Economic Outlook

Bank Credit Analyst: Stuck in a Rut

Friedman: Italian Debt Crumbles

Bremmer: Transatlantic Breakdown

Lewitt: The Great Unwinding

Kass: No-Growth Stagflation

Zervos: Spoos & Blues

Jensen: Liquidity Crisis Ahead

Weldon: Currency Wars

A Few Final Thoughts

Hollywood (Florida), Cayman Islands, and Surprises

“The expected rarely occurs and never in the expected manner.”

– Vernon A. Walters

“The fundamental nature of exploration is that we don’t know what’s there. We can guess and hope and aim to find out certain things, but we have to expect surprises.”

– Charles H. Townes

I see it every December and January: in the flurry of economic and political forecasts, someone says we ought to “expect a surprise.”

Phrases like this drive the writer part of me crazy. A surprise, by definition, is something you don’t expect, so telling us to expect one makes no sense. They might as well say, “Expect the warm water to be cold.” The words don’t go together that way.

The analyst part of me, though, knows what they really mean: not that we should expect a particular unforeseeable event, but that we should recognize the probability that we will be surprised in some way, at some point.

In fact, that prediction is almost always realized. I can guarantee you’ll get surprised this year. I can’t guarantee what specific events will surprise you, but I can make some educated guesses, as I did last week in “Economicus Terra Incognita.” Today we’ll go a step further and look at some of the “surprises” others are seeing in their crystal balls.

We can acknowledge the difficulty of making forecasts while also learning from informed speculation. How to do this? Pay attention to people who know their limitations. The most useful forecasts come from well-informed analysts who understand the very real boundaries that guide speculation about the future. One of my favorite Clint Eastwood lines, which I often quote to my children and friends, is the familiar, “A man has to know his limitations.”

Last week we discussed the limitations of forecasting. Condensed into one paragraph, my forecast said that world GDP will continue to decline, while the US will have slow growth – closer to 1% than 2% – but we shouldn’t plunge into recession without a shot across the bow to the US economic system from overseas. I speculated that such a shock might come from the collapse of Europe, a true crisis in China (beyond falling to 3–4% growth), or an uncharacteristically severe bear market in stocks. In the past, bear markets have not caused recessions – the causality is the other way around. But in the past, the US economy was not sputtering along at stall speed, so I don’t think we can rule out causation running the other way. All my other forecasts follow from those basic thoughts, which you can read if you like.

So today we’ll look at 2016 forecasts from some professionals I trust. I know most of them personally and have been friends with some of them for years. I know they aren’t just “talking their book.” They may turn out to be wrong, but if so, it will be for the right reasons. After we review the forecasts, we’ll look at some common threads among them, as well as important differences.

I should also note that some of the following material isn’t normally available to the public. My friends either sell it at very high prices or share it only with their well-heeled clients. They let me publish it for two reasons.

First, they know I will present their opinions fairly and respectfully, even if I disagree.

Second, they know my readers are intelligent folks with whom they might form fruitful business relationships. So if you see promising connections, I urge you to contact them and explore the potential. Now, on with the show.

The venerable Bank Credit Analyst traditionally begins each year by transcribing a conversation with longtime (and possibly mythical) subscriber, “Mr. X,” who shows up in their offices very concerned and full of questions. Strangely, Mr. X always seems to reflect my own concerns, so I look forward eagerly to the BCA new year’s issue. Former editor and now chief economist Martin Barnes and his team endeavor to lay Mr. X’s concerns to rest. I have been reading the Bank Credit Analyst for 25 years.

Much of what I learned early on about the markets I gleaned by reading and talking with Martin Barnes. The ring of authority and certainty in his deep Scottish brogue weaves a spell, making you want to believe that the world is as Martin sees it. That things often turn out the way Martin expects comes as no surprise. Some of my favorite personal moments have come sipping scotch with Martin late at night at Leen’s Lodge, Grand Lake Stream, Maine, gazing at the stars as we vigorously contend over the minutiae of economics. And if I ever become particularly confused, I have the privilege of being able to pick up the phone and call Martin, who will at least talk me off the ledge. However, I digress.

On this year’s visit, Mr. X is mightily concerned that extreme central bank monetary policies are creating major economic and financial distortions. He sees a risk-filled environment and wonders if he should cut his equity exposure. (Note: BCA’s letter was published in December, before this year’s market fall.)

This year, BCA says Mr. X is right to be concerned. The team believes the sluggish economic recovery stems from structural rather than cyclical factors. In BCA’s view, the “debt supercycle” (a concept they developed multiple decades ago) is now ending in a very slow turn that could take another decade or more to complete. We are not dealing with a normal balance-sheet recession and recovery. Modest income growth is constraining demand, which in turn constrains debt reduction.

All kinds of interesting consequences spring from this view. BCA openly wonders if we may have reached “Peak Globalization.” This is a rather un-BCA type of thing for BCA to worry about – which makes me pay all the more attention. It is now on the list of things I must ponder. World trade volumes are no longer growing faster than world GDP. At the same time, technologies like 3-D printing and robotics are making it possible to produce goods closer to consumers. Thus, in order to compete, companies must set up factories closer to their final markets rather than building in their home countries and exporting. Calls for tighter immigration controls are really a form of trade tariff. They impede an important good – labor – from reaching its optimal position.

Like Ian Bremmer (below), BCA believes China will avoid a hard landing, but they do foresee lower Chinese growth in the future. Emerging markets in general face tough times, especially those with excessive debt. BCA is mildly bearish on oil, gold, and other commodities and thinks the US dollar is likely to gain further against emerging and commodity-oriented currencies.

A few quotes are in order:

The current global economic malaise of slow growth and deflationary pressures reflects more than just a temporary hangover from the 2007–09 balance sheet recession. Powerful structural forces are at work, the effects of which will linger for a long time. These include an ongoing overhang of debt, the peak in globalization, adverse demographics in most major economies, monetary policy exhaustion, and low financial asset returns. Investor expectations have yet to adjust to the fact that sub-par growth and low inflation are likely to persist for many years….

The Fed will raise interest rates by less than implied by their current projections. And the European Central Bank and Bank of Japan may expand their QE programs. Yet, monetary policy has become ineffective in boosting growth. Fiscal policy needs to play a bigger role, but it will require another recession to force a shift in political attitudes toward more stimulus….

The Fed will raise interest rates by less than implied by their current projections. And the European Central Bank and Bank of Japan may expand their QE programs. Yet, monetary policy has become ineffective in boosting growth. Fiscal policy needs to play a bigger role, but it will require another recession to force a shift in political attitudes toward more stimulus….

The fundamental backdrop to corporate and EM bonds remain bearish and spreads have not yet reached a level that discounts all of the risks. A buying opportunity in high-yield securities could emerge in the coming year but, for the moment, stay underweight spread product….

The dollar is likely to gain further against emerging and commodity oriented currencies. But the upside against the euro and the yen will be limited given the potential for disappointments about the US economy….

Friedman: Italian Debt Crumbles

Now let’s turn to geopolitical concerns for a moment. All my readers have had a chance to look at George Friedman’s 2016 forecast. New readers can access a summary for free hereand find a link to the full version. I can’t tell you how thrilled I am that George has partnered with Mauldin Economics. He brings so much to our table with his insights. Rather than go over what you have hopefully already read (and if you haven’t, you should), let me highlight one position he has clarified further since he wrote that forecast.

In a note entitled “The Precarious State of Italian Banks,” George and his team gave us an update on the serious financial problems facing Italy. You can find good news, but the bad news overwhelms the good. Nonperforming loans have now reached $216 billion, which is about 17% of Italian GDP. We have already seen some Italian banks fail rather spectacularly, and we are going to see that number increase. There is never just one cockroach. And while depositors are covered up to €100,000, that doesn’t do much good for businesses and wealthier households.

Italian bank debt is now very suspect. As it happens, Italians, rather than depositing their money in the bank at very little or no interest, buy bank bonds to get at least some return. In the recent spate of bank closings, 130,000 shareholders lost €790 million. The four small banks that failed represented just 1% of total Italian bank deposits. The total amount of bank debt held by Italian households is €237.5 billion. That’s billion with a B.Think of it as high-yield debt on steroids – except that it is generally very low-yield.

It’s not clear whether the Italian insurance deposit scheme has the money to cover even a fraction of the bigger potential losses. The ratio of assets to deposits covered is about 250 to 1. Now, the US FDIC’s required ratio is about 100 to 1, but US banks don’t have nonperforming loans of 17.9%, either.

Theres a lot more to this story than my brief summary can detail, but the point is that the problems in Europe don’t stop with the immigration crisis. The credit crisis of a few years ago has not gone away. Italy’s debt-to-GDP is growing every year, and it was already at a critical level five years ago – before the ECB took rates into negative territory and bought massive quantities of Italian bonds. They can continue to do that, but can they buy Italian deposits and defaulted bank debt? That’s rather doubtful. This is a story we will be watching closely as it unfolds this year.

You can sign up for George’s free “This Week in Geopolitics” letter here, or enjoy his team’s writings on a more or less daily basis for a phenomenally low introductory price by going here. Best deal in town.

Bremmer: Transatlantic Breakdown

Staying with the geopolitical theme, my friend and geopolitical expert Ian Bremmer of Eurasia Group isn’t one to jump at shadows. He very often shows how scary headlines really aren’t so scary. He’s usually right, too.

However, Ian and his Eurasia Group colleagues just published a detailed 2016 geopolitical risk analysis in which they foresee a “dramatically more fragmented” world in the year ahead. Political divisions are breaking down the existing order all over the globe. Unity is in short supply everywhere.

Nowhere is this lack of unity more potentially harmful than in the US–European alliance. That relationship has been the cornerstone of the international architecture since the close of World War II. The NATO military alliance is only one facet. There is also the Bretton Woods currency regime, the United Nations, the World Trade Organization, the International Monetary Fund, and the World Bank. All are weaker and less relevant now than they have ever been.

Why is the framework falling apart? Ian points to three reasons.

First, China’s ascent, along with that of other emerging markets, added a new dimension to a previously bilateral world order. No longer can we reduce every conflict to “East vs. West.” Now both East and West contain several distinct power centers, each of which has its own unique interests and priorities.

Second, Ian says, unilateral moves by both the George W. Bush and Obama administrations have displeased our allies. He cites both the electronic surveillance that Edward Snowden revealed and the growing “weaponization” of finance as forms of coercive diplomacy.

Third, European leaders have their hands so full with internal political and economic challenges that they now pay less attention to global strategic issues.

The result is that we have a bunch of powerful governments all going their own way. That’s why international bodies like the UN and IMF appear so paralyzed. To various degrees, they are paralyzed. Without their coordinating role, all kinds of conflicts will be more problematic than they were in the past.

This is only the first item on Ian’s list, by the way. He has nine more of varying severity. On the bright side, his report debunks two well-known threats as “red herrings.” Despite Donald Trump’s sound and fury, even if he reaches the White House, Congress and the courts will stop Trump from implementing most of his more radical ideas. The election will be much noise but little substance. (The president has less real power than you might imagine, an original design feature from our founding fathers.)

Ian’s second red herring is China. He thinks the Xi Jinping government can continue to manage its economic transition and maintain social order. China has its challenges, but the much-feared “hard landing” will not happen – at least not in 2016 – says Ian.

Michael Lewitt’s newsletter, The Credit Strategist, is consistently on my “must-read” list. It is one of the better-written and more thought-provoking sources I follow. Unfortunately, his current outlook is not at all encouraging. He thinks we are in the early stages of unwinding the largest credit bubble in history. Things are going to get much worse before they get better.

In his Jan. 11 issue, Michael points out that most of the S&P 500 stocks are already in bear territory, down 20% or more from their 52-week highs. He thinks the bullish narrative is flat-out wrong. Then he unloads this broadside, which I cannot possibly summarize and so will quote in full:

Investors need to learn to ignore what they are told by the establishment and think for themselves.

The same government that wants to deny that radical Islamic terrorists seek to destroy us is telling people that the U.S. economy is strong.

The same Chinese government that backs Iran and actively undermines American interests around the world claims its economy is growing at high single digit rates while electricity production, commodity prices and other data tell a much darker story.

And a Federal Reserve that creates bubble after bubble while issuing forecasts that make weathermen look like Nostradamus tells us the economy is so strong that it plans to raise interest rates four more times in 2016 while commodity prices plunge, 96 million people can’t find work, and it could barely bring itself to squeeze a 25-basis-point hike out of its tightly clenched loins after seven years.

Anyone who believes a word that any of these people say is, not to put too fine a point on it, a fool.

Ouch. I assume he is not speaking of the Motley Fool kind. On the other hand, it is hard to argue with him. Positive spin from the US government, the Chinese government, and the Federal Reserve often fails to match reality.

I think we can strike a middle road, however. Yes, take everything they tell us with lots of salt. It is not necessarily in their perceived interests to give us the complete, unvarnished truth. Occasionally, though, they slip up and give it to us straight. We should watch for those occasions and pay attention to them.

Michael thinks the Fed will soon retract its December rate hike and launch another round of quantitative easing. More QE won’t help, but it is all they know how to do. In that scenario, Lewitt’s prescription is simple: sell all your stocks, buy gold, and ride out the storm.

My old friend Doug Kass heads Seabreeze Partners Management and writes for RealMoney Pro. His custom is to identify 15 potential surprises that each new year could bring. You can read the full list here. Here are some I think are noteworthy.

Surprise No. 1: Terrorism Dismantles an Already Fragile Global Recovery

I fear we’ll see attacks that demonstrate how terrorism incidents are systemic and not simply isolated. It could become apparent that we face a broad, aggressive wave of terrorism aimed (as expressed by ISIS) at defeating the West’s world domination.

Acceptance of this notion would cause significant disruption in global markets and the world’s economies. Shares in airlines, hotels, entertainment companies (especially theme-park related) might suffer the most throughout the year.

This may well happen, but I’ll say this: if we let terrorist threats disrupt our economies, it will likely be because we let fear take control.

Surprise No. 5: America Falls into Recession and Stocks Tank

Too much debt, too little growth, fiscal-policy paralysis, a “spent” Federal Reserve and limited capital spending (which adversely impacts productivity) weigh down stocks in 2016. So do crony capitalism, geopolitical instability a further narrowing of market leadership and a further technical breakdown.

This one would not much surprise me, for exactly the reasons Doug states. We are overdue for a recession. I think it will more likely strike in 2017, but I would admit that the probability of a recession this year is not low. I think a painful stock correction is likely even if we avoid slipping into outright recession. It may have already started, in fact.

Surprise No. 6: Stagflation

I think stagflation could join “screwflation” as a concern for 2016. Wages could rise and non-energy commodities (particularly agricultural) could pass the Federal Reserve’s inflation target despite disappointing US growth.

Although we could see slowing and recession-like growth in 2016’s third and fourth quarters, the yield curve won’t invert. But oil and a drought that causes higher agricultural prices could raise headline inflation to well above the Fed’s target.

Our traditional inflation measures are less and less useful in reflecting everyday life. They overstate the benefits of lower oil and understate rising healthcare costs. The Fed hiked rates because it thinks inflation is approaching the target range, but wage growth is still mild or neutral. None of this makes sense.

Under “stagflation” we could see flat wages, lower fuel costs. and higher food prices. The result would be net negative for most people, but it won’t show up in CPI or PCE that way.

Surprise No. 9: The European Union Begins to Unravel

German Chancellor Angela Merkel’s open-door immigration policy backfires and causes her to resign, while Britain leaves the EU (a “Brexit”) under the assault of Euro-skepticism.

Separatist initiatives in Scotland and other countries advance and France’s National Front party rises to new heights in the face of immigration fears. Support to Greece and other EU peripheral countries diminishes, causing another emerging-market crisis. European borders are shuttered and trade comes to a halt.

This one could easily happen. This week we posted a short video with George Friedman. He is very concerned about Germany, for reasons you will see in the video; and Germany is Europe’s core. I’ve learned not to underestimate the EU’s ability to postpone the inevitable, but I don’t see how their union can last much longer, at least as currently structured.

Zervos: Spoos & Blues

David Zervos is the chief strategist at Jefferies & Company. He made a good call a year ago to raise European and Japanese stock exposure. Both outperformed US equities in 2015. Now he is losing confidence in that trade. He said this in a Dec. 22 year-end update.

I am ending 2015 much less confident in both the European and Japanese QE-led reflation trades. Mario [Draghi] seems to have rolled over to a strengthening anti-QE German-led contingent. And Haruhiko [Kuroda] cannot seem to overcome the politically charged distributional asymmetries in stimulus that arise from a weaker yen. I certainly remain hopefully that they both can push ahead, but hope is no foundation for a high-quality trading theme. Instead, I’m pivoting back towards my old flame – Janet!!

Thank you, David, for coining the phrase “politically charged distributional asymmetries.” It rolls right off the tongue.

David goes on to say how impressed he is with his old flame Janet Yellen’s skillful management of the Fed’s lift-off from zero rates. He thinks reflationary momentum will intensify as the year goes on. To take advantage, he suggests what he calls the “spoos & blues” trade. Spoos are the S&P 500 stock index and blues are US Treasury bonds. One or the other should do well in 2016, he thinks. He does not think the US can go into recession until we get an inverted yield curve, and we are a long way from an inverted yield curve.

Jensen: Liquidity Crisis Ahead

Neils Jensen at London-based Absolute Return Partners is one of the most thoughtful analysts I know. Like me, he thinks long-term and rarely attaches a time frame to his forecasts. Jensen thinks the big story of 2016 may be a “third leg” of the global financial crisis.

The first leg, of course, was the US subprime mortgage debacle and related breakdowns in 2007–2008. The second leg was the European sovereign debt crisis, which first blew up in 2010 and is still in progress, particularly in Greece.

What could be the next leg? One possibility he mentions is a widening emerging-market crisis as commodity prices fall further or remain weak. If the Fed follows through on its rate hike plans (far from certain), the dollar will strengthen further. This will make it harder for non-US borrowers to pay dollar-denominated debts.

That is a toxic combination for commodity-exporting companies and nations. Not only is their income plummeting due to low resource prices, but their debt servicing costs are increasing as the dollar moves higher. The potential for major implosions is significant.

I think this fear probably explains IMF chief Christine Lagarde’s open pleas for the Federal Reserve to consider the impact on emerging-market nations as it tightens policy. There is little sign the Fed intends to do so. I would argue that Yellen is right to ignore Lagarde. The Fed’s mandate is to maintain maximum employment and price stability in the US, not to bail out other countries. Nevertheless, the Fed could well spark an EM crisis that will spiral out of control and hurt everyone.

Jensen’s other “third-leg” candidate is a bond market liquidity crisis. New capital regulations discourage banks from holding non-sovereign bonds in inventory. The problem with this arrangement is that banks have long used their own inventories for market-making. They are the reason it is (or was) easy to move in and out of corporate and high-yield bonds with minimal slippage or delay.

Liquidity is shrinking even as the amount of money in bond ETFs and mutual funds is growing. These products promise their shareholders daily liquidity. See the problem? Last month’s collapse of Third Avenue Focused Credit Fund may turn out to be the dress rehearsal for more such failures.

Jensen sees a high probability for both scenarios (EM crisis and bond liquidity crisis) to happen in 2016. Neither will be good, but the second one will have much greater impact on other asset classes like stocks, if it happens. And it would certainly not be good for world GDP growth.

My book Code Red, written some 2½ years ago, laid out the rationale for why I and co-author Jonathan Tepper believed that the last half of this decade would see an intensifying currency war. Indeed, we made the point that Japan, under the guise of quantitative easing, had fired the first shot. Greg Weldon’s forecast for the next year is that the intensity of the initial currency skirmishes (my term) will increase this year. In his 2016 forecast he lists 20 countries that have seen the US dollar appreciate by 50% over the last five years, representing a total population of 2.2 billion people. He also notes the interesting fact (one that I missed – he is so good at finding these little details) that Zimbabwe is planning to use the Chinese currency in order to cement ties with China.

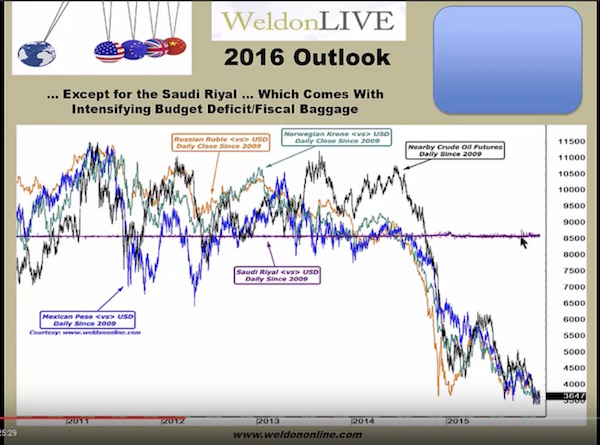

I will offer one of Greg’s scores of charts. It shows that the oil-based economies – Mexico, Norway, Russia – have seen their currencies fall along with the price of oil. The exception – the flat line in the graph – is the Saudi riyal, which is dollar-pegged. This peg can’t last, and the other currencies in the Middle East that are pegged to the riyal are also going to come under pressure. (I note that Saudi Arabia is selling oil into Europe at $26, clearly intent upon maintaining market share!)

Greg and I have been talking about these currency phenomena for a very long time. I’m not sure how far back we go. He is an old-school commodity trader and writer, and his rapid-fire PowerPoints and voice webcasts cover almost everything that can be traded. He is bullish the gold mining companies, with the caveat that, if the FOMC proves to be as hawkish as some of its members sound (i.e., for more interest-rate increases this year), then the dollar will get stronger and gold will come under intense pressure, possibly making new lows.

I agree. If you can tell me what the Fed will do, I will tell you, with 90% certainty, what gold will do. The problem is, since I am reasonably sure that the Fed doesn’t even know what it’s going to do, it is very likely you don’t know what it is going to do, either. We are all guessing. And guessing makes for a very fraught trading environment. You can see the first part of Greg’s “2016 Outlook” here.

Everywhere you look in the macro world, major and minor events reveal stress cracks at the edges. The Bank of Japan is now buying corporate bonds at negative interest rates in the open market. How in the Wide, Wide World of Sports can you have a functioning corporate bond market when somebody is buying at negative rates?

“The market had looked at the 0.1 percent level as the floor for corporate bonds, but if investors can be confident that they can sell the debt to the BOJ at negative levels, that level may come down,” said Takayuki Atake, an analyst in Tokyo at SMBC Nikko Securities Inc., a unit of Sumitomo Mitsui Financial Group Inc. “It’s a landmark that we’ve reached negative yields for corporate bonds.” (Bloomberg)

The VIX is back above its 400-day moving average, which is historically a good buying opportunity. While the absolute nominal index number has been higher, getting above the 400-day moving average is not the norm.

Long-term debt for oil exploration and production companies exploded by 70% since 2010 to $353 billion this last year, fueled by the low-interest-rate environment of the Federal Reserve. While the bonds are not selling well in the open market, the defaults are yet to come. Oil plunged below $30 this week, and there is a real possibility of its going much lower, given that Iran is, as of yesterday, free and clear to go into the markets with its production.

I could list multiple dozens of odd and troubling facts, but the upshot is that the world has given us a difficult trading environment. Stick with me this year as I peer through the fog to find a few opportunities here and there.

And let me end on a positive note. Even with all our economic and geopolitical troubles, the progress of humanity in overcoming many persistent problems has been persistent and impressive. Technology and social understanding are advancing on dozens of different fronts.

Let me suggest you watch this short YouTube video. It shows Elon Musk’s Falcon 9 rocket landing on its pad. This rocket will cut the cost of space launches by 90% and perhaps eventually by 99% from today’s cost. If you can watch this video without your emotions jumping, if you can see the young men and women screaming in joy over their success and not want to join them in shouting as you watch the rocket deploy its fins at the last moment and touch down ever so gently, then you are probably an NSA spy cam linked to a computer and not a human being.

How can you not be an optimist? Really? How can you not be?

Hollywood (Florida), Cayman Islands, and Surprises

I fly next Sunday to Hollywood, Florida, where I will be at the ETF.com conference with some 2000 people, talking about all things ETF. I will be giving the keynote address at the Tuesday lunch, doing interviews, holding meetings, and of course doing the rounds of dinners and gatherings every evening. I expect to learn a lot.

The following week I will go to the Cayman Islands to speak at the Cayman Alternative Investment Summit, one of the biggest hedge fund and alternative investment gatherings outside of the US. They have an impressive lineup of speakers, and I note that this year the celebrity guest speaker is Jay Leno. That should be fun. I just looked through the speaker list and noticed that Pippa Malmgren, who will also be at my SIC conference (see below), is speaking, and it will be fun to catch up with her again. I will be on a panel (moderated by KPMG chief Economist Constance Hunter) with old and brilliant friends Nouriel Roubini and Raoul Pal. At least I know that with those two guys there is no need to wear a tie.

And that is pretty much it as far as the scheduled trips. I know I still have to get to New York and a half-dozen other places for short trips, and will let you know if I’m in your area. But we are really trying to limit the travel as the work on my book grows more intense. “Oh deadline, where is thy sting?” is the refrain that echoes in my mind. If you are trying to write a book on what the next 20 years will look like, you can’t take 20 years to write it.

Let me remind readers that my Strategic Investment Conference will be held in Dallas, May 24–27. We are finalizing the speaker list, which you can see at the website, and have just confirmed Niall Ferguson. I should note that both George Friedman and David Zervos, whose 2016 forecasts we just sampled, are among our all-star lineup. I am excited that on Thursday night we will be going to the biggest C & W bar in Dallas (Gilley’s, for you locals) and taking over the entire place; in addition to longnecks, Mexican food, and barbecue, we will enjoy a conversational shoot-out featuring Michael Barone, Steve Moore, and Juan Williams, with a focus on the upcoming elections. Who knows – maybe we’ll be talking about Biden versus …??? And maybe even a brokered Republican convention.

You can’t even imagine what chaos a brokered convention would be. I have been a delegate to national conventions, where I have been intimately involved with and have led multiple floor fights on the state level at the largest state convention in the country. We haven’t seen an open floor fight at the national level since 1948, and back then we had powerbrokers. Today there are no powerbrokers of any real consequence. And you may think that this or that candidate will walk in with a certain percentage of delegates that are “his” or “hers.” That’s not how it works. After the first vote, where you are committed, you are no longer legally bound. You simply have no idea what chaos could ensue. Maybe I should write about that story. The Rules Committee for the national convention, whose work is normally both arcane and mundane, is already engaged in serious discussions. And if things haven’t changed by the time the gavel falls to open the convention, the convention gets to adopt its own rules. Normally, the rules suggested by the Rules Committee go uncontested. (I think maybe in ’76 the Reagan delegates kicked up a little fuss.) Adding to the fun, the current Rules Committee members generally have to be reelected before the next convention. I can guarantee you, last year no one thought the most interesting committee assignment would be on the Rules Committee. And maybe it won’t be.

The flipside of a brewing floor fight is that the media would be focusing on the convention for months in advance and would go to 24-hour coverage during the convention. It would be the ultimate reality TV show. Who gets voted off the island? Who gets fired? You couldn’t buy that kind of TV time.

It is time to hit the send button. I think I am going to see Leonardo DiCaprio in The Revenant. My “Sunday off” will be spent reading Matt Ridley’s new book, The Evolution of Everything. A relaxing way to do research for my own book. Cool techie hint: if you read a book in the Kindle app (as I do on my iPad), you can highlight and make notes and then go to them on your personal Amazon Kindle page at some later date. You’re actually allowed to cut and paste from there. I fantasize about having my highlighted sections and notes from every book I’ve read for the last 50 years somewhere in the cloud. Dear gods, I would be dangerous.

Your rationally optimistic analyst,

John Mauldin

subscribers@MauldinEconomics.com

Earlier in the week I asked my friend Gary Shilling if he could give me a summary of his 2016 forecast. He agreed to do so and sent it on. Then this morning he sent out a special short report on China that offers what I think is a valuable perspective that differs from what we’re seeing in the headlines – John Mauldin

The current turmoil in the Chinese economy and financial markets is shaking security markets globally as the yuan nosedived in the first week of this year and Chinese equities lost $1.1 trillion. What a contrast to the 13.3% compound annual growth from 1992 through 2007 (Chart 1) that propelled China’s GDP from 9% of America’s total to 59% last year (Chart 2)! So China moved ahead of Japan in 2009 to become the world’s second-largest economy as hundreds of millions of Chinese rose from poverty.

Reveling in Success

The Chinese revel in that success. They view themselves as the world’s superior society, and have chafed at being under European thumbs in the 1800s and Japanese hegemony in the last century. For years, the Chinese have lusted to be big players on the global stage, and have her yuan currency recognized by the International Monetary Fund as a reserve currency, right up there with the dollar, euro, yen and sterling. It finally was late last year.

They also have enjoyed the widespread conviction in the West that, with recent sluggish growth in North America and Europe, China was inheriting the mantle of global economic leadership. Indeed, many observers in and out of China believed that growth there would spill over to the West and spur gains in North America and Europe.

Leadership Direction

In fact, however, economic leadership has been the reverse. Like virtually all developing economies, China’s has been driven by exports that directly or indirectly are sold to North America and Europe. And those imports by the West are fundamentally curtailed by sluggish overall economic growth, the result of deleveraging, the working off of excess debt built up in the exuberant 1980s and 1990s. Annual Chinese export growth dropped from 20% to 30% in the 2000s to a 7% decline last November from a year earlier (Chart 3).

In the U.S., real GDP growth has averaged only 2.2% since the recovery commenced in mid-2009, about half the rebound rate you’d expect after the deepest recession since the 1930s. Similarly, the eurozone has limped along at a 0.7% rate with another recession in 2011-2013 following the 2007-2009 global Great Recession while Japan’s real GDP has averaged 0.9% with three more declines of a least two consecutive quarters since 2009.

Globalization

Also, globalization the transfer of manufacturing and other production from the West to China and other emerging economies is largely completed, curbing that source of emerging economy advance. U.S. factory output as a share of GDP skidded from 17% in 1997 to 12% in 2009, but then leveled off when just about all the production that could be moved overseas was offshored (Chart 4).

The resulting weakness in the Chinese economy, however, was masked until recently by massive housing, capital spending and infrastructure investment. But the residues are excess capacity, ghost cities and total corporate and government debt that leaped from 160% in 2004 to 232% in 2014. Also, China’s huge total economic size covered up its still-underdeveloped status. Even with the explosive growth in the past several decades, Chinese GDP per capita in 2014 was $7,590, or just 14% of America’s (Chart 5).

Chinese leaders want to shift to a domestic-led economy driven by consumer spending and services, but whenever overall growth flags, they resort to the same old, same old infrastructure spending. So the result is even more excess capacity and more political and economic power for the inefficient State-Owned Enterprises. And officials merge them rather than allow them to fail. At the same time, private firms are starved for capital.

These actions not only reveal Beijing’s distrust of free markets but also its reluctance to address the trade-off between heavy industry pollution generation and economic growth. Meanwhile, consumer spending in China is almost off the chart compared to G-7 and even BRIC economies. It’s 34% of GDP in China vs. 59% in India, 60% in Italy and 68% in the U.S. (Chart 6).

Financial Pygmy

China is a giant in global manufacturing, but an amateurish pygmy on the worldwide financial stage. That was evident last summer when the government clumsily intervened to arrest the one-third drop in Chinese stocks after hyping equities as the way to recapitalize debt-laden SOEs (Chart 7).

Margin selling was prohibited, brokers and state-owned enterprises ordered to buy stocks and trading halted as share prices plummeted. More recently, institutions are only allowed to sell 1% of their stock positions, and then after three weeks notice. As scared investors traded yuan for dollars to ship overseas (Chart 8), Chinese foreign currency reserves fell $600 billion since last August to $3.3 trillion at year’s end. The removal of those yuan also shrinks the domestic money supply.

Then followed currency devaluation as China attempts to spur exports to revive economic growth, which is probably running only half the official 6.9% rate (Chart 1). Additional devaluation is likely but more subtly to avoid further massive flight from the yuan (Chart 8). Export subsidies, internal devaluation through wage and price cuts, and a shift from the dollar to a trade-weighted basket of currencies are all active possibilities. Notice (Chart 9) that since 2005, that the yuan has risen 26% vs. the dollar, but 40% against the trade weighted basket of currencies. This leaves China at a 14% currency disadvantage compared with her trading partners.

Chinese officials say they want to move toward free markets but still insist on top-down control a very difficult combination to manage. Following the market turmoil touched off by the 1.9% yuan devaluation last August 11, the central bank the People’s Bank of China said it would set the yuan’s daily fix, around which it is allowed to fluctuate 2%, in line with the previous day’s closing level. That would give markets more sway over its value than the previous administered rates.

But with this new mechanism, official attempts to weaken the yuan to spur exports and economic growth in early January resulted in a stampede out of the currency. So the PBOC abandoned that step toward a free market for the yuan and ordered the government-controlled large banks to buy yuan to support the currency. The daily currency fix is back to being a black box. This reality was driven home by the recent statement by a senior Chinese economic official that China has plenty of ammunition to defeat attacks on her currency. “Attempts to sell short the yuan will not succeed,” he said. “The expectations of markets can be changed.” Translation: We have ways!

Recently, China security regulators instituted a circuit-breaker system to protect investors from massive sell-offs by suspending trading after meaningful market losses. But reflecting disdain for stocks inherent volatility, they set the collar too narrow, at only 7%.

So it backfired after the limit was hit twice in the system’s first four days and was suspended on January 7, only 29 minutes into the trading day. Skittish retail investors that dominate the Chinese market dumped stocks in anticipation of an early market closing, and precipitated their expectation. That was the shortest trading day in the Chinese stock market’s 25 years.

Not Dead

China won’t shrivel up and die, but will be a much less important actor on the global stage, as she shifts her orientation from commodity-munching exports, housing and infrastructure to consumer spending and services. The same was true of Japan starting in the early 1990s. Before that, many Americans though they’d soon be working for Japanese companies or run out of business by then. The Japanese were buying Iowa farmland, Pebble Beach and Rockefeller Center with gay abandon. But at the end of the 1980s, Japan’s stock market bubble collapsed (Chart 10) as did overblown house prices (Chart 11), and the economy fell into the still-ongoing era of tiny 1.1% real GDP growth and deflation (Chart 12).

Similarly, Chinese stocks went off the cliff last summer (Chart 7) and residential housing activity has collapsed (Chart 13). And just as Japan’s delay in cleaning up the busted zombie banks in the 1990s and 2000s contributed to business malaise, China’s delay in restructuring the SOEs will likely have similar repercussions.

Furthermore, China has yet to address the trade-off between pollution and economic growth that Japan did earlier. We remember being in Tokyo in the 1980s when pollution was so thick that even on cloudless days, you still couldn’t see the sun.

Another parallel that’s slowing economic growth, in both China and Japan, is the declining work force. Population in Japan is actually falling (Chart 14) as the sub-replacement fertility rate combines with the longest G-7 life expectancy (Chart 15). When the effects of no legal immigration into Japan are included, the proportion of the total population of working-age is headed for the lowest level among major countries (Chart 16).

Old Before Rich

In China, the earlier one child per couple policy is slashing the number of prime new labor force entrants, the 15-to-24-year-olds (Chart 17), while the supply of rural labor to move to cities and man factories has run out. Unlike Japan, however, China is getting old before it gets rich.

The earlier massive buying of foreign assets by Japan was aimed in part at securing raw materials for her manufacturing juggernaut and markets for its output. In retrospect, however, it was also due to a dearth of growth-spurring investment opportunities at home. Ditto for China, which is now buying foreign real estate and other assets in huge quantities.

We keep extensive files of newspaper clippings and other information to help in writing our own reports. In the 1980s, the Japan files were measured in feet but our China files took only an inch or two. Today, it’s the reverse. Still, as shock-and-awe over China recedes in future years, along with China’s significance on the world stage, we expect our files on China to shrink back to Japan’s size.

Subscribe to GARY SHILLING’S INSIGHT and you’ll receive:

13 Monthly Reports (25-35 pages) via E-Mail for $335 ($375 via regular mail)

THAT’S 13 REPORTS FOR THE PRICE OF 12!

Your subscription will start with the January 2016 INSIGHT report that includes Gary Shilling’s long-term outlook, his 2016 investment themes, and his views on whether slow economic growth is here to stay.

TO SUBSCRIBE, CALL US at 1-888-346-7444 or 973-467-0070. Or E-MAIL US at insight@agaryshilling.com.

BE SURE TO MENTION OUTSIDE THE BOX to get your 13-month subscription.

(THIS OFFER IS AVAILABLE ONLY TO NEW SUBSCRIBERS.)

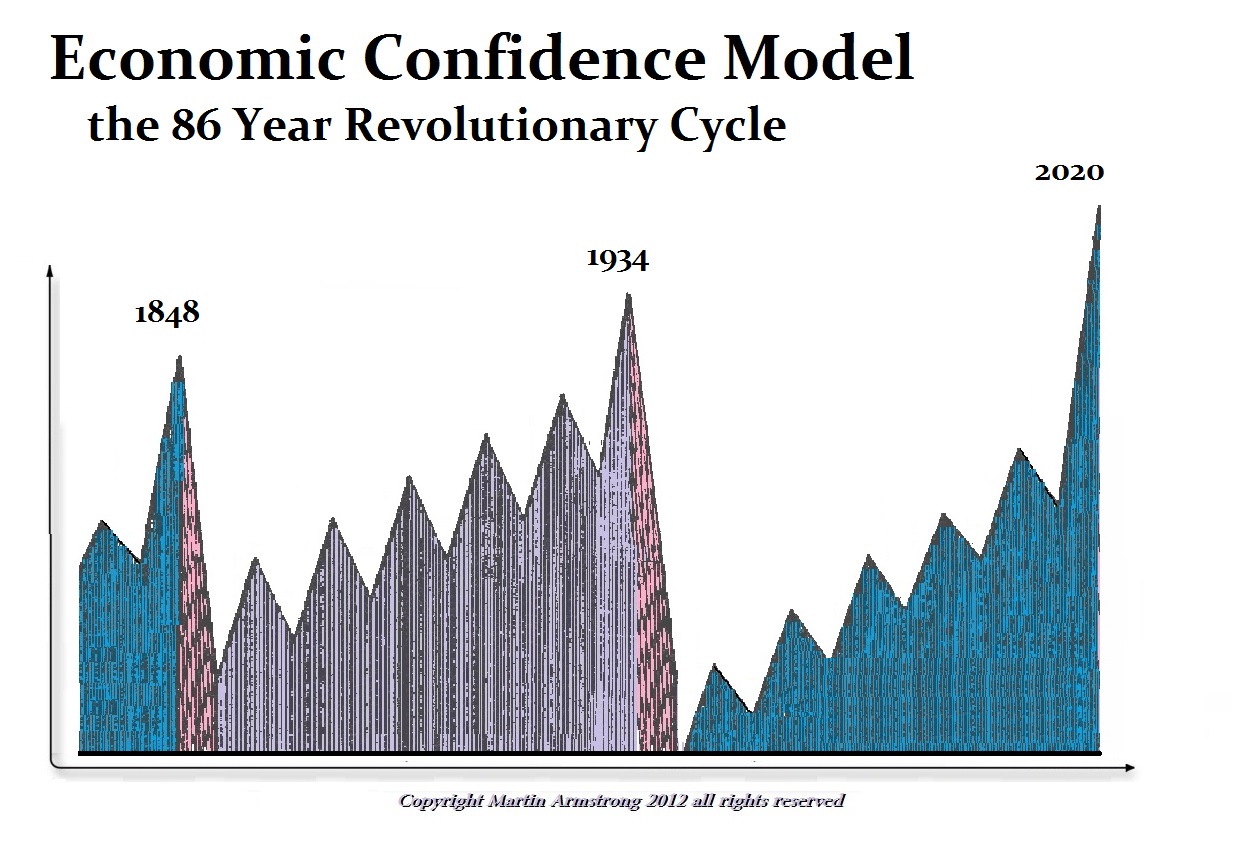

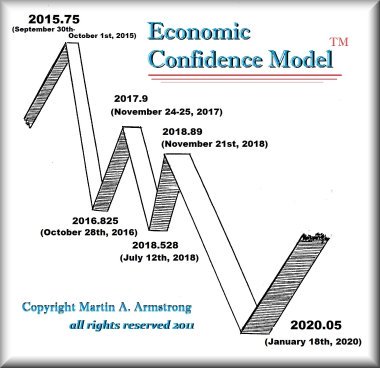

I have warned that 2017 will be the political year from hell. What I am illustrating here is the link between a sovereign debt crisis and the Revolutionary Cycle. In 1933, Roosevelt came to power in the USA and turned the country toward socialism. That same year, 1933, brought Hitler and Mao to power. So 1934 was the revolutionary year. Such revolutions do not always bring blood in the streets. The next one is due in 2020 and we should see the system we currently live under go completely upside-down.

The ISM purchasing managers’ index for the manufacturing sector in December 2015 in the USA has plummeted to its lowest level since June of 2009. This warns that the U.S. economy is entering a recession that is in line with the forecast of the ECM and the rise in the dollar.

The ISM purchasing managers’ index for the manufacturing sector in December 2015 in the USA has plummeted to its lowest level since June of 2009. This warns that the U.S. economy is entering a recession that is in line with the forecast of the ECM and the rise in the dollar.

However, keep in mind that this is simultaneously coming with the changing technology trend. By that, we mean that low-level jobs are being replaced rapidly by automated computers, in part, because of Obamacare and its Draconian tax burden upon business exceeding 25 employees. Therefore, unemployment will rise due to this expansion in technology and raising the minimum wage will accelerate that trend further.

In business, inventories are also shrinking as companies move to “just in time” methods by using technological advancements to minimize carried inventory. This trend is only further accelerated by the banks moving toward transactional banking where they are no longer interested in relationship banking. This also reduces the availability of loans for small business as banks do not want the risk.

The convergence of these trends will feel the recession ahead. Eventually, this will materialize in rising unemployment, a deepening crisis in student loans, and the fiscal mismanagement of governments demanding more and more taxes which will become a toxic cocktail of doom.

The ultimate rise in stocks in the years ahead (after a correction sling-shot move) will unfold simply as capital tries to secure its future by getting out of government bonds and banks.

Have you ever worked in a mind-numbing cubicle? I did when I was younger, and I hated it.

Being stuck in a cramped cubicle lit by overhead fluorescent lights, wedged between dozens of coworkers whose phone conversations and keyboard strokes—as well as bodily odors and noises—sucked a little bit of life out of me every single day.

My cubicle experience made me feel like a white-collar prisoner, and I knew this was not how I wanted to spend my professional life. I needed to either move up the company ladder or start my own business.

Maybe I’m just a crybaby, because tens of millions of people toil in cubicles every day.

The cubicle, created by office furniture maker Herman Miller, has been around since 1968 and must have contributed to thousands of white-collar suicides, but it is solidly entrenched in American business life today and generates more than $3 billion in annual sales.

More importantly, I consider the office furniture business to be an extremely useful economic indicator. After all,

businesses only buy large amounts of office furniture—including the dreaded cubicle—when they are expanding their workforce and growing.

That is why my bear market antenna started to twitch when I read what two of the largest office furniture and cubicle manufacturers in the world had to say.

Cubicle Hell Warning #1: If you’ve ever worked in a cubicle, the odds are good that it was made by Steelcase, a manufacturer of a wide selection of office furniture, including what they call “seating products,” aka cubicles.

Steelcase reported its quarterly results at the end of December. The company surprised Wall Street with a very pessimistic outlook, warning that the next two quarters would be worse than previously forecast because of declining sales.

- Quarterly revenue came in at $787.6 million; a 1.6% year-over-year decline. However, Steelcase warned that its sales could fall to $720–$745 million, roughly a 2% decline.

- Steelcase management said it expects to make per-share earnings of 20 to 24 cents in the current quarter, below the 25 cents Wall Street predicted.

- Cash on hand fell by 6.9%, and inventories increased by 2.4% in the last 90 days.

- Steelcase’s biggest customers cut back the most. Big orders—defined as at least $3 million—fell 20% in the last quarter.

Steelcase stock suffered a 20% haircut on the news.

“The thing that was most pronounced was … a decline in orders from large customers and a decline in large projects,” Steelcase CEO Jim Keane said. “At the same time, order growth in the US furniture industry has slowed, as has overall US business capital spending. Our orders and pipeline at the end of the quarter showed fewer large projects than last year.”

The industries that cut back the most were insurance, energy, information technology, and financial services.

Cubicle Hell Warning #2: Herman Miller may be best known for its ultra-comfortable work chairs, but its specialty is selling bulk orders of cubicles to the biggest corporations in America.

.

However, its bread-and-butter customers are cutting back.

“I’d say if there is anything that you will hear out there, certainly the size of projects continues to be on mid-to-smaller size. There [are] not as many very, very large things out there, at least that we can see,” said CEO Brian Walker.

The drop in big orders resulted in a sales decline from Herman Miller’s largest sector, North America, for just the second time in the last 17 quarters.

Moreover, 2015 per-share earnings of $1.82 are still lower than 2007 ($1.98) and 2008 ($2.56).

Cubicle Hell Warning #3: HNI Corporation is another publicly traded office furniture maker, and its business has fallen off a cliff.

Sales growth at its office division was chugging along at a healthy pace; +13.7% in Q1 and up +6.4$ in Q2. However, sales growth turned negative in Q3, and forward guidance projected an acceleration in the decline to a range of negative 3% to negative 7%.

No wonder that HNI’s stock recently hit a new 52-week low. Remember, stocks that hit new 52-week lows almost always do so for very good reasons.

Cubicle Hell Warning #4: The Business and Institutional Furniture Manufacturers Association, or BIFMA, hears chatter from hundreds of its members.

Wherever the sector is heading, it isn’t positive. BIFMA reported a sharp decline in office furniture order growth—from 10% early in the year to 3% in the last couple months.

A Good Crisis Indicator

The ups and downs of the office furniture business is not a standalone indicator that you can use to time the market. It is, however, a very good advance indicator of overall economic health.

And if the above cubicle hell warning signs are any indication, our economy is headed for a severe slowdown. So unless you want to put your portfolio through cubicle hell… you better have a strategy to protect it when bad times come calling.

That doesn’t mean you should rush out and sell all of your stocks tomorrow morning, but it does mean that you should crank down the volatility of your portfolio.

You see, everybody loves volatility when stocks are rising, but everybody hatesvolatility when the stock market heads south.

Tony Sagami

30-year market expert Tony Sagami leads the Yield Shark and Rational Bear advisories at Mauldin Economics. To learn more about Yield Shark and how it helps you maximize dividend income, click here. To learn more about Rational Bear and how you can use it to benefit from falling stocks and sectors, click here