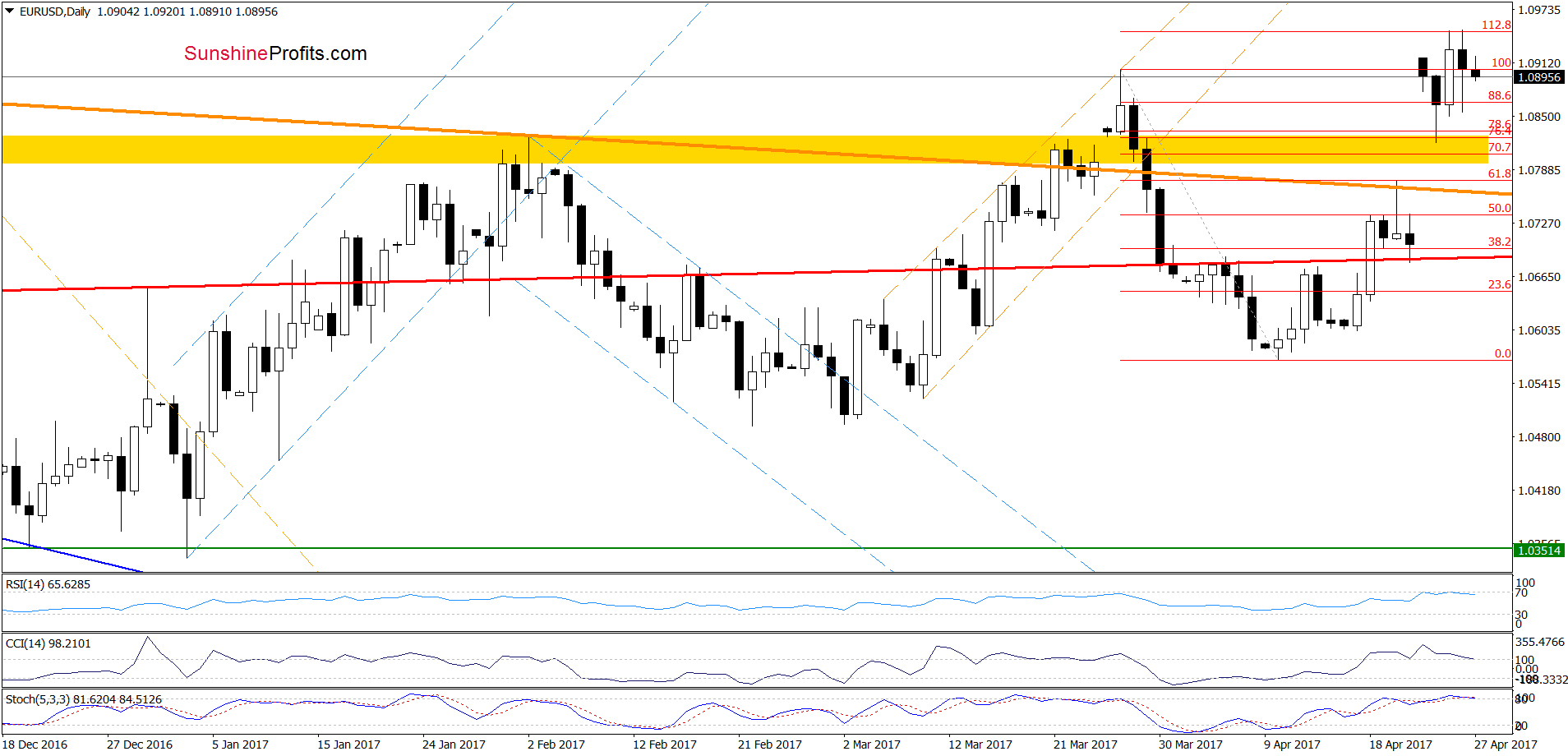

EUR/USD

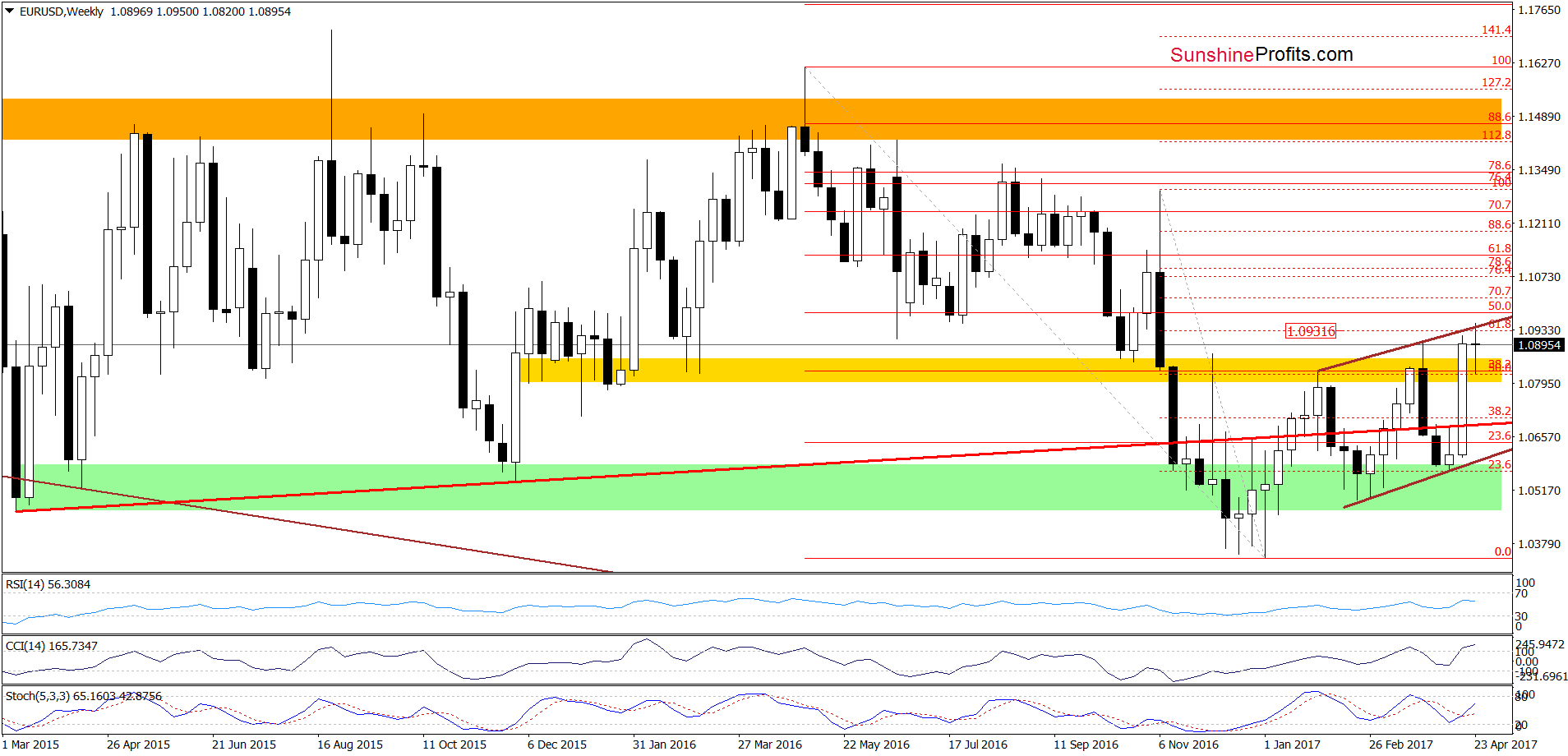

Looking at the charts, we see that although EUR/USD rebounded slightly yesterday, this “improvement” was very temporary and currency bears pushed the exchange rate lower earlier today. Thanks to this drop the pair came back under the March high, which means that our previous commentary on this currency pair is up-to-date:

(…) EUR/USD tested the strength of the upper border of the brown rising trend channel, the 61.8% Fibonacci retracement (both marked on the weekly chart) and the 112.8% Fibonacci extension (seen on the daily chart), which resulted in a comeback below the March high. Additionally, the sell signal generated by the RSI remains in place, supporting currency bears. On top of that, the CCI and the Stochastic Oscillator are very close to generating sell signals, which suggests that reversal and lower values of the exchange rate are just around the corner.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.1052 and the initial downside target at 1.0521) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

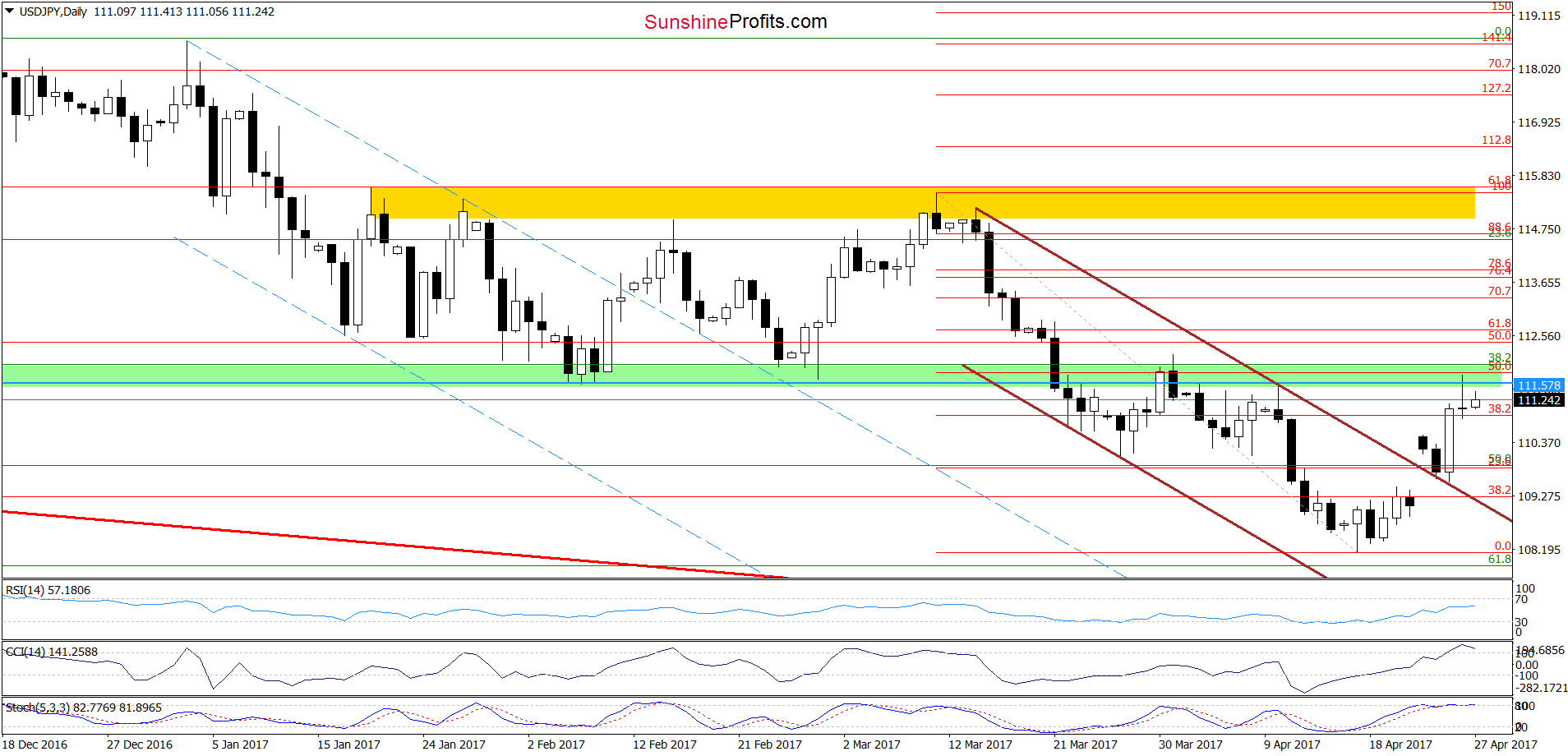

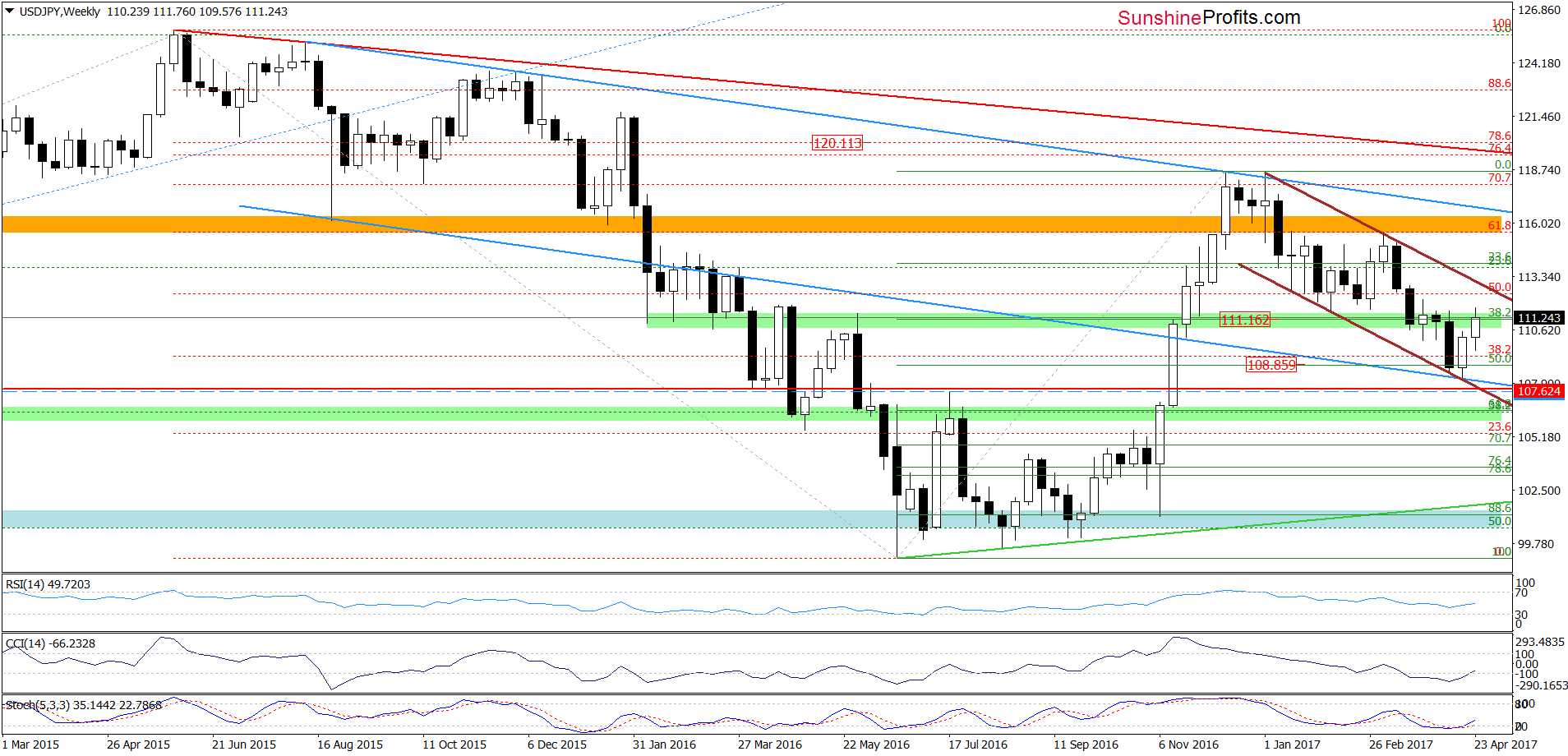

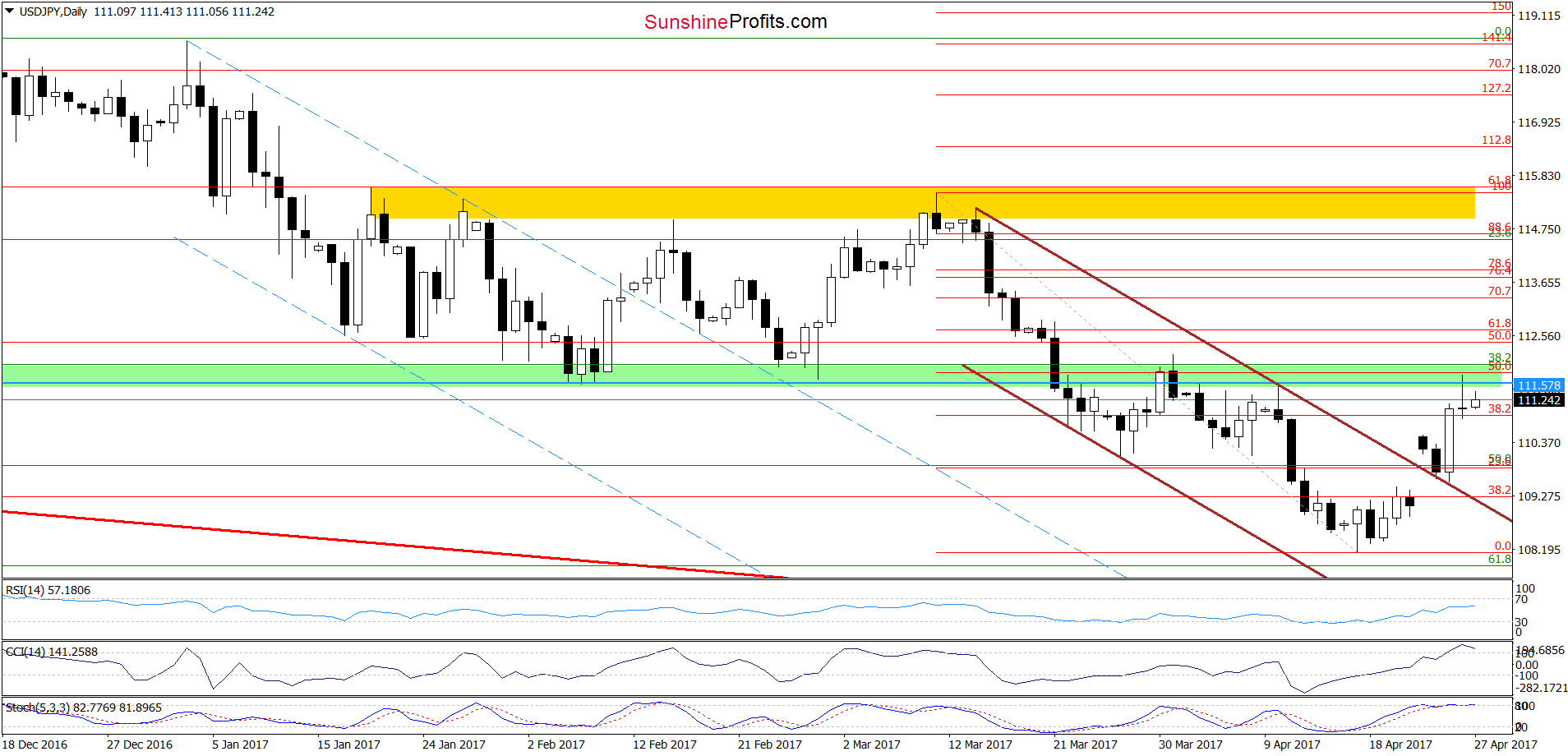

USD/JPY

Quoting our last commentary on this currency pair:

(…) the combination of the lower border of the brown declining trend channel and the lower line of the blue trend channel (both marked on the weekly chart) triggered a rebound, which took the exchange rate above the upper line of the brown declining trend channel seen on the daily chart. Earlier today, the pair moved a bit lower, which looks like a verification of the earlier breakout. If this is the case, we’ll see further improvement and a test of the green zone (marked on the daily chart in the coming days.

From today’s point of view, we see that the situation developed in line with the above scenario and USD/JPY extended gains, making our long positions more profitable and reaching our first upside target yesterday. What’s next? Taking into account the green resistance zone and the current position of the daily indicators it seems that we may see a pullback in the coming days.

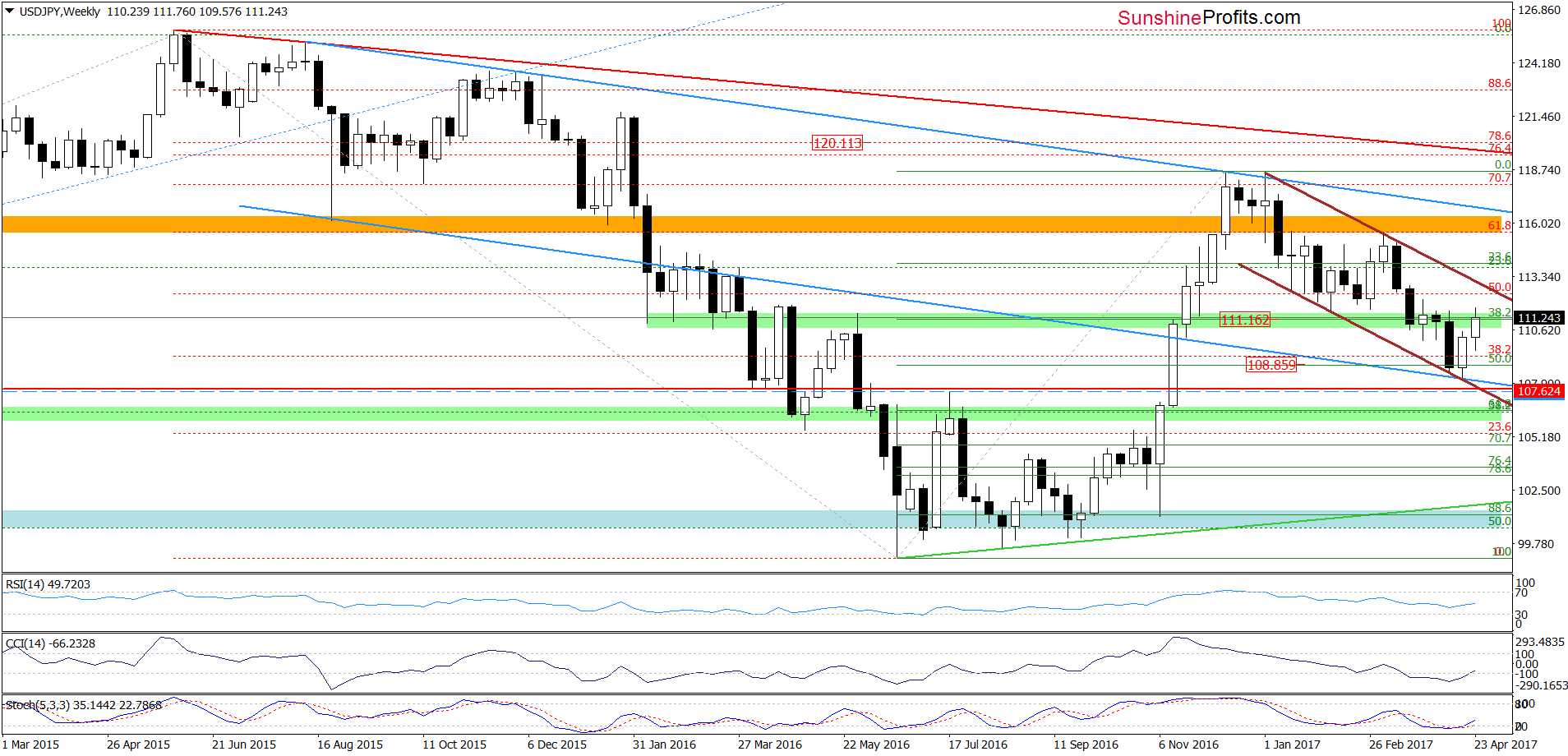

Nevertheless, when we zoom out our picture and take a closer look at the medium-term chart below, we see that the buy signals generated by the weekly indicators remain in cards, supporting currency bulls and further improvement.

Therefore, even if USD/JPY moves a bit lower in the very short-term perspective, we believe that higher values of the exchange rate are just a matter of time. This means that if the exchange rate breaks above the green zone, we’ll see (at least) a test of the upper border of the medium-term brown declining trend channel in the following days.

Very short-term outlook: bullish

Short-term outlook: bullish

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Long (already profitable) positions (with a stop-loss order at 107.62 and the initial upside target at 111.16) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

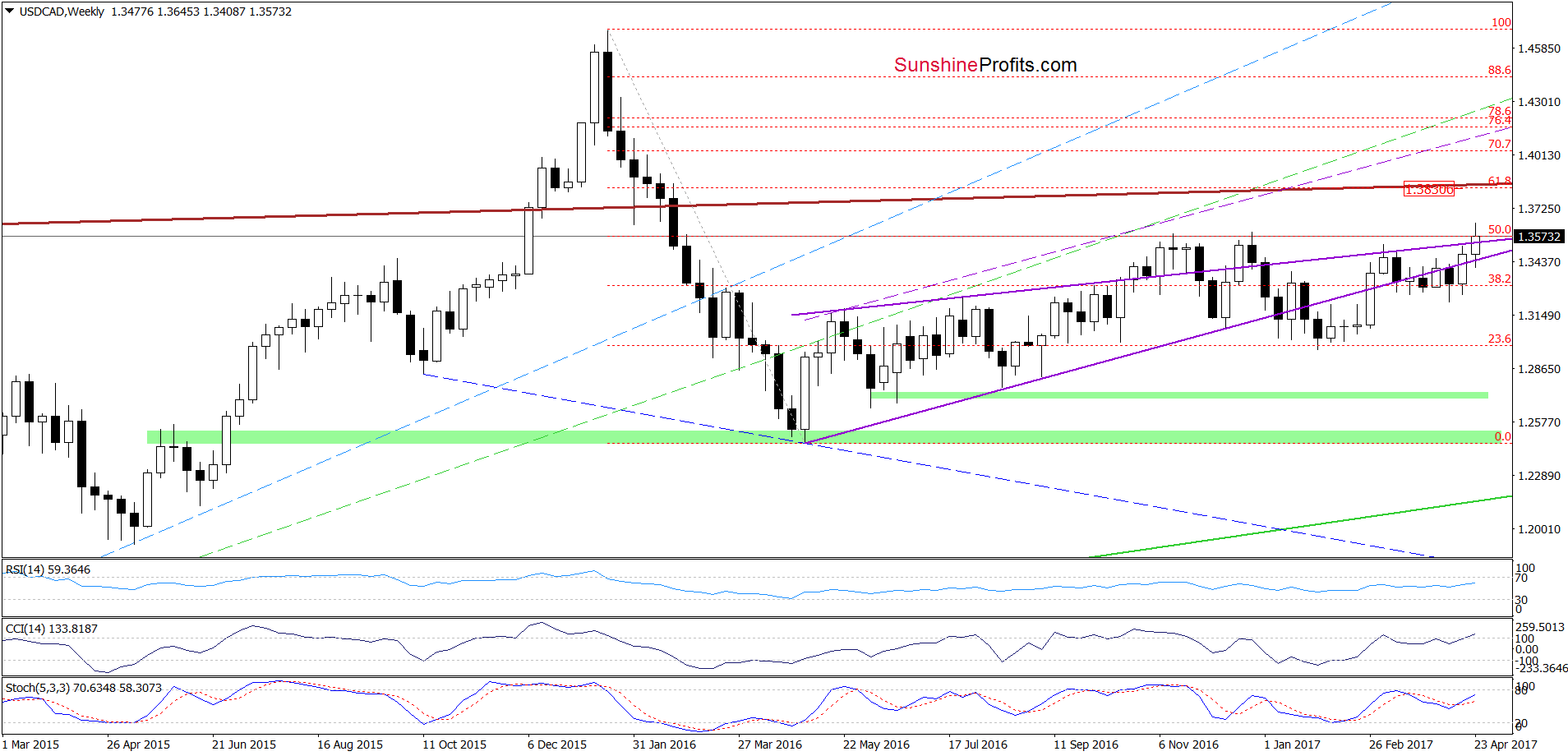

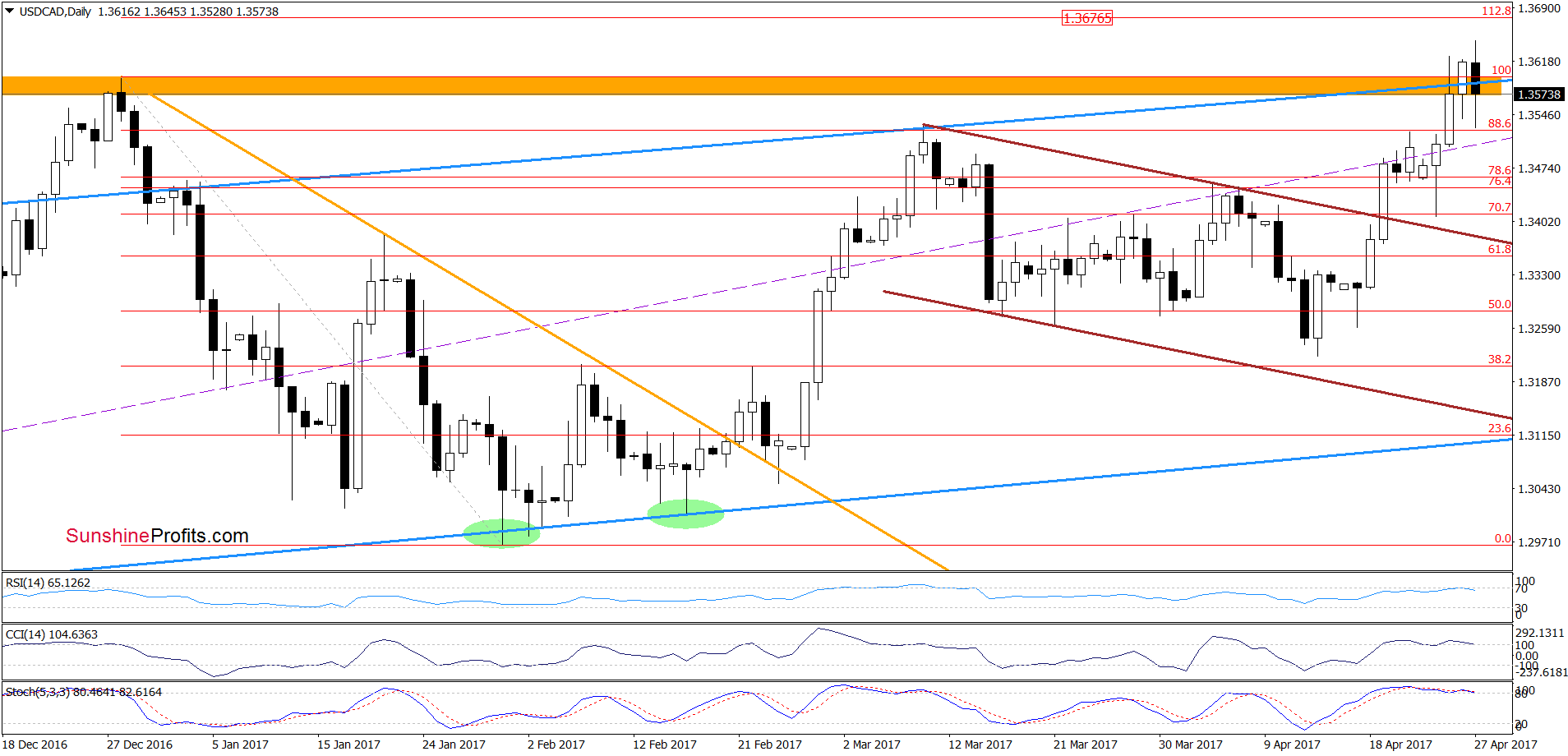

USD/CAD

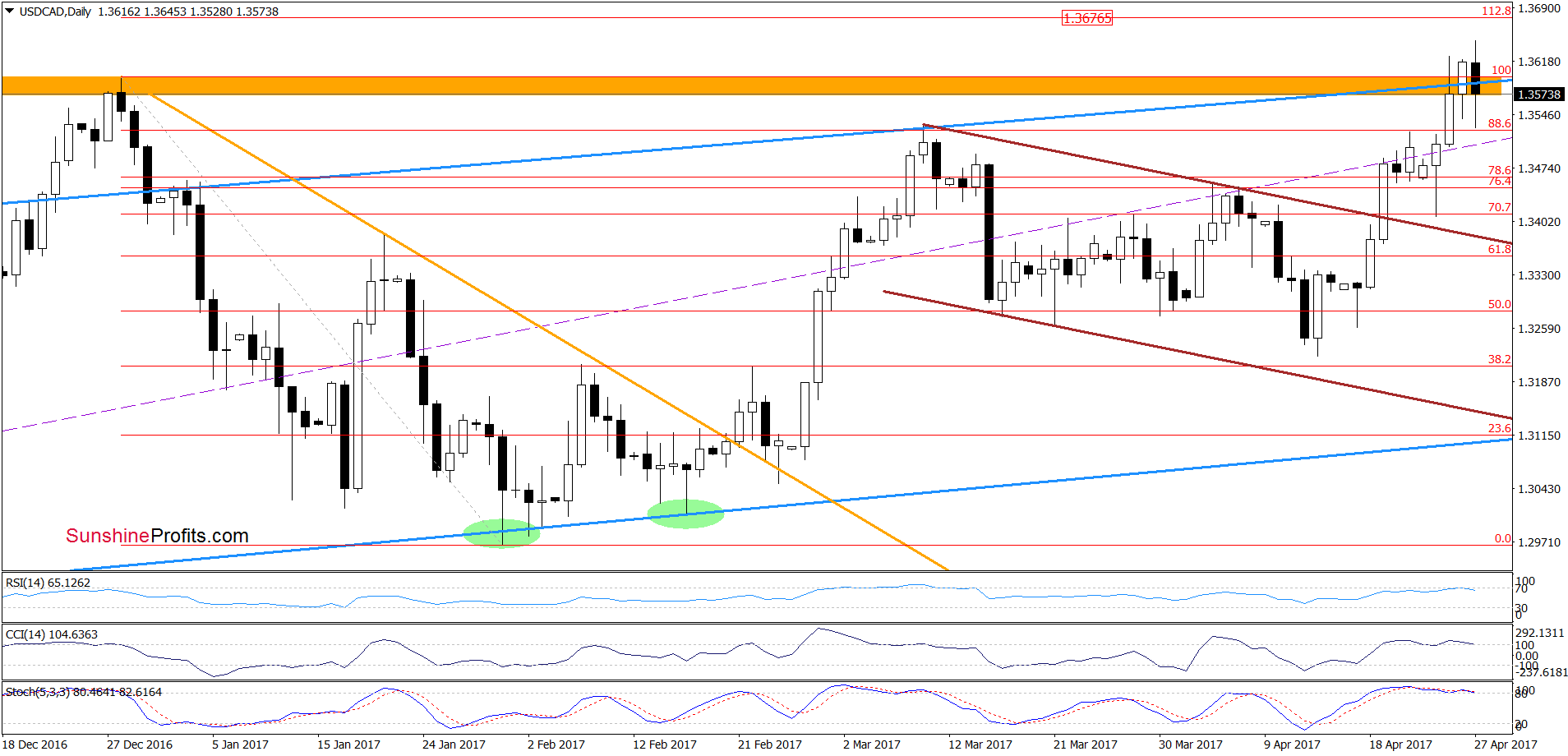

On the daily chart, we see that although USD/CAD broke above the December high and the orange resistance zone, currency bulls didn’t hold gained levels, which resulted in a pullback earlier today. Thanks to this move, the pair invalidated the earlier breakout, which is a negative development – especially when we factor in the current position of the daily indicators. Nevertheless, this event will be more bearish and reliable only if USD/CAD closes today’s session under the previous peak and the orange zone.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager