Energy & Commodities

Rogers asserted he is more optimistic about agriculture than other sectors of the world economy, especially after oil plummeted in the second half of 2014. While he affirms that the basic fundamental problem in agriculture still exists, he doesn’t see “supply yet that can cause a permanent change in the supply/demand.””it is agriculture which Mr Rogers says he prefers “to any other sector where you can easily invest” thanks to its supply and demand dynamics.” ...continue reading HERE

Rogers asserted he is more optimistic about agriculture than other sectors of the world economy, especially after oil plummeted in the second half of 2014. While he affirms that the basic fundamental problem in agriculture still exists, he doesn’t see “supply yet that can cause a permanent change in the supply/demand.””it is agriculture which Mr Rogers says he prefers “to any other sector where you can easily invest” thanks to its supply and demand dynamics.” ...continue reading HERE

also:

Ag price weakness will prove only temporary

Don’t give up on ags. They are a “wonderful place” for investors.

At least, so says Jim Rogers, one of the biggest names in commodities, who in the first decade of the century played a big role in bringing the asset class to the fore, and popularised the idea of the “supercycle”.

The pullback in shares may be justified, said Mr Rogers

“I am pessimistic about stocks for the next couple of years,” he tells Agrimoney.com.

“The Dow Jones industrial average [share index] is not that far from its all-time high,” making share investment appear, given the abounding uncertainty and economic disappointments, poor value.

But for Mr Rogers, agriculture is “wonderful place to be”.….continue reading HERE

Recently, Light Crude has seen a dramatic 35%+ increase in value. As the current price continue to flirt with $40 per barrel, the likelihood of a further price rise is on everyone’s mind. With recent lows near $26 per barrel, what is the possibility that oil will form a base above $30 and attempt a rally?

Historically, the 2009 low price for oil was $33.20. This level should be viewed as a key level of support for current price action. The recent price rotation below this level is a sign that oil prices are under extreme pressure in the current economic environment with a supply glut and slower than expected demand.

It is my opinion that the price of oil will continue to reflect the supply/demand aspects of the global markets in relation to global economic activity. Thus, my analysis is that Oil will likely attempt to retest support, near $30 or below, in the immediate future in direct relation to continued supply production in conjunction with slower global demand.

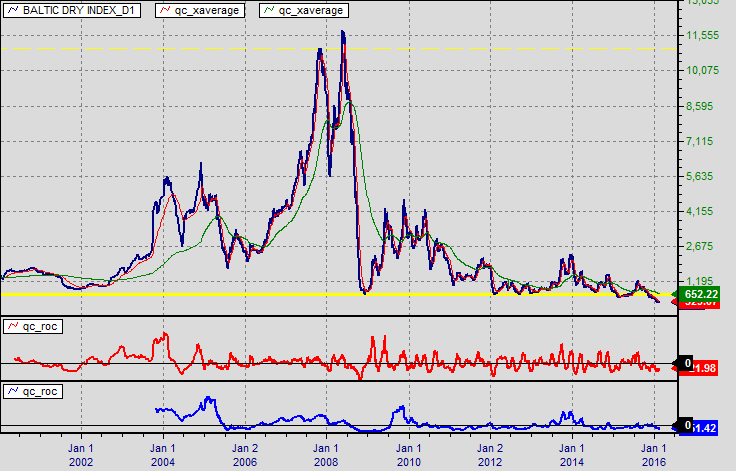

(Baltic Dry Index Chart – LongTerm)

The BDI Index continues to attempt to push to new lows. This is a strong indication that global exports and international demand from consumers and business is continuing to diminish.

Oil prices have shown signs of life over the past few weeks, as production declines in the U.S. raise expectations that the market is starting to adjust. As a result, Brent crude recently surpassed $40 per barrel for the first time in months.

A growling list of companies are capitulating, announcing production cuts for 2016. Continental Resources, for example, could see output fall by 10 percent. A range of other companies have made similar announcements in recent weeks. The energy world has been speculating about declines from U.S. shale, and the declines are finally starting to show up in the data.

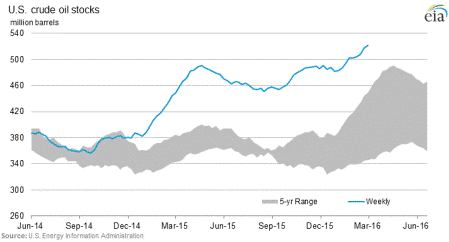

Despite the newfound optimism that oil markets are balancing out, crude oil sitting in storage is at a record high in the United States. Energy investors may have preferred to focus U.S. production declines, or the fall in gasoline inventories in early March, but meanwhile crude oil stocks continue to signal that oversupply persists.

Crude stocks rose once again last week, hitting yet another record of 521 million barrels. Storage levels at Cushing, Oklahoma, an all-important hub where the WTI benchmark price is determined, have surpassed 90 percent of capacity. U.S. output may be starting to decline, but it is doing so at a painfully slow rate.

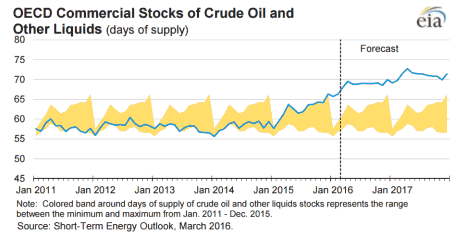

It isn’t just a U.S. problem. Crude oil storage levels continue to climb around the world. Commercial stocks in the OECD surpassed 3 billion barrels in 2015. The EIA sees oil storage in the OECD rising to 3.24 billion barrels by the end of this year. It doesn’t stop there. Storage levels rise a bit more next year, hitting 3.30 billion barrels by the end of 2017.

That is a staggering forecast that should scare any oil investor. It also suggests that the price rally over the past few weeks, which has pushed oil prices up around 40 percent since early February, could be fleeting. There is evidence that suggests the rally was driven by speculators closing out short bets on oil, after accruing net-short positions at multiyear highs in recent months. In early March, hedge funds and other major investors shed short positions at the fastest rate in almost a year. The rally, then, hinged on the sudden shift in sentiment from oil speculators.

The underlying fundamentals, however, have not appreciably changed in recent weeks. U.S. oil production is declining, but more or less at the same pace that it has for months.

On the other hand, rising inventories undercut the notion that the market is adjusting. As a result, as the short-covering rally reaches its limits, and the markets digest the fact that the world is still oversupplied with oil, prices could fall once again.

The problem, as mentioned above, is that inventories could continue to rise around the world through the rest of this year, if EIA data is anything to go by. Oil prices may have rallied in recent weeks, but the EIA was more pessimistic in March than it was in February. The EIA says that global storage levels could rise by 1.6 million barrels per day (million b/d) in 2016 and by another 0.6 million b/d in 2017. Those predictions are higher than the EIA’s February estimate.

“With large global oil inventory builds expected to continue in 2016, oil prices are expected to remain near current levels,” the EIA concluded in early March. The EIA lowered its price forecast for Brent by $3 per barrel, expecting it to average $34 for the year. 2017 does not look much better: the EIA sees Brent prices averaging just $40 per barrel next year, a whopping $10 lower than what the EIA predicted last month. That could mean prices stay below $50 per barrel through 2017.

Price forecasts are always wrong, and often wildly off the mark. While it is difficult, if not impossible, to accurately predict price movements, especially a year or two out, it is impossible to argue with the sky-high levels of oil sitting in storage. Even if U.S. oil production continues to decline, the greater than 500 million barrels of oil inventories – a record high – need to start declining in a substantial way before the oil markets will see a sustained rally.

Historic day in the coal sector yesterday. With one of the world’s largest producers saying that it may soon disappear completely.

The news comes after Peabody missed payment Tuesday on $71 million in interest due on $1.65 billion worth of bonds. The company has now entered into a 30-day grace period to make the payments.