Energy & Commodities

Anxiety is a thin stream of fear trickling through the mind. If encouraged, it cuts a channel into which all other thoughts are drained. Arthur Somers Roche

2015 was a terrible year for oil and it looked like 2106 would even worse; oil dipped below $30.00 and all cockroaches (oops we mean analysts) started to state $10.00 oil was next. When we heard this nonsense, we penned an article titled will the crude oil price crash become even worse in 2016?

What you need to remember is that the oil market tanked suddenly, and this occurred while the Top Analysts were making calls for higher prices. Hence, just as the oil market collapsed when everybody was proclaiming higher prices, oil will probably stabilise sometime in 2016 as everyone expects it to keep crashing.

In March of 2016, we reiterated our views in this article Mass Psychology predicted crude oil bottom 2016

Notice that the $30.00 price point level has held on a monthly basis. Oil has not closed below this important level on a monthly basis for two months in a row, and this has to be viewed a very bullish development. Our overall view is for crude oil to trend higher with the possibility of trading past the $55.00 ranges. In the face of extreme negativity, oil is reversing, just as it collapsed in the face of Euphoria. A weekly close above 35.00 will set the foundation for oil to trade past the main downtrend line and in doing so send the first signal for a move to the $50 plus ranges.

So what does the future hold in store for oil?

Oil traded as high as $51.34 so we did not fare too shabbily regarding our suggested targets for oil.

Before we continue, it appears less and less likely that oil will trade past $90.00 unless the investment bankers and oil companies collude to boost oil prices artificially. Every few months’ large fields of oil are being discovered; the latest find is in Texas.

One portion of the giant field, known as the Wolfcamp formation, was found to hold 20 billion barrels of oil trapped in four layers of shale beneath West Texas. That is almost three times larger than North Dakota’s Bakken play.

“The fact that this is the largest assessment of continuous oil we have ever done just goes to show that, even in areas that have produced billions of barrels of oil, there is still the potential to find billions more,” Walter Guidroz, coordinator for the geological survey’s energy resources program, said in the statement. : Full Story

Countries such as Saudi Arabia who depend almost entirely on oil are going to be in serious trouble. One positive development from this is Saudi will be forced to engage in less mischief; they are one of the biggest exporters of terrorism, and now that their coffers are running dry they are going to face lean times. These are not our views; an article penned in the New York Times strongly supports this line of thinking

The first American diplomat to serve as envoy to Muslim communities around the world visited 80 countries and concluded that the Saudi influence was destroying tolerant Islamic traditions. “If the Saudis do not cease what they are doing,” the official, Farah Pandith, wrote last year, “there must be diplomatic, cultural and economic consequences.” Full Story

The chart below was the chart was used in the Jan 2016 article which we referred to at the start of this article. $65.00 represents the high-end target or extreme targets.

If you look at the chart, you notice that crude oil traded to almost $52.00 before pulling back, so it came within striking of hitting the targets we issued in Jan of 2016. Oil is holding up remarkably well in the face of strong a dollar; in fact, it started to trend higher as the dollar strengthened. If the dollar should let out a bit of steam, then Oil could quickly surge to the $55.00-60.00 targets before pulling back.

There is a zone of resistance in the $51.80-53.00 ranges that oil was unable to overcome and as long as it does not close below $35.00 on a weekly basis, the outlook will remain bullish. As the trend is still bullish oil still has a pretty good chance of trading to the $55.00-58.00 ranges with a possibility of overshooting towards $65.00 (this is an extreme target and not one we would focus on)

Given that oil was trading below $30.00 when we penned the article in Jan 2106 we are quite satisfied with the way oil followed the projected pathway. As we are now towards the end of the bullish phase caution is warranted; traders looking to play this final move should consider opening positions below $45.00 and once oil trades past 51.50, consider placing tight stops. After oil trades to the suggested targets, we expect oil to pull back to the $45.00 ranges with a possible overshoot to the $39.00-$42.00 ranges.

A person’s fate is their own temper.

Benjamin Disraeli

….related:

“oil will now turn up and further that oil stocks will quite soon break out upside” – Clive Maund’s Oil Market Update

Also: Copper Calls Gold Bottom On Trumphoria Surge

Clive Maund’s Oil Market Update published Tuesday Nov 15th

After the severe decline in the oil price in 2014 – 2015, which was partly motivated by the Neocon intention to crush the Russian economy as one prong of an asymmetrical warfare campaign that also involved sanctions and a military pressure, the price has marking out a potential base pattern since the middle of last year, as we can see on the 4-year chart for Light Crude shown below. The pattern is looking increasingly like an irregular Head-and-Shoulders bottom, and while it would obviously abort and the price break to lower levels in the event that a general market crash manifests, it is clear that the pattern has the potential to support a substantial bullmarket. This it is interesting to observe the strongly bullish action in copper over recent weeks, which points to a general commodity bullmarket taking hold next year, even if copper is short-term overbought and has signaled that it needs to take a breather. Whilst we can speculate about what may bring this on, it is clear that the election of Trump with his grandiose plans for rebuilding America is likely to be a big factor, although how he plans to finance all this is another matter – probably by means of “helicopter money”, which will mean increasing inflation and a commodity bullmarket, especially in gold and silver, that will also be positive for the oil price. For several months the price has been tracking sideways in a trading range bounded by the support and resistance shown, and right now it may be marking out a second Right Shoulder low of the prospective giant Head-and-Shoulders bottom. A clear breakout above the resistance at the top of this range will be a major technical event that will signal a new bullmarket in oil.

….continue reading more and view the charts on the Oil Market Update HERE

…also read Copper Calls Gold Bottom On Trumphoria Surge

“If Trump stays true to his promise for energy independence, it won’t happen overnight, and the most logical alternative to OPEC imports would naturally be Canada. The U.S.’ northern neighbor has suffered a serious economic slowdown because of the international oil price rout.”

“If Trump stays true to his promise for energy independence, it won’t happen overnight, and the most logical alternative to OPEC imports would naturally be Canada. The U.S.’ northern neighbor has suffered a serious economic slowdown because of the international oil price rout.”

Technical Analyst Clive Maund takes a look at the cannabis sector, and how the the election results for eight states, including California, might facilitate a massive boom. (published Nov 8th)

Not only do we have the US elections today, we also have voting in eight states on the legalization of cannabis, including the all-important State of California, which just by itself is one of the biggest economies in the world. The outcome of this vote is of crucial importance to the future of this fledgling industry, although all the indications are that it will be favorable.

In attempting to determine the immediate course of the cannabis sector right after the vote, there are two major factors to consider. One is the actual outcome of the vote, and whether it exceeds or fails to meet market expectations and what this will lead to. The other is the heavy buying of the sector ahead of the vote that has caused huge runups in many stocks, making it vulnerable to a wave of profit taking on the vote—especially if it fails to meet expectations.

We already made big, and in some cases huge gains as a result of the boom in cannabis stocks over the past month or two, and were in the vanguard of the wave of profit taking across the sector last week, caused by understandable nervousness ahead of the vote. However, it is important to understand that this still very young industry stands on the threshold of a massive boom, which if the vote goes well as expected, will be comparable to the boom in the liquor industry when prohibition was lifted back in the 30’s, and the stocks of the best companies will go on to make spectacular gains. So it is now thought that, assuming the vote goes at least as well as expected, any post vote bout of profit taking will be short-lived and followed by a reversal and a strong and sustained rally as this industry booms—and the spreading legalization of cannabis in the US will have a knock-on effect around the world. This is the reason why, after we took profits in many stocks last week, we started rotating back into the best ones on Friday and on Monday.

So what tactics should investors and speculators employ at this juncture, especially those who are new on the scene? Firstly, after yesterday’s rally, there is so little time left before the outcome of the vote is known that it probably makes sense to wait for the results. Then, if we do see an immediate wave of “sell on the news” profit taking, it will be viewed as throwing up a major buying opportunity, especially if the vote generally meets or exceeds expectations. If a positive vote triggers a wave of buying, this may then be followed by a bout of profit taking that briefly drives prices lower, perhaps quite a lot lower, again providing an opportunity to step up to the plate and buy the better stocks. The key point to keep in mind is that if the vote goes well, especially in California, then we are on the threshold of a massive one-off boom in this sector and fortunes will be made, with the best stocks multiplying in value perhaps 10 or 20 times over the next year or two.

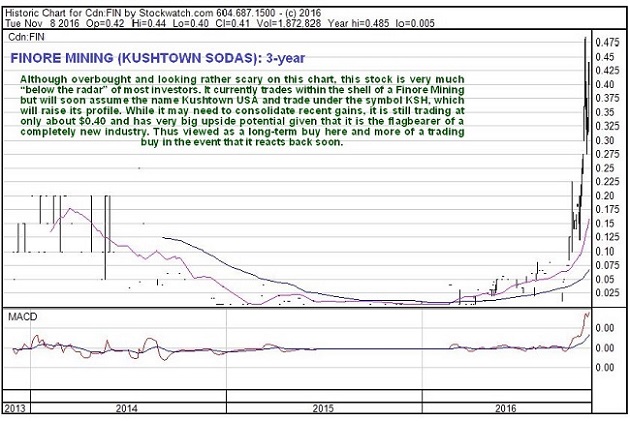

One very interesting stock in the sector that is viewed as having great potential is Kushtown Sodas and Edibles, which manufactures a range of sodas that include a medical marijuana tincture known as Kushtown Tincture, which is reputedly a great remedy for cancer and other ailments. The company is the first and most recognized edible company in the industry, and its products are rapidly growing in popularity. The good thing is that its stock is still below the radar of most investors, one symptom of this being that its stock trades as a shell called Finore Mining (code FIN on the Canadian market), and another being that it is not listed in Stockcharts.com. We can however access its stock chart in Stockwatch.com where we can see that somebody is on to it, as it has risen quite a bit already in recent months.

If you want to find out more about this high-growth sector, click here to download our free Green Paper, and if you want to read my strategic insights into the sector, you can subscribe here.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years’ experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Want to read more Streetwise Reports articles like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see recent articles with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Clive Maund: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. The companies mentioned in this article were not involved in any aspect of the article preparation. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

Charts provided by Clive Maund

Crude rallied during October reaching the $52 level. Yet for the close, it crashed and burned on the last day to AVOID a buy signal at $49.35 level. We bounced off the first Downtrend Line, which now stands at $51.86 for November. This is what I mean about the hidden order within markets. This has NOTHING to do with me making a great call or some personal opinion to pound my chest. There is something much more significant taking place in market activity. This is what our model simply allows you to see. The numbers are the numbers. It has nothing to do with me being personally right or wrong. The numbers will continue to be generated long after I am gone.

….related: