Currency

Will the dollar continue to trend down and will it be enough to sustain a broader move in equities above their respective highs – is the follow up question for investors and traders alike. Over the near-term, the major benchmarks for the dollar continue to flirt with the lows from last fall; a spot we have speculated would provide support for a retracement bounce. Considering the strengthening inverse correlation that equities and the dollar have trended with since that time, the S&P 500 is now bumping up against its highs from last fall as well. Although the bounce in the dollar may move first, we do not believe the rally in equities is sustainable or represents a major breakout from the range the markets have remained within over the past 2 years.

Will the dollar continue to trend down and will it be enough to sustain a broader move in equities above their respective highs – is the follow up question for investors and traders alike. Over the near-term, the major benchmarks for the dollar continue to flirt with the lows from last fall; a spot we have speculated would provide support for a retracement bounce. Considering the strengthening inverse correlation that equities and the dollar have trended with since that time, the S&P 500 is now bumping up against its highs from last fall as well. Although the bounce in the dollar may move first, we do not believe the rally in equities is sustainable or represents a major breakout from the range the markets have remained within over the past 2 years.

The truth is always somewhere in between.

Having done this for a while, I’ve seen lots of Jekyll/Hyde impersonations from the market, but none this drastic. Truly, every single assumption people held about the markets in January has turned out to be 100%, completely, utterly wrong.

Only in financial markets can one thing be true in January and the complete opposite thing can be true in April.

You need a lot of personal qualities to be a good investor, but intellectual flexibility is very high on the list. In fact, you need to be so intellectually flexible that you can hold two opposing ideas in your head at the same time.

Very few people can do this. The idea that two opposite things can both be true—impossible.

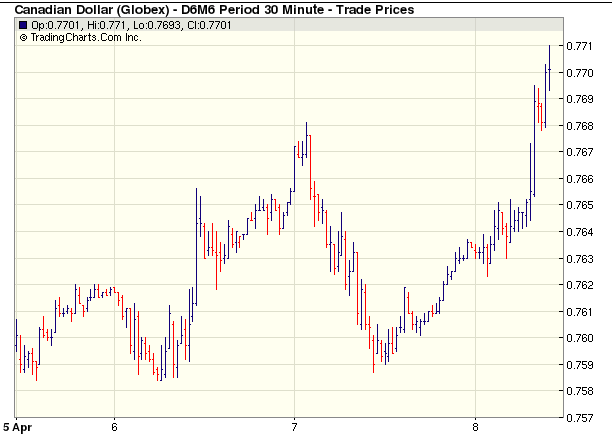

I remember telling people a few months ago that there was every reason for the Canadian dollar to get weaker, fundamentally speaking—and that it would probably head higher. The following two things can both be true:

- Canada is experiencing an energy bust and has a housing bubble and is headed for a prolonged period of economic weakness.

- The Canadian dollar can go higher.

There are a lot of Wall Street people who don’t understand this. Someone asked me yesterday about Brexit, what I thought it would do to GBP.

The pound would strengthen, I said.

“That makes no sense,” he replied. The BOE would have to ease monetary policy to offset a weakening economy caused by exiting the EU. GBP should weaken.

“But,” I said, “everyone’s been hammering GBP the last six months on Brexit fears, and they continue to hammer it, so when they finally vote for it, everyone will be short and will have to cover.”

In fact, high up on my list of trades I want to put on is buying pound sterling about a week before the referendum. It will go up no matter what the result is.

The Apparent Contradiction of My Portfolio

I’ll give you a sneak peek into my portfolio, in very broad terms. I am:

- Short commodity-producing G10 countries

- Long EM, gold, and commodities

People tell me this all the time. They say, “There is no possible way for both of those things to work at the same time. If 1) works, 2) won’t, and vice versa.

I have been pounding the table on the EM/gold/commodities/risk trade for months. People say, well, that means your Canada short will go up an uncomfortable orifice. And that is what has happened pretty much so far.

But remember intellectual flexibility: the idea that two opposite things can both be true simultaneously. Commodities can go up, and Canada can go down. It can happen.

The reason it can happen is because Canada can behave idiosyncratically if its housing market comes unglued. Prices were goofy seven years ago, and they’re many times more goofy today—just sheer madness. If there were a crash, the Canada short would work, in spite of commodities going up.

The same is also true of Australia and Norway.

This is how alpha is generated. If I am just long commodities and I get it right, I am not smart, I am lucky. I managed to successfully market-time something. That’s great, but big whoop.

If you have two opposite trades on and you make money, not only will you have generated alpha, but you will have done so by minimizing volatility. That’s the holy grail of investing, right there.

You would be pretty shocked at the number of professional money managers out there whose business plan is to pretty much market-time stuff. It is no wonder that hedge fund performance has been so miserable the last two years. There has been no trending market to time.

The vast majority of money that’s lost in the markets is lost because people are intellectually rigid. “That can never happen,” they say. Or they don’t even consider something to be within a range of possibilities. Then they are surprised.

I am rarely surprised anymore. This is a very good thing.

By the way, in case you missed it, here’s the link to the video interview again—just click on the screenshot below.

Jared Dillian

Editor, The 10th Man![]()

also: Larry Edelson on How Markets Outwit You

Jared’s premium investment service, Street Freak, is available now. Click here for our introductory offer. Jared Dillian, former head of ETF Trading at one of the biggest Wall Street firms and author of the highly acclaimed book, Street Freak: Money and Madness at Lehman Brothers, shows you how to pick and trade trends, and master your inner instincts. Learn how to use “Angry Analytics” as a leading indicator of budding trends you can profit from… and how to view any market situation through the lens of a trader. Jared’s keen insight into market psychology combined with an edgy, provocative voice make Street Freakan investment advisory like no oth er. Follow Jared on Twitter at @dailydirtnap.

The Canadian dollar zoomed to 77 cemts as renewed optimism about the prospects for global economic growth sent oil prices soaring.

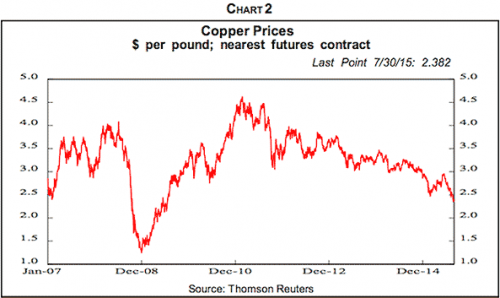

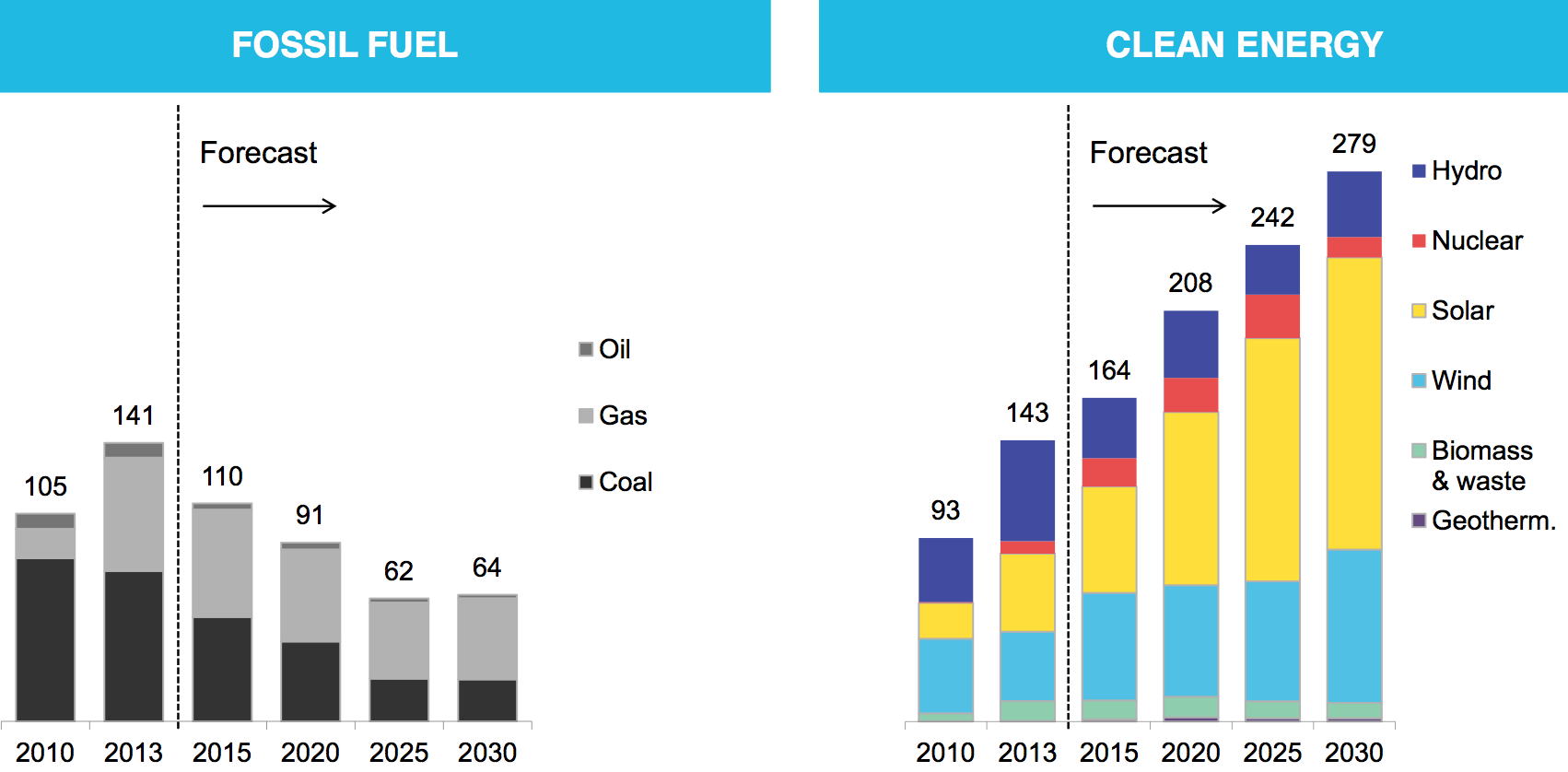

Oil

The U.S. dollar retreated below the key C$1.30 USDCAD, -1.3693% level for the first time in a week, with one dollar buying C$1.2982 in recent trade. By comparison, it bought C$1.3143 late Thursday in New York.

Robust data on housing starts and the Canadian labor market also helped support the currency by giving the Bank of Canada more reasons to keep monetary policy on hold. Canada is a major crude-oil exporter and moves in its currency, also referred to as the loonie, are often closely correlated to moves in oil prices.

….for the MIG Bank Daily Currency Report go HERE

The reality is that we’re one panic away from foreign-exchange markets ripping free of central bank manipulation.

The reality is that we’re one panic away from foreign-exchange markets ripping free of central bank manipulation.

While all eyes on fixated on global stock markets as the measure of “prosperity” and “growth” (or is it hubris?), the larger force at work beneath the dovish cooing of central bankers is foreign exchange: the relative value of nations’ currencies, which are influenced (like everything else) by supply and demand, which is in turn influenced by interest rates, perceived risk, asset purchases and sales by central banks and capital flows seeking the lowest possible risk and the highest possible return.

Which brings us to Triffin’s Paradox,

…..continue reading Triffin’s Paradox Revisited: Crunch-Time for the U.S. Dollar and the Global Economy April 5, 2016 HERE

also:

The Network Effect, Jobs and Entrepreneurial Vitality April 7, 2016

The Panama Papers: This Is the Consequence of Centralized Money and Power April 6, 2016

….as Volatility Curves Invert

The $5.3 trillion-a-day foreign-exchange market is getting turned on its head.

For the first time since 2010, traders of all five of the world’s most-transacted currency pairs are more wary of price swings in the next three months than over the next year. Typically, longer-term measures of volatility are higher to account for future uncertainty.

The last time the volatility measures were all inverted, markets were caught in the midst of the Greek debt crisis.….continue reading HERE