Energy & Commodities

An incredible amount of fraudulent, virtual silver is being created in order to cap price and paint the chart. Will JPM and the rest of The Evil Empire be successful once again in capping price and routing the Specs. The reaction to today’s FOMC minutes may help to determine the outcome.

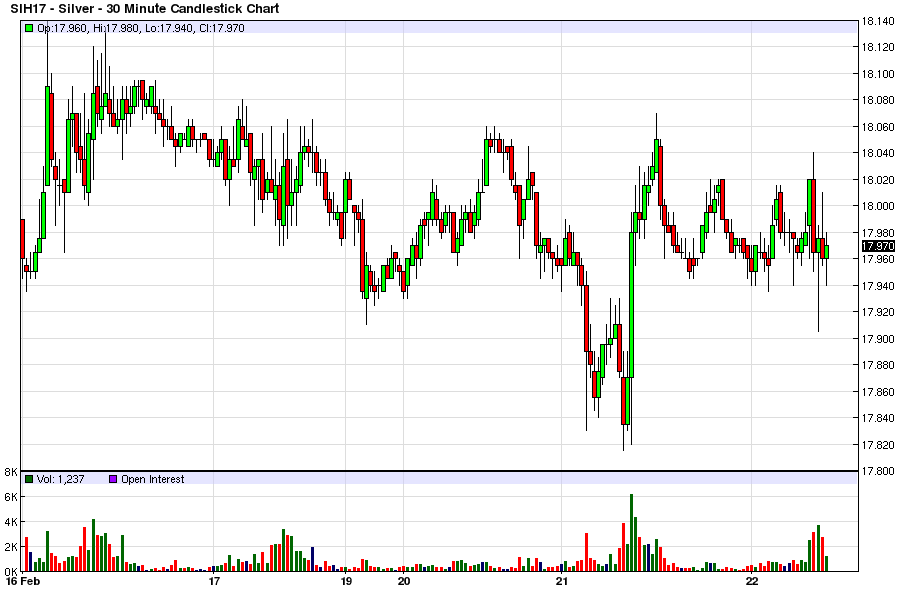

Again, I can’t stress enough the devious and fraudulent nature of this latest attempt to contain and cap price. The past four days have seen the price of Comex Digital Silver pressing up against the key resistance of $18 and the 200-day moving average near $17.93. See below:

Over this same time period, the Comex Silver Banks led by JPM have increased the total supply of Comex silver contracts by 12,809 contracts. So, while price has been flat, total supply of Comex silver contracts has been increased by 6.5%. THIS is how you cap price and paint the chart!

Imagine for a moment where price would be this morning if total open interest was held flat for the past week. How much higher would price be if sellers of existing contracts needed to be found for the 12,809 contracts of buying pressure? On a larger scale, yes the price of Comex Digital Silver is up $2 year-to-date or about 13%, but how much higher would price be if The Banks hadn’t fraudulently added 44,000 new contracts since December 30?

Why do we always describe this as “fraud”? Two primary reasons:

- The Banks are selling something that they don’t have. Can you enter into a contract to sell a house or a car if you don’t actually own the house or car you are attempting to sell?

- The Banks create this new “silver” from whole cloth without depositing as collateral any additional silver into their Vaults.

Regarding point #2, see below. Note that at the beginning of 2017, total silver within the Comex vaulting structure was 181,903,037 ounces. Total Comex open interest that day was 163,812 contracts. With each contract representing 5,000 ounces of silver, this equates to a virtual exposure of 819,060,000 ounces.

As of last Friday, total open interest had grown to 205,602 contracts or 1,028,010,000 ounces or virtual silver yet the total amount of silver in the Comex vaults was stagnant at 184,088,021 ounces.

So, The Comex Silver Banks have increased the supply of virtual silver by 25% while only increasing the supply of physical silver in the vaults by 2%. This is fraud, this is a scam and this has absolutely ZERO connection to the supply/demand fundamentals of actual physical silver.

And what are The Banks attempting to accomplish in their aggressive efforts to cap price? Two things. First, maintaining price below the 200-day moving average is important in managing future Spec demand for additional Comex paper.

Second and perhaps more important is the chart-painting aspect of keeping price below $18. As you can see on this weekly chart, by capping price here, JPM et al are effectively attempting to paint a massive head-and-shoulder top onto the weekly chart.

So, once again, you must be alert and cautious here. The forces aligned against you in the Comex silver “market” are powerful and these criminals are doing everything in their collective power to rig price in their favor. Will they be successful (again)? That will depend upon a number of factors going forward. For today, at least, you’d be wise to not underestimate the collusive power of The Banks and the fraudulent nature of their paper derivative pricing scheme.

TF

So where do you see the best opportunities now?

So where do you see the best opportunities now?

….read the entire interview in The Globe and Mail

Natural gas prices plunged to their lowest level since November on mild weather in the U.S., which has caused storage levels to decline at a much slower pace than expected.

Natural gas prices plunged to their lowest level since November on mild weather in the U.S., which has caused storage levels to decline at a much slower pace than expected.

Contracts for March delivery on the Nymex exchange dipped to $2.63 on February 21, down a third since December. The bearish swing has come after successive EIA reports showing a modest drawdown in gas inventory levels.

Natural gas consumption is seasonal, with spikes in demand occurring in winter months. As such, storage levels build up over the course of the year, especially in the milder months of spring and fall. Then, gas is used up in the winter. The winter of 2016 was the warmest on record, leading to a paltry drawdown in inventories. The result was a cratering of natural gasprices last year as inventories swelled following the end of winter.

Related: Biggest Gasoline Glut In 27 Years Could Crash Oil Markets

Plus “Oil rises after news OPEC could extend output cuts”

Plus “Oil rises after news OPEC could extend output cuts”

Another week brings yet more signs that the highly-anticipated oil market “balance” will not occur in the immediate future. Heading into 2017, there was a broad consensus that global oil production would fall below demand in the first half of the year, a deficit that would help bring down inventories and lead to relative balance between supply and demand. Mid-2017 seemed to be the timeframe that everyone was looking at for this development to occur.

But there are growing signs that the oil market won’t reach balance by then, and perhaps not this year at all. “We don’t really see a real balancing of the market coming until much much later,” Richard Gorry of JBC Energy Asia told CNBC in an interview. “Right now the oil market is oversupplied by about 500,000 barrels per day in the first quarter. So to see inventories continue to go up is absolutely of no surprise to us.”

…related:

Oil rises after news OPEC could extend output cuts

Oil prices rose on Thursday after OPEC sources said the group could extend its oil supply-reduction pact with non-members and might even apply deeper cuts if global crude inventories failed to drop to a targeted level.

OPEC and other exporters including Russia agreed last year to cut output by 1.8 million barrels per day (bpd) to reduce a price-sapping glut. The deal took effect on Jan. 1 and lasts six months.

Most producers appear to be sticking to the deal so far but it is unclear how much impact the supply reductions are having on world oil inventories that are close to record highs.

The supply pact could be extended by May if all major producers showed “effective cooperation”, an OPEC source told Reuters.

“There’s a good chance and high odds that the group (OPEC) decides that they want to continue this process,” Energy Aspects analyst Richard Mallinson said.

Benchmark Brent crude was up 30 cents at $56.05 a barrel by 1330 GMT. U.S. light crude gained 30 cents to $53.41 a barrel.

Global inventories are bloated and supplies high, especially in the United States.

U.S. crude and gasoline inventories soared to record levels last week as refineries cut output and gasoline demand softened, the Energy Information Administration said on Wednesday.

Crude inventories jumped 9.5 million barrels in the week to Feb. 10, nearly three times more than forecasts, boosting commercial stocks to a record 518 million barrels.

Gasoline stocks rose by 2.8 million barrels to a record 259 million barrels.

U.S. crude production, meanwhile, has risen 6.5 % since mid-2016 to 8.98 million bpd.

Analysts say the oil market is balanced between these twin pressures: OPEC cuts and rising U.S. inventories and production.

Brent and U.S. crude futures have traded within a $5 per barrel range since the start of the year.

“Prices have not seen this kind of stability for several years,” said David Wech, managing director of Vienna-based consultancy JBC Energy.

“However, if crude prices are to break out of their recent range in the next few weeks, the risk is to the downside.”

Gavin Wendt, founding director and senior resource analyst at commodity research firm MineLife, said: “The world oil market is very much in wait-and-see mode, which is why the price has remained in the mid-$50s per barrel range since mid-December.”

It’s been an exciting start to the year thus far for precious metals investors. Both metals are off to a good start, and the January rallies are very reminiscent of 2016. Despite the 9% rally off the lows for silver, we still have a reading of more than 3 bears for every 1 bull. Bullish sentiment is still in bearish territory on silver, and the metal has been locked in a descending channel for nearly 7 months now. Fortunately for the bulls, the trend in sentiment in data is finally starting to turn the corner, and brighter days may be ahead.